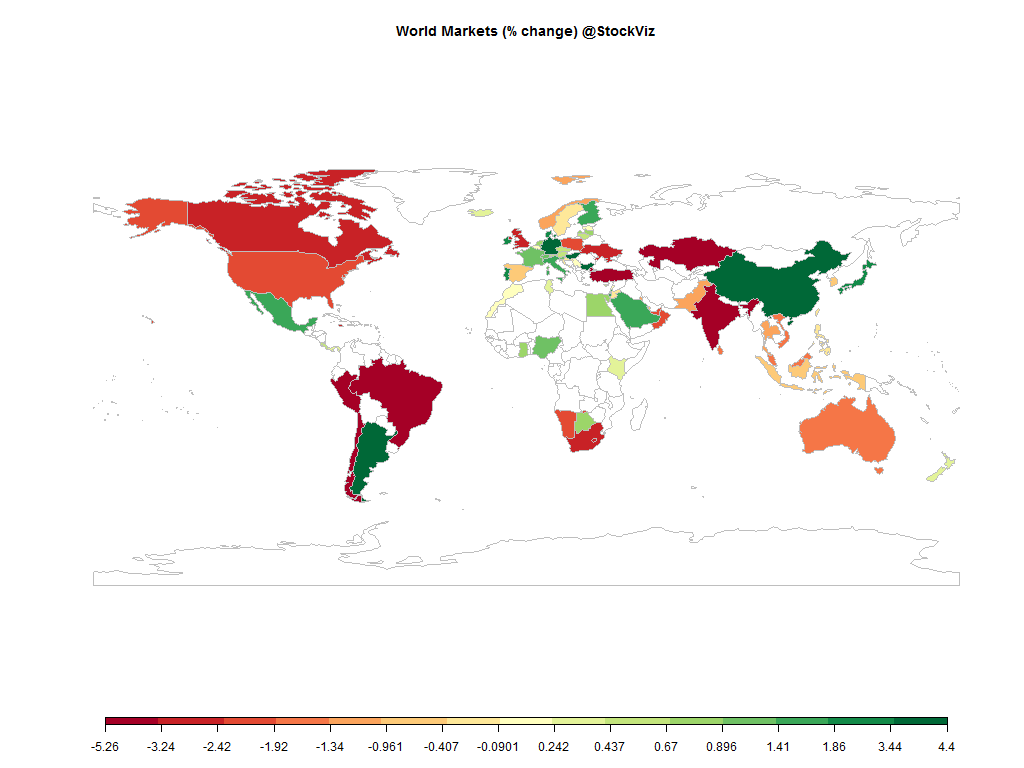

Equities

Commodities

| Energy |

| Heating Oil |

-9.11% |

| RBOB Gasoline |

-6.43% |

| WTI Crude Oil |

-12.16% |

| Brent Crude Oil |

-10.01% |

| Ethanol |

-5.40% |

| Natural Gas |

-3.75% |

| Metals |

| Gold 100oz |

-4.17% |

| Palladium |

-3.70% |

| Platinum |

-5.31% |

| Copper |

+0.75% |

| Silver 5000oz |

-3.70% |

| Agricultural |

| Coffee (Robusta) |

-9.60% |

| Cotton |

-4.92% |

| Soybean Meal |

+0.75% |

| Soybeans |

-0.77% |

| Cattle |

-0.03% |

| Lumber |

-5.63% |

| Orange Juice |

-3.39% |

| Sugar #11 |

-4.84% |

| Wheat |

+5.67% |

| Coffee (Arabica) |

-3.41% |

| Lean Hogs |

-7.64% |

| Cocoa |

-2.97% |

| Corn |

-2.21% |

| Feeder Cattle |

+3.22% |

| White Sugar |

