Equities

Commodities

| Energy |

| Brent Crude Oil |

+8.76% |

| Natural Gas |

-9.78% |

| RBOB Gasoline |

+9.15% |

| Heating Oil |

+2.68% |

| WTI Crude Oil |

+4.59% |

| Ethanol |

-4.48% |

| Metals |

| Gold 100oz |

-1.21% |

| Platinum |

-2.23% |

| Copper |

-0.39% |

| Palladium |

-0.48% |

| Silver 5000oz |

-6.52% |

| Agricultural |

| Cattle |

+2.97% |

| Soybean Meal |

-0.93% |

| White Sugar |

-2.52% |

| Cocoa |

-1.70% |

| Corn |

-4.21% |

| Feeder Cattle |

-0.83% |

| Soybeans |

-1.54% |

| Coffee (Arabica) |

+0.56% |

| Coffee (Robusta) |

+1.80% |

| Lumber |

+4.47% |

| Wheat |

-5.64% |

| Cotton |

+3.58% |

| Lean Hogs |

-2.73% |

| Orange Juice |

-4.10% |

| Sugar #11 |

-2.50% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.47% |

| Markit CDX NA HY |

-0.41% |

| Markit CDX NA IG |

+0.80% |

| Markit iTraxx Asia ex-Japan IG |

-2.99% |

| Markit iTraxx Australia |

-1.67% |

| Markit iTraxx Europe |

+0.81% |

| Markit iTraxx Europe Crossover |

+3.18% |

| Markit iTraxx Japan |

-2.11% |

| Markit iTraxx SovX Western Europe |

+0.12% |

| Markit LCDX (Loan CDS) |

+0.02% |

| Markit MCDX (Municipal CDS) |

+0.38% |

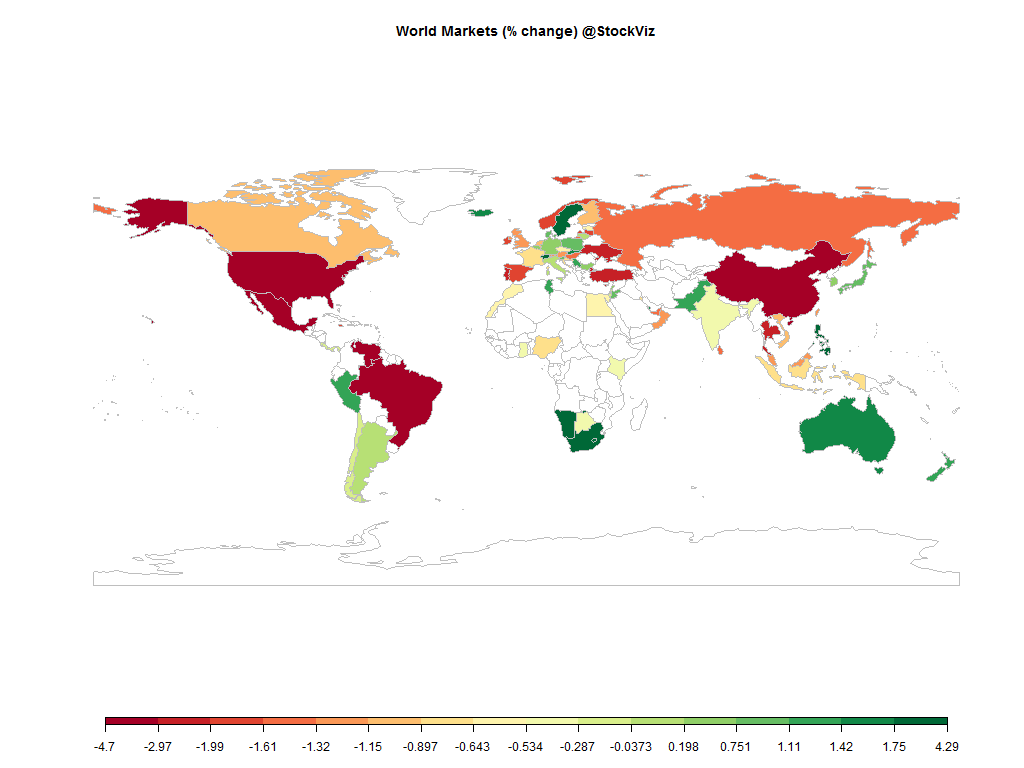

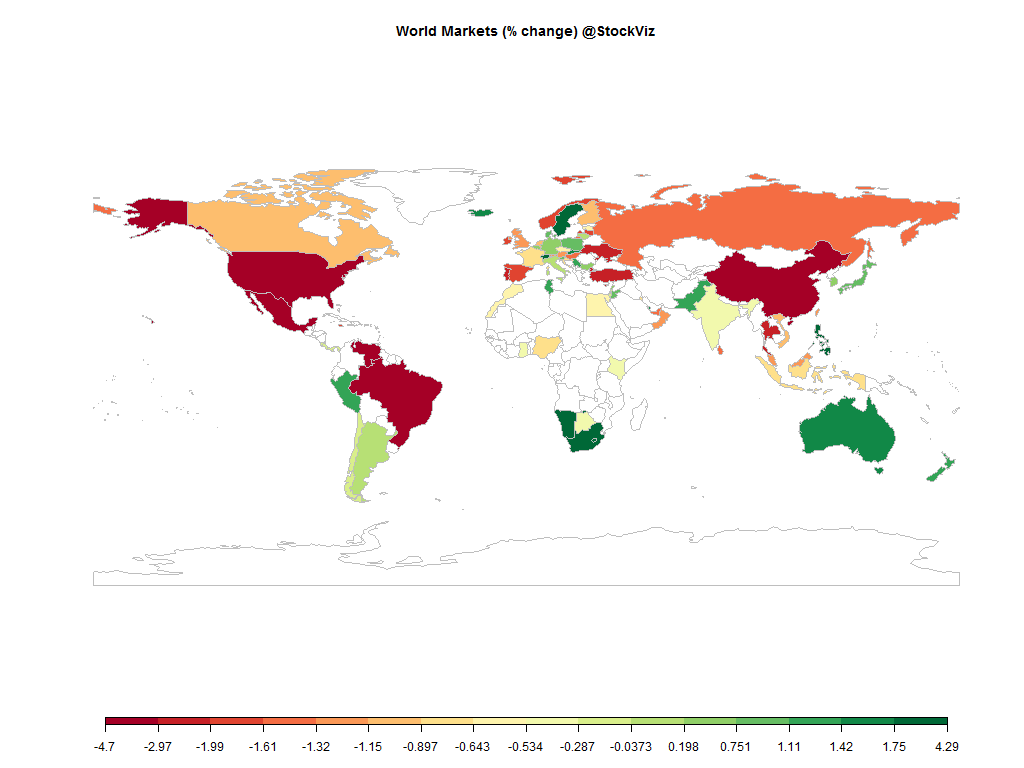

India got off lightly in the carnage this week.

US large-cap earnings were weak due to the rapid appreciation of the US Dollar.

Oil found a bid but precious metals were hit.

