Equities

| MINTs | |

|---|---|

| JCI(IDN) | -8.12% |

| INMEX(MEX) | -2.52% |

| NGSEINDX(NGA) | -0.09% |

| XU030(TUR) | -7.15% |

| BRICS | |

|---|---|

| IBOV(BRA) | -8.27% |

| SHCOMP(CHN) | -13.57% |

| NIFTY(IND) | -8.82% |

| INDEXCF(RUS) | +2.53% |

| TOP40(ZAF) | -6.33% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | +1.55% |

| RBOB Gasoline | -20.43% |

| Heating Oil | +5.31% |

| Natural Gas | -0.11% |

| WTI Crude Oil | +2.13% |

| Ethanol | -2.80% |

| Metals | |

|---|---|

| Copper | -2.53% |

| Gold 100oz | +3.98% |

| Platinum | +2.33% |

| Silver 5000oz | -2.01% |

| Palladium | -3.68% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +4.13% |

| USDMXN(MEX) | +4.51% |

| USDNGN(NGA) | +0.18% |

| USDTRY(TUR) | +5.21% |

| BRICS | |

|---|---|

| USDBRL(BRA) | +5.63% |

| USDCNY(CHN) | +2.49% |

| USDINR(IND) | +3.39% |

| USDRUB(RUS) | +5.67% |

| USDZAR(ZAF) | +5.15% |

| Agricultural | |

|---|---|

| Coffee (Robusta) | -10.83% |

| White Sugar | -3.49% |

| Coffee (Arabica) | -4.25% |

| Cotton | -0.87% |

| Orange Juice | +5.07% |

| Sugar #11 | -3.86% |

| Wheat | -2.76% |

| Cattle | -1.92% |

| Cocoa | -1.60% |

| Corn | -2.89% |

| Feeder Cattle | -4.25% |

| Soybeans | -8.96% |

| Lean Hogs | -13.32% |

| Lumber | -7.58% |

| Soybean Meal | -9.85% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | -1.30% |

| Markit CDX NA HY | -1.26% |

| Markit CDX NA IG | +8.97% |

| Markit iTraxx Asia ex-Japan IG | +20.22% |

| Markit iTraxx Australia | +10.82% |

| Markit iTraxx Europe | +7.90% |

| Markit iTraxx Europe Crossover | +35.71% |

| Markit iTraxx Japan | +3.62% |

| Markit iTraxx SovX Western Europe | +0.08% |

| Markit LCDX (Loan CDS) | -0.14% |

| Markit MCDX (Municipal CDS) | +3.22% |

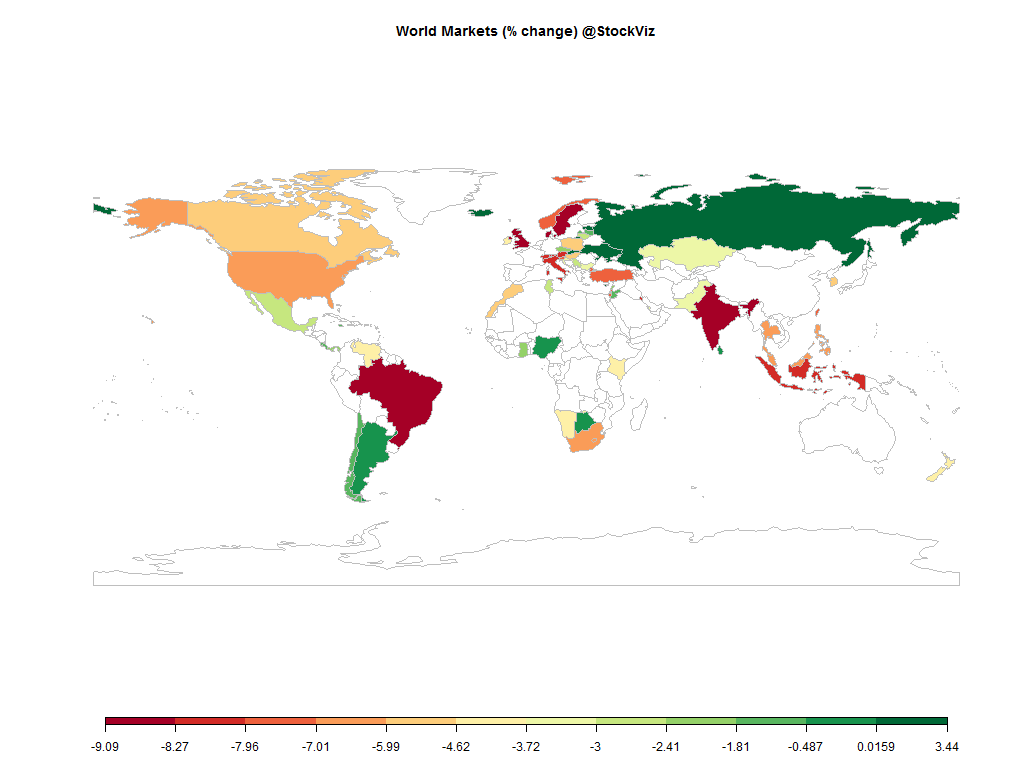

All major indices suffered huge losses. The dollar rallied, commodities fell and investors fled risk-assets.

