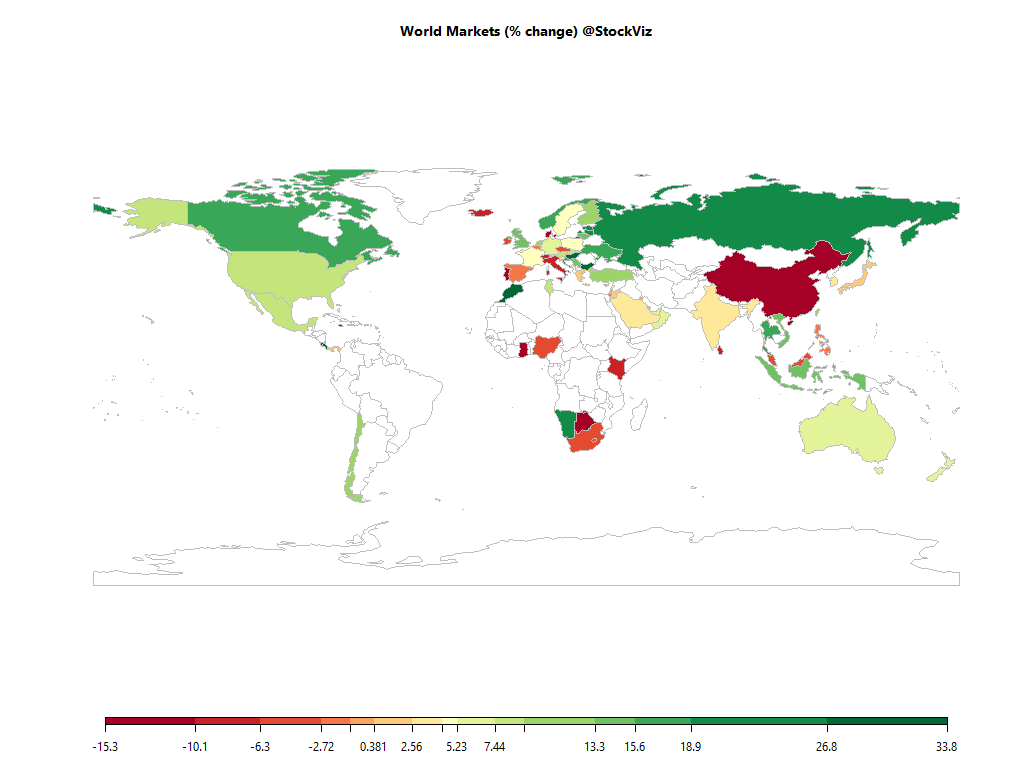

Equities

| MINTs | |

|---|---|

| JCI(IDN) | +15.32% |

| INMEX(MEX) | +7.55% |

| NGSEINDX(NGA) | -6.17% |

| XU030(TUR) | +9.23% |

| BRICS | |

|---|---|

| IBOV(BRA) | +38.93% |

| SHCOMP(CHN) | -12.31% |

| NIFTY(IND) | +3.01% |

| INDEXCF(RUS) | +26.76% |

| TOP40(ZAF) | -4.14% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | +50.36% |

| Ethanol | +14.71% |

| Natural Gas | +59.73% |

| WTI Crude Oil | +43.59% |

| RBOB Gasoline | +31.72% |

| Heating Oil | +53.94% |

| Metals | |

|---|---|

| Gold 100oz | +8.52% |

| Palladium | +20.96% |

| Platinum | +4.23% |

| Silver 5000oz | +15.22% |

| Copper | +17.37% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -2.28% |

| USDMXN(MEX) | +20.35% |

| USDNGN(NGA) | +58.22% |

| USDTRY(TUR) | +20.84% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -17.81% |