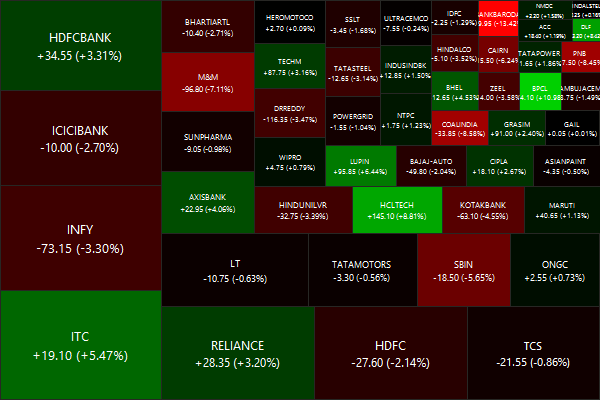

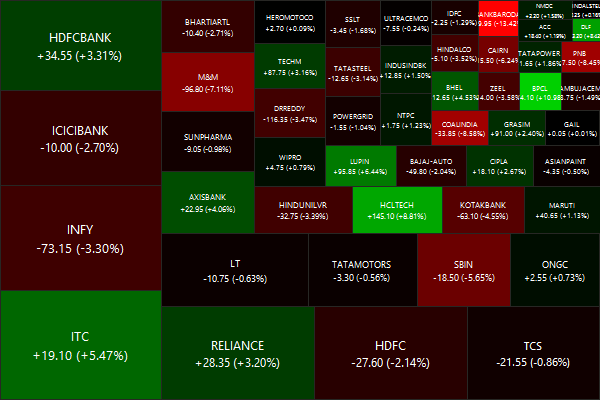

Nifty Heatmap

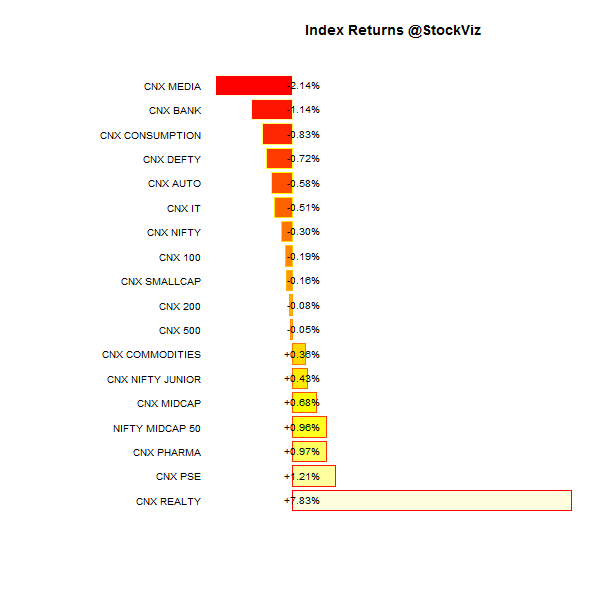

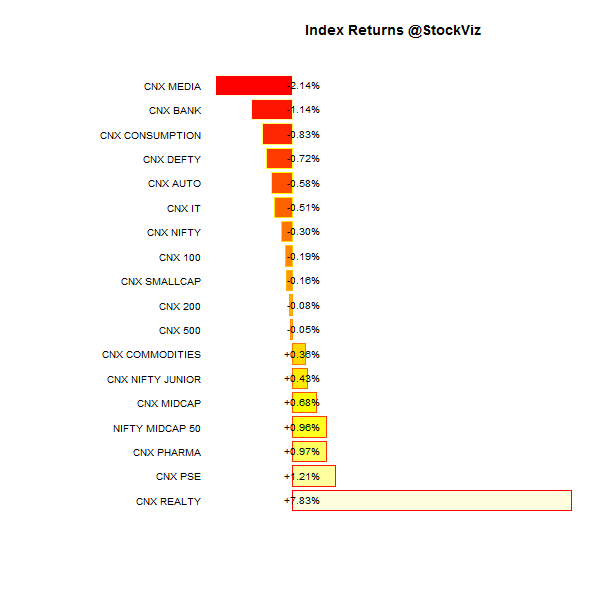

Index Returns

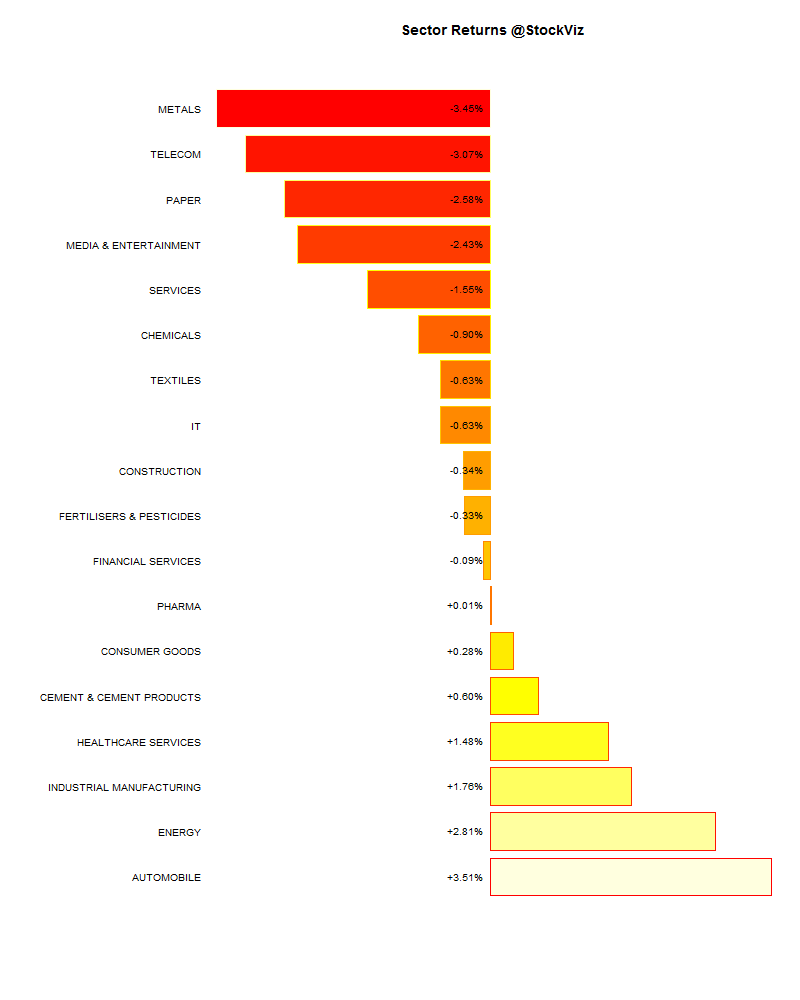

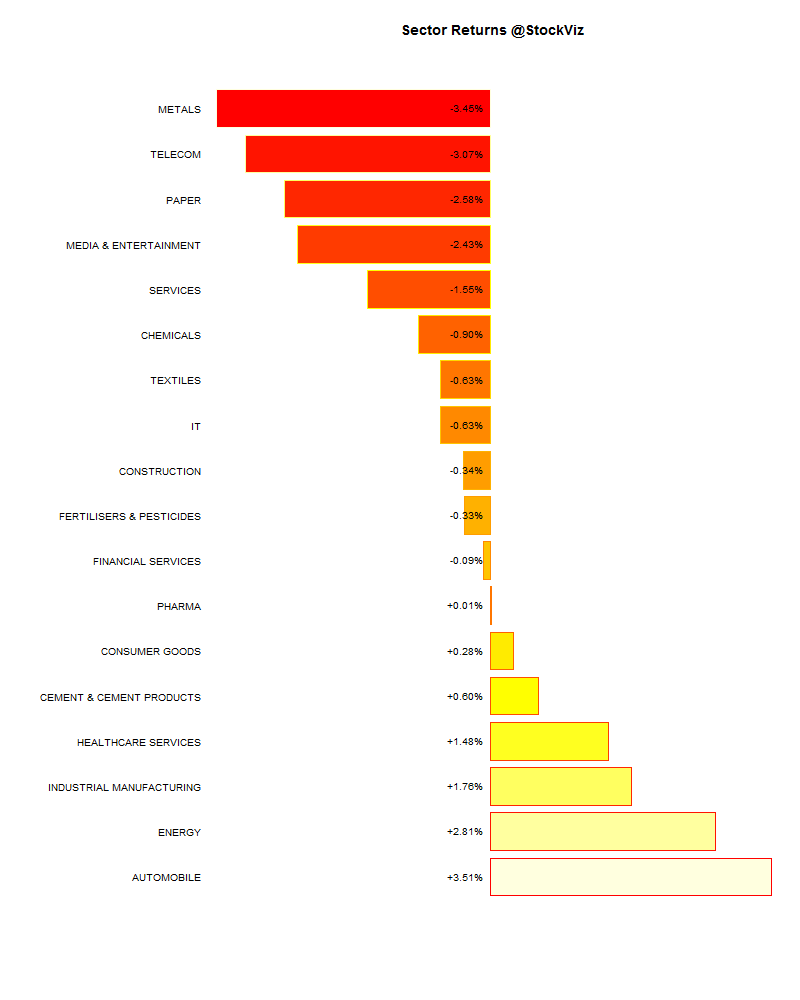

Sector Performance

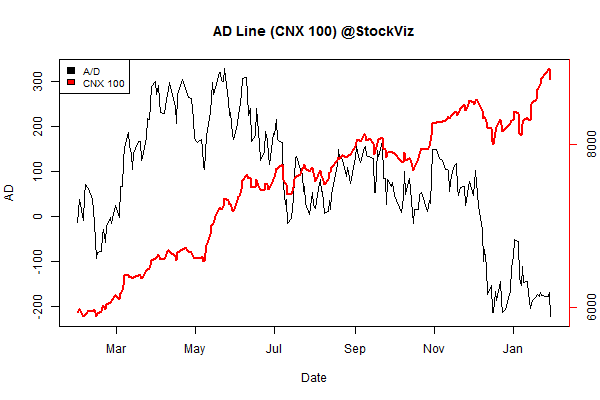

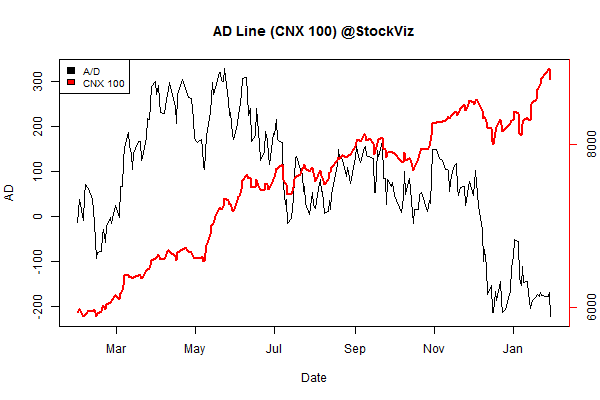

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-8.74% |

67/70 |

| 2 |

-7.77% |

65/73 |

| 3 |

-4.87% |

55/82 |

| 4 |

-4.92% |

64/74 |

| 5 |

-2.13% |

68/69 |

| 6 |

-3.39% |

68/70 |

| 7 |

-0.75% |

65/73 |

| 8 |

-0.09% |

64/73 |

| 9 |

+0.30% |

