Delayed Entry

In our previous post, we saw how a mechanical expiry-to-expiry short-call NIFTY butterfly with a stop-loss significantly outperformed a non-stop-loss strategy. However, the odds that a stop-loss would be triggered was almost 50%.

In our introductory post on butterflies, we had noted how the strategy P&L gets “pulled” as we get closer to expiry. This implies that during the first half of the trade, the position sits idle. However, the underlying NIFTY index could have already made its move out of the wings and could be on its way back to the center. To avoid this, we can delay entry until, say, 10 days have passed since expiry.

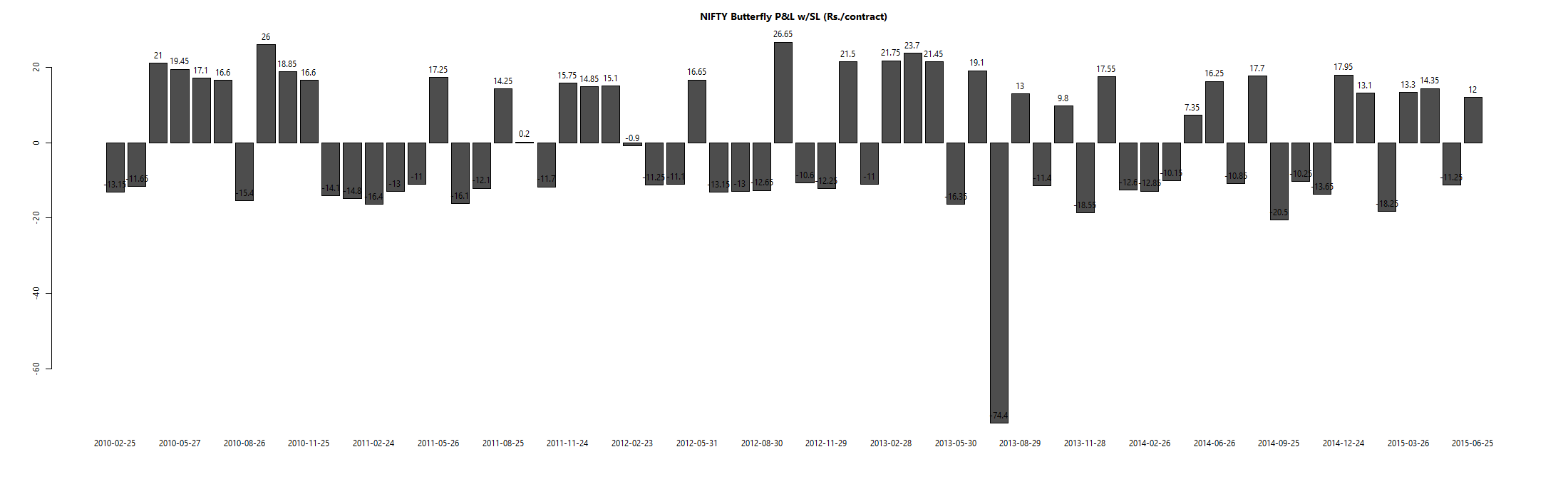

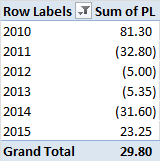

Returns with stop-loss and delayed entry

Conclusion

Although on the face of it, selling butterflies on the NIFTY sounds attractive – NIFTY is a volatile index and a rising NIFTY will make the moves required for a profitable trade lower – a mechanical backtest did not lead to a strategy that could be applied on an on-going basis.