Equities

Commodities

| Energy |

| Brent Crude Oil |

+1.43% |

| Ethanol |

+2.70% |

| Heating Oil |

-0.44% |

| Natural Gas |

+4.52% |

| RBOB Gasoline |

+1.21% |

| WTI Crude Oil |

+1.54% |

| Metals |

| Copper |

-0.33% |

| Gold 100oz |

+1.09% |

| Palladium |

+2.78% |

| Platinum |

+1.12% |

| Silver 5000oz |

+3.21% |

| Agricultural |

| Cattle |

+0.68% |

| Cocoa |

+0.64% |

| Coffee (Arabica) |

-1.43% |

| Coffee (Robusta) |

-0.29% |

| Corn |

-3.32% |

| Cotton |

-0.47% |

| Feeder Cattle |

-1.49% |

| Lean Hogs |

-2.37% |

| Lumber |

+4.66% |

| Orange Juice |

+9.06% |

| Soybean Meal |

-1.38% |

| Soybeans |

+0.80% |

| Sugar #11 |

+1.58% |

| Wheat |

-2.14% |

| White Sugar |

-0.43% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.15% |

| Markit CDX NA HY |

-0.52% |

| Markit CDX NA IG |

+1.57% |

| Markit CDX NA IG HVOL |

+3.01% |

| Markit iTraxx Asia ex-Japan IG |

+0.10% |

| Markit iTraxx Australia |

+1.12% |

| Markit iTraxx Europe |

+1.12% |

| Markit iTraxx Europe Crossover |

+8.18% |

| Markit iTraxx Japan |

+3.92% |

| Markit iTraxx SovX Western Europe |

-0.58% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

+0.59% |

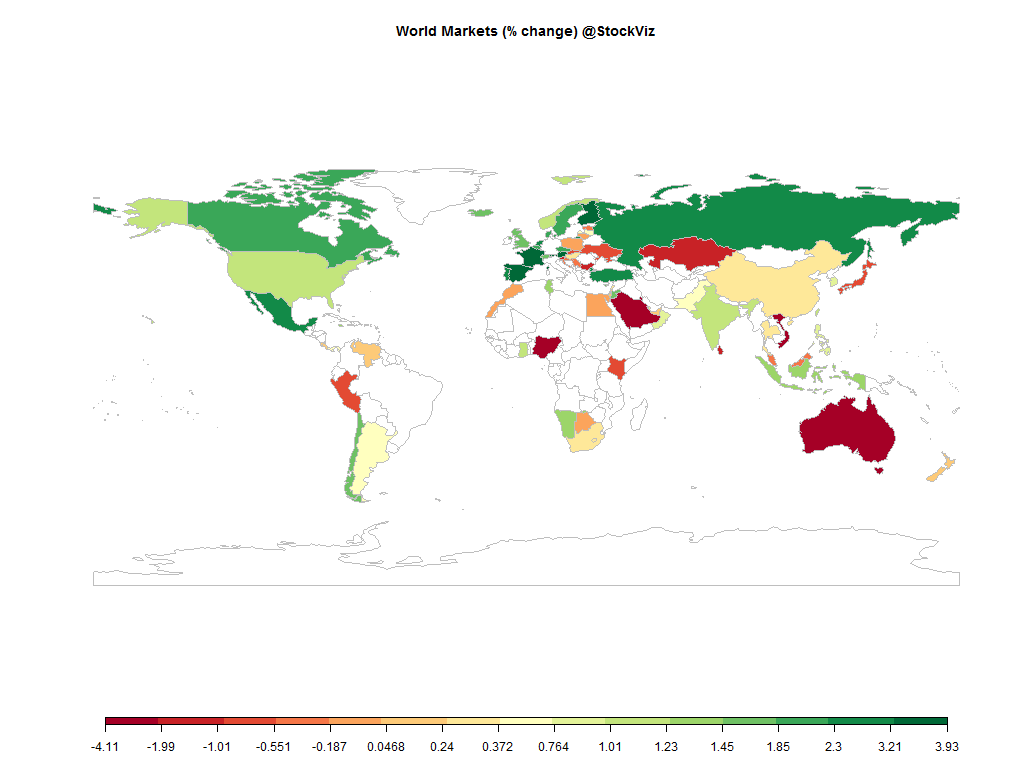

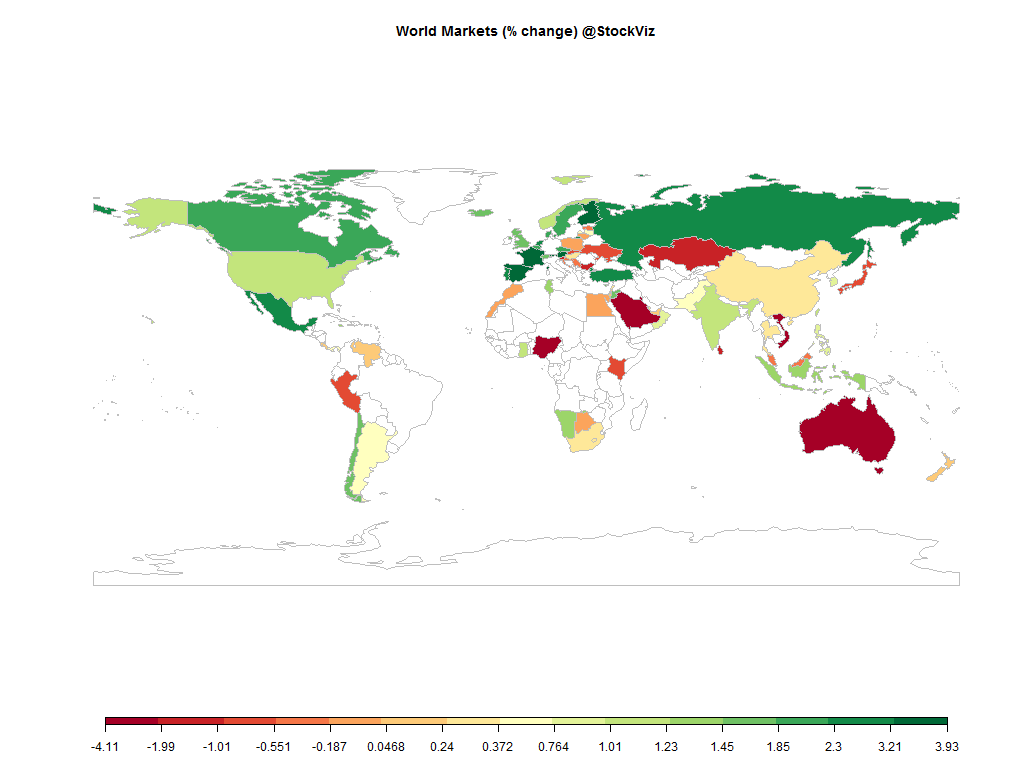

A good week for the markets, with the Chinese central bank getting into the easing game. Credit spreads moved the other way – liquidity maybe driving up stocks, but the credit markets seem to be saying something else.

The SPX continued to make fresh highs but the best performing market was Brazil.