66/72 |

| 10 (mega) |

+2.15% |

69/69 |

Large caps were the best performers …

Top Winners and Losers

Bank earnings were a rude wake-up call about the true state of the current economy. Bad loans from the previous boom continue to haunt financials.

ETF Performance

Given how poorly government owned enterprises are managed, why own any PSE at all?

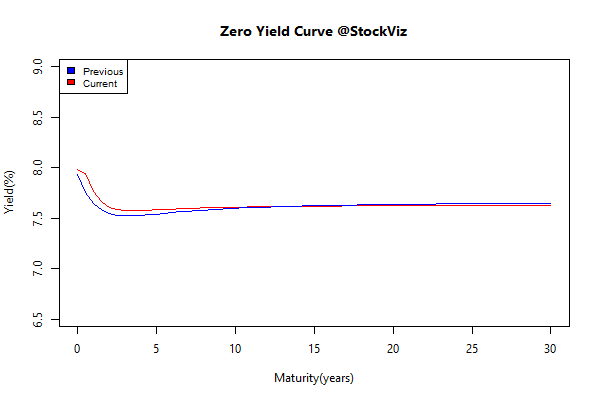

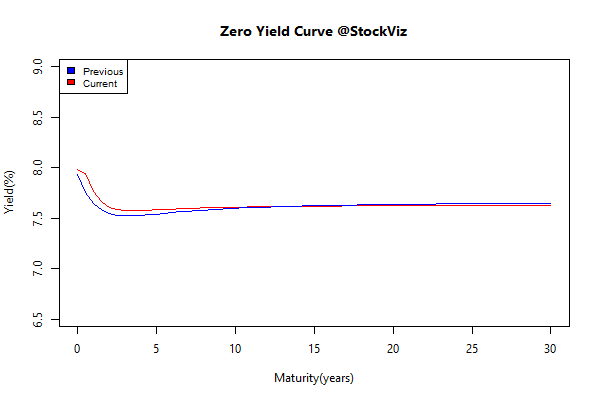

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.07 |

+0.13% |

| GSEC SUB 1-3 |

+0.14 |

+0.06% |

| GSEC SUB 3-8 |

+0.05 |

+0.09% |

| GSEC SUB 8 |

+0.00 |

+0.21% |

Unchanged.

Investment Theme Performance

Momentum took it on the chin this week…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

John Maynard Keynes was also an extraordinary investor. He was a fundamental, focused investor, similar to Warren Buffett in that he practiced buy and hold in a select group of stock holdings. But even with a small number of holdings he still tried to diversify his risks.

But given the volatility of his returns, there is no way investors would put up with this type of drawdowns in today’s investment world. Keynes would certainly be fired if he were managing money this way today.

Source: Would Keynes Have Been Fired as a Money Manager Today?