Equities

Commodities

| Energy |

| Brent Crude Oil |

+10.30% |

| Ethanol |

+4.44% |

| Heating Oil |

+8.39% |

| RBOB Gasoline |

+38.22% |

| Natural Gas |

+13.84% |

| WTI Crude Oil |

+11.73% |

| Metals |

| Palladium |

+15.93% |

| Copper |

+2.35% |

| Gold 100oz |

-0.06% |

| Silver 5000oz |

+4.73% |

| Platinum |

+5.15% |

| Agricultural |

| Cocoa |

-2.75% |

| Feeder Cattle |

-0.55% |

| White Sugar |

+8.29% |

| Cattle |

-4.71% |

| Coffee (Robusta) |

+9.77% |

| Corn |

-1.27% |

| Lumber |

+21.75% |

| Orange Juice |

+17.57% |

| Sugar #11 |

+4.72% |

| Coffee (Arabica) |

+11.78% |

| Cotton |

+2.76% |

| Soybeans |

+7.00% |

| Lean Hogs |

-2.05% |

| Soybean Meal |

+4.55% |

| Wheat |

+5.96% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+2.89% |

| Markit CDX NA HY |

+3.28% |

| Markit CDX NA IG |

-27.66% |

| Markit iTraxx Asia ex-Japan IG |

-6.67% |

| Markit iTraxx Australia |

-15.03% |

| Markit iTraxx Europe |

-26.80% |

| Markit iTraxx Europe Crossover |

-98.68% |

| Markit iTraxx Japan |

-9.45% |

| Markit MCDX (Municipal CDS) |

-14.58% |

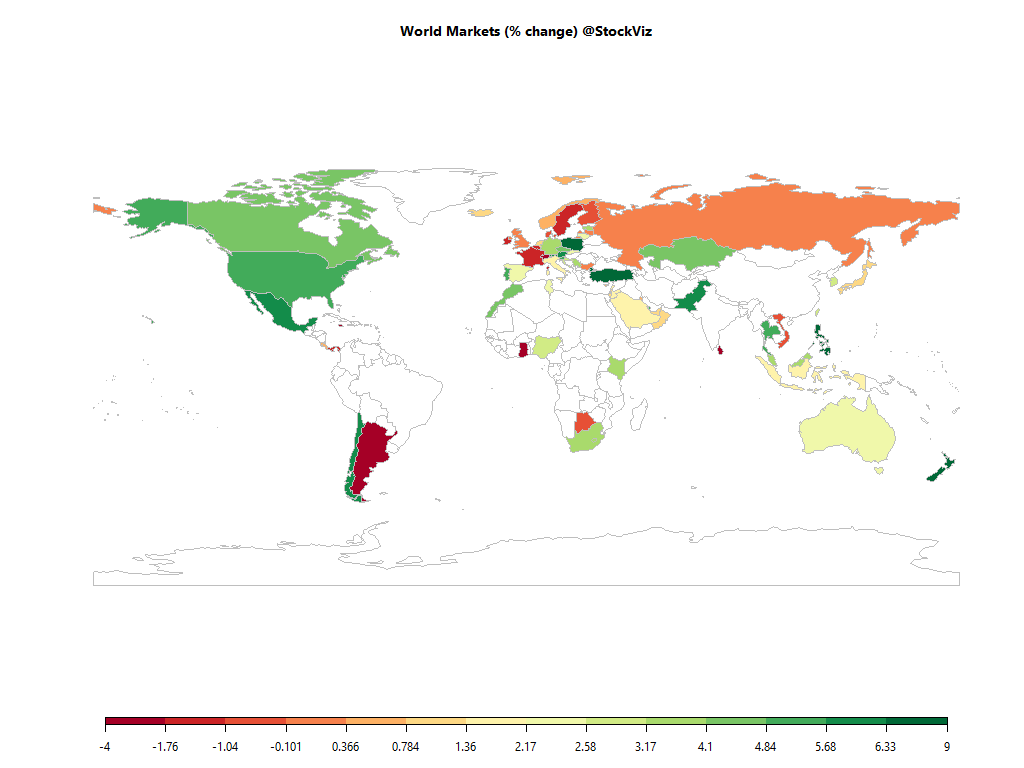

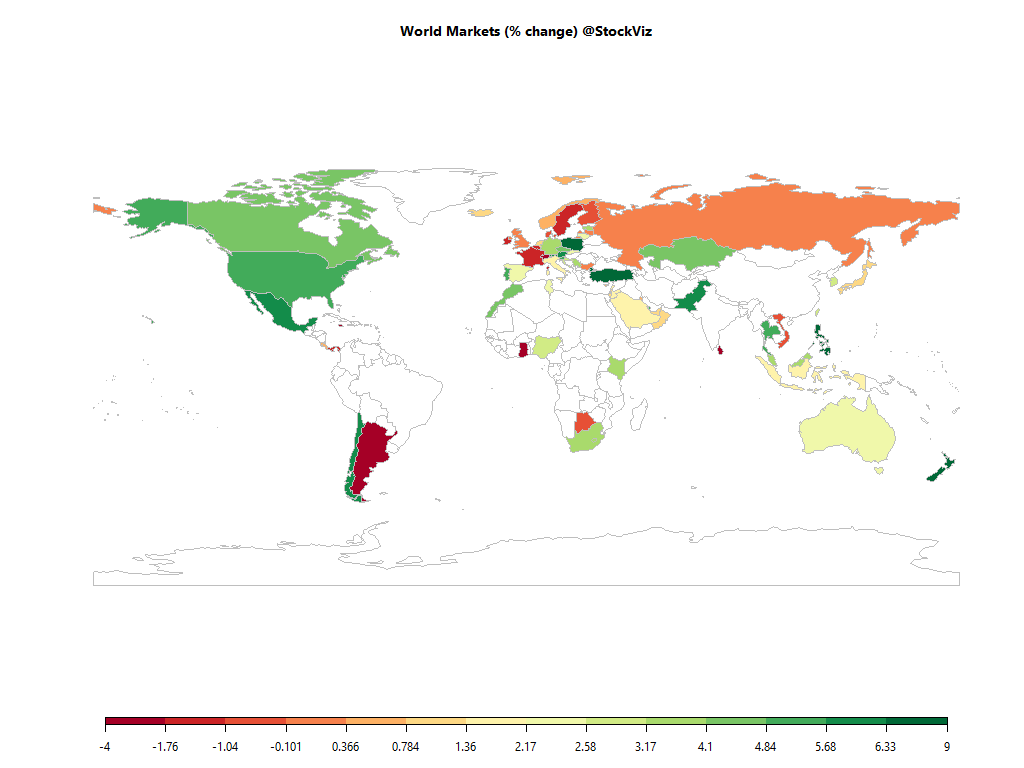

Markets rebounded with the Fed assuming the role of the world’s central bank…

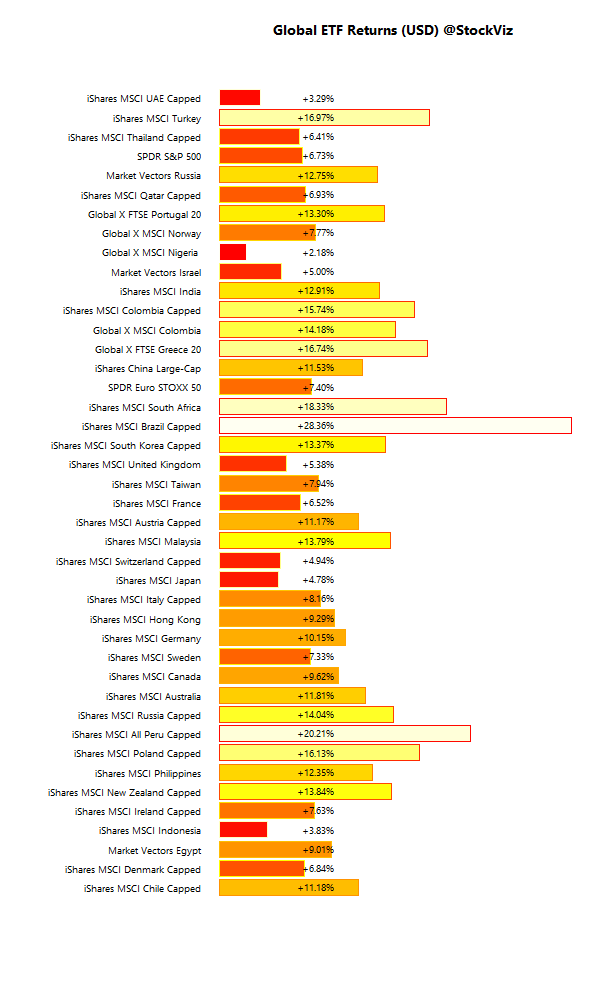

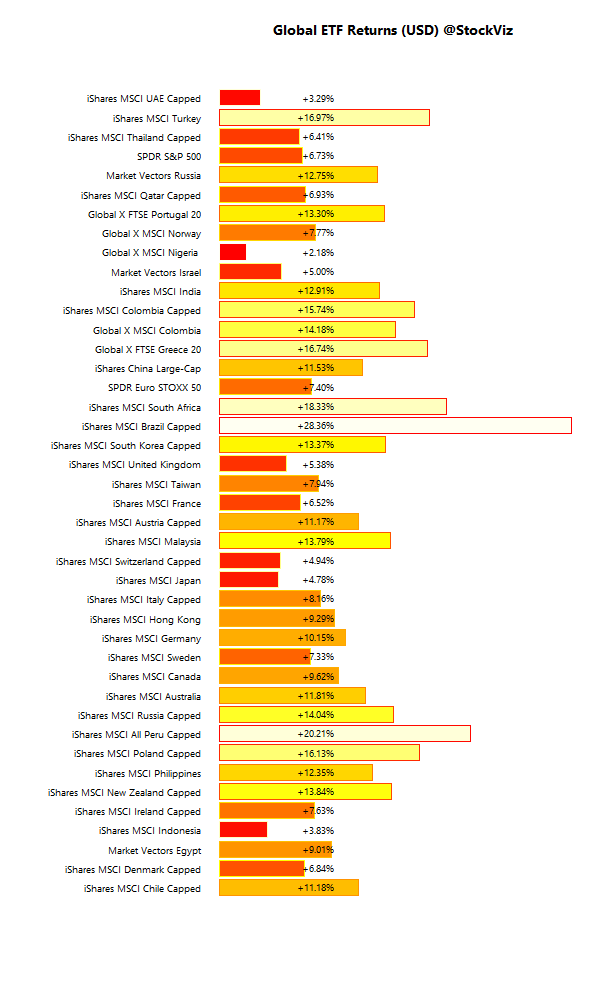

International ETFs (USD)

