Equities

| MINTs | |

|---|---|

| JCI(IDN) | +3.64% |

| INMEX(MEX) | +0.84% |

| NGSEINDX(NGA) | +5.91% |

| XU030(TUR) | +0.49% |

| BRICS | |

|---|---|

| IBOV(BRA) | +7.23% |

| SHCOMP(CHN) | +0.54% |

| NIFTY(IND) | +2.06% |

| INDEXCF(RUS) | -0.13% |

| TOP40(ZAF) | -4.08% |

Commodities

| Energy | |

|---|---|

| Natural Gas | +30.17% |

| WTI Crude Oil | +0.16% |

| Ethanol | -1.09% |

| RBOB Gasoline | -5.50% |

| Heating Oil | +2.04% |

| Brent Crude Oil | +1.21% |

| Metals | |

|---|---|

| Copper | +6.22% |

| Platinum | +8.45% |

| Silver 5000oz | +23.75% |

| Gold 100oz | +10.46% |

| Palladium | +10.93% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -3.91% |

| USDMXN(MEX) | -0.63% |

| USDNGN(NGA) | +41.74% |

| USDTRY(TUR) | -1.71% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -10.71% |

| USDCNY(CHN) | +1.13% |

| USDINR(IND) | +0.09% |

| USDRUB(RUS) | -3.88% |