-2.66% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-1.16% |

| Markit CDX NA HY |

-0.13% |

| Markit CDX NA IG |

+3.42% |

| Markit iTraxx Asia ex-Japan IG |

+6.08% |

| Markit iTraxx Australia |

+1.60% |

| Markit iTraxx Europe |

-0.90% |

| Markit iTraxx Europe Crossover |

-9.29% |

| Markit iTraxx Japan |

-0.06% |

| Markit iTraxx SovX Western Europe |

-2.06% |

| Markit LCDX (Loan CDS) |

-0.02% |

| Markit MCDX (Municipal CDS) |

+2.18% |

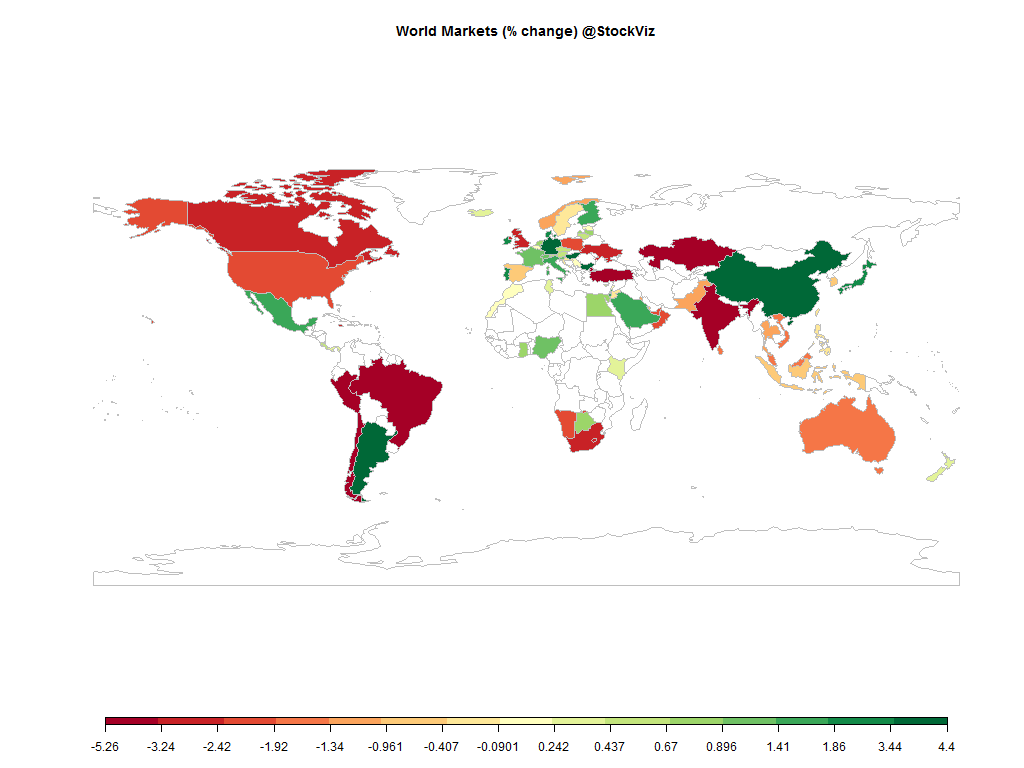

The markets threw a taper tantrum with rising rates in the US almost a certainty this year.

QE pushed the Euro down to ~parity vs. the US Dollar.

It was a bad week for the commodity complex as well as the rise in USD pummeled pretty much everything.

