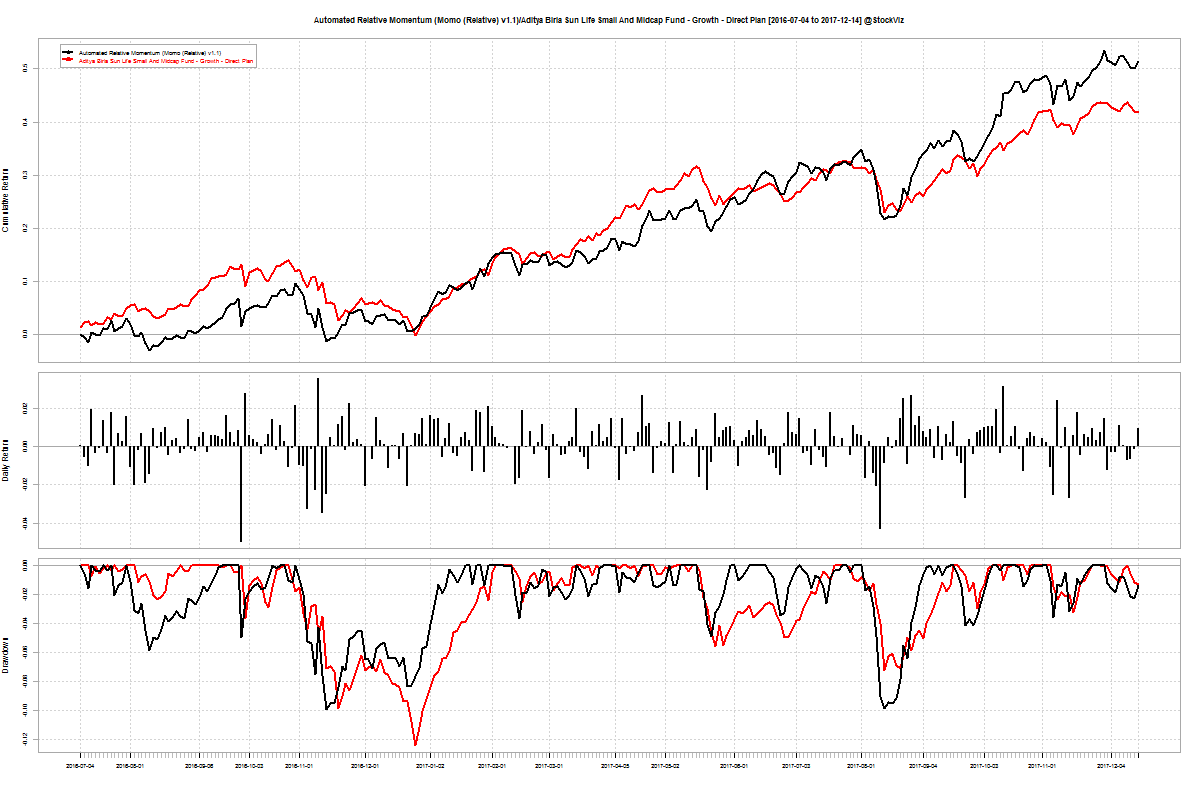

Momentum strategies have been on a tear over the last few years and have generally out-performed pure-value strategies. When we compare momentum returns with mutual funds, the most common criticism we encounter is that mutual fund returns are after transaction costs whereas our “Theme” returns are before transaction costs.

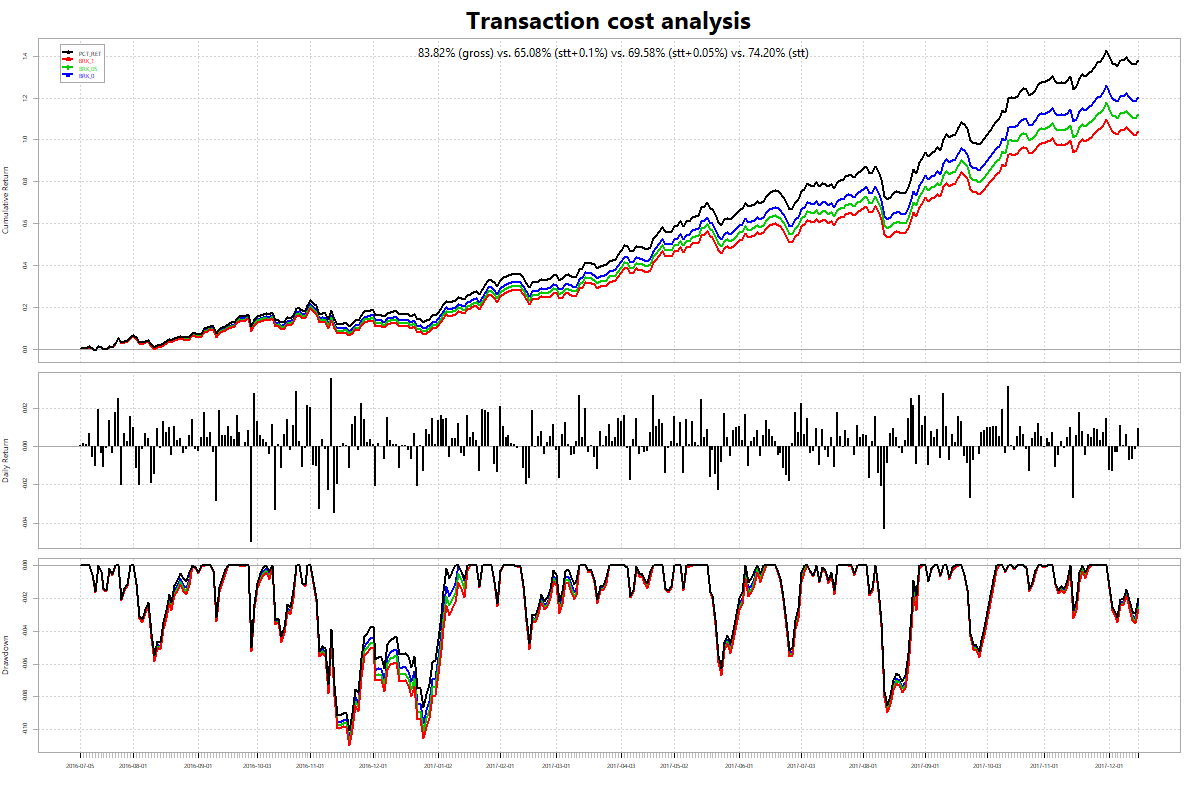

The challenge we face in showing post-cost returns is that we offer different brokerage slabs to different types of clients, making a one-cost-fits-all analysis impossible. However, we can show how different brokerage slabs impact returns.

A gross return of 83.82% translates to returns of 74.20%, 69.58% and 65.08% for brokerage slabs of 0.1%, 0.05% and 0% respectively (STT of 0.1% was assumed.) Momentum out-performs even after transactions costs.