| USDZAR(ZAF) | -7.32% |

| Agricultural | |

|---|---|

| Cocoa | +7.39% |

| Soybean Meal | +2.12% |

| Soybeans | +8.41% |

| Cattle | -6.71% |

| Lean Hogs | +2.70% |

| Lumber | +1.68% |

| Wheat | -10.73% |

| Coffee (Robusta) | +4.29% |

| Corn | -12.72% |

| Cotton | -1.80% |

| White Sugar | +17.27% |

| Coffee (Arabica) | +19.34% |

| Feeder Cattle | -3.30% |

| Orange Juice | +19.45% |

| Sugar #11 | +19.14% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.24% |

| Markit CDX NA HY | -0.98% |

| Markit CDX NA IG | +8.31% |

| Markit iTraxx Asia ex-Japan IG | +6.85% |

| Markit iTraxx Australia | +8.24% |

| Markit iTraxx Europe | +22.86% |

| Markit iTraxx Europe Crossover | +86.86% |

| Markit iTraxx Japan | +8.40% |

| Markit MCDX (Municipal CDS) | +5.17% |

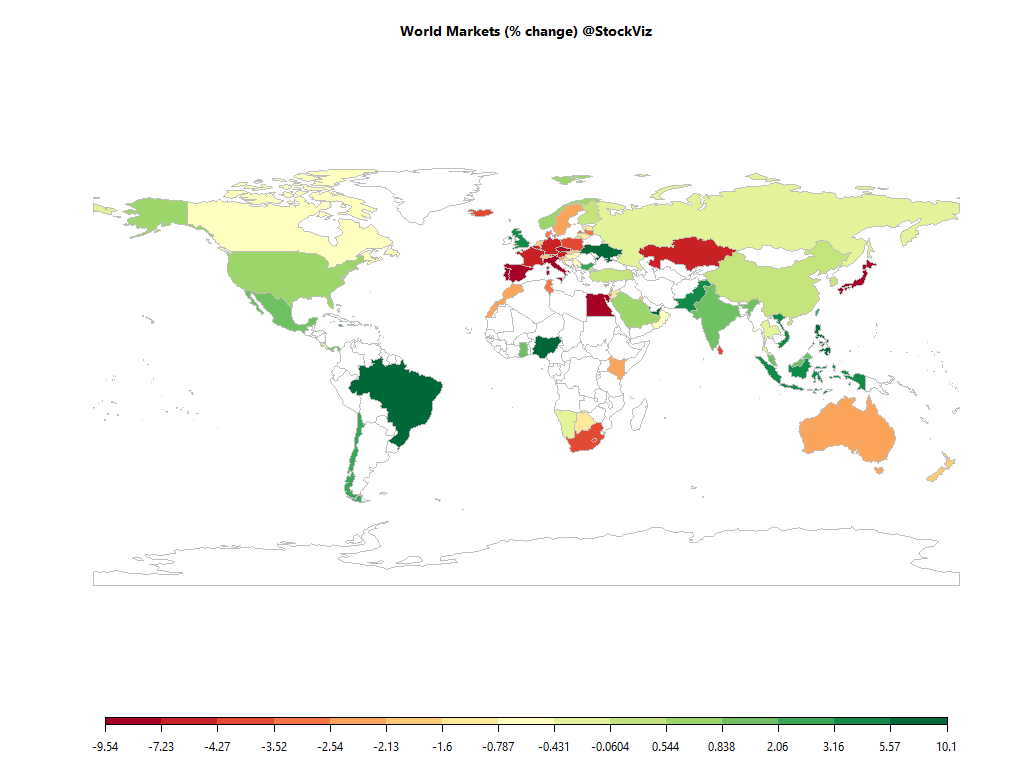

Brexit! Rexit! What, me worry?

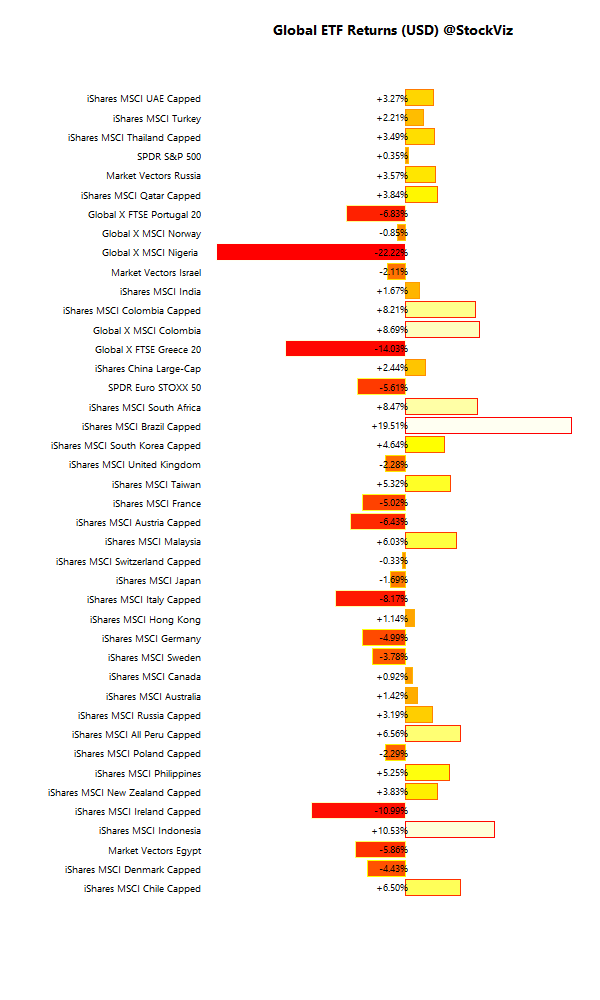

International ETFs (USD)

