Equities

| MINTs | |

|---|---|

| JCI(IDN) | +0.48% |

| INMEX(MEX) | +0.57% |

| NGSEINDX(NGA) | -16.50% |

| XU030(TUR) | +2.99% |

| BRICS | |

|---|---|

| IBOV(BRA) | -6.79% |

| SHCOMP(CHN) | -22.65% |

| NIFTY(IND) | -4.82% |

| INDEXCF(RUS) | +1.34% |

| TOP40(ZAF) | -3.78% |

Commodities

| Energy | |

|---|---|

| Heating Oil | -3.91% |

| Natural Gas | -1.66% |

| RBOB Gasoline | -11.16% |

| WTI Crude Oil | -10.10% |

| Brent Crude Oil | -4.76% |

| Ethanol | +1.79% |

| Metals | |

|---|---|

| Palladium | -11.05% |

| Silver 5000oz | +3.62% |

| Copper | -3.29% |

| Gold 100oz | +5.37% |

| Platinum | +0.33% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -0.07% |

| USDMXN(MEX) | +5.13% |

| USDNGN(NGA) | -0.17% |

| USDTRY(TUR) | +1.33% |

| BRICS | |

|---|---|

| USDBRL(BRA) | +0.98% |

| USDCNY(CHN) | +1.27% |

| USDINR(IND) | +2.48% |

| USDRUB(RUS) | +3.59% |

| USDZAR(ZAF) | +2.66% |

| Agricultural | |

|---|---|

| Cotton | -3.97% |

| Soybeans | +1.23% |

| Wheat | +1.75% |

| Coffee (Arabica) | -7.87% |

| Lean Hogs | +10.06% |

| Cocoa | -11.17% |

| Coffee (Robusta) | -6.98% |

| Corn | +3.70% |

| Soybean Meal | +2.84% |

| White Sugar | -3.72% |

| Cattle | -0.74% |

| Feeder Cattle | -6.28% |

| Lumber | -6.05% |

| Orange Juice | -5.13% |

| Sugar #11 | -13.48% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | -0.81% |