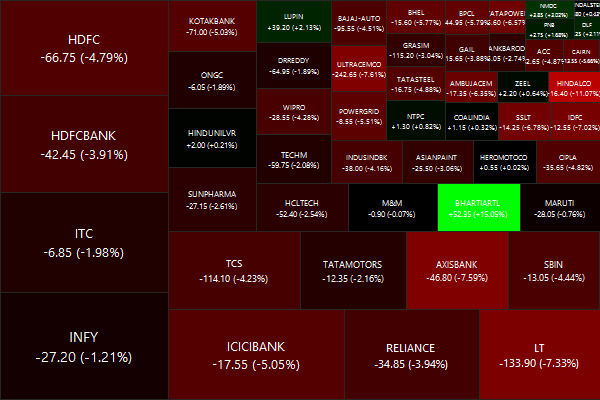

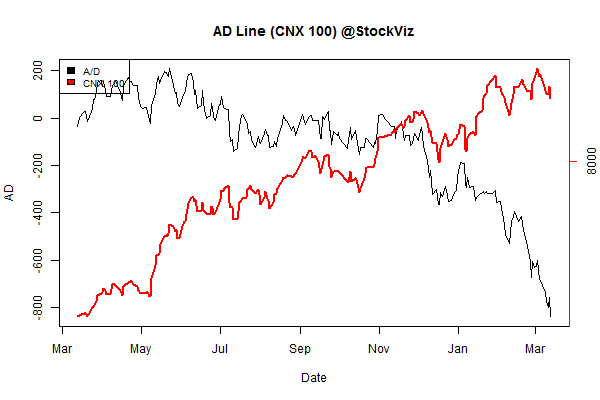

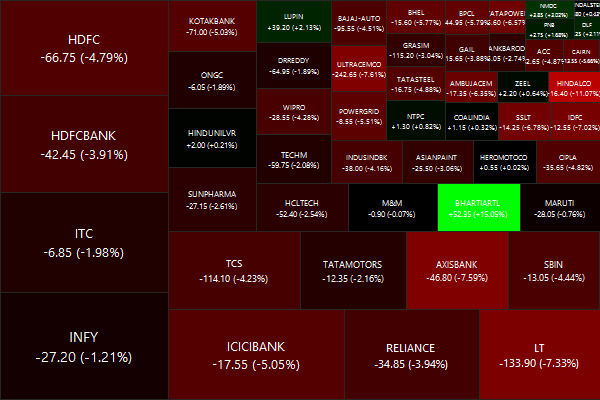

Nifty Heatmap

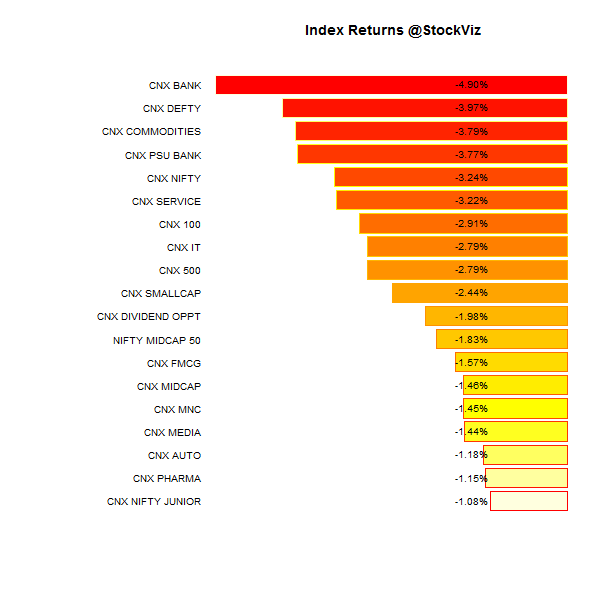

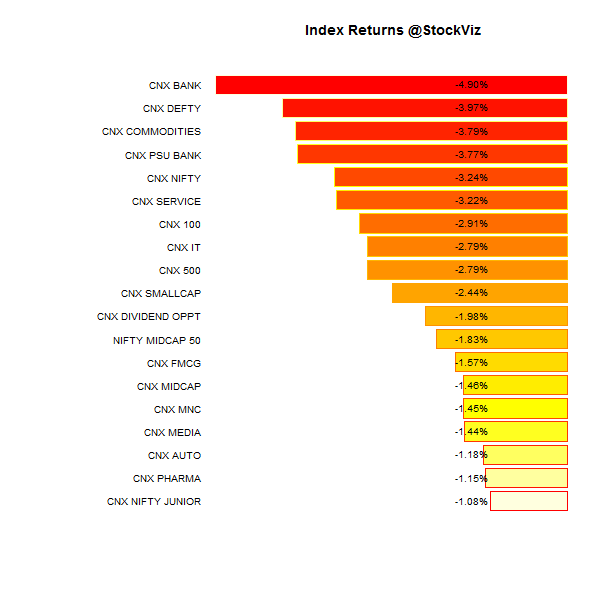

Index Returns

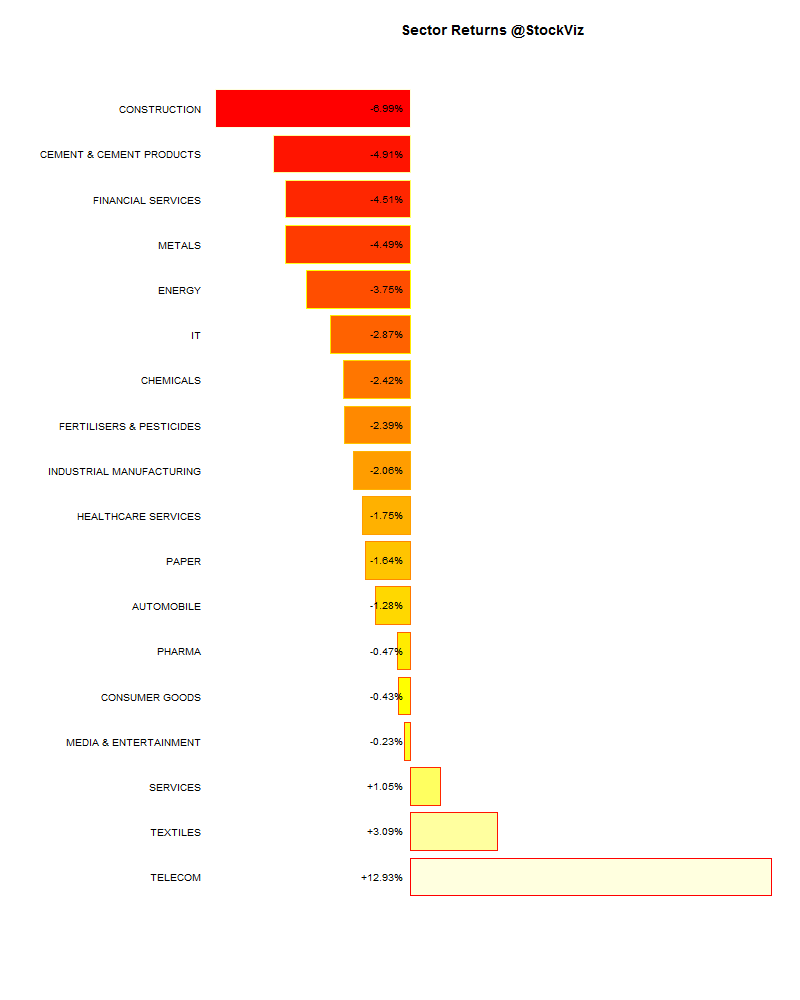

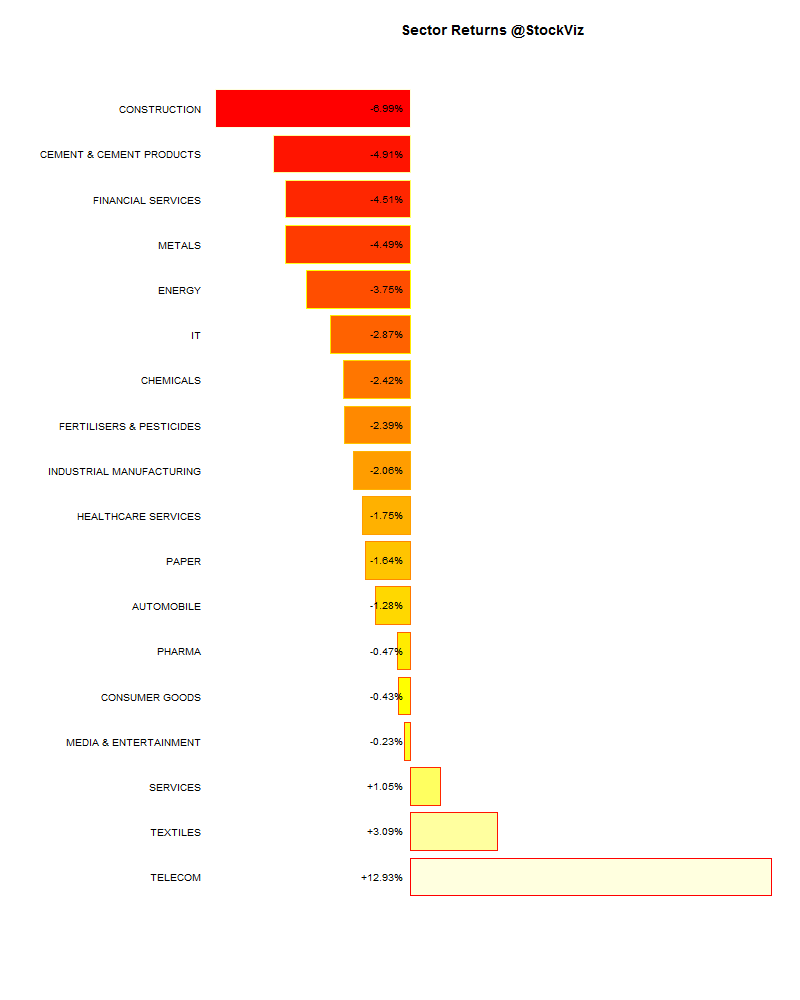

Sector Performance

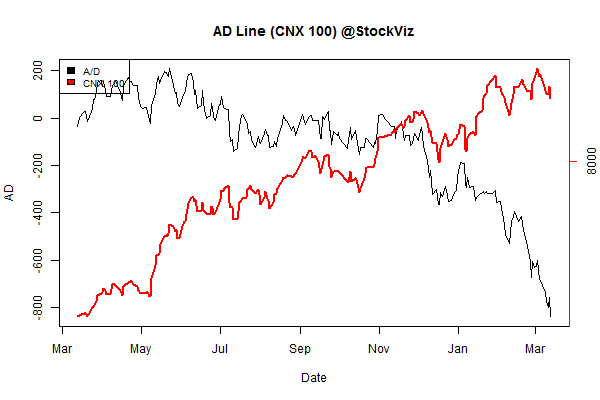

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-4.85% |

66/68 |

| 2 |

-2.91% |

61/72 |

| 3 |

-1.30% |

64/69 |

| 4 |

-0.80% |

67/67 |

| 5 |

+0.51% |

64/69 |

| 6 |

-0.18% |

62/71 |

| 7 |

+1.14% |

68/66 |

| 8 |

+0.52% |

69/64 |

