MOMENTUM

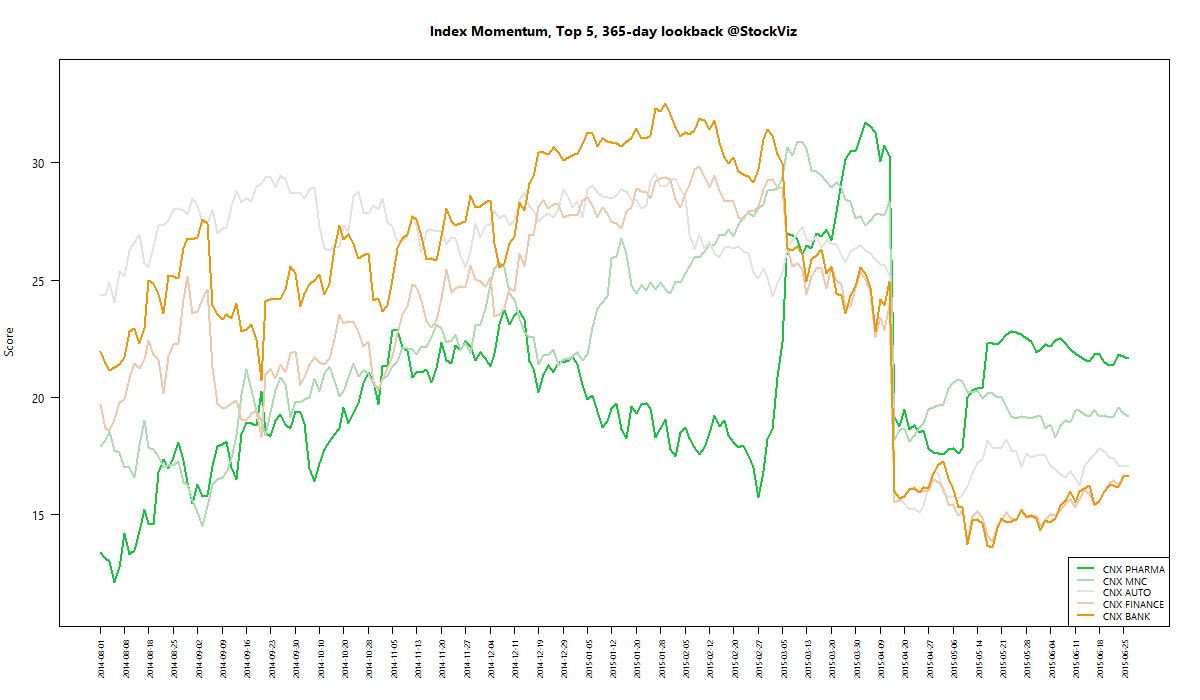

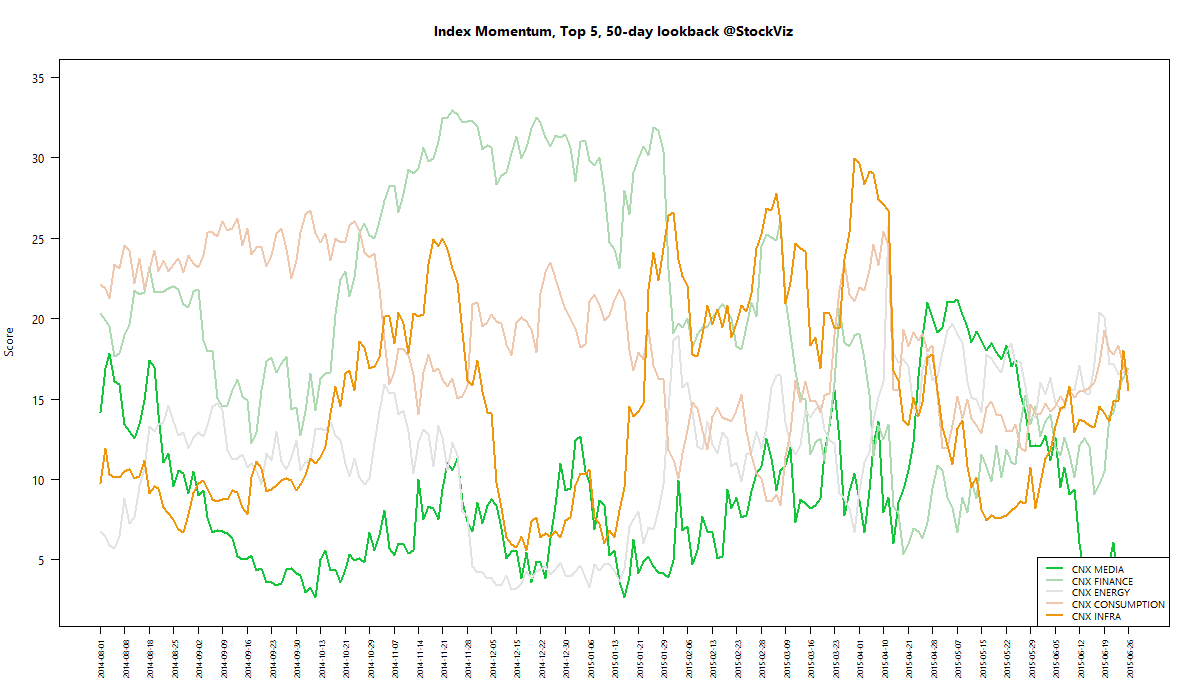

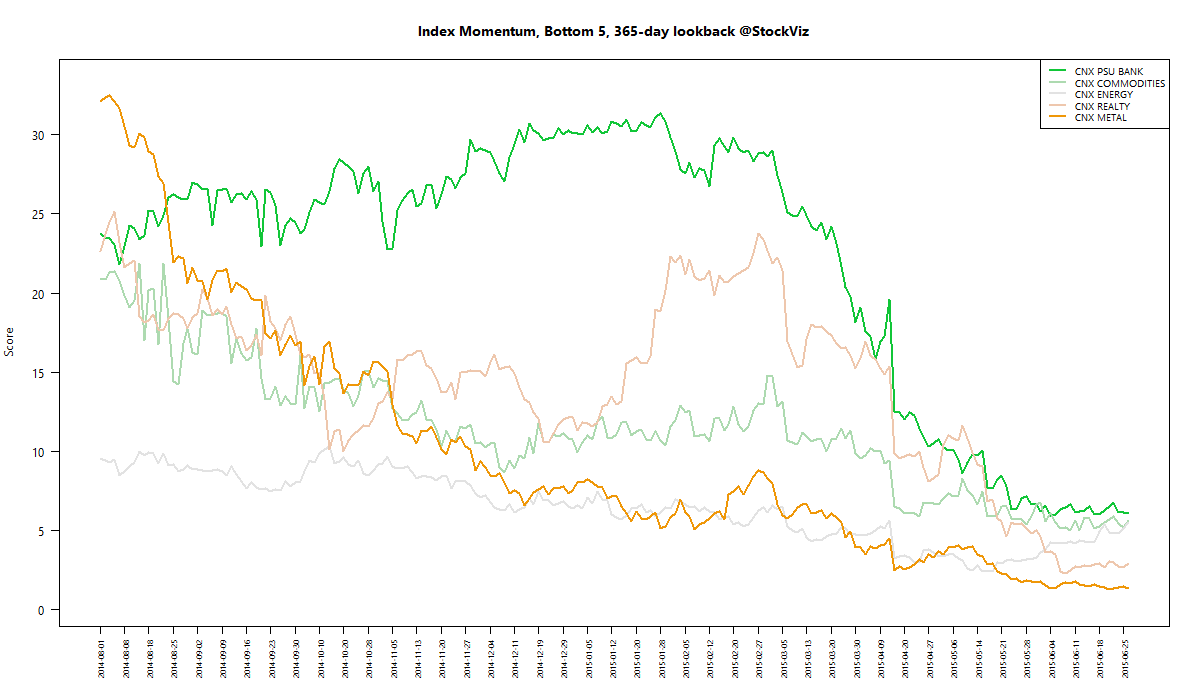

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

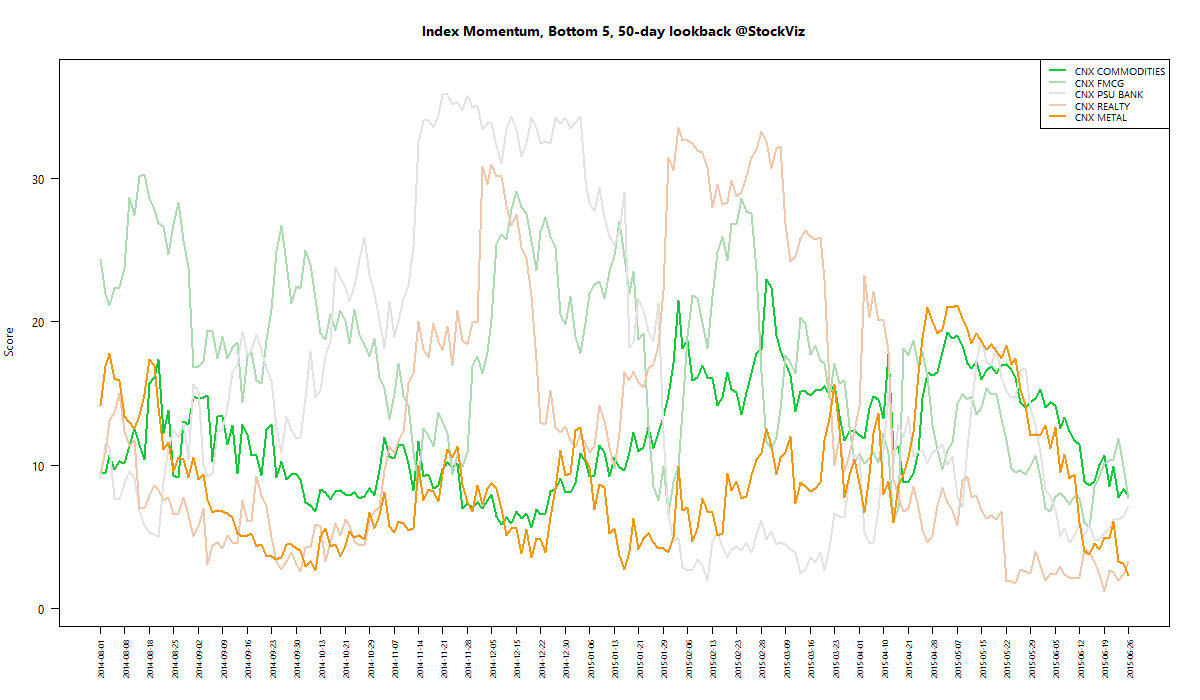

Here are the best and the worst sub-indices:

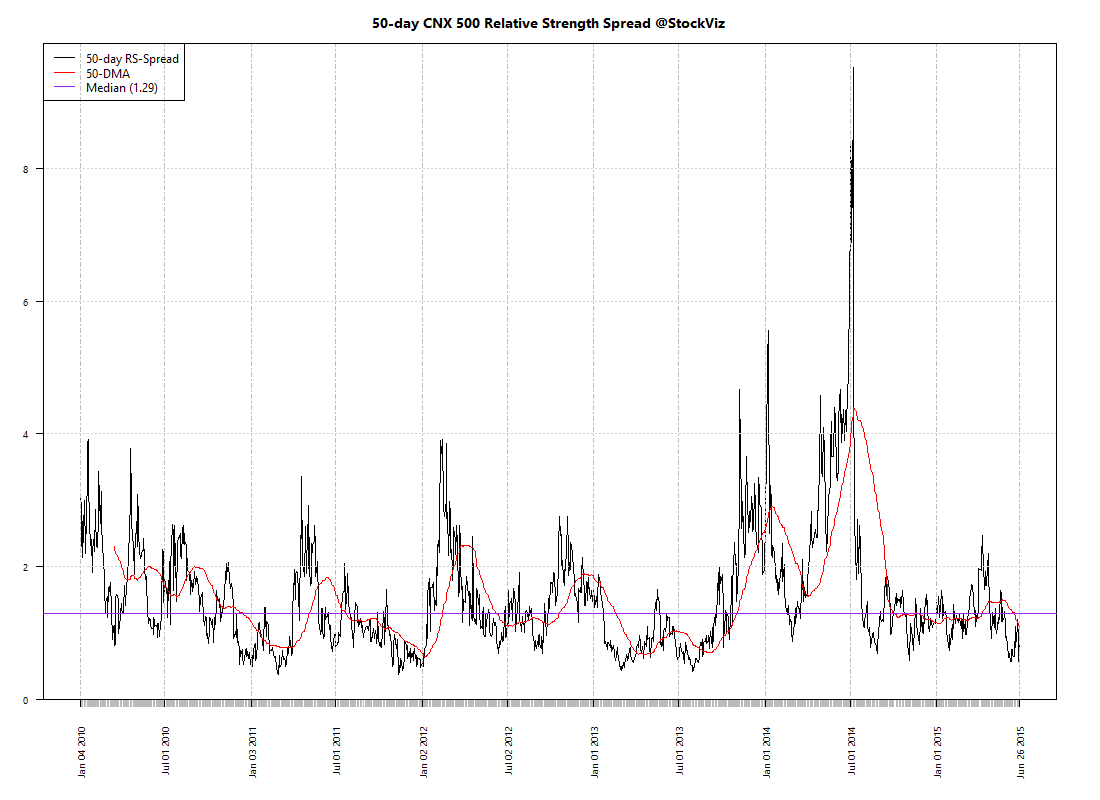

Relative Strength Spread

Refactored Index Performance

50-day performance, from April 17, 2015 through June 26, 2015:

Trend Model Summary

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | LONG |

7.17

|

2015-Jan-27

|

| CNX BANK | LONG |

10.62

|

2015-Jan-27

|

| CNX ENERGY | LONG |

25.82

|

2008-Jan-14

|

| CNX FMCG | LONG |

11.66

|

2015-Feb-25

|

| CNX INFRA | LONG |

47.92

|

2008-Jan-09

|

| CNX IT | LONG |

88.10

|

2000-Feb-21

|

| CNX MEDIA | LONG |

24.66

|

2008-Jan-04

|

| CNX METAL | LONG |

58.47

|

2008-Jan-04

|

| CNX MNC | LONG |

3.71

|

2015-Mar-12

|

| CNX NIFTY | LONG |

6.84

|

2015-Mar-03

|

| CNX PHARMA | LONG |

12.76

|

2015-Apr-08

|

| CNX PSE | LONG |

24.69

|

2008-Jan-04

|

| CNX REALTY | SHORT |

90.21

|

2008-Jan-14

|

A perk up in momentum metrics: RS-Spread has reverted to mean; bank and financials are showing some green shoots.