| Markit CDX NA HY | -2.26% |

| Markit CDX NA IG | +16.56% |

| Markit iTraxx Asia ex-Japan IG | +19.42% |

| Markit iTraxx Australia | +17.89% |

| Markit iTraxx Europe | +14.77% |

| Markit iTraxx Europe Crossover | +51.56% |

| Markit iTraxx Japan | +15.56% |

| Markit MCDX (Municipal CDS) | +6.25% |

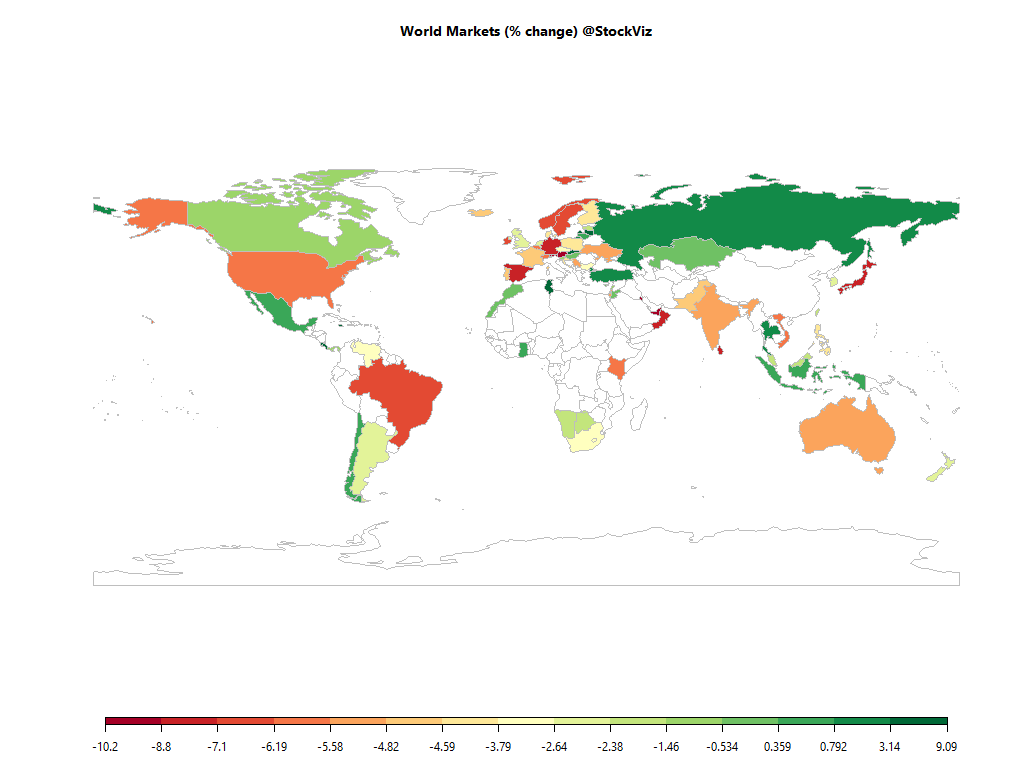

A fresh bout of volatility hit the markets in January. EM currencies crashed, China capital outflows accelerated and Japan announced negative interest rates. The first half of February will see companies announce their quarterly results, adding a fresh dose of fuel to the volatility fire…

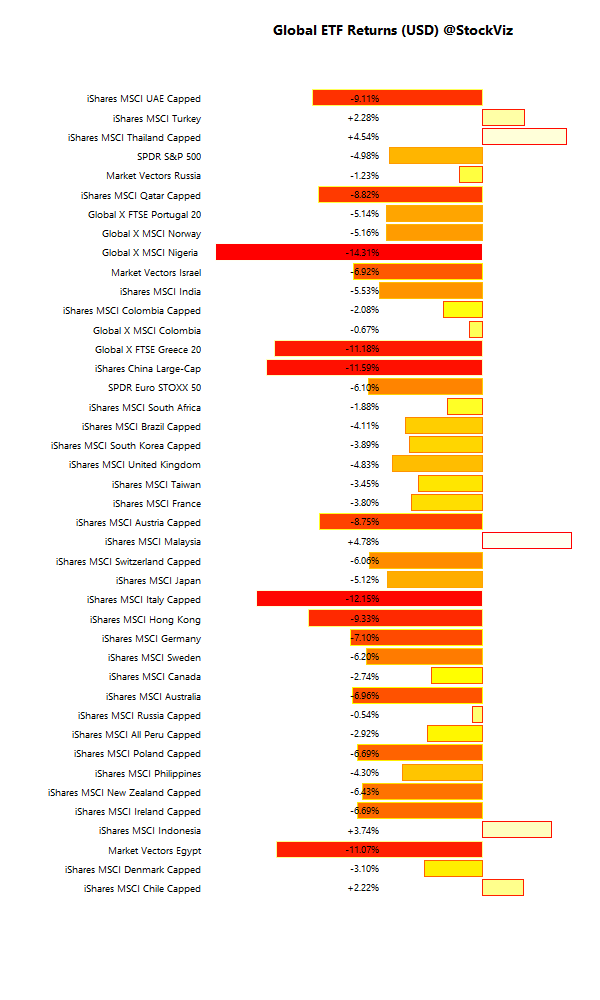

International ETFs (USD)

