Equities

Commodities

| Energy |

| Ethanol |

-15.34% |

| Heating Oil |

-40.11% |

| Natural Gas |

-34.44% |

| WTI Crude Oil |

-45.96% |

| Brent Crude Oil |

-44.91% |

| RBOB Gasoline |

-37.32% |

| Metals |

| Palladium |

-23.91% |

| Gold 100oz |

-11.43% |

| Copper |

-27.92% |

| Platinum |

-27.90% |

| Silver 5000oz |

-15.79% |

| Agricultural |

| Feeder Cattle |

-27.98% |

| Lumber |

-23.89% |

| Coffee (Arabica) |

-39.01% |

| Corn |

-0.96% |

| Lean Hogs |

-39.92% |

| Soybeans |

-13.54% |

| Sugar #11 |

-8.29% |

| Cocoa |

+16.12% |

| Cotton |

-2.18% |

| Soybean Meal |

-22.16% |

| Wheat |

-5.69% |

| Cattle |

-24.30% |

| Coffee (Robusta) |

-21.21% |

| Orange Juice |

+8.52% |

| White Sugar |

-8.77% |

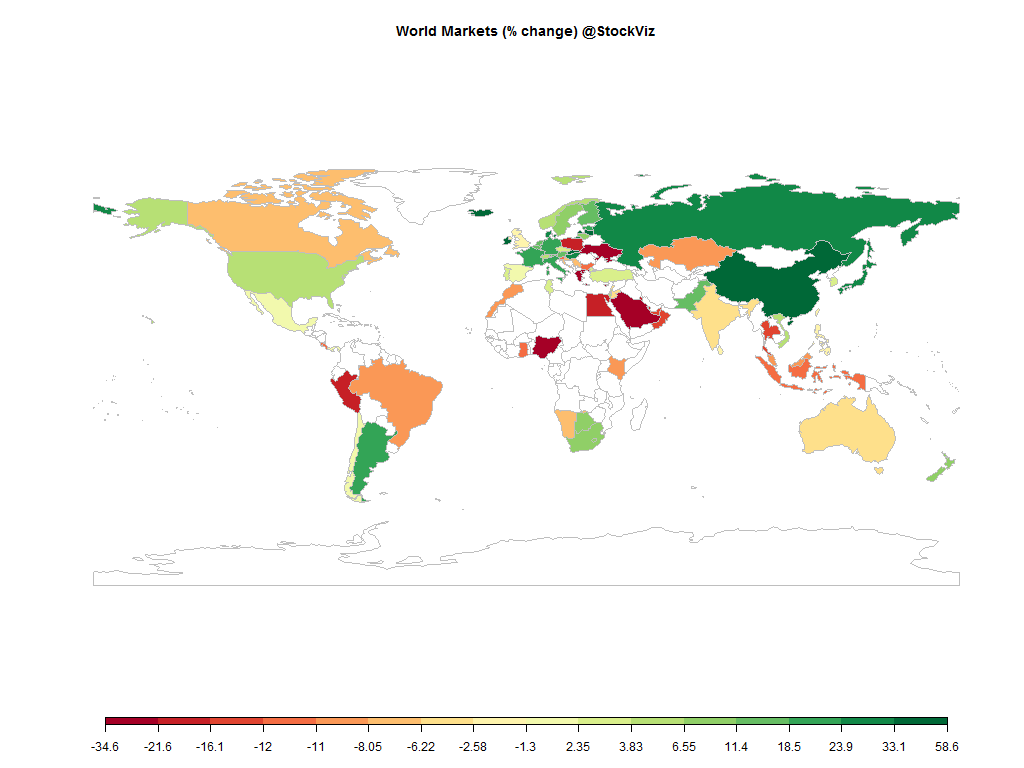

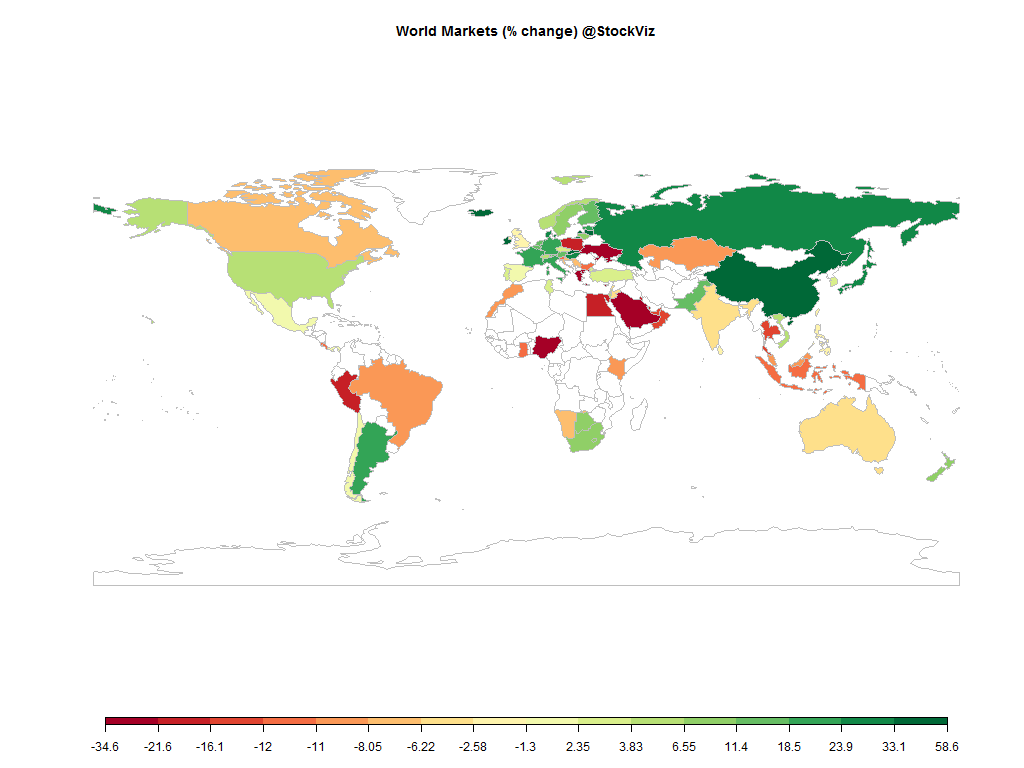

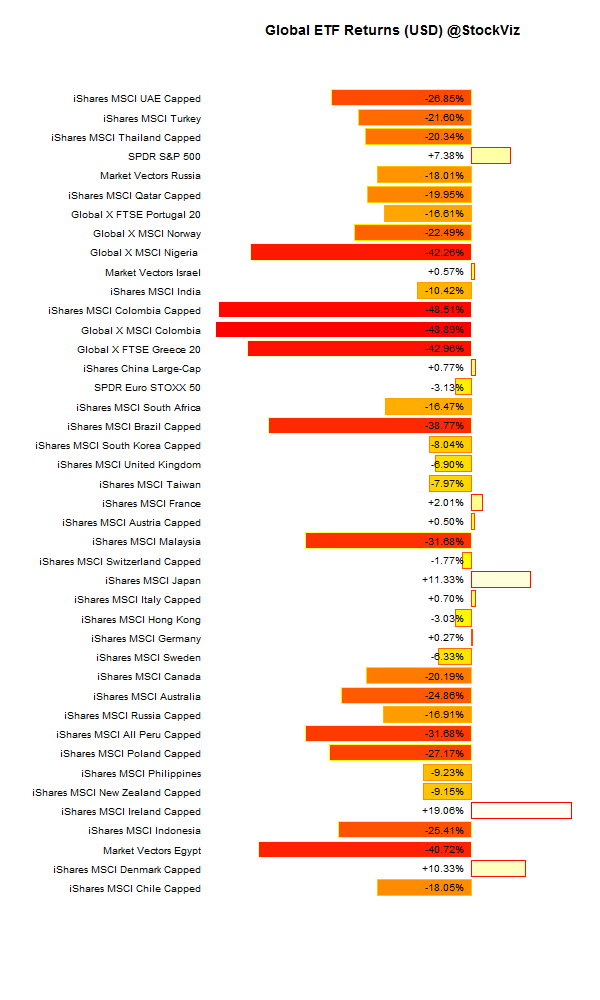

International ETFs (USD)