| 9 |

+0.37% |

66/67 |

| 10 (mega) |

-1.01% |

62/72 |

A bit of green in the belly of the beast but red in the large- and small-cap zones.

Top Winners and Losers

Not a good week for high-beta. Telecom stocks rallied…

ETF Performance

Banks and financials got beat up pretty bad…

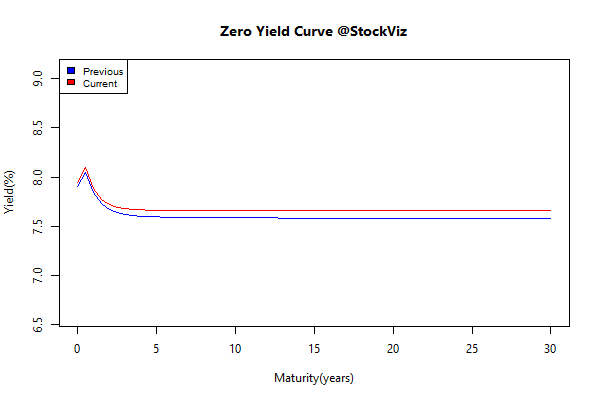

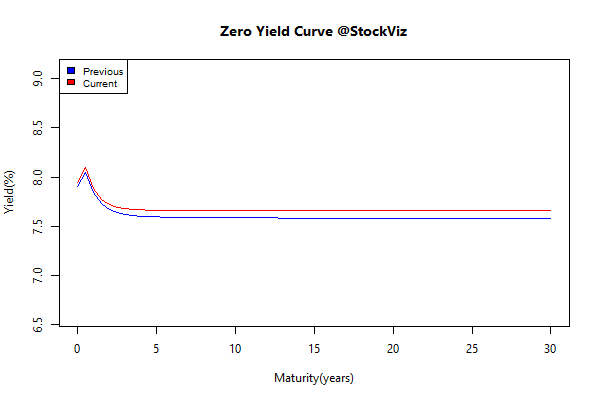

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.05 |

+0.19% |

| GSEC SUB 1-3 |

+0.20 |

+0.04% |

| GSEC SUB 3-8 |

+0.27 |

-0.76% |

| GSEC SUB 8 |

+0.18 |

-1.32% |

The long-end of the curve wilted – given the rate of revisions in GDP estimates, our policy makers are more or less flying blind. Not a comforting thought if you are a bond investor.

Investment Theme Performance

Momentum barely held on, but most investment strategies got beat up…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

Human leadership is almost entirely leadering. It is:

90% flying starling bullshit that just looks meaningful,

9% poorly calibrated goose-like navigational inertia reflecting ancient realities that have almost certainly shifted, and

1% lion-like roaring and posturing by a charismatic few.

Leaders like to call the three elements agility, mission and vision.

Source: The Art of Agile Leadership