What are MNC Funds?

MNC funds invest in the Indian listed shares of foreign firms, like Bosch, Britannia and Colgate Palmolive. The funds are bench-marked against the CNX MNC Index.

The MNC index has out-performed pretty much every other market-cap index. We had discussed this previously and had pointed out that the UTI MNC Fund is decent place to get exposure to this asset class.

UTI vs Birla Sun Life

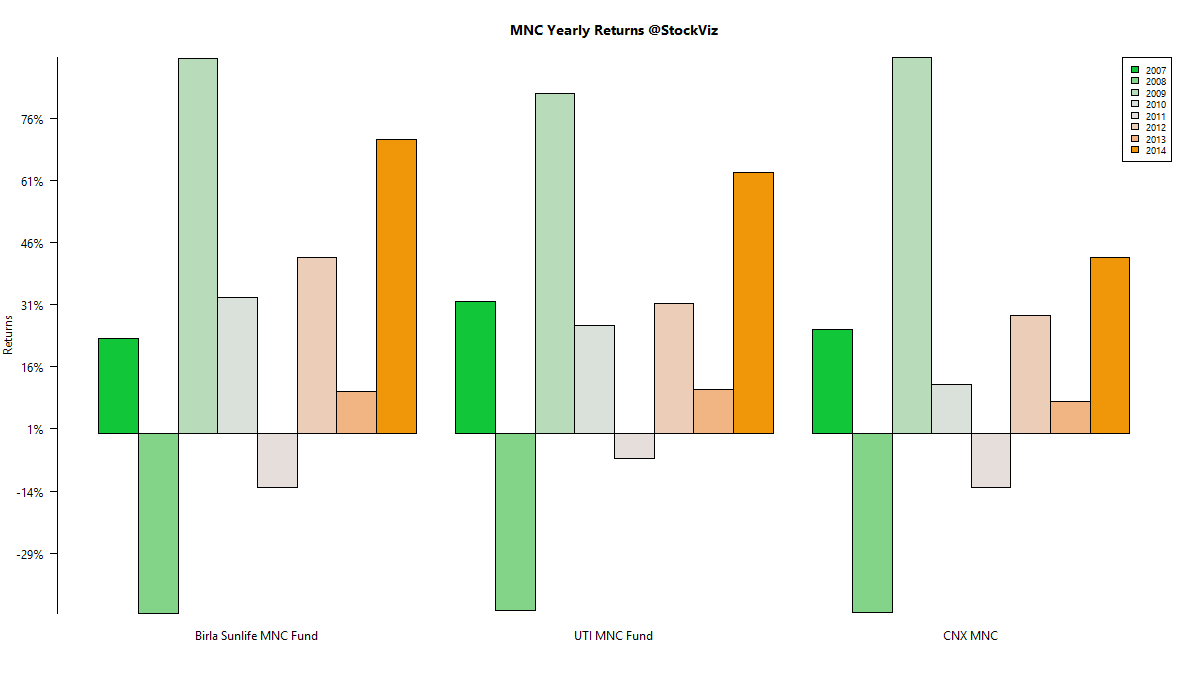

Thankfully, there are only two funds that track this asset class – one is the UTI MNC Fund and the other is the Birla Sun Life MNC Fund. Here’s how their growth schemes compare:

Between 2006-07-03 and 2015-03-19, BSL MNC Fundhas returned a cumulative 478.61% with an IRR of 22.31% vs. UTI MNC Fund’s cumulative return of 427.17% and an IRR of 21.02%. (http://svz.bz/1Exk126)

The difference in performance between the two funds is de minimis when you consider that the period of comparison is almost eight years. The main thing to focus on here is that an IRR of ~22% is extremely hard to achieve in any asset class over that stretch of time.

Active Management

| SYMBOL | Birla Sunlife MNC Fund | UTI MNC Fund | CNX MNC |

|---|---|---|---|

| INGVYSYABK | 8.97 | 3.01 | – |

| ICRA | 8.67 | – | – |

| HONAUT | 8.53 | 3.48 | – |

| BAYERCROP | 8.33 | – | – |

| BOSCHLTD | 5.99 | 7.19 | 9.22 |

| GILLETTE | 5.89 | 2.71 | – |

| GLAXO | 5.48 | 1.44 | 2.59 |

| PFIZER | 5.15 | 1.38 | – |

| MARUTI | 3.62 | 7.16 | 18.09 |

| STERLINH | 3.61 | – | – |

| CRISIL | 3.01 | 2.92 | – |

| HINDUNILVR | 2.74 | 4.21 | 24.37 |

| CUMMINSIND | 2.73 | 4.36 | 4.38 |

| WABCOINDIA | 2.47 | 0.32 | – |

| ACC | 1.96 | – | – |

| BATAINDIA | 1.65 | – | – |

| HITACHIHOM | 1.64 | – | – |

| FAGBEARING | 1.47 | – | – |

| KANSAINER | 1.45 | – | – |

| COLPAL | 1.39 | 1.33 | 5.02 |

| PGHH | 1.35 | 1.92 | – |

| OFSS | 1.15 | 2.43 | 2.62 |

| SMLISUZU | 1.15 | 0.12 | – |

| AMBUJACEM | 1.11 | 3.64 | 7.25 |

| NESTLEIND | 0.94 | 1.38 | – |

| ALSTOMT&D | 0.72 | 1.76 | – |

| BLUEDART | 0.71 | 0.58 | – |

| SIEMENS | 0.7 | 3.04 | 4.66 |

| FMGOETZE | 0.69 | – | – |

| ITC | 0.66 | – | – |

| AIL | 0.59 | 0.17 | – |

| DISAQ | 0.57 | – | – |

| AKZOINDIA | 0.53 | 1.6 | – |

| FULFORD | 0.52 | – | – |

| ABB | 0.49 | – | 2.51 |

| SANOFI | 0.46 | 1.41 | – |

| ITDCEM | 0.46 | 2.31 | – |

| CASTROLIND | 0.45 | 2.97 | 2.59 |

| RANBAXY | 0.36 | 0.58 | – |

| SCHNEIDER | 0.26 | – | – |

| MPHASIS | 0.07 | 2.33 | 1.2 |

| EICHERMOT | – | 6.28 | – |

| BRITANNIA | – | 4.17 | 4.84 |

| MCDOWELL-N | – | 2.53 | – |

| SKFINDIA | – | 2.47 | – |

| MAHINDCIE | – | 2.13 | – |

| SSLT | – | 1.95 | 7.96 |

| INGERRAND | – | 1.49 | – |

| MONSANTO | – | 1.13 | – |

| TIMKEN | – | 1.07 | – |

| CLNINDIA | – | 0.97 | – |

| GSKCONS | – | 0.9 | 2.69 |

| AUTOAXLES | – | 0.38 | – |

| WHIRLPOOL | – | 0.21 | – |

Portfolio trajectories

Both have allowed their winners to run and have different positions that have worked out well for them. Here’s how the Birla Sunlife Fund looks like:

And this is how the UTI Fund looks like:

The View

You will do well to have either fund in your portfolio. But given the narrow focus of these funds, these should complement your portfolio rather than dominate it. If you have any questions, feel free to get in touch!