And, the dollar rally paused for the cause…

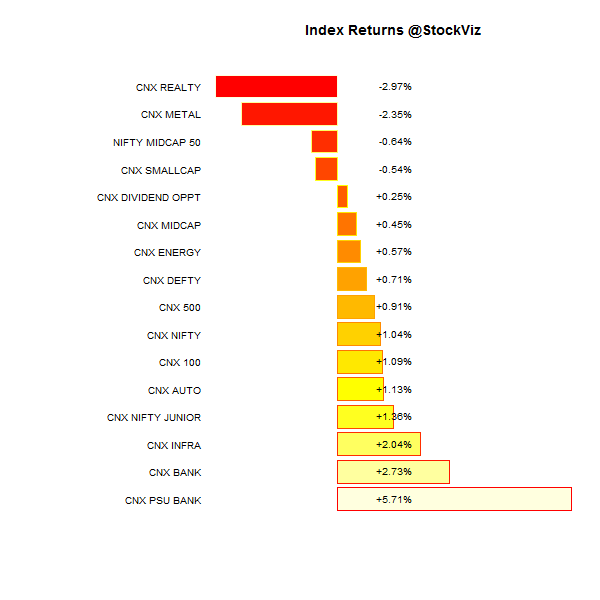

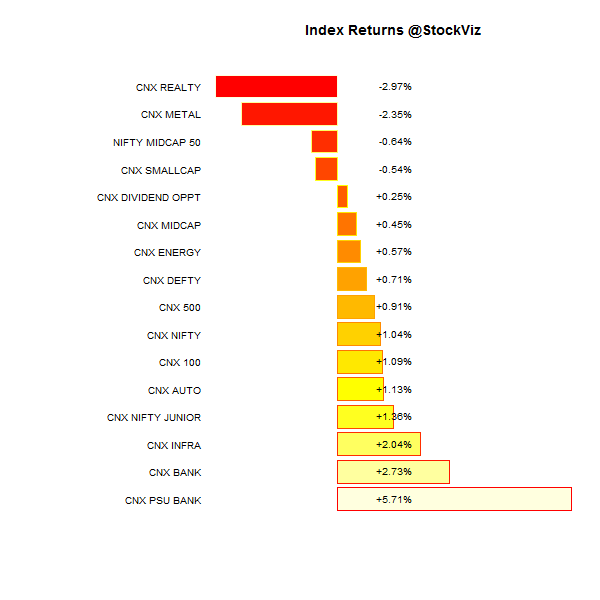

Index Returns

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-1.34% |

66/73 |

| 2 |

-0.29% |

75/64 |

| 3 |

-0.58% |

68/72 |

| 4 |

-0.16% |

67/71 |

| 5 |

-0.40% |

67/72 |

| 6 |

+0.23% |

80/59 |

| 7 |

+0.57% |

71/69 |

| 8 |

+0.45% |

72/66 |

| 9 |

+0.90% |

74/65 |

| 10 (mega) |

+1.16% |

73/67 |

Large caps out-performed small caps, primarily driven by banks.

Top Winners and Losers

In one week, Bosch went from being a value stock to full priced…

ETF Performance

Banks stole the show. Will this carry through to next week?

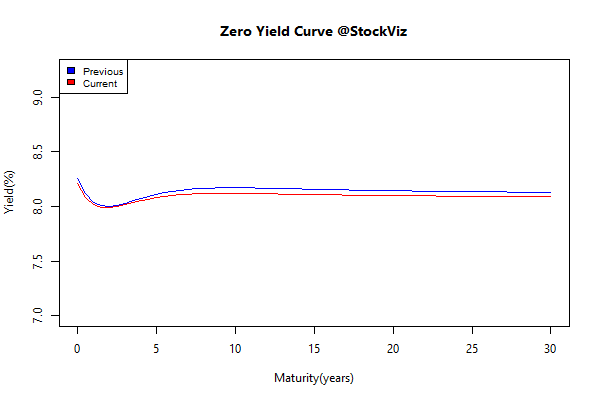

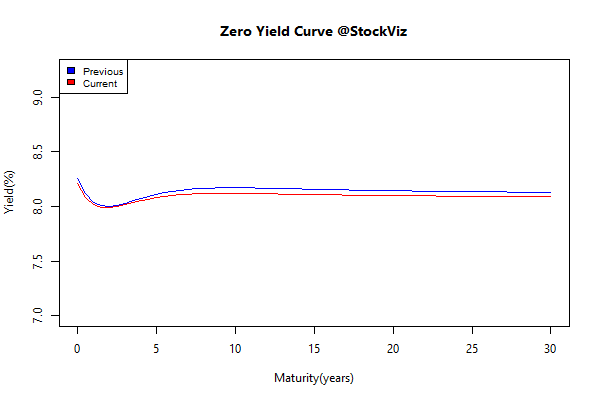

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.09 |

+0.18% |

Bond Indices

| GSEC SUB 1-3 |

+0.04 |

+0.26% |

Bond Indices

| GSEC SUB 3-8 |

+0.03 |

+0.21% |

Bond Indices

| GSEC SUB 8 |

+0.01 |

+0.19% |

The yield curve is beginning to invert. Next rate-cut is fully priced in to the long-end of the curve.

Investment Theme Performance

Thought for the weekend

Emotions are life’s “beta”.

The concept that a stock moves with either more or less volatility than the market seems a neat analog for life. Sometimes you are the windshield, sometimes you’re the bug. We’ve all had beta 3 days, both for good or for bad. But no one except a finance person would try to quantify that with a number.

“How was your day, honey?”

Answer: “Oh, a gap up open when I got a new customer to trade with me, but a lousy close when the market went nuts after the Fed meeting. Definitely a beta 2 day. Hopefully tomorrow will be calmer.”

Source: Nick Colas: Ten Signs You’ve Been on Wall Street Too Long