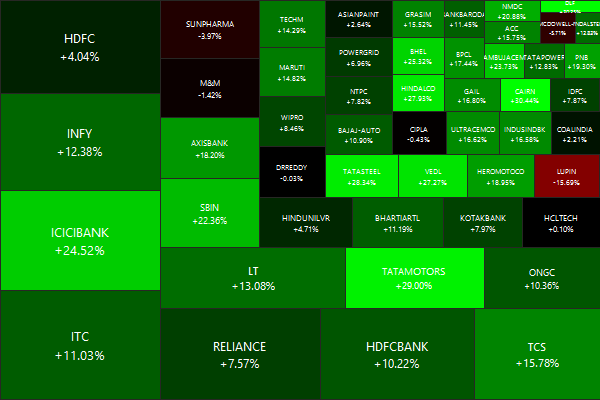

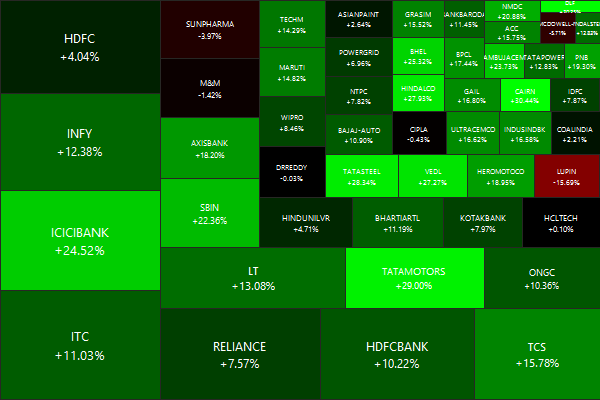

Nifty Heatmap

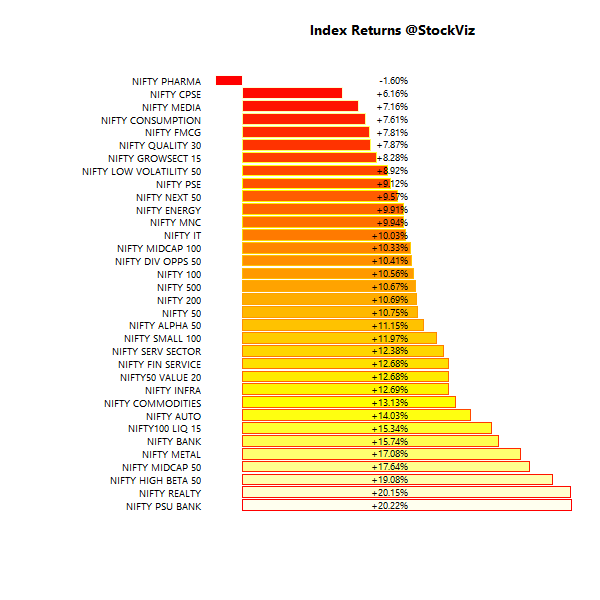

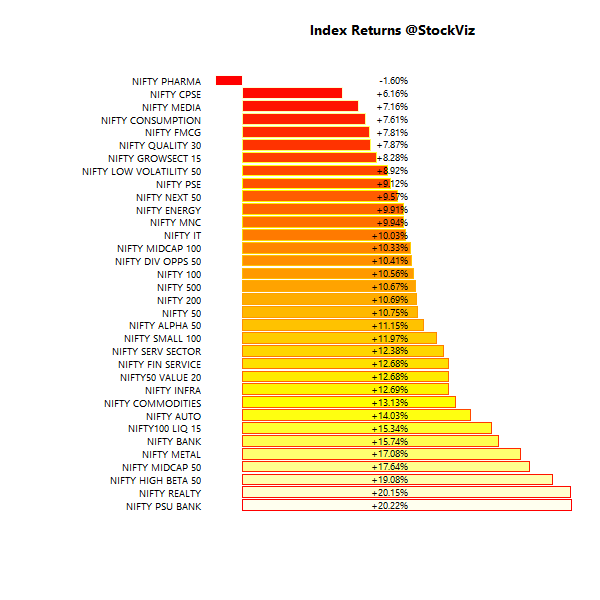

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+0.54% |

70/61 |

| 2 |

+9.38% |

82/48 |

| 3 |

+10.53% |

91/39 |

| 4 |

+9.03% |

82/48 |

| 5 |

+7.85% |

84/46 |

| 6 |

+6.78% |

85/45 |

| 7 |

+10.83% |

83/47 |

| 8 |

+7.10% |

83/47 |

| 9 |

+12.46% |

81/49 |

| 10 (mega) |

+1.97% |

74/57 |

Top Winners and Losers

ETF Performance

With bank balance-sheet clean up in full swing, banks got the better bid…

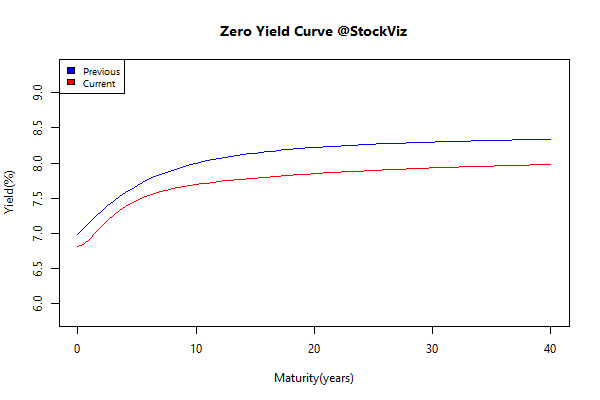

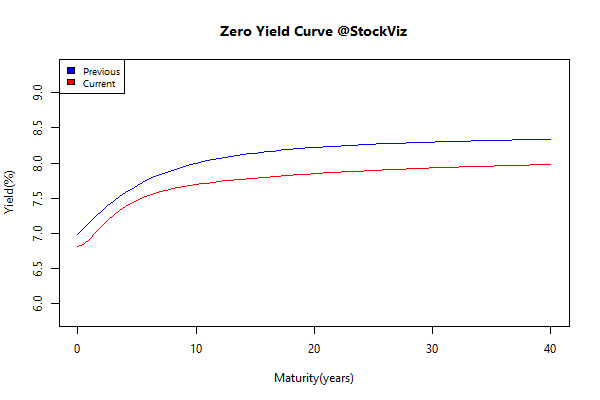

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.22 |

+1.22% |

| 5 10 |

-0.24 |

+1.91% |

| 10 15 |

-0.30 |

+2.56% |

| 15 20 |

-0.35 |

+3.94% |

| 20 30 |

-0.37 |

+4.59% |

Rate cut already factored in?

Investment Theme Performance

The worst hit asset classes saw the steepest rebound…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

Why do amateurs believe they can outperform the professionals — or even identify those pros who will outperform? (Performance of individual mutual funds cannot be predicted with any greater degree of accuracy than individual stocks or bonds.)

- Overconfidence

- Optimism Bias

- Hindsight Bias

- Attribution Bias

- Confirmation Bias

Source: Why We Think We’re Better Investors Than We Are