Equities

Commodities

| Energy |

| Ethanol |

-6.07% |

| Brent Crude Oil |

-17.93% |

| Heating Oil |

-16.11% |

| Natural Gas |

-3.76% |

| RBOB Gasoline |

-15.34% |

| WTI Crude Oil |

-21.37% |

| Metals |

| Gold 100oz |

-6.50% |

| Copper |

-9.92% |

| Platinum |

-8.90% |

| Silver 5000oz |

-4.49% |

| Palladium |

-9.26% |

| Agricultural |

| Cocoa |

-0.56% |

| Coffee (Arabica) |

-3.75% |

| Lean Hogs |

+3.36% |

| Cattle |

-0.95% |

| Corn |

-10.04% |

| Cotton |

-2.35% |

| Orange Juice |

+7.45% |

| Wheat |

-18.75% |

| White Sugar |

-5.81% |

| Coffee (Robusta) |

-13.05% |

| Feeder Cattle |

-1.44% |

| Lumber |

-12.67% |

| Soybean Meal |

-1.42% |

| Soybeans |

-7.29% |

| Sugar #11 |

-8.91% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.28% |

| Markit CDX NA HY |

-0.15% |

| Markit CDX NA IG |

-1.71% |

| Markit iTraxx Asia ex-Japan IG |

-3.67% |

| Markit iTraxx Australia |

-2.15% |

| Markit iTraxx Europe |

-13.99% |

| Markit iTraxx Europe Crossover |

-47.76% |

| Markit iTraxx Japan |

-5.14% |

| Markit iTraxx SovX Western Europe |

-2.34% |

| Markit LCDX (Loan CDS) |

-0.06% |

| Markit MCDX (Municipal CDS) |

-4.61% |

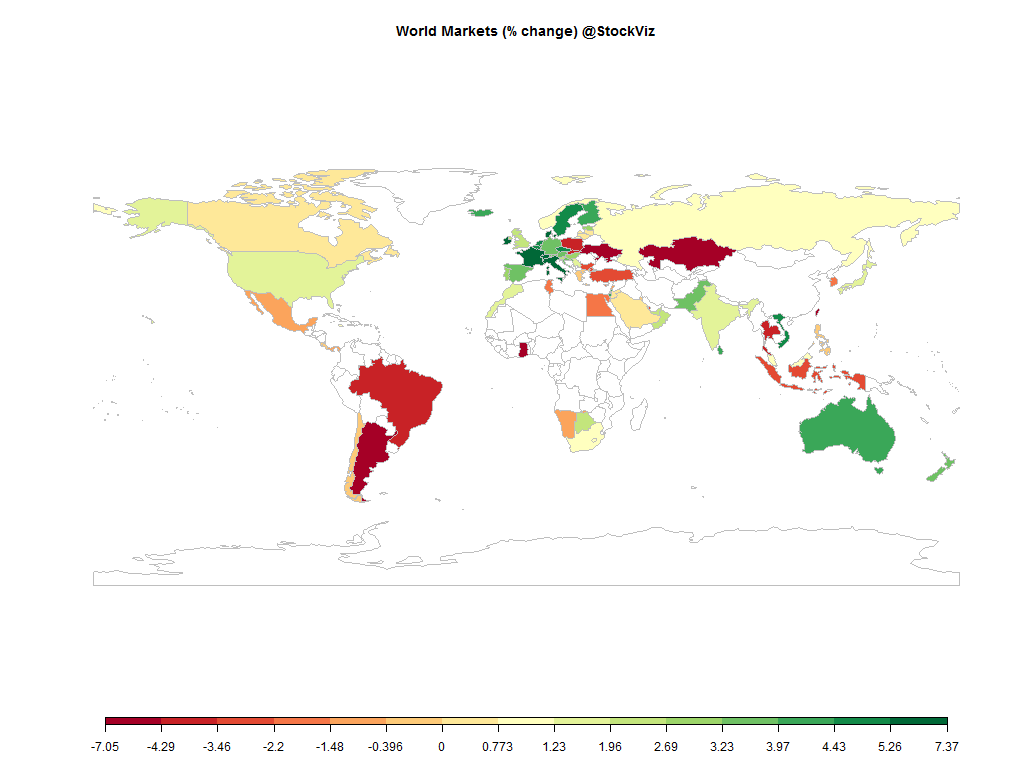

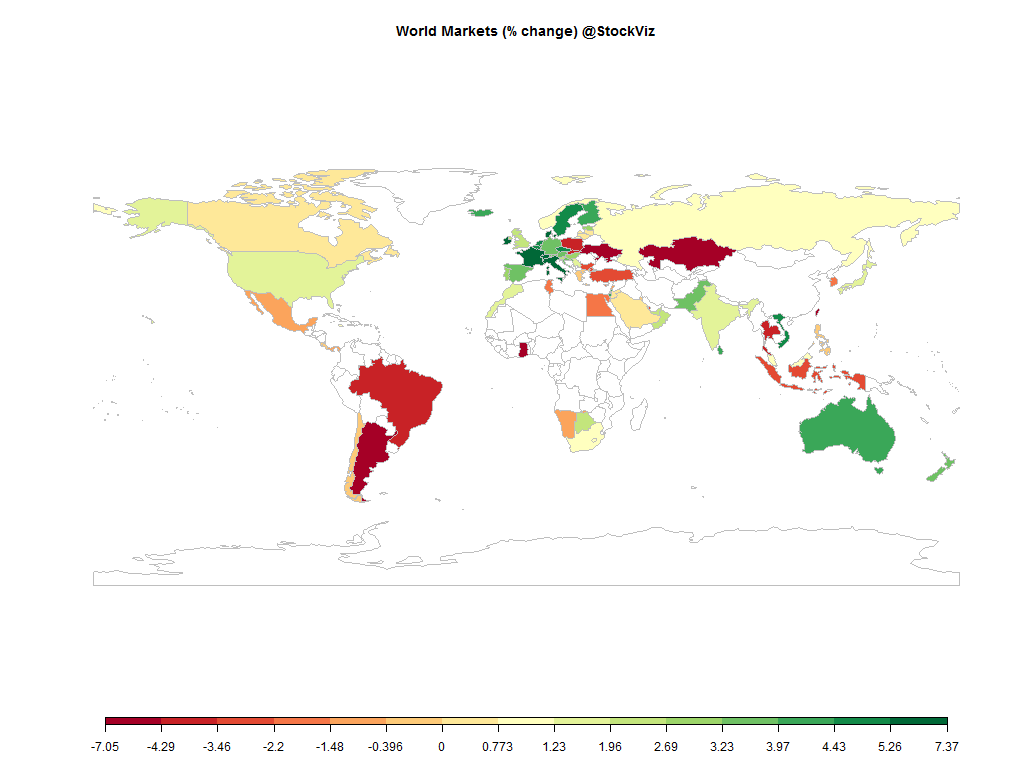

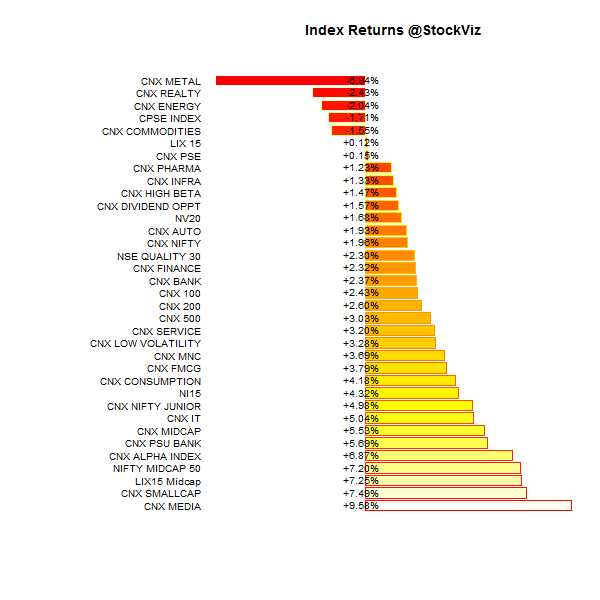

Indian midcaps rallied; the bottom fell out of commodities and oil; China was a total shit show. Will the midcap party continue into August?