Oil

With oil down about 57 per cent from its peak last June, and copper and iron ore down about 50 and 70 per cent respectively from their peaks in early 2011, it has become clear that story was profoundly misleading. Whether or not the supercycle exists, the regular old cycle definitely does, and there is nothing very super about it at all.

Why the commodities super cycle was a myth

USDINR

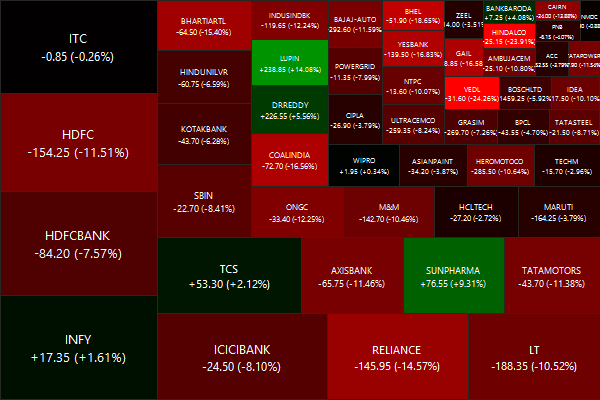

Nifty Heatmap

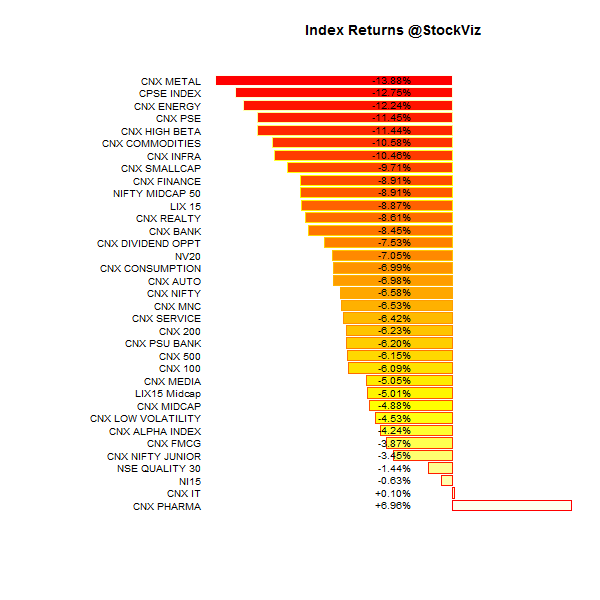

Index Returns

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -10.15% | 69/68 |

| 2 | -9.65% | 53/83 |

| 3 | -11.73% | 45/92 |

| 4 | -10.91% | 50/86 |

| 5 | -11.00% | 46/90 |

| 6 | -8.71% | 51/86 |

| 7 | -6.63% | 56/80 |

| 8 | -5.76% | 57/80 |

| 9 | -6.01% | 61/75 |

| 10 (mega) | -4.25% | 72/65 |

Midcaps bore the brunt…

Top Winners and Losers

Pharma vastly out-performed the cyclicals and commodity players…

ETF Performance

| GOLDBEES | +7.12% |

| JUNIORBEES | -3.41% |

| NIFTYBEES | -6.44% |

| PSUBNKBEES | -6.53% |

| BANKBEES | -8.55% |

| INFRABEES | -10.30% |

| CPSEETF | -12.67% |

Gold caught a safe-haven bid…

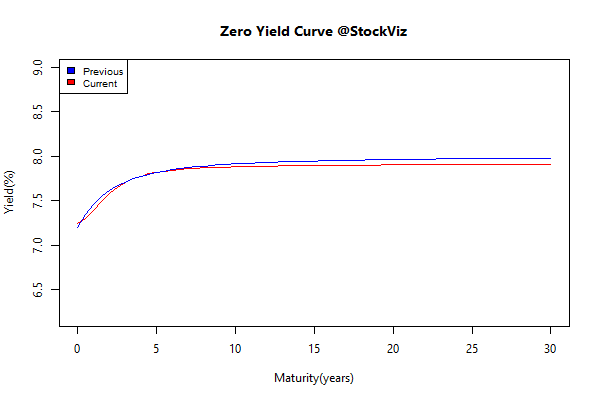

