Equities

Commodities

| Energy |

| Brent Crude Oil |

-5.20% |

| Ethanol |

+5.48% |

| Heating Oil |

-3.27% |

| Natural Gas |

-8.76% |

| RBOB Gasoline |

-4.40% |

| WTI Crude Oil |

-4.07% |

| Metals |

| Copper |

-0.33% |

| Gold 100oz |

+1.65% |

| Palladium |

-0.76% |

| Platinum |

+0.35% |

| Silver 5000oz |

+8.67% |

| Agricultural |

| Cattle |

+2.22% |

| Cocoa |

-2.34% |

| Coffee (Arabica) |

+4.66% |

| Coffee (Robusta) |

+2.78% |

| Corn |

+3.74% |

| Cotton |

-5.11% |

| Feeder Cattle |

+0.87% |

| Lean Hogs |

+4.26% |

| Lumber |

-2.97% |

| Orange Juice |

+1.35% |

| Soybean Meal |

-2.52% |

| Soybeans |

-0.84% |

| Sugar #11 |

+1.15% |

| Wheat |

+9.15% |

| White Sugar |

+1.63% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.39% |

| Markit CDX NA HY |

+0.11% |

| Markit CDX NA IG |

-1.05% |

| Markit CDX NA IG HVOL |

+0.05% |

| Markit iTraxx Asia ex-Japan IG |

-0.64% |

| Markit iTraxx Australia |

-1.41% |

| Markit iTraxx Europe |

-1.03% |

| Markit iTraxx Europe Crossover |

-4.53% |

| Markit iTraxx Japan |

-3.54% |

| Markit iTraxx SovX Western Europe |

-1.10% |

| Markit LCDX (Loan CDS) |

+0.18% |

| Markit MCDX (Municipal CDS) |

-0.40% |

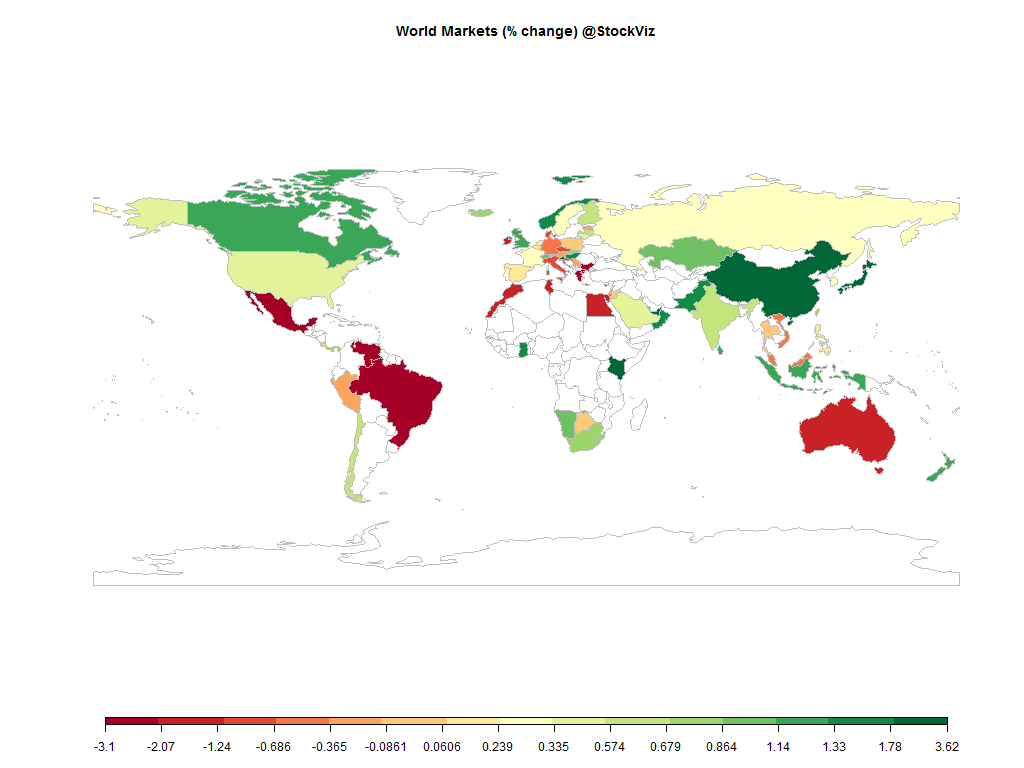

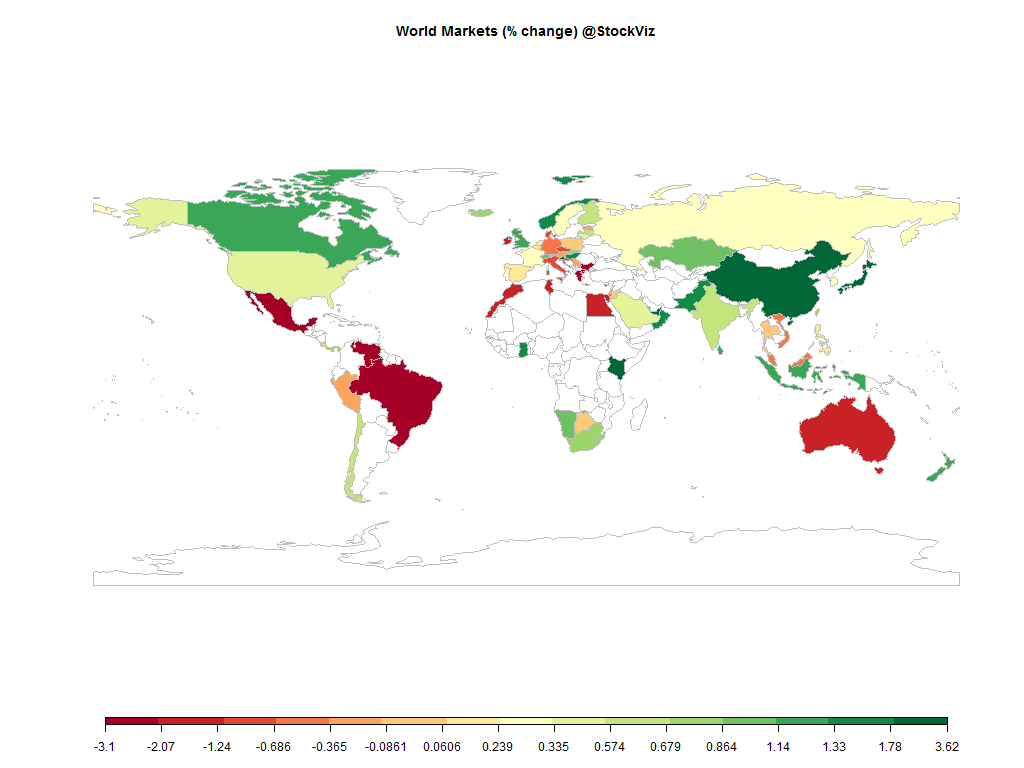

The US Dollar continued to rally and credit spreads contracted. The NIFTY index ended making fresh highs. Oil continued to tumble.