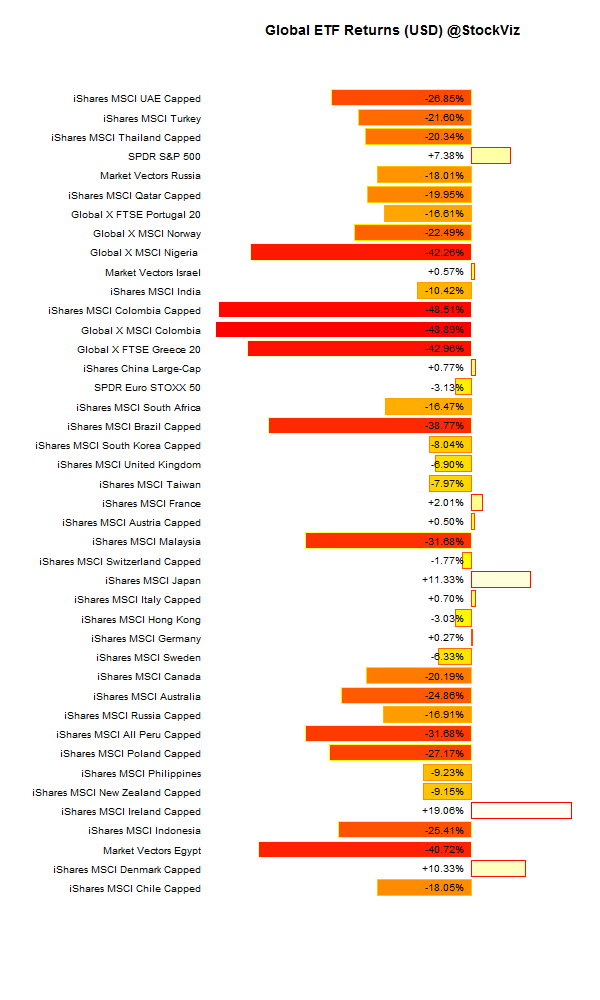

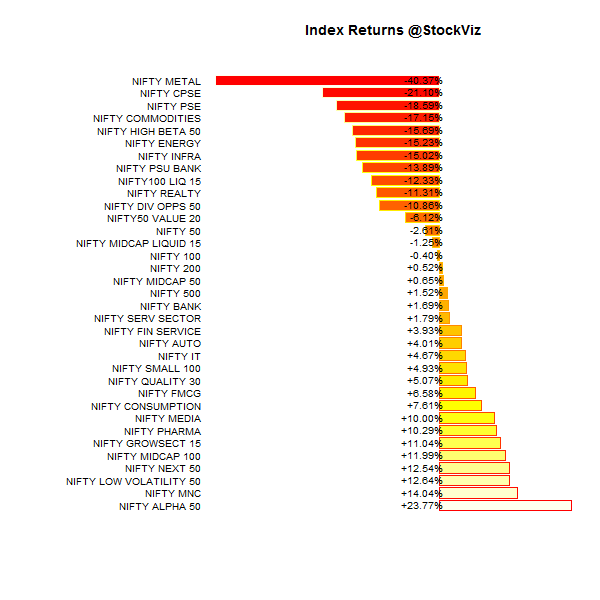

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+29.48% |

79/55 |

| 2 |

+42.65% |

76/58 |

| 3 |

+11.26% |

64/70 |

| 4 |

+19.62% |

72/61 |

| 5 |

+15.77% |

66/68 |

| 6 |

+18.22% |

72/62 |

| 7 |

+13.38% |

71/62 |

| 8 |

+15.21% |

72/62 |

| 9 |

+11.70% |

73/61 |

| 10 (mega) |

+5.37% |

79/55 |

Most of the action was in the mid-and-small cap arena. Lot of dispersion, lot of good opportunities…

ETF Performance

The private sector created wealth and the public sector destroyed it.