| USDCNY(CHN) | +6.95% |

| USDINR(IND) | +2.68% |

| USDRUB(RUS) | -15.62% |

| USDZAR(ZAF) | -11.23% |

| Agricultural | |

|---|---|

| Coffee (Arabica) | +8.62% |

| Lumber | +22.21% |

| Soybean Meal | +18.45% |

| Soybeans | +14.50% |

| Corn | -2.02% |

| Lean Hogs | +10.35% |

| Orange Juice | +40.79% |

| Sugar #11 | +29.06% |

| Wheat | -13.17% |

| White Sugar | +23.43% |

| Cattle | -14.59% |

| Cocoa | -22.96% |

| Cotton | +11.41% |

| Feeder Cattle | -21.62% |

| Coffee (Robusta) | +44.77% |

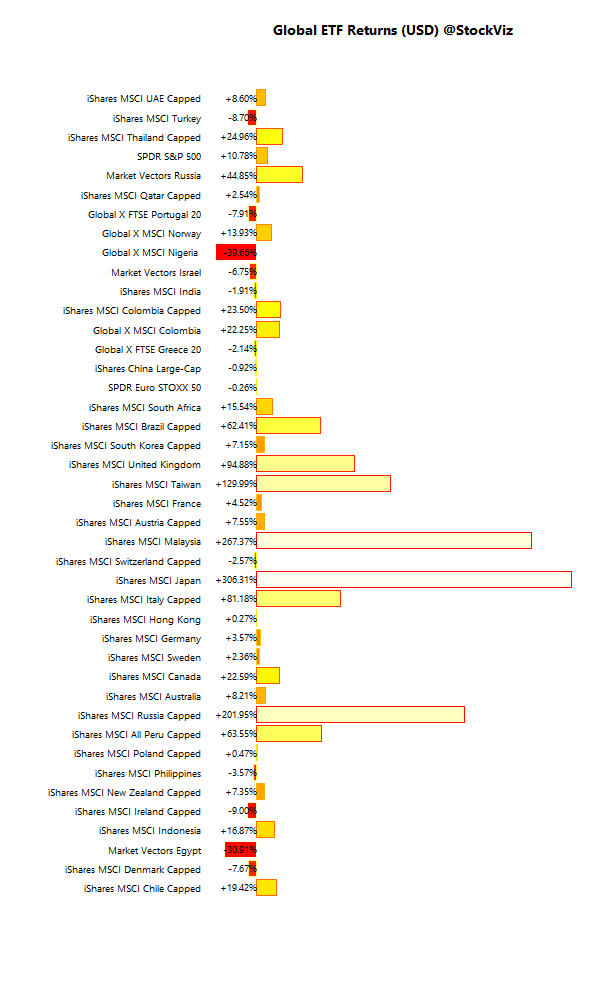

International ETFs (USD)

