Equities

Commodities

| Energy |

| Brent Crude Oil |

+10.69% |

| Natural Gas |

-3.56% |

| Heating Oil |

+8.80% |

| Ethanol |

+3.84% |

| RBOB Gasoline |

+9.52% |

| WTI Crude Oil |

+9.96% |

| Metals |

| Copper |

+3.17% |

| Gold 100oz |

-3.40% |

| Platinum |

-1.20% |

| Silver 5000oz |

+0.00% |

| Palladium |

+1.49% |

| Agricultural |

| Cotton |

+3.32% |

| Feeder Cattle |

-5.77% |

| Lean Hogs |

-5.17% |

| Cocoa |

+2.84% |

| Coffee (Robusta) |

+0.78% |

| Orange Juice |

-2.21% |

| Soybean Meal |

-0.30% |

| Sugar #11 |

-1.56% |

| White Sugar |

-0.23% |

| Coffee (Arabica) |

+2.84% |

| Corn |

+4.05% |

| Lumber |

-1.77% |

| Soybeans |

+1.33% |

| Wheat |

+4.92% |

| Cattle |

+0.87% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.23% |

| Markit CDX NA HY |

+0.20% |

| Markit CDX NA IG |

-0.16% |

| Markit iTraxx Asia ex-Japan IG |

-2.37% |

| Markit iTraxx Australia |

-1.91% |

| Markit iTraxx Europe |

-1.10% |

| Markit iTraxx Europe Crossover |

-7.98% |

| Markit iTraxx Japan |

-0.66% |

| Markit iTraxx SovX Western Europe |

+1.02% |

| Markit LCDX (Loan CDS) |

+0.05% |

| Markit MCDX (Municipal CDS) |

+1.79% |

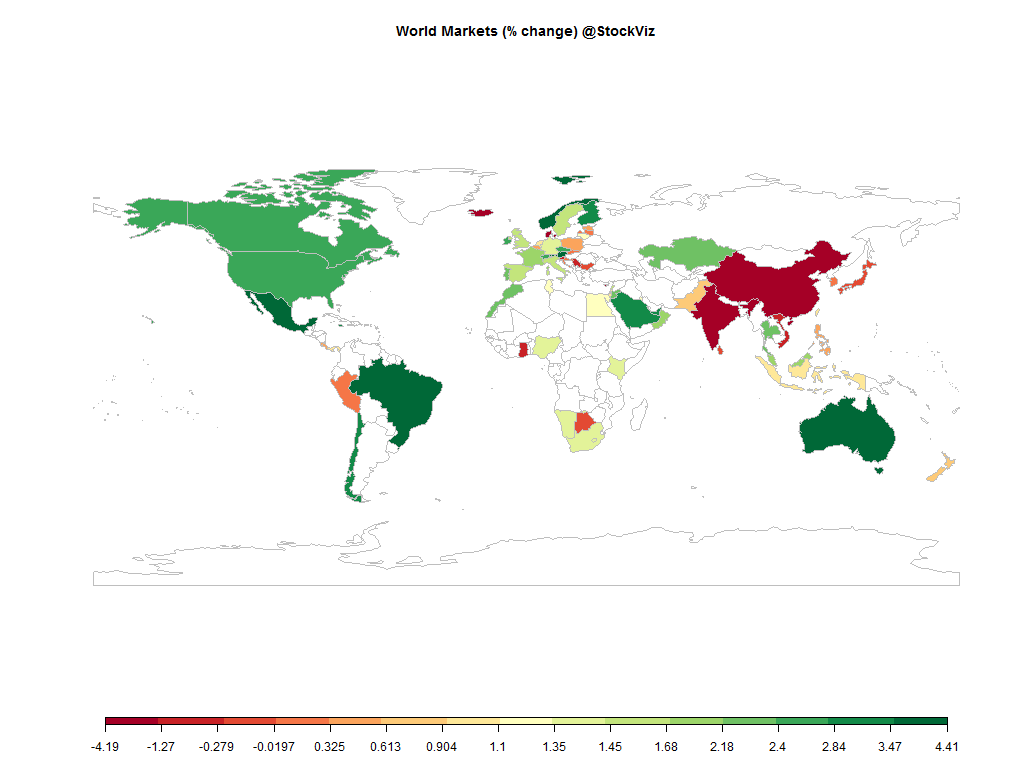

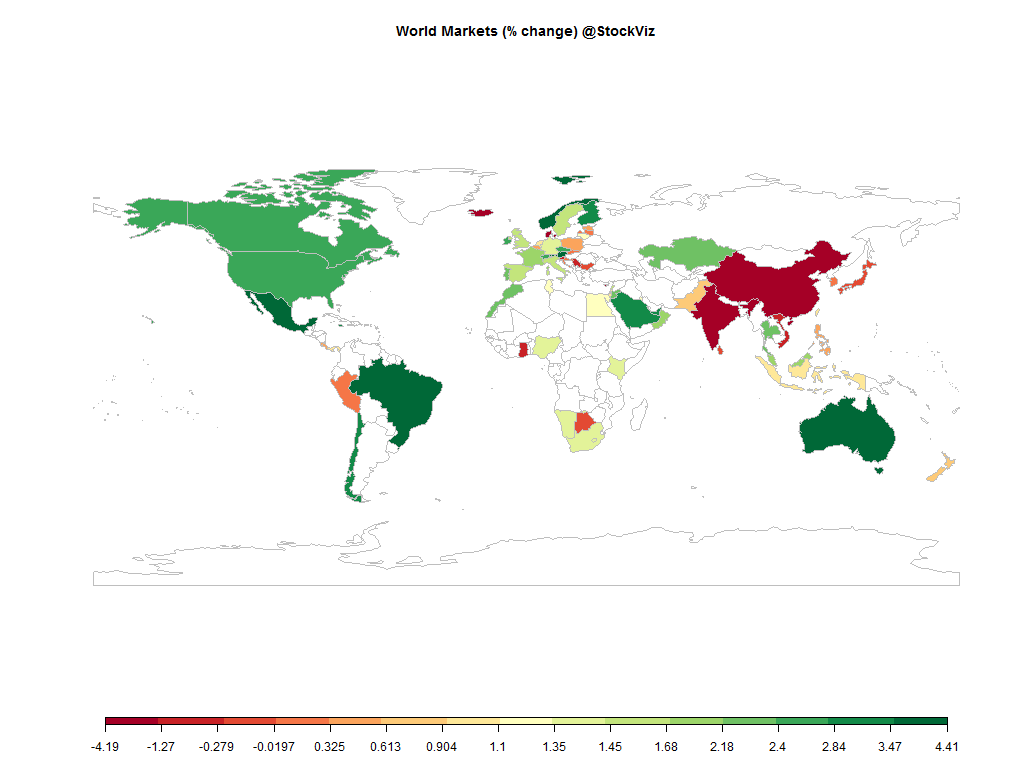

Looks like the dollar rally stalled out and the energy complex got a huge boost. US and European markets ended in the green. Credit narrowed as well.

