Diversification vs. Returns vs. Currency hedging

Some Indian funds, under the guise of diversification, invest in foreign equities. However, the benefit of diversification comes from investing across asset classes. Does investing in the same asset class, i.e., equities, really give the investor uncorrelated returns? Or are funds using international equities as a rupee-short in disguise?

World Equity Correlation

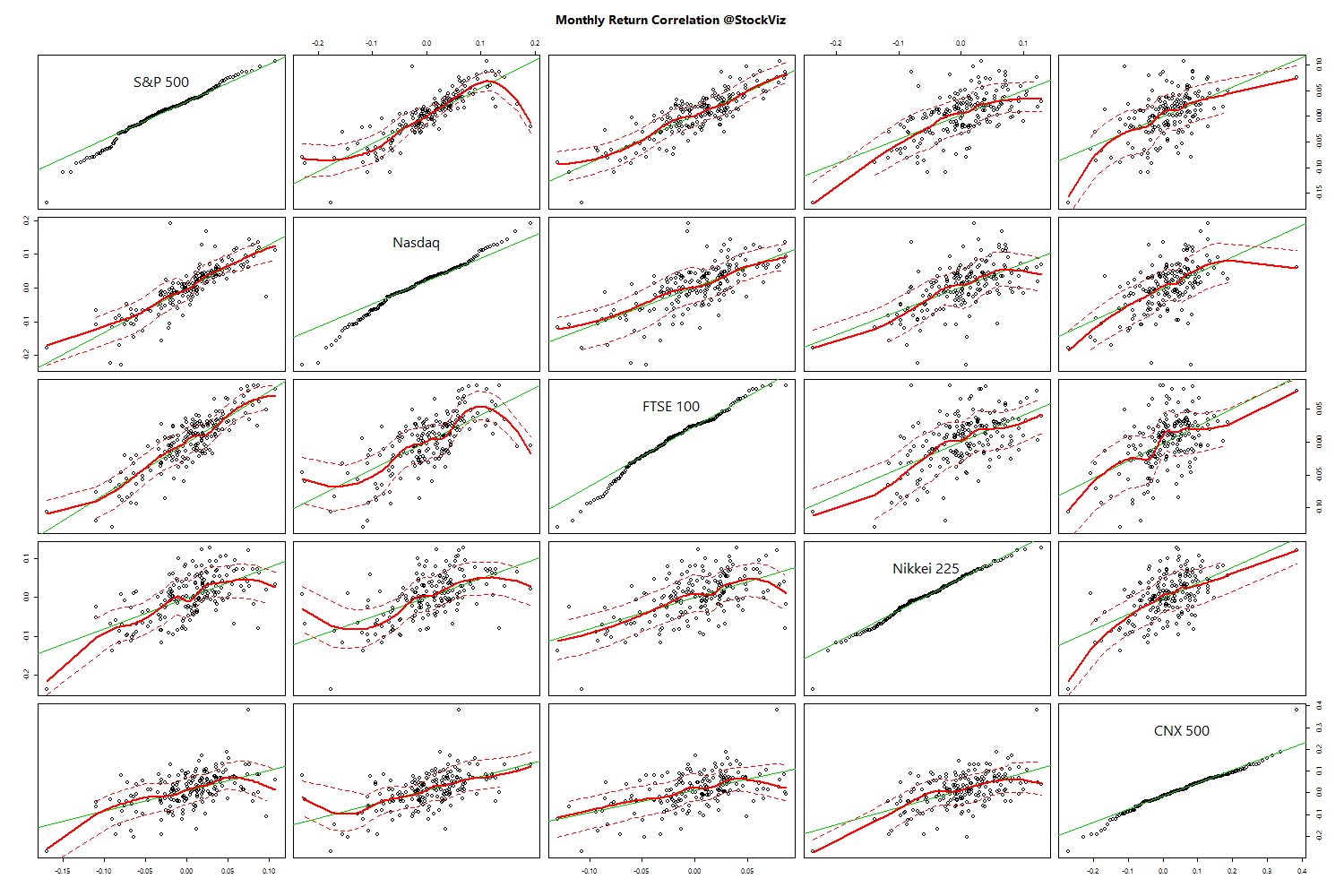

When you run correlations between the monthly returns of the S&P 500, Nasdaq, FTSE 100, Nikkei and CNX 500, here’s what you get:

| S&P 500 | Nasdaq | FTSE 100 | Nikkei 225 | CNX 500 | |

|---|---|---|---|---|---|

| S&P 500 | 1.0000000 | 0.8387130 | 0.8537901 | 0.6144493 | 0.5226191 |

| Nasdaq | 0.8387130 | 1.0000000 | 0.6913427 | 0.5909979 | 0.5499836 |

| FTSE 100 | 0.8537901 | 0.6913427 | 1.0000000 | 0.5717508 | 0.5216565 |

| Nikkei 225 | 0.6144493 | 0.5909979 | 0.5717508 | 1.0000000 | 0.5633231 |

| CNX 500 | 0.5226191 | 0.5499836 | 0.5216565 | 0.5633231 | 1.0000000 |

A zero or negative correlation would validate the diversification claim. But that is not the case. Indian equities are loosely correlated with international stock markets.