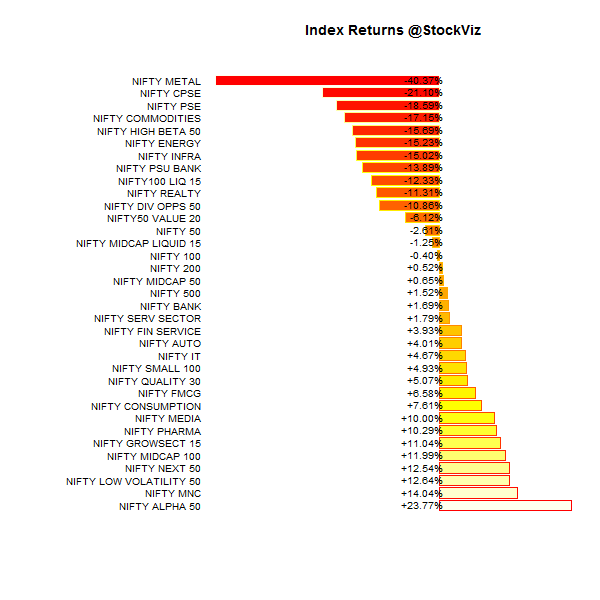

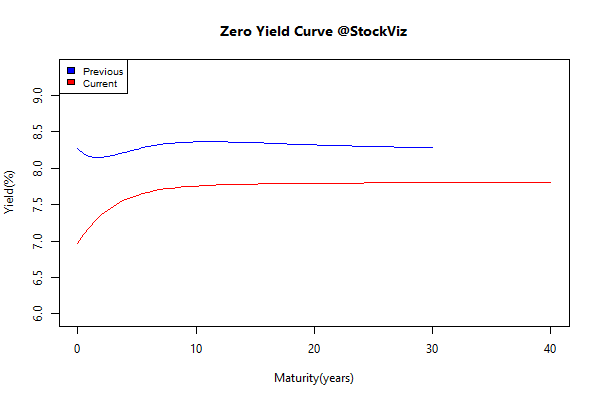

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.83 |

+10.59% |

| 5 10 |

-0.65 |

+12.11% |

| 10 15 |

-0.62 |

+13.39% |

| 15 20 |

-0.62 |

+14.29% |

| 20 30 |

-0.63 |

+14.97% |

Raghuram Rajan magic: low inflation + falling rates = bond investor jackpot!

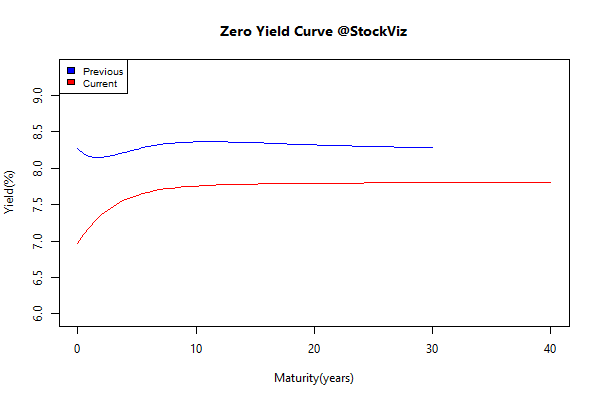

Investment Theme Performance

And what a momentum driven market it was. In hindsight, it was a long momentum, short high-beta market. Will momentum continue into Samvat 2072?

Equity Mutual Funds

Bond Mutual Funds

Thoughts

The only way an investor would have not made decent returns in Samvat 2071 is if one:

- Invested in the NIFTY ETF – Active management doesn’t work!

- Invested based on macro – Taper Tantrum! Will RBI cut rates tomorrow?!

- Invested based on financial television – Price-Volume Breakout! The pundit octa-box!

- Invested based on tips – Call from Indore: Aap trading karti?

- Invested based on emotions – Oh My God! The market is crashing! Sell! The market is shooting up! Buy!

Comments are closed, but trackbacks and pingbacks are open.