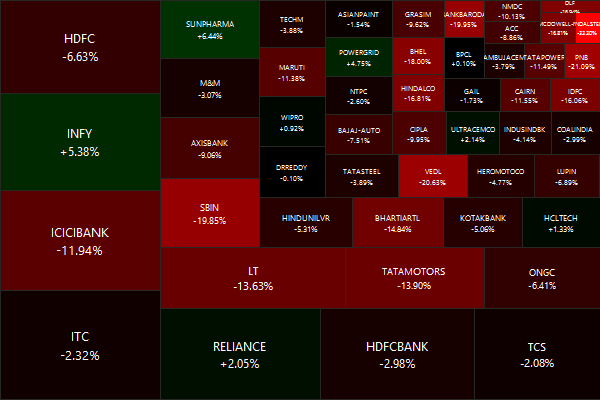

Nifty Heatmap

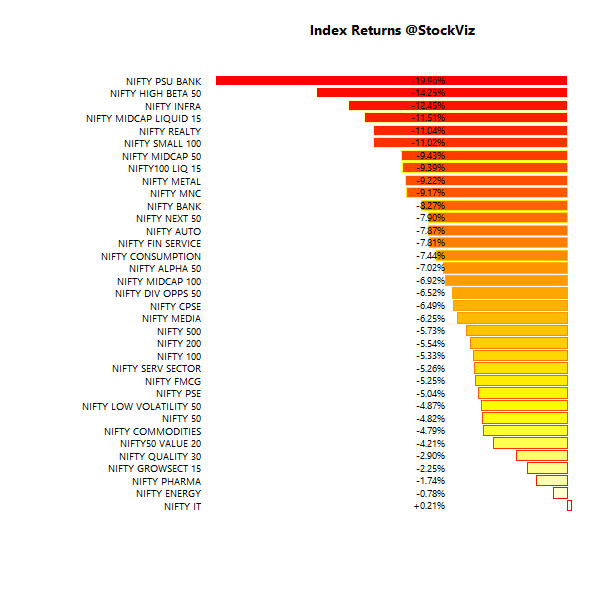

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -17.03% | 69/71 |

| 2 | -9.17% | 65/74 |

| 3 | -15.39% | 52/87 |

| 4 | -16.38% | 45/95 |

| 5 | -18.88% | 41/98 |

| 6 | -14.42% | 45/94 |

| 7 | -15.34% | 51/89 |

| 8 | -15.24% | 56/83 |

| 9 | -16.29% | 55/84 |

| 10 (mega) | -7.84% | 67/73 |

Mid- and small-caps bore the brunt of the selloff…

Top Winners and Losers

Whats the difference between a Brutality and Fatality?

ETF Performance

| GOLDBEES | +6.32% |

| NIFTYBEES | -5.07% |

| CPSEETF | -6.19% |

| JUNIORBEES | -8.02% |

| BANKBEES | -8.28% |

| INFRABEES | -12.00% |

| PSUBNKBEES | -20.00% |

Gold saw a bid on the back of Rupee collapse…

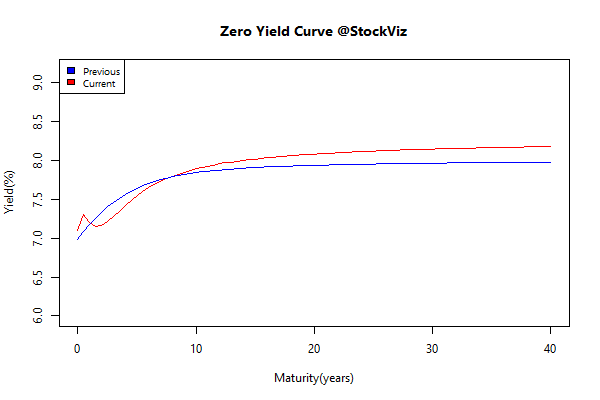

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.13 | +0.99% |

| 5 10 | -0.06 | +0.96% |

| 10 15 | -0.02 | +0.86% |

| 15 20 | +0.06 | -0.04% |

| 20 30 | +0.11 | -0.48% |

Bonds proved their worth during the turmoil – diversification FTW!

Investment Theme Performance

| Tactical CNX 100 | -3.66% |

| Enterprise Yield | -4.30% |

| HighIR Momentum | -4.77% |

| Low Volatility | -5.31% |

| Low Beta | -5.75% |

| High Sharpe | -6.27% |

| High Alpha | -6.42% |

| Balance Sheet Strength | -8.44% |

| Magic Formula | -10.25% |

| Financial Strength Value | -10.76% |

| Velocity | -11.18% |

| Acceleration | -11.41% |

| High Beta | -12.19% |

| Quality to Price | -14.25% |

| Momentum | -16.59% |

Momentum saw the worst drawdown among all strategies. But the last few days have seen a dramatic recovery…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

Here’s what happens when you make short-term decisions with long-term capital:

- You constantly change your strategy and chase past performance.

- You ignore any semblance of a long-term plan.

- You end up being reactive instead of pro-active with your decisions.

- You incur higher fees from increased trading, due diligence and switching costs.

- You lose sight of your actual goals and time horizon.

- You end up with a portfolio that’s built to withstand the last war, not the next one.

- You lose out on much of the long-term benefits that come from diversification, rebalancing and mean reversion.