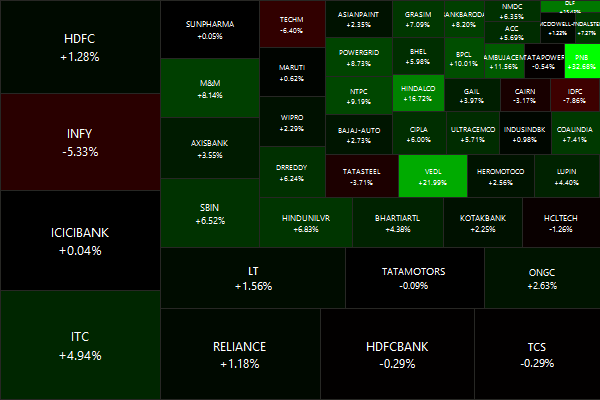

Nifty Heatmap

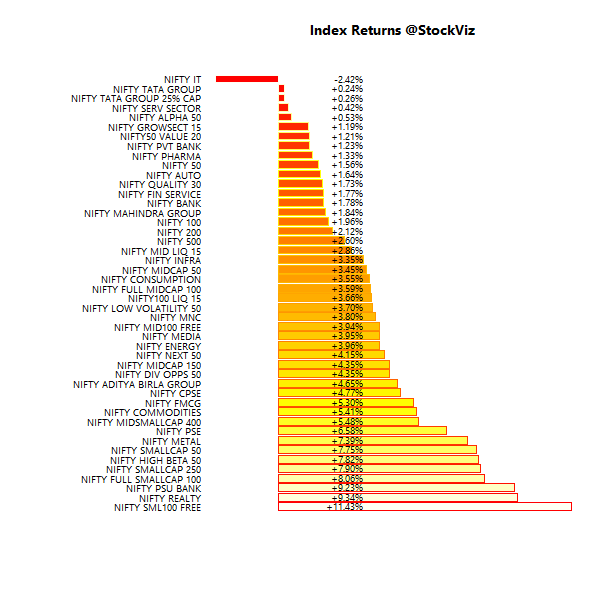

Index Returns

Check out our dashboard here.

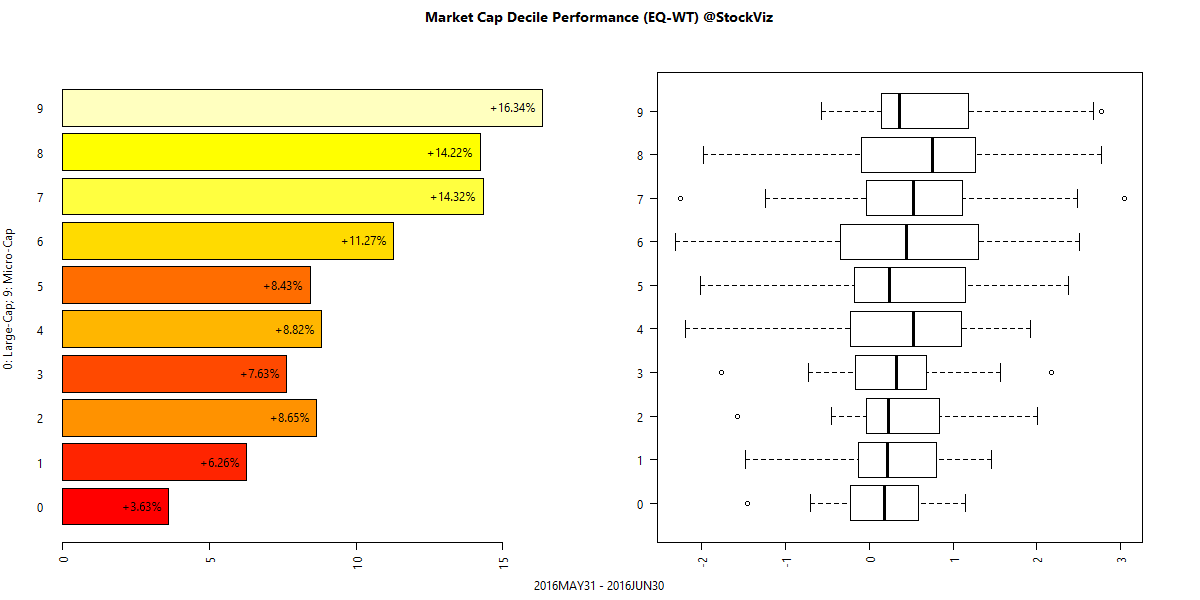

Market Cap Decile Performance

Top Winners and Losers

Have commodities bottomed out? Is the government’s bank capitalization and merger plan a “game changer?”

ETF Performance

| PSUBNKBEES | +10.71% |

| GOLDBEES | +4.98% |

| CPSEETF | +4.70% |

| JUNIORBEES | +3.98% |

| BANKBEES | +2.69% |

| NIFTYBEES | +1.96% |

| INFRABEES | +1.52% |

PSU banks – because tax payer money is free!

