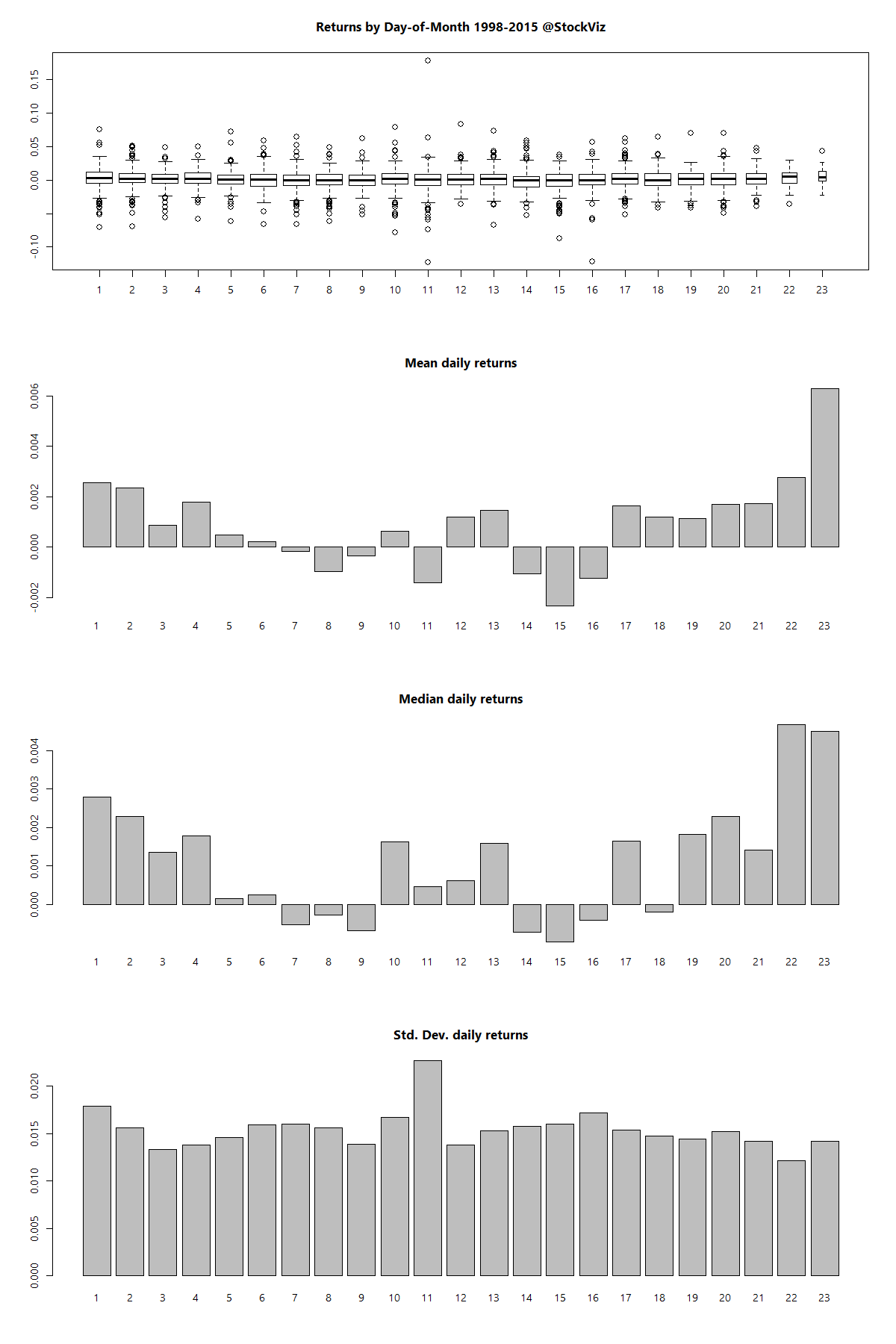

An analysis of daily returns of the NIFTY 50 index between 1998 and 2015 shows that:

- The first few and the last few trading days of a month are the best days to be long.

- Middle of the month returns are more volatile and, on an average, negative.

- Cumulative returns of a strategy that is long on the first 5 and the last 5 days of the month and short the others is 1,112.154% vs. 636.1821% of a buy and hold strategy.

Further reading: An Anatomy of Calendar Effects (SSRN)