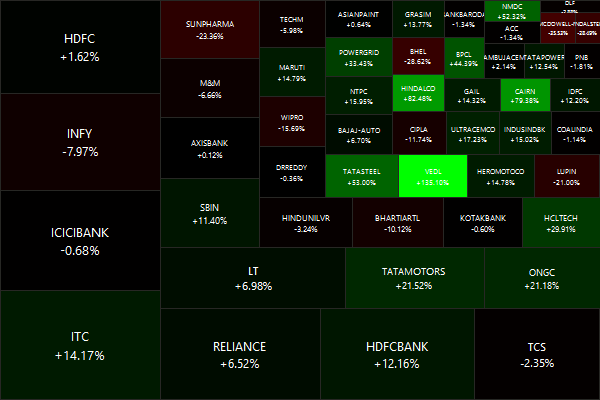

Nifty Heatmap

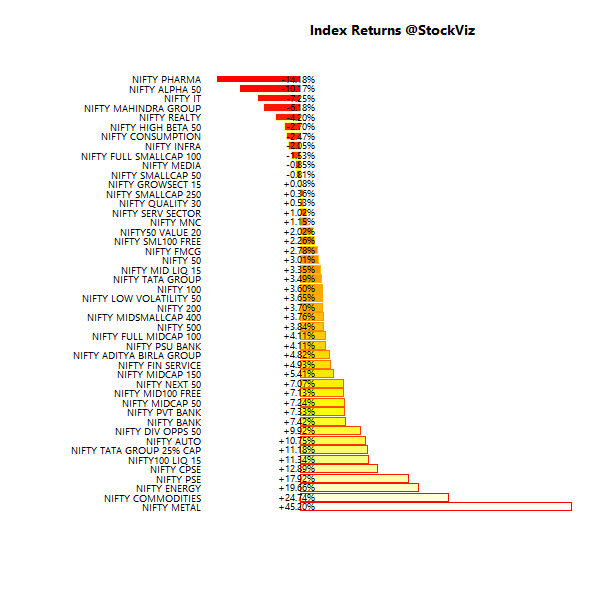

Index Returns

More: Sector Dashboard

ETF Performance

| CPSEETF | +17.50% |

| GOLDBEES | +12.52% |

| BANKBEES | +7.74% |

| JUNIORBEES | +7.45% |

| NIFTYBEES | +3.97% |

| PSUBNKBEES | +3.69% |

| INFRABEES | -1.97% |

Public sector and gold out-performed. Enough said.