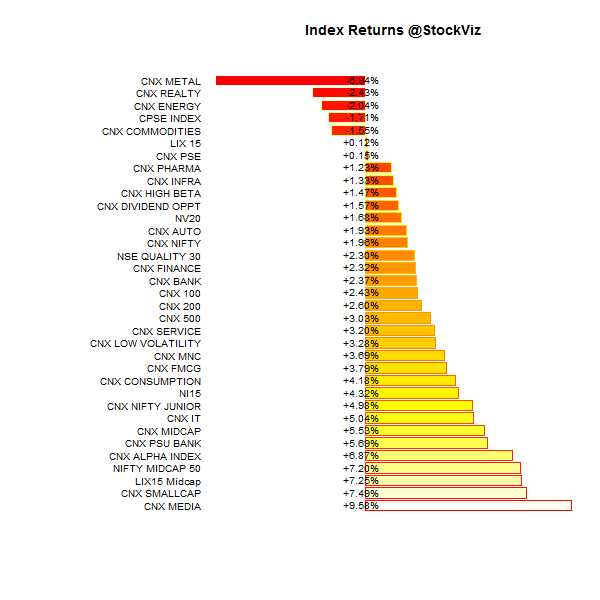

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+17.40% |

76/54 |

| 2 |

+22.15% |

87/41 |

| 3 |

+33.99% |

97/33 |

| 4 |

+17.22% |

98/31 |

| 5 |

+17.19% |

89/40 |

| 6 |

+12.51% |

85/45 |

| 7 |

+10.13% |

78/51 |

| 8 |

+8.94% |

81/49 |

| 9 |

+4.99% |

74/55 |

| 10 (mega) |

+2.06% |

64/66 |

Midcaps and smallcaps put in some impressive numbers…

Top Winners and Losers

Commodities were the most-hated sector…

ETF Performance

Hopefully, a crashing gold will wean us off it?

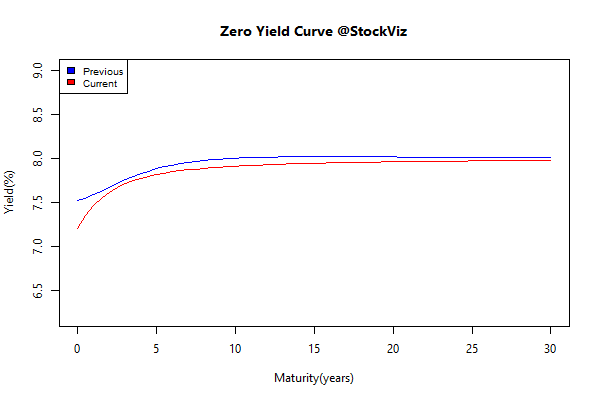

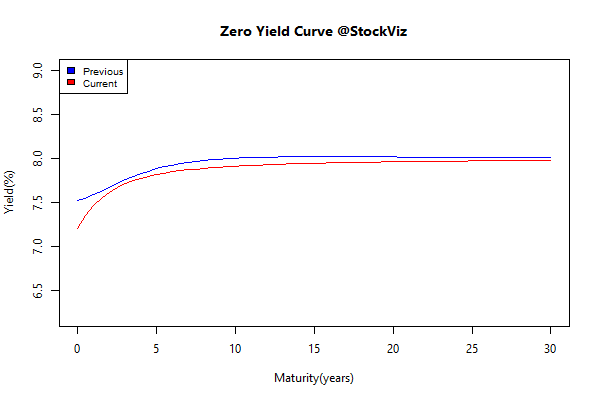

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.08 |

+0.88% |

| 5 10 |

-0.09 |

+1.12% |

| 10 15 |

-0.05 |

+1.04% |

| 15 20 |

-0.10 |

+1.57% |

| 20 30 |

-0.15 |

+2.20% |

The long-end rallied…

Investment Theme Performance

Congratulations all around…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

Hanging on every twist and turn of the headlines are a group of folks we call “macro tourists.” They are a terrific source of chatter at any cocktail party — such as “Tsipras may have just doomed the Greeks for the next decade.”

Why does this matter to investors? For two reasons: First, macro tourists are everywhere; and second, they seem to be terrible stewards of your capital.

Market-moving headlines would seem to present an opportunity to capitalize on the potential volatility that often follows.

But here’s the big risk for investors who try to game the headlines: Figuring out what just happened is hard enough; the macro investor must guess at what’s ahead — outcomes for the near and far future as well as the market reaction to those outcomes.

It’s no wonder the macro tourists, both professional manager and amateur investor alike, have been for the most part unsuccessful.

Source: Curse of the Macro Tourist