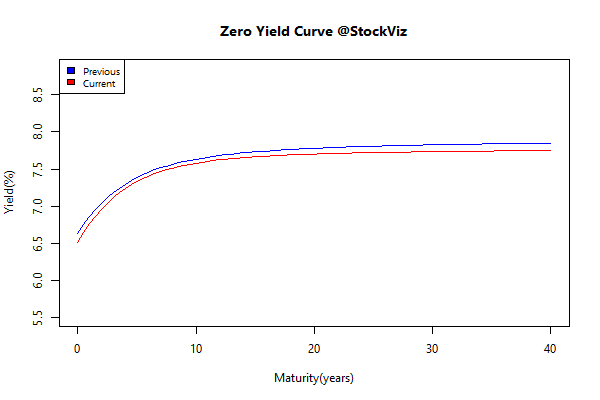

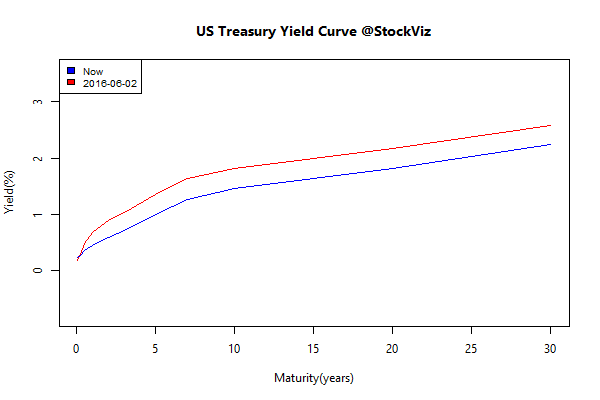

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.07 | +0.83% |

| 5 10 | -0.07 | +0.98% |

| 10 15 | -0.01 | +0.71% |

| 15 20 | -0.08 | +1.37% |

| 20 30 | -0.12 | +1.88% |

Bonds rallied across the board. Note the shift in the yield curve.

Investment Theme Performance

| Velocity | +19.26% |

| Acceleration | +17.23% |

| Momentum | +10.11% |

| Enterprise Yield | +7.24% |

| Quality to Price | +7.04% |

| Financial Strength Value | +6.45% |

| High Beta | +5.34% |

| Low Beta | +4.90% |

| Balance Sheet Strength | +4.51% |

| Magic Formula | +3.96% |

| High Alpha | +3.43% |

| Low Volatility | +3.32% |

| High Sharpe | +3.27% |

| HighIR Momentum | +2.99% |

| Tactical CNX 100 | +2.97% |

Momentum strategies regained their thrones after spending months in the boondocks…

