Introduction

We often hear the term “buy-the-dip” whenever the markets are correcting. However, here are some questions that face an investor:

- What exactly is a “dip?”

- Where does the cash come from?

- How much should I buy?

The answers to these questions will determine how much alpha you will generate by employing this strategy.

What is a “dip?”

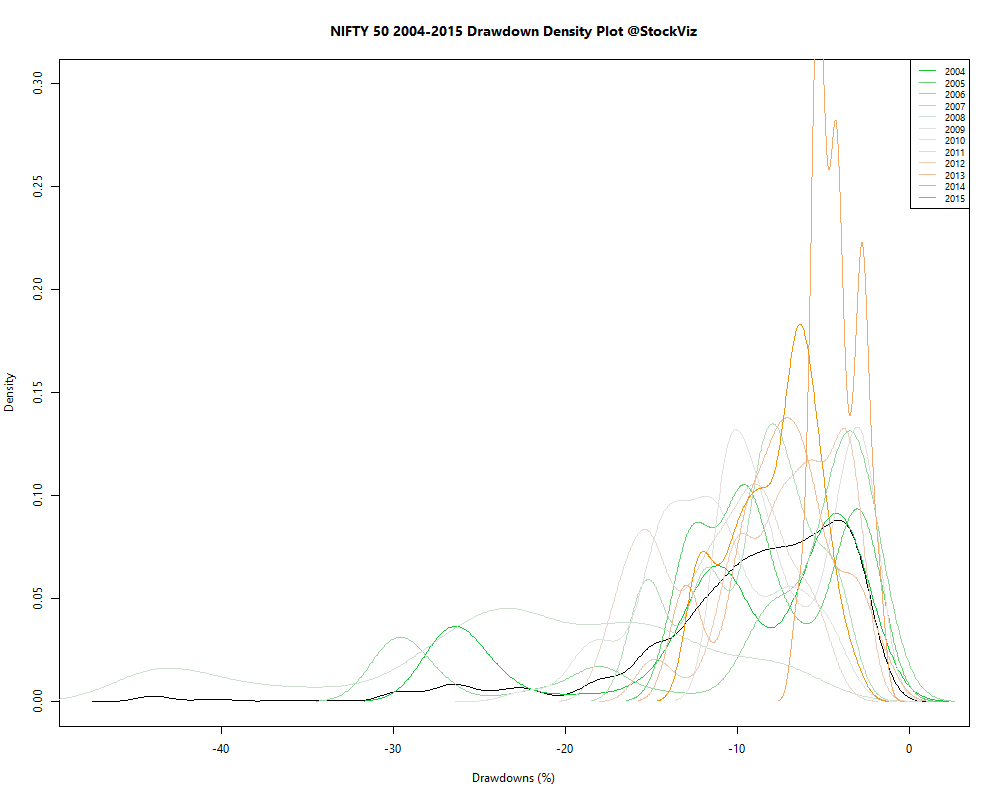

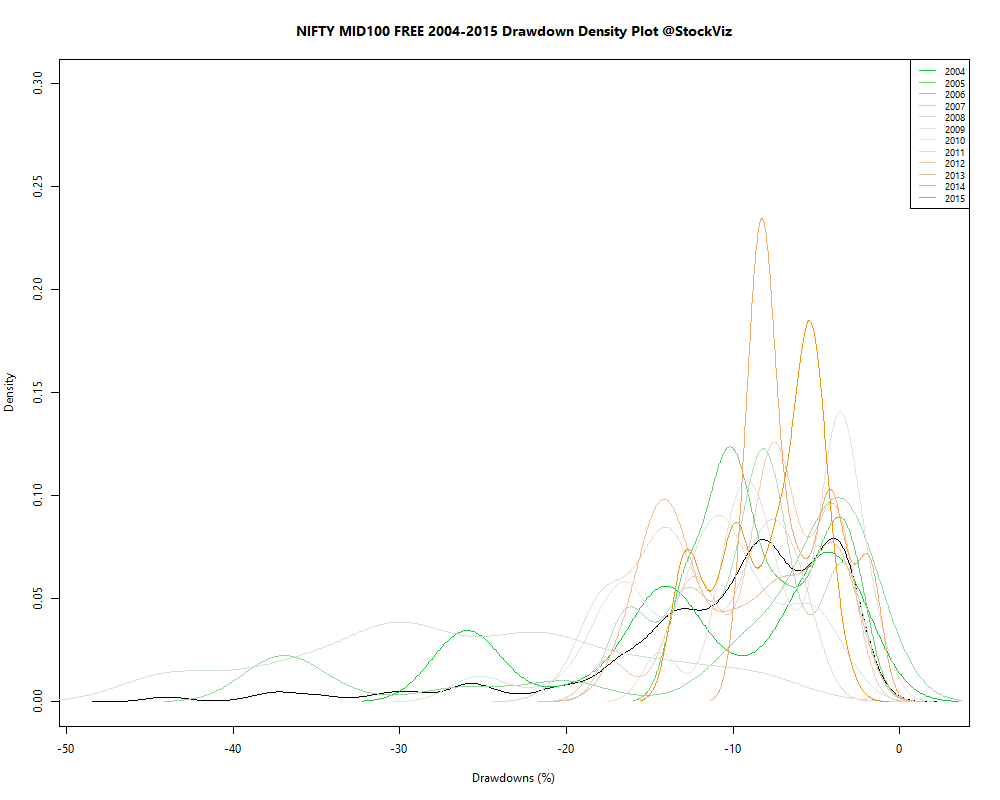

A dip is a percentage loss from a near-time peak (also called a drawdown.) For example, if the NIFTY posts a 50-day cumulative loss of 5%, then that is a 5% dip over where the NIFTY closed 50-days ago. To get a sense for how these 50-day dips/drawdowns are distributed, we do a density plot.

As we can see, most of the NIFTY dips are at around 5%. A more than 10% dip is a “back the truck up” event where we deploy all our cash. For MIDCAPs, it is around 10% and 15%.

The back test

Every day, an investor has Rs. 1 that he needs needs to invest. He can either buy the NIFTY/MIDCAP or he can park it a short-term bond fund/savings account. Additionally, if it is a “back the truck up” dip, he can liquidate the bond fund and buy the NIFTY/MIDCAP. Let’s tag this as DIP.

In a DIP, the investor only buys NIFTY/MIDCAP if it is in a dip. Otherwise, he buys Rs. 1 worth of bonds.

The base case is that the investor buys Rs. 1 worth of NIFTY/MIDCAP every day. Let’s tag this as SIP.

Should you buy the dip?

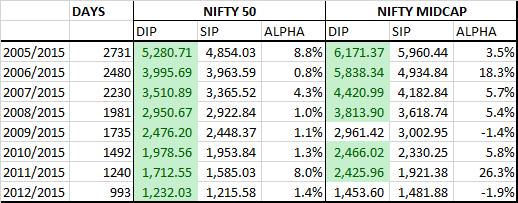

Yes, buying the dip allows you to build a bigger corpus, if your transaction costs are zero. Here are the NIFTY and NIFTY MIDCAP buy the dip (DIP) vs. daily purchase (SIP) final corpus:

Given how small the alpha is, net of fees/commissions/slippage/taxes, this is a losing proposition. You are better off with a SIP.