Drawdown, of an investment, is the peak-to-trough decline during a specific period.

It is not uncommon for stock indices to drawdown 30% in a year. Here’s how we see it.

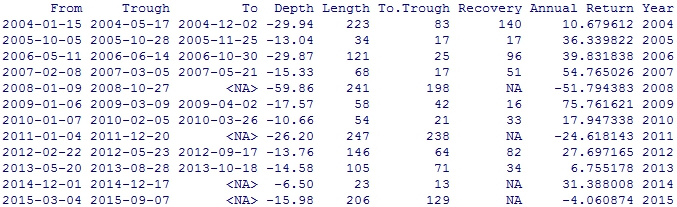

Nifty 50 Drawdowns

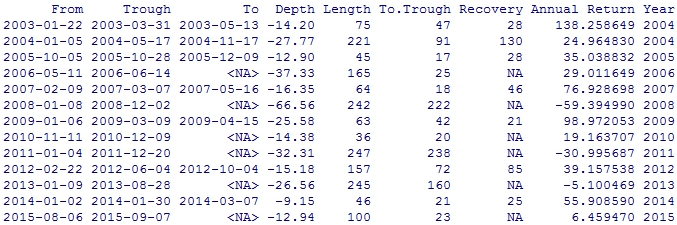

Nifty Midcap 100 Drawdowns

Explainer

Drawdowns take their time to form and can be identified into three distinct points:

- The day from which the investment started going down. ‘From’ in the above images.

- The day on which the investment stopped going down. ‘Trough’ in the above images.

- The day on which the investment recouped all its losses from (1). ‘To’ in the above images.

The number of days the whole processes took is the ‘Length’ of the drawdown. ‘Recovery’ shows the number of days it took to get back to it initial value.

Path dependency

The yearly breakup shown above doesn’t give the real picture of how the investment actually performed during the entire stretch of time. For example, here’s NIFTY 50 vs. MIDCAP 100:

Depending on where your starting point is, you end up with different drawdown and return profiles. You can fool around with that here: svz.bz

Take-away

Returns go hand-in-hand with drawdowns. Seasoned investors wait for it (in bond funds) to enter, most long-term investors learn to ignore them and continue their dollar cost averaging (aka SIP.)