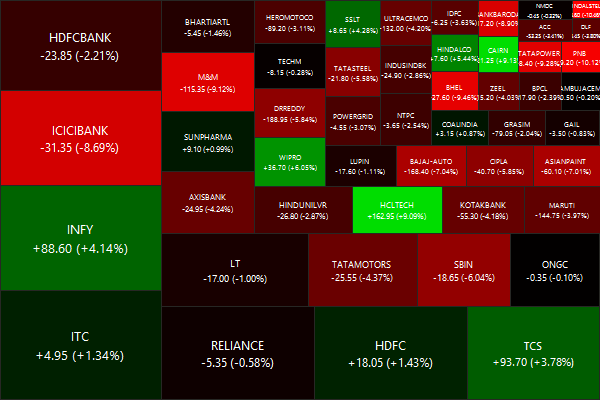

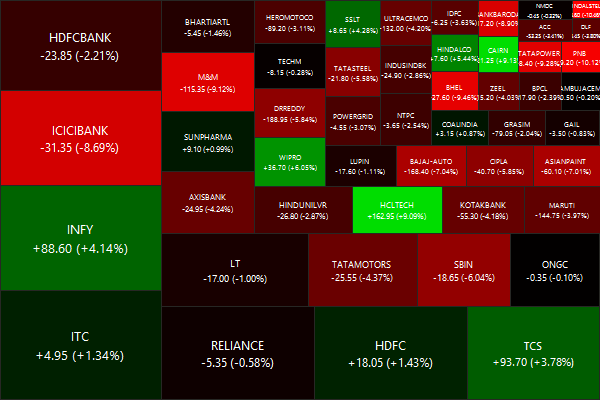

Nifty Heatmap

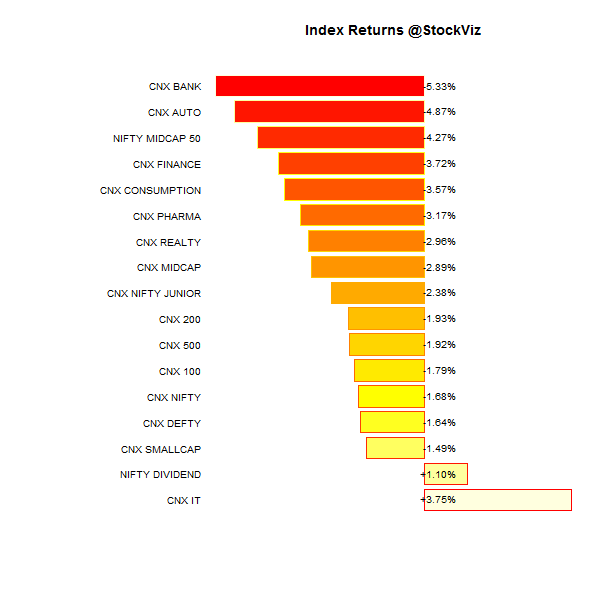

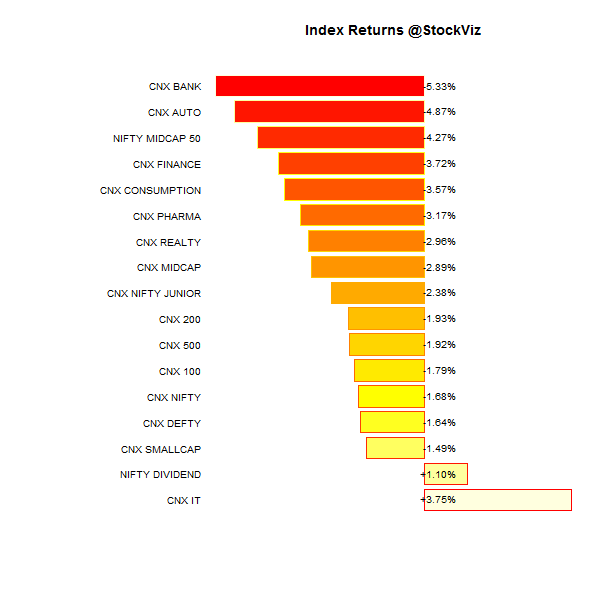

Index Returns

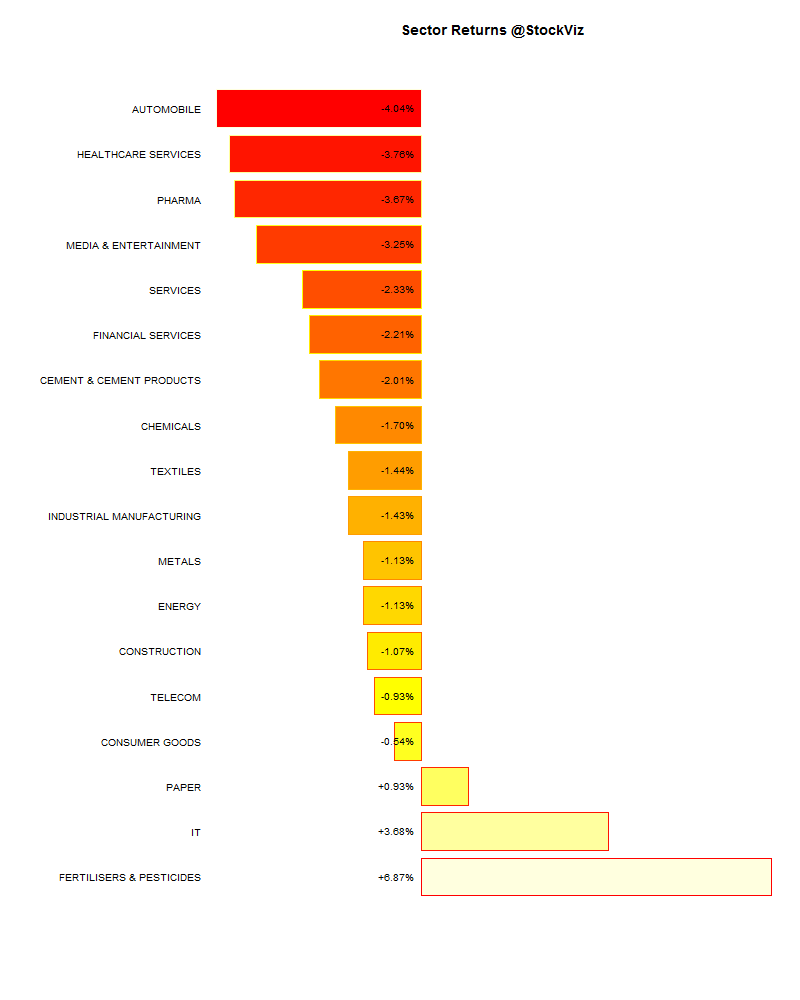

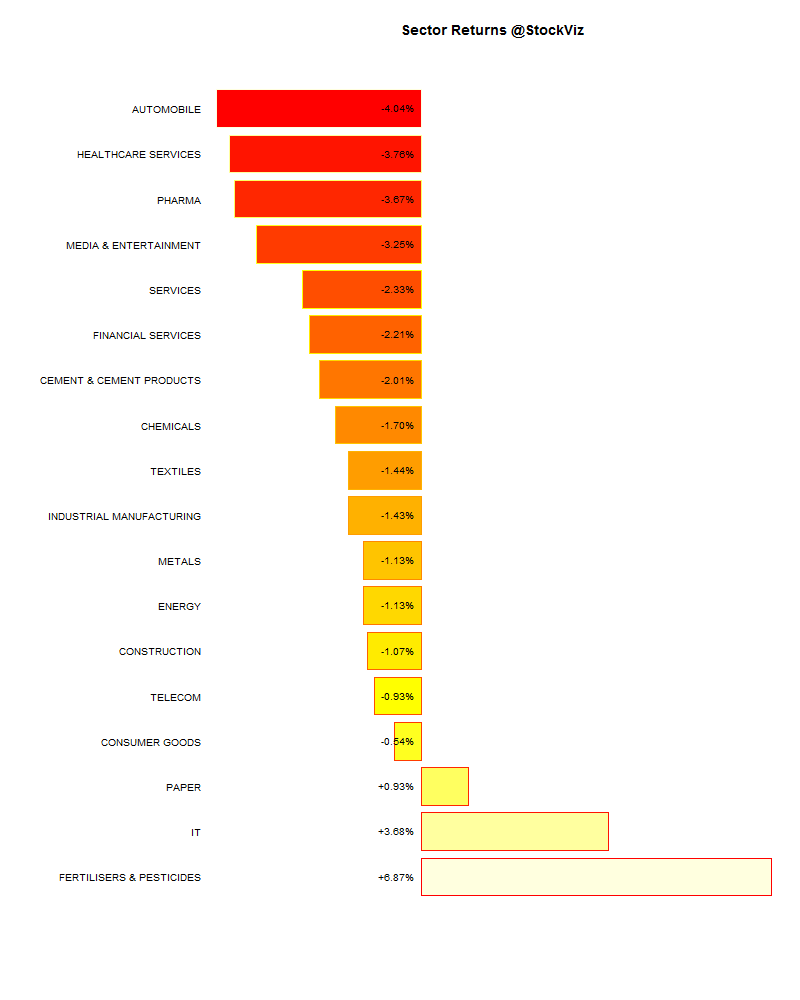

Sector Performance

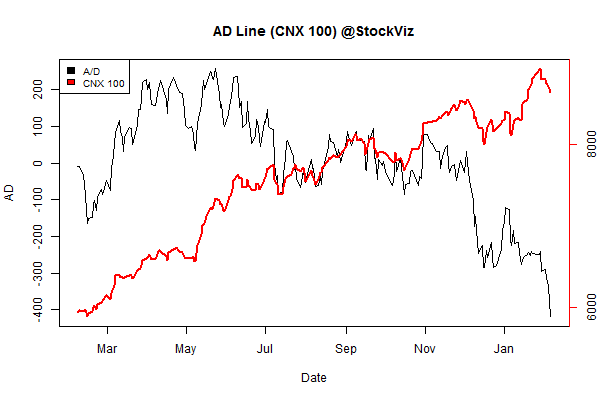

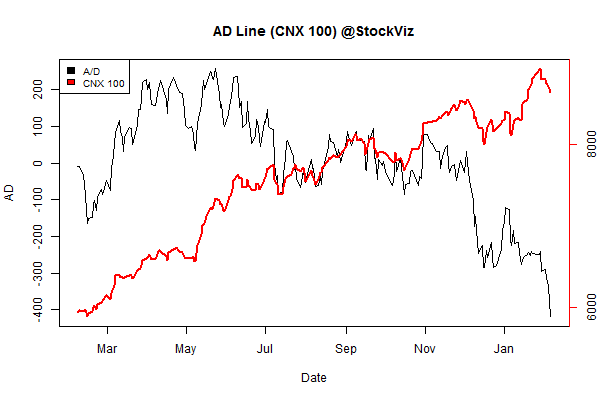

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-1.85% |

69/63 |

| 2 |

-0.11% |

62/70 |

| 3 |

+0.28% |

68/64 |

| 4 |

-0.64% |

66/65 |

| 5 |

-0.72% |

68/64 |

| 6 |

-0.69% |

67/65 |