World equity Returns

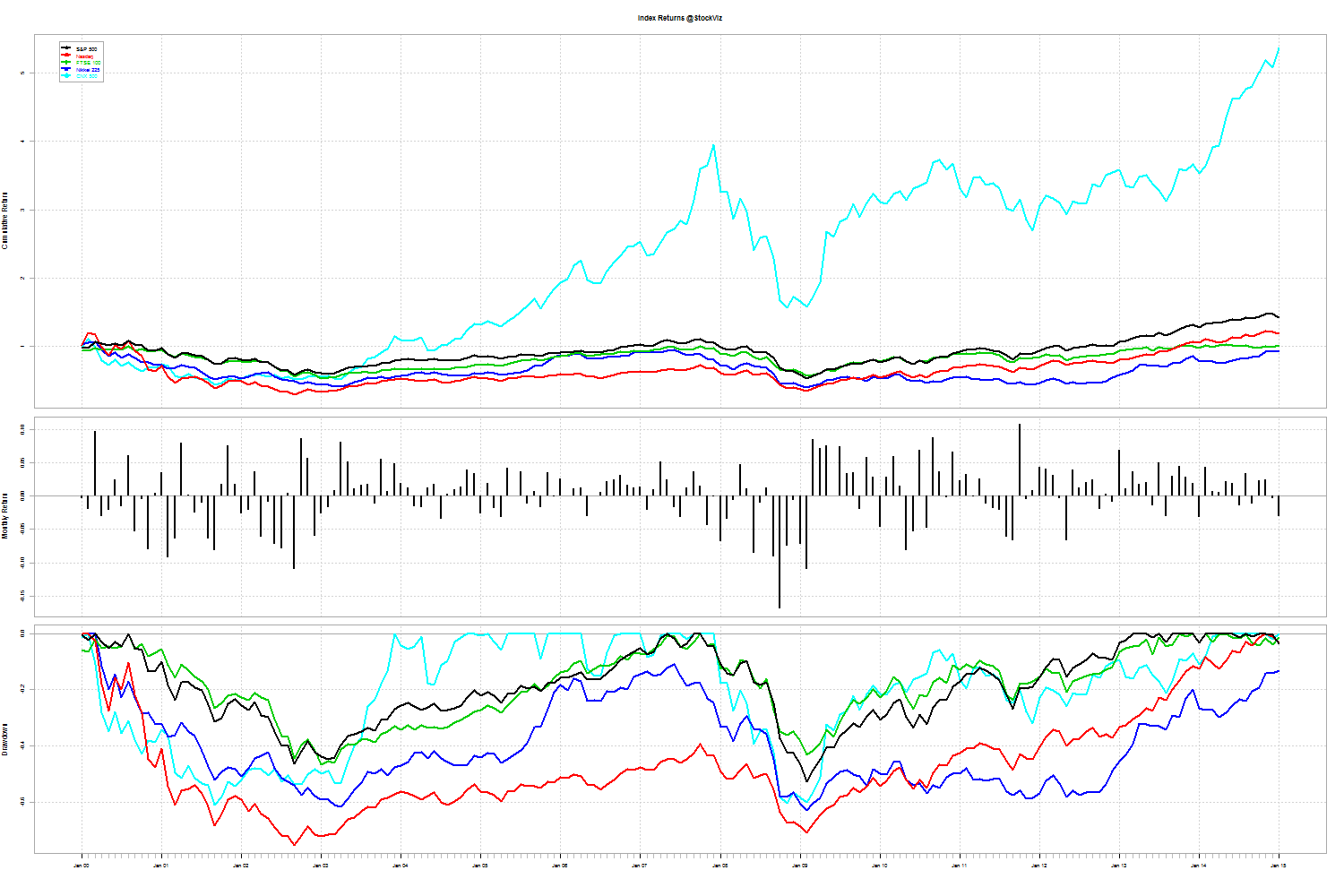

When it comes to returns, Indian equities have outperformed all the main indices.

Currency hedge

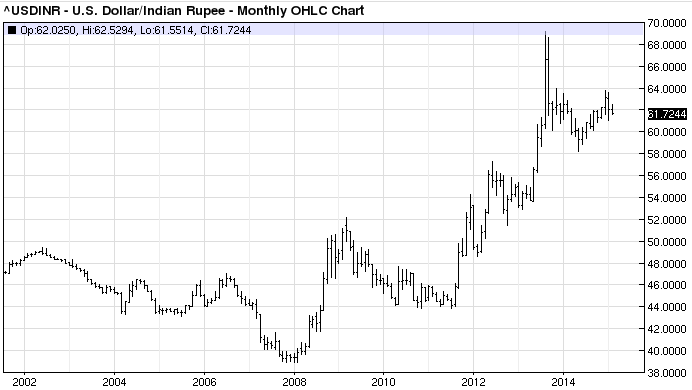

The 50% depreciation in the rupee since 2000, however, make a strong case for adding short-INR/long-USD assets.

Competency

Although Rupee depreciation makes a case for holding dollar assets, why do it in a convoluted way by buying individual stocks? The competency of an Indian asset manager in picking stocks in a foreign market is questionable.

For example, the PPFAS fund holds about 20% of its assets in foreign equities. This, at a time when most developed markets have given up on stock-picking and have turned to indexing instead. Can a manager, sitting in India, select stocks in a foreign market that outperform that market?

The problem with a mixed-in portfolio like PPFAS is that it is very difficult to break performance down to its components. Between 2014-01-01 and 2015-02-25, PPFAS Long Term Value Fund has returned a cumulative 44.20% with an IRR of 37.45% vs. BSE MID CAP’s cumulative return of 58.84% and an IRR of 49.50%. (http://svz.bz/1DZzX1L)

Conclusion

Exposure to US Dollar assets makes sense given the historical depreciation of the Indian rupee against the US dollar. However, we are not convinced that buying a fund that tries to pick stocks in foreign markets is the way to go. Investors would be better of being net short the rupee, or buying the S&P 500 ETF separately.