If you concentrate your portfolio, your mistakes will kill you;

If you diversify, the payoff from your successes will be diminished.

-Howard Marks

If you diversify, the payoff from your successes will be diminished.

-Howard Marks

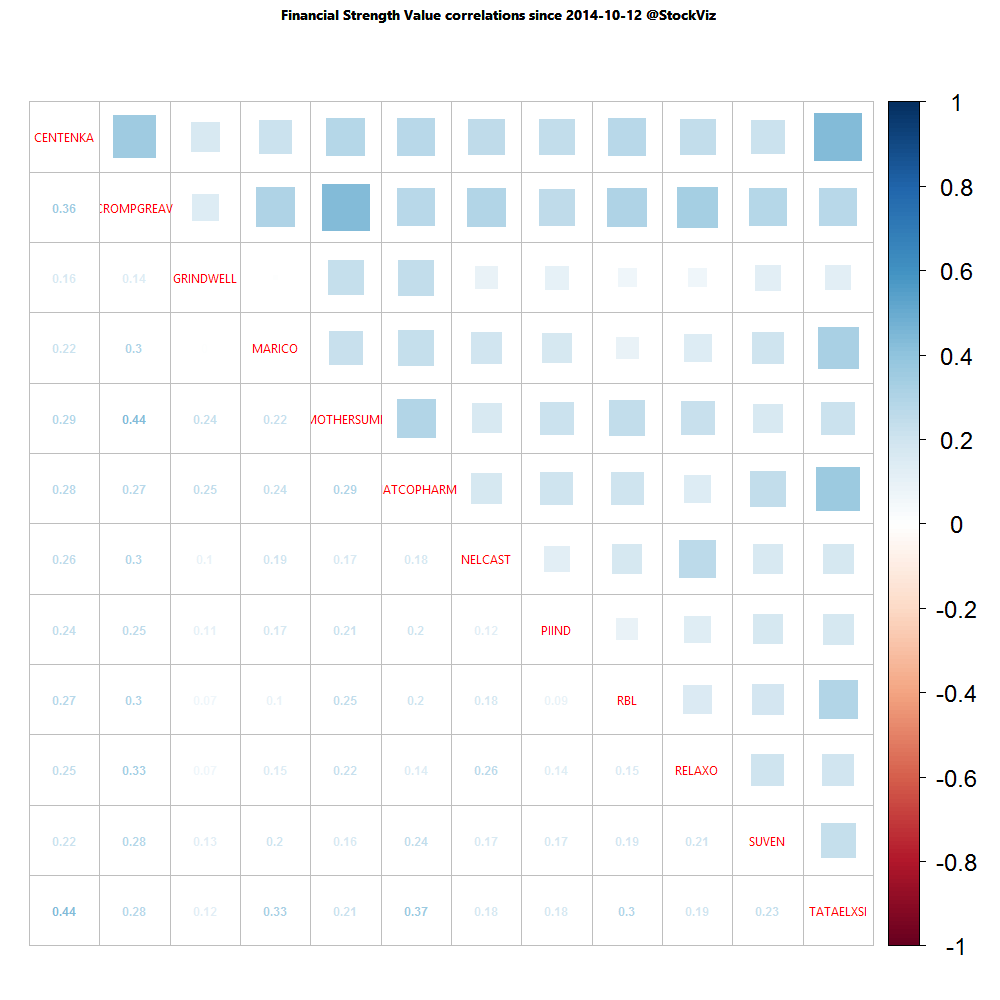

Investors can now look at the correlation (over one-year and one-month horizons) between stocks that make up an investment ‘Theme’ strategy. For example, here’s how the one-year correlation of the Financial Strength Value Theme looks like:

A lot of thick blue squares mean that positive correlations are high. Red squares mean negative correlations are high. Whites are the doldrums.

Happy Sankranti and Pongal!