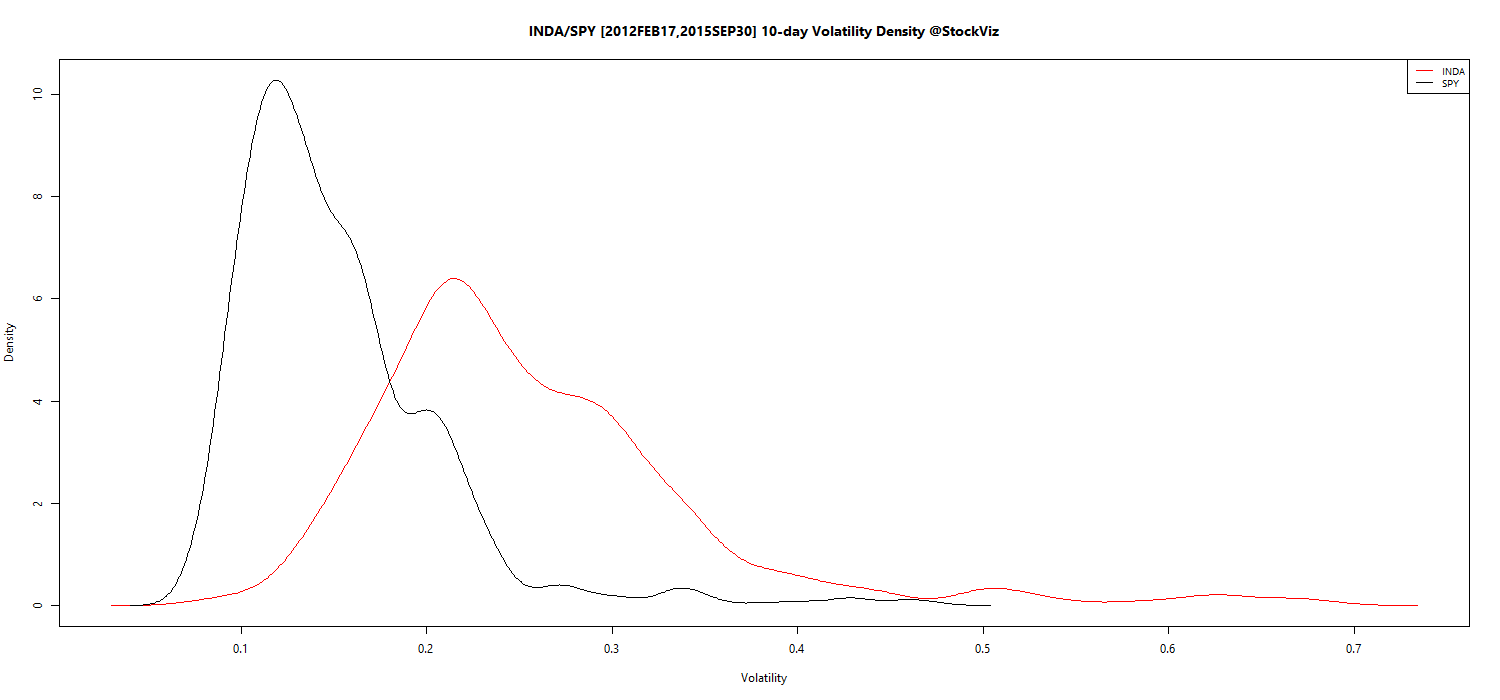

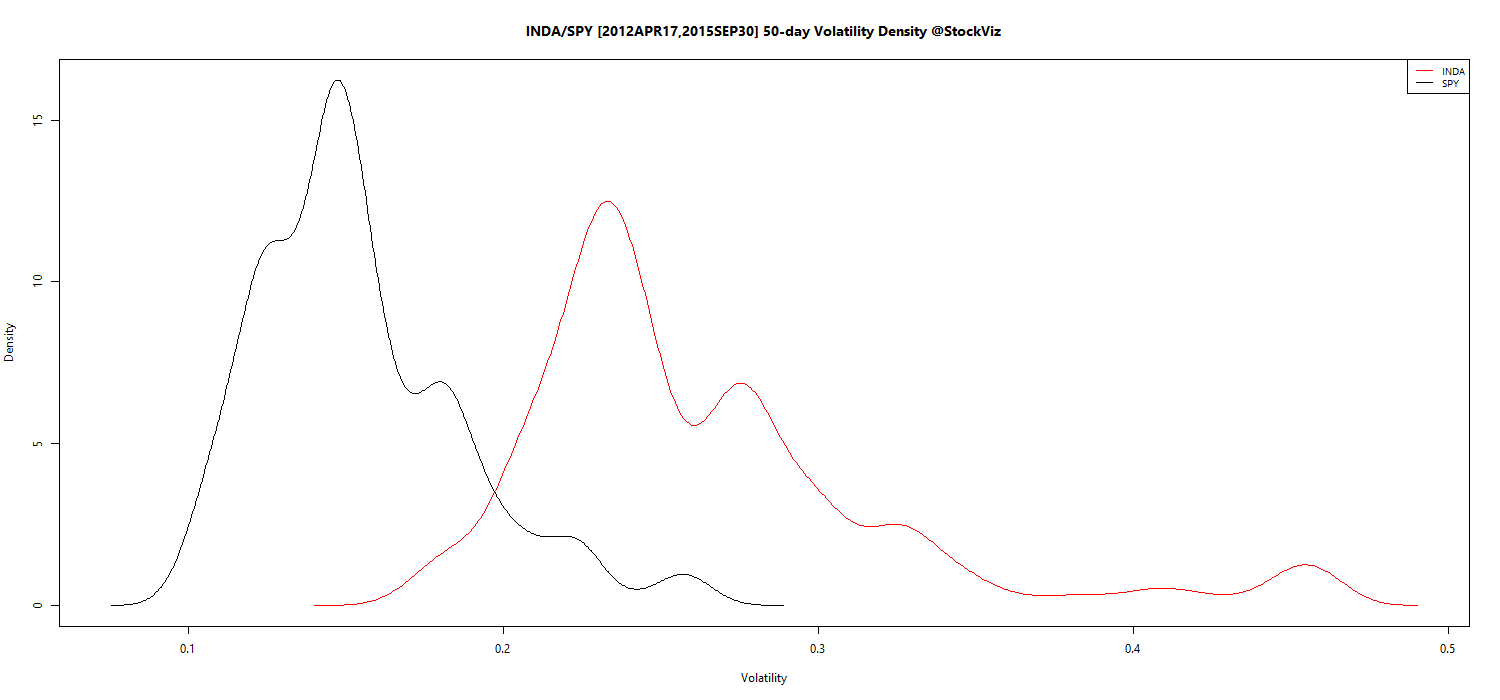

The iShares MSCI India ETF (INDA) tracks the MSCI India Total Return Index, representing about 85% of the Indian stock market. As a follow up to our earlier post on the historical volatility of the NIFTY ![]() , we thought we’ll compare the volatilities of INDA and SPY, the S&P 500 ETF.

, we thought we’ll compare the volatilities of INDA and SPY, the S&P 500 ETF.

As expected, a dollar denominated emerging market ETF is more volatile than the S&P. File this away in your brain attic.