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.01 | +0.73% |

| 5 10 | -0.03 | +0.77% |

| 10 15 | -0.08 | +1.25% |

| 15 20 | -0.04 | +0.98% |

| 20 30 | -0.02 | +0.89% |

Yields went down a smidgen…

Investment Theme Performance

| Low Volatility | +2.16% |

| Financial Strength Value | -1.50% |

| Next Trillion | -1.69% |

| ASK Life | -1.79% |

| PPFAS Long Term Value | -3.08% |

| CNX 100 Enterprise Yield | -3.35% |

| Magic Formula | -4.30% |

| Tactical CNX 100 | -4.90% |

| Balance Sheet Strength | -6.86% |

| The RBI Restricted List | -8.80% |

| Momentum | -9.28% |

| Quality to Price | -9.84% |

| High Beta | -10.96% |

| ADAG stocks | -16.65% |

The only strategy that ended in the green was low-vol…

Equity Mutual Funds

Bond Mutual Funds

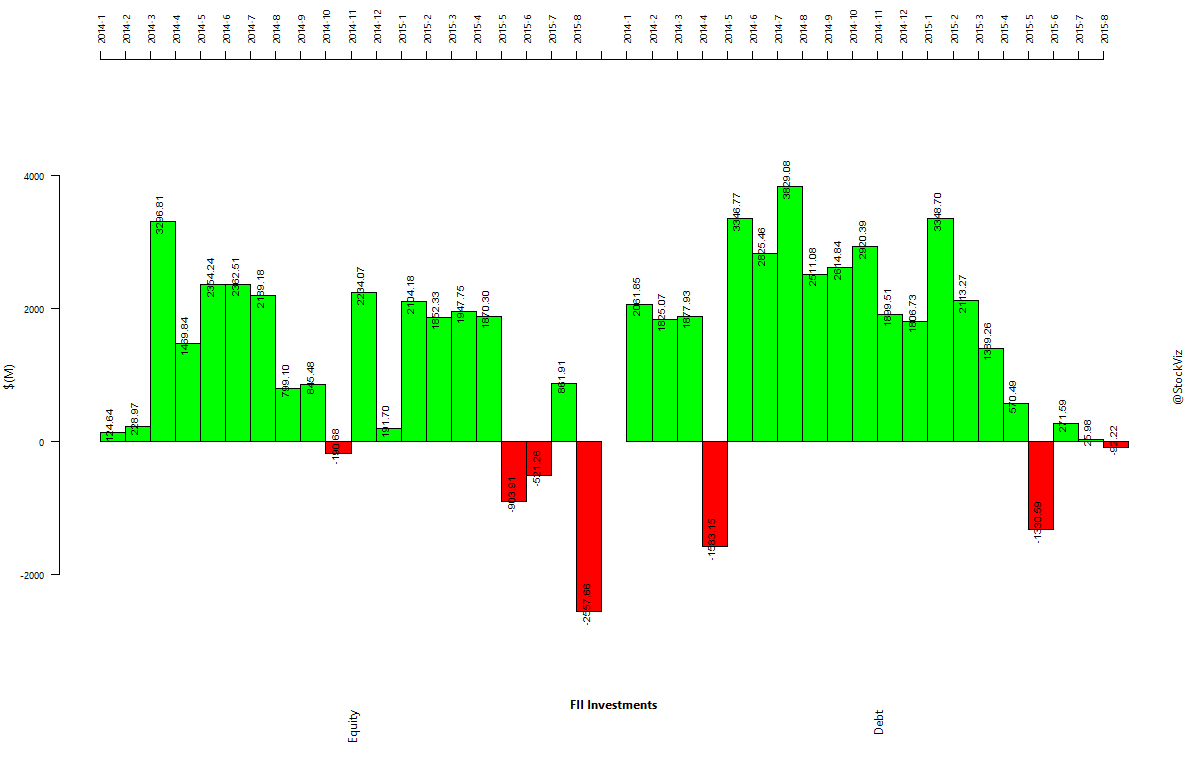

FII and DII Activity

FII’s pulled out more than $2.5bn from the Indian markets. DII’s barely lent any support.

Thought to sum up the month

What ails the truth is that it is mainly uncomfortable, and often dull. The human mind seeks something more amusing, and more caressing.

Source: The Unreliable Experts: getting in the way of outstanding performance