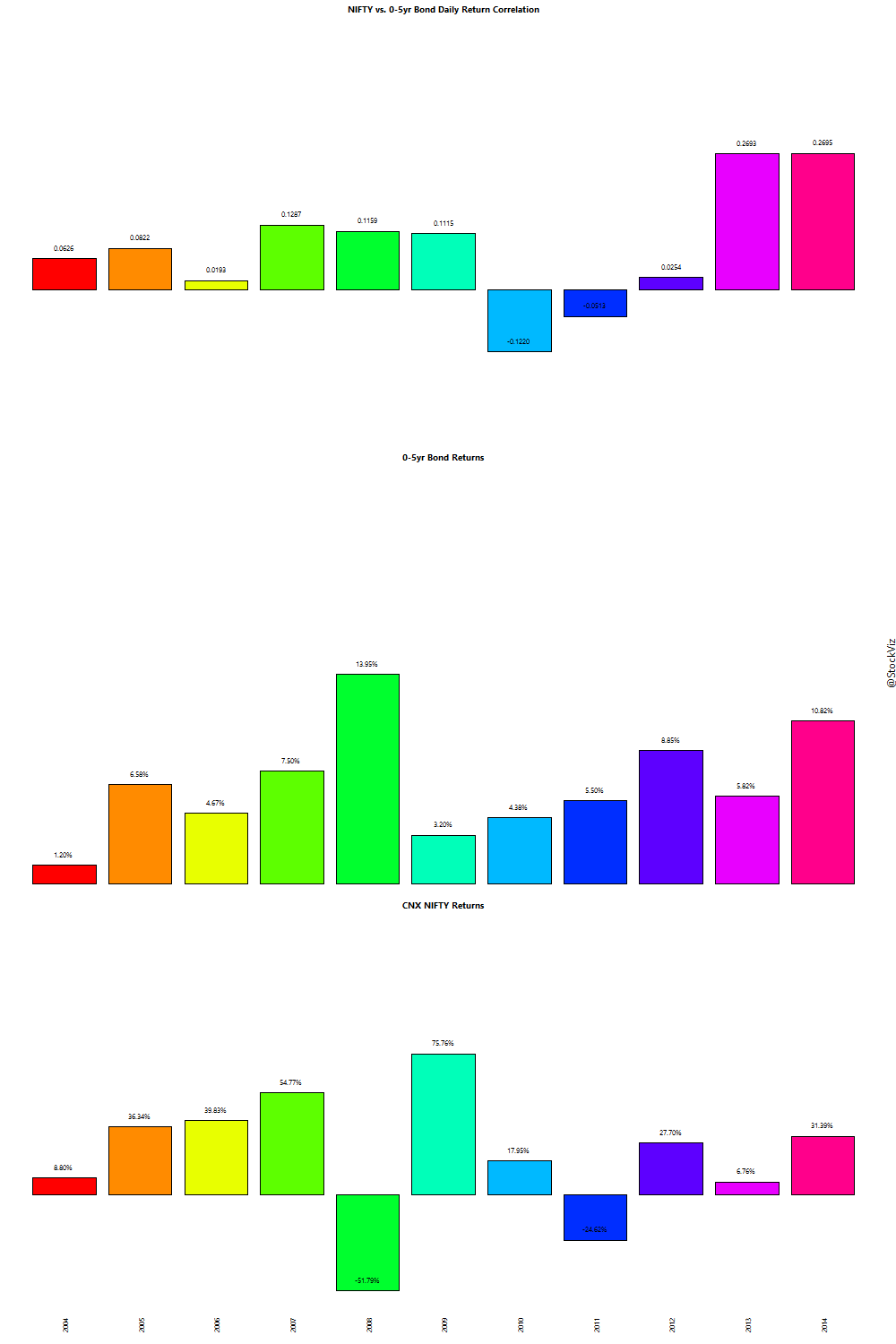

We compared the total returns from the short-end of the curve to Nifty. Here’s what we found:

- IRR over the last 10 years for bonds was 6.53%.

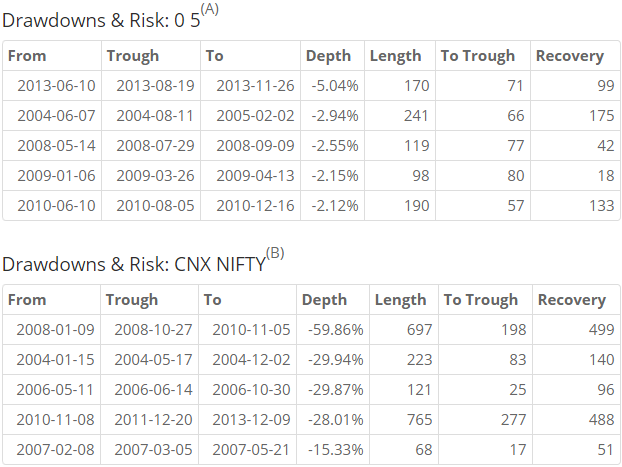

- Biggest drawdown was -5.04%.

- Only two years of negative correlation with NIFTY.

The right place for bonds in a portfolio is for regular income. From a returns perspective, you are better off investing in equities. Bonds are no less volatile when compared to the returns they give, and are mostly correlated with equity volatility.