Equity Mutual Funds

Bond Mutual Funds

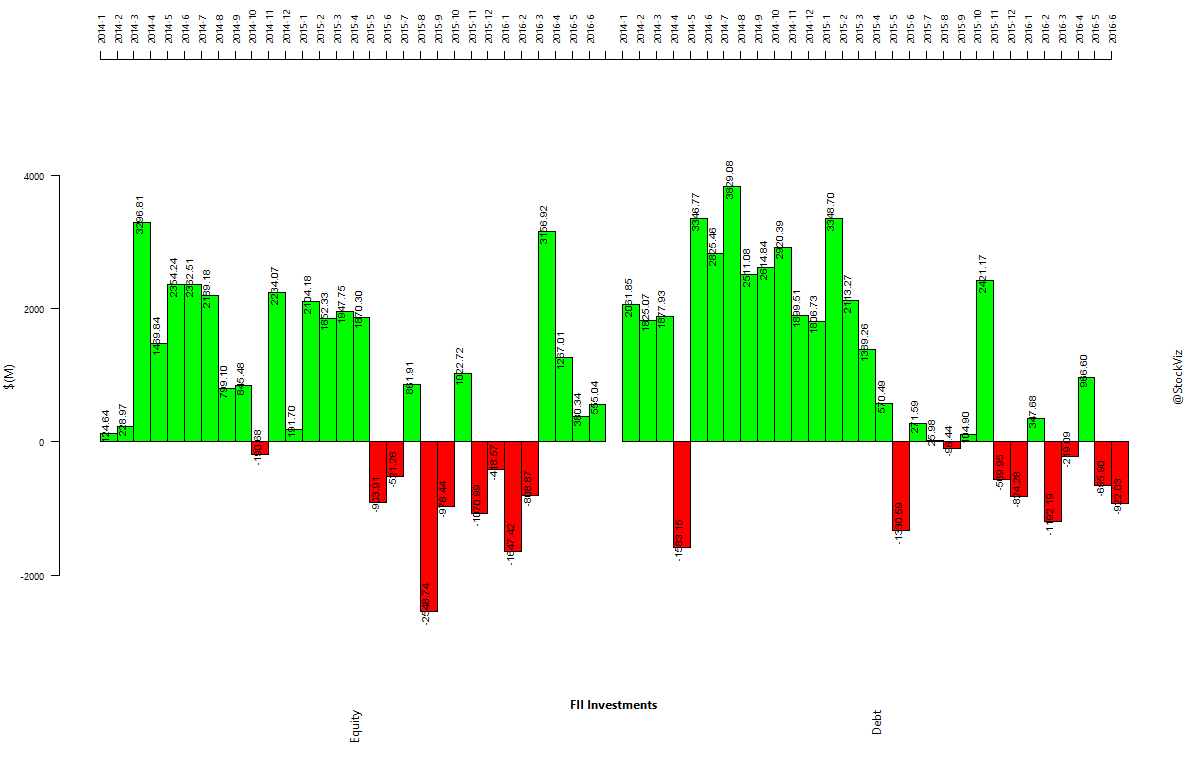

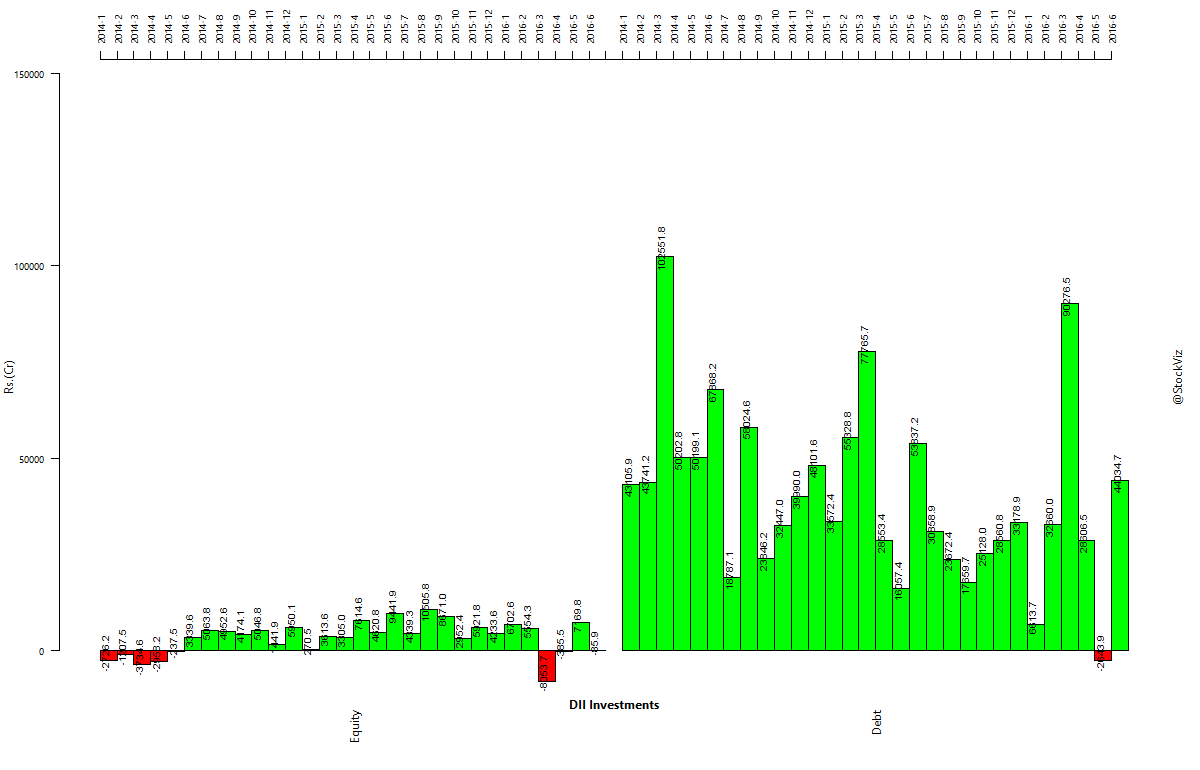

Institutional flows

FIIs sold out bonds and bought into equities. DIIs did the opposite…

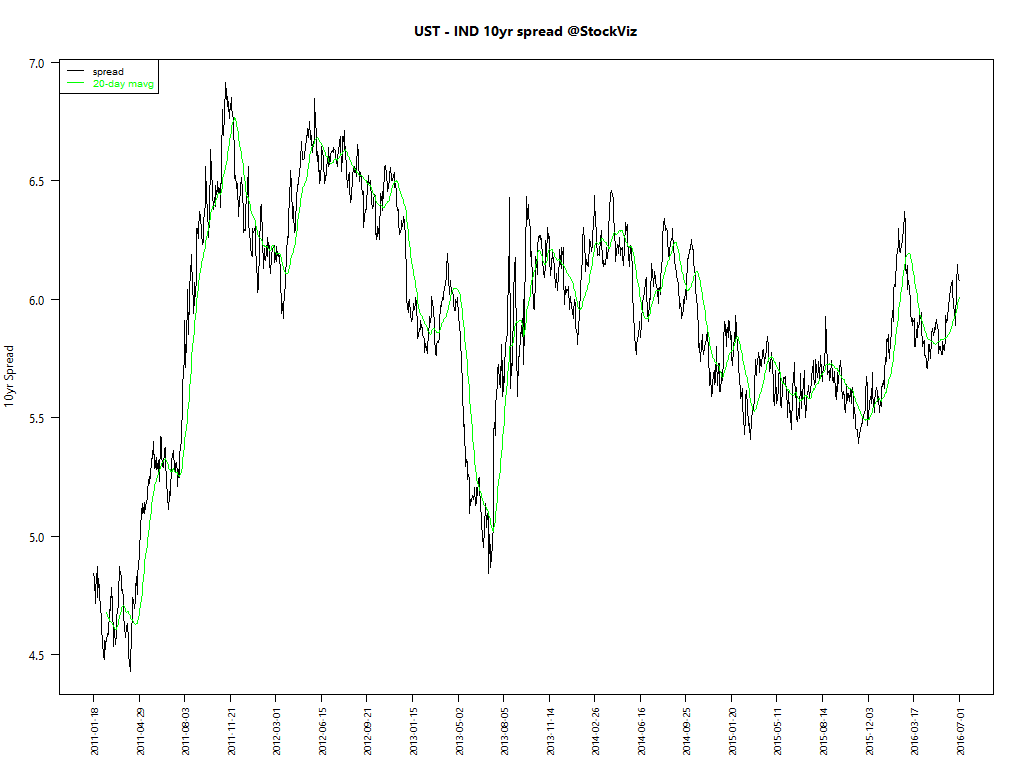

US Treasuries

Looks like Indian bonds are no where near overbought compared to US Treasuries.

Book of the month

Black Box Thinking: Why Most People Never Learn from Their Mistakes–But Some Do (Amazon)

The only way to improve decision making is to record everything and use the telemetry to deconstruct failure. Once we know why something went wrong, we can go back to improving the decision making process. Much like how every airline crash is an opportunity to learn and improve flight safety. Investors will find a lot of takeaways from this book.