| 7 |

-1.03% |

55/76 |

| 8 |

-0.74% |

67/65 |

| 9 |

-2.18% |

64/68 |

| 10 (mega) |

-2.59% |

64/68 |

The market sank as a whole…

Top Winners and Losers

Oil prices staged a smart bounce back: CAIRN #winning, HPCL #loser.

ETF Performance

Bank results were a splash of cold water on a market driven by hopium. Will the budget rescue?

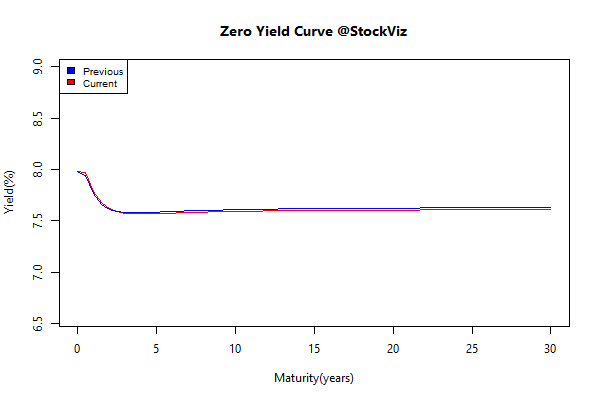

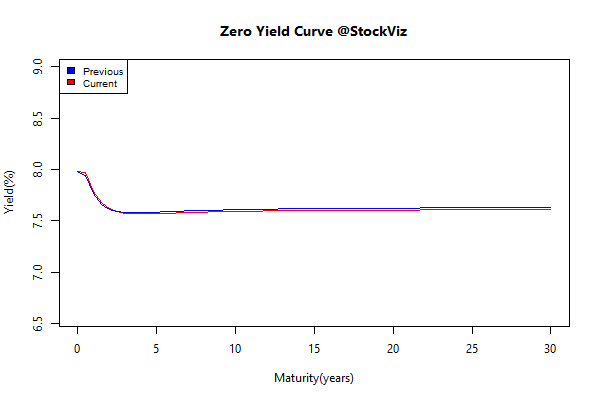

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.02 |

+0.15% |

| GSEC SUB 1-3 |

+0.07 |

+0.14% |

| GSEC SUB 3-8 |

-0.11 |

+0.36% |

| GSEC SUB 8 |

-0.11 |

+0.79% |

Nothing to do but to clip that coupon and hit the links…

Investment Theme Performance

Almost all investment strategies bled…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

One of the hardest parts about investing is that no matter what it is that you buy there will almost certainly be another investor, asset class, sector, fund or security that will be outperforming you at any given point in time. Behavior is the ultimate equalizer in the markets. Most investors will always prefer to invest based on a narratives over evidence.

Source: @awealthofcs