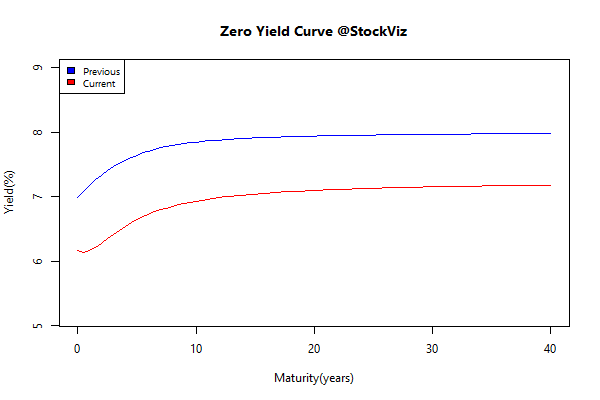

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -1.08 | +10.74% |

| 5 10 | -1.16 | +14.34% |

| 10 15 | -1.04 | +15.88% |

| 15 20 | -1.00 | +17.91% |

| 20 30 | -0.89 | +18.62% |

Long end of the curve had a tremendous run this year…

Investment Theme Performance

| Enterprise Yield | +23.38% |

| Acceleration | +13.78% |

| Magic Formula | +12.97% |

| Balance Sheet Strength | +4.00% |

| HighIR Momentum | -2.17% |

| Quality to Price | -3.50% |

| Financial Strength Value | -4.20% |

| Velocity | -11.50% |

| Momentum | -14.84% |

Equity strategies were red for the most part…

Equity Mutual Funds

Bond Mutual Funds

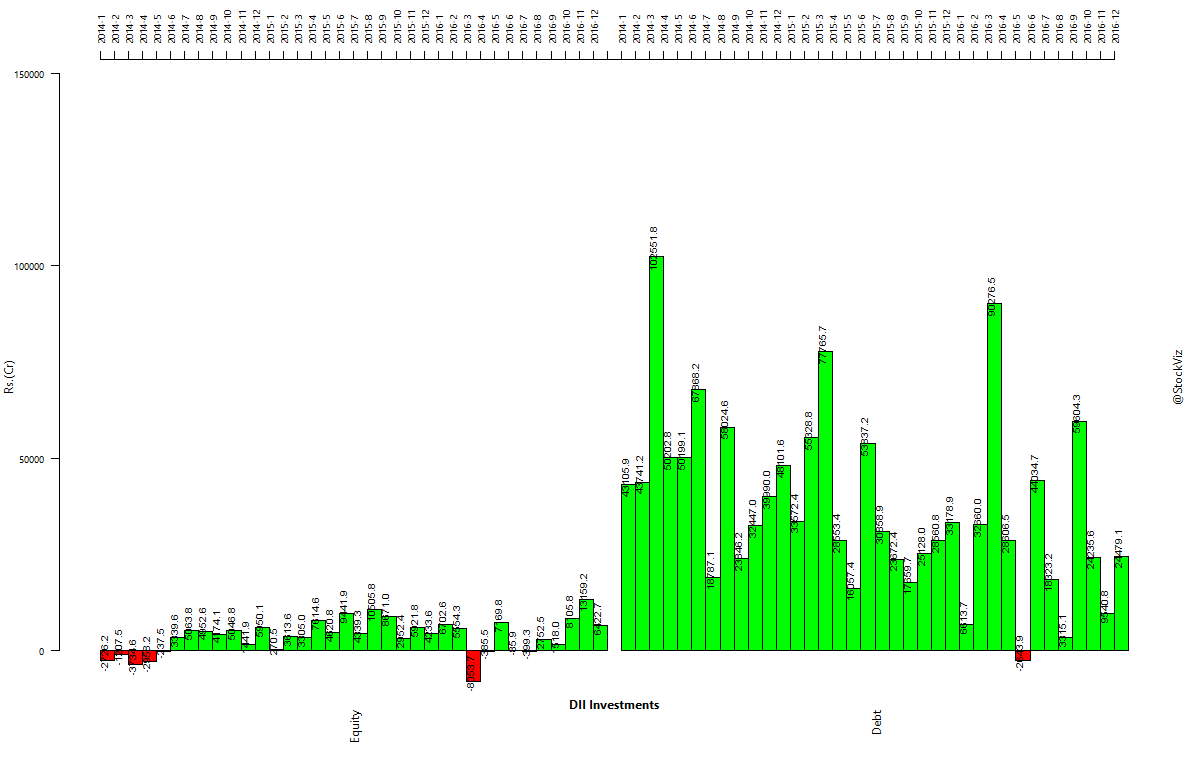

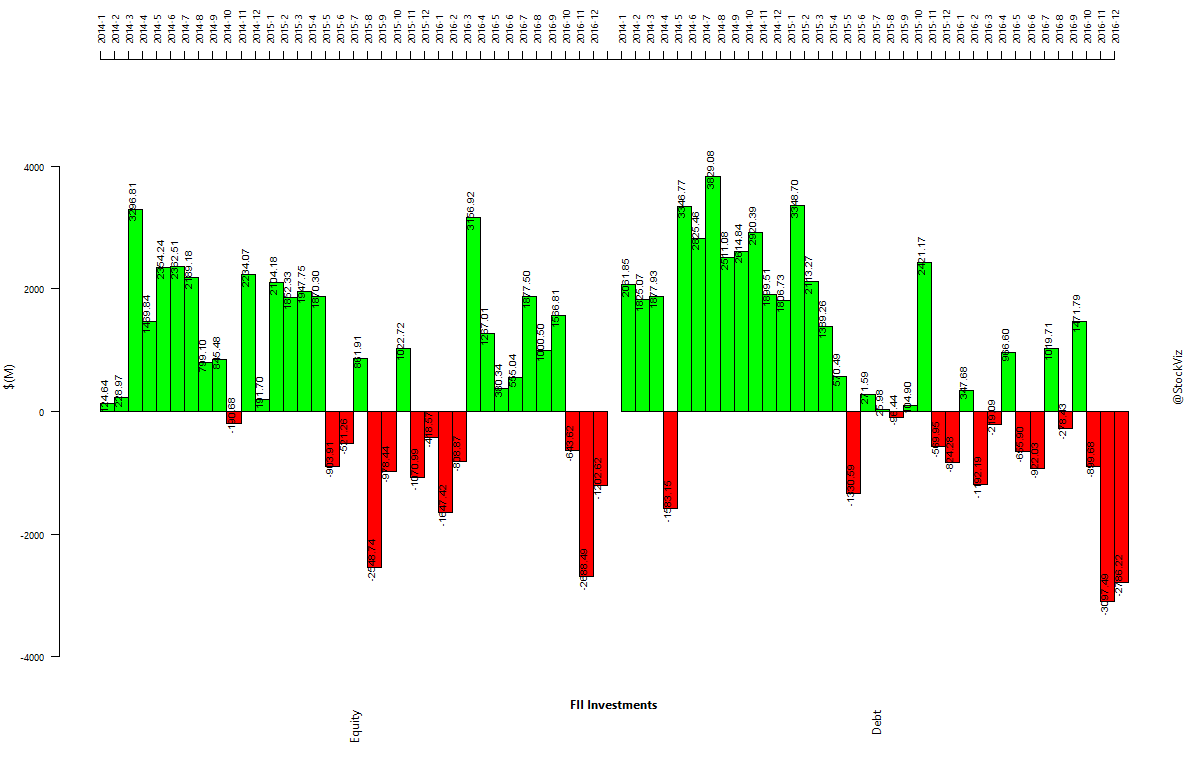

Institutional flows

Keep those SIPs going, your country needs you!

Good luck for the new year!