We have created a whole bunch of Themes based on indices published by the NSE. We call them Re-factored Indices because they use a weighting that is different from NSE’s. We currently have free-float cap weighted and equal weighted themes. Investors can now invest in standard indices directly, without having to go through an index fund.

Long-term out performance

Some indices show persistent long-term out-performance. For example, MNCs have beaten PSEs (StockViz) and have shown to have lower draw-downs. Investors can map the MNC Theme and let NSE/IISL figure out what stocks should be part of that index.

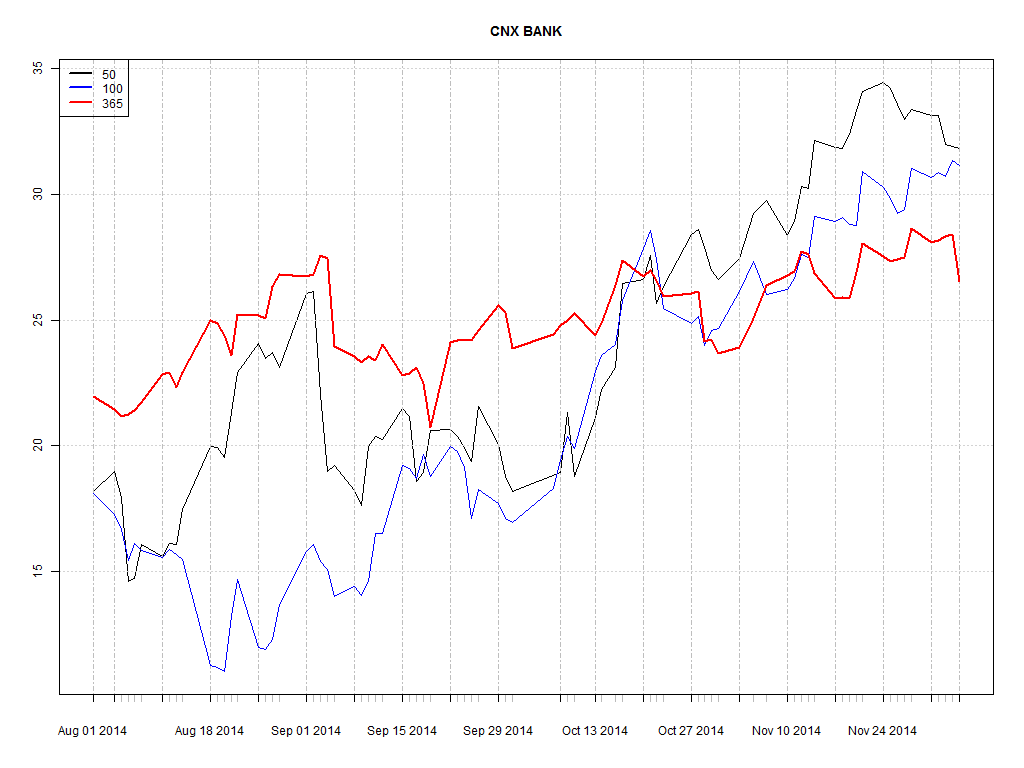

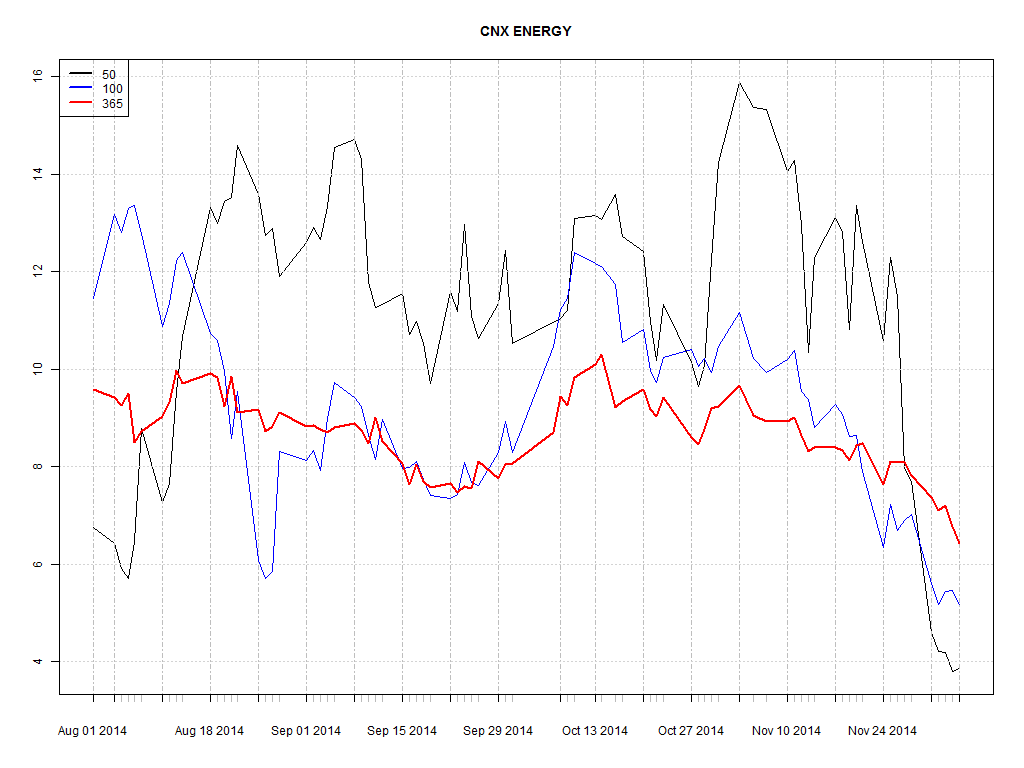

Momentum

Short-term investors can use momentum effects to their advantage and implement a switching strategy. For example, CNX BANK shows greater momentum than CNX ENERGY:

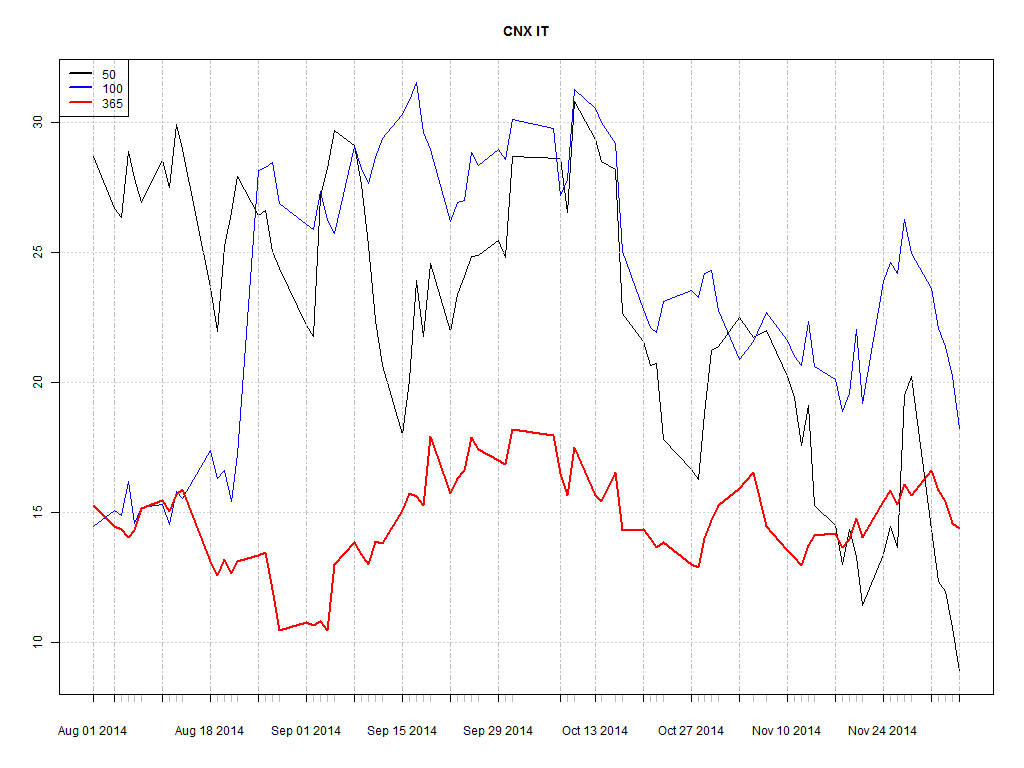

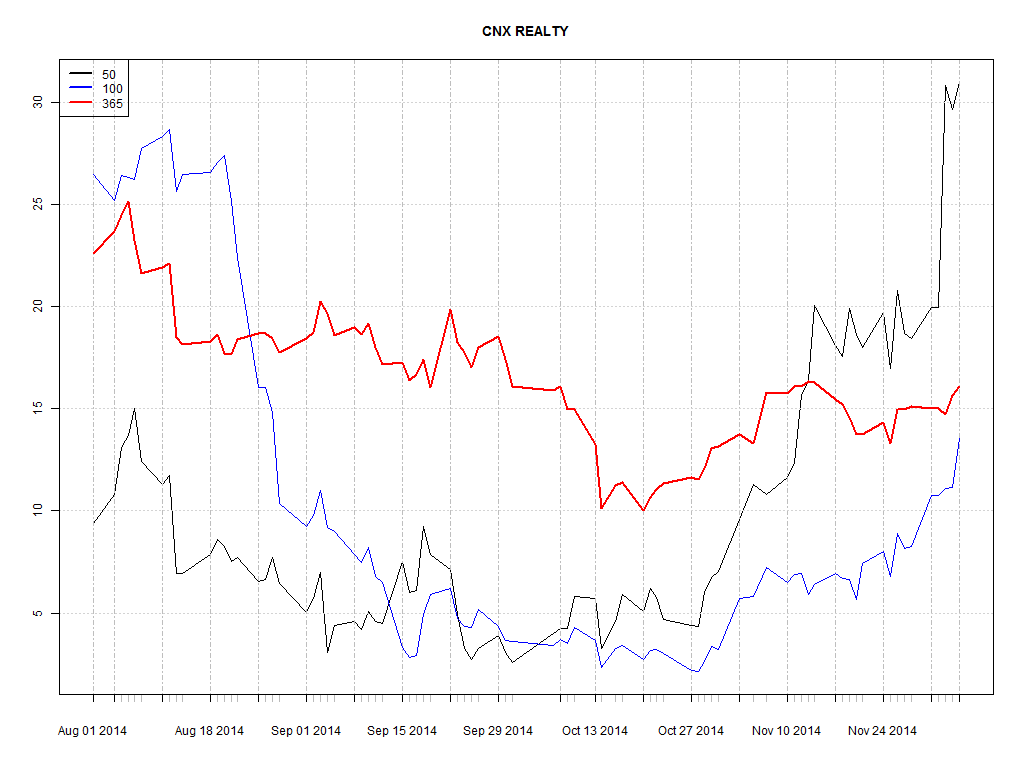

And over the last week, momentum in CNX REALTY has improved drastically whereas CNX IT has decreased:

Conclusion

Re-factored Indices can act as ETF-proxies for long-term, passive investors and opens up interesting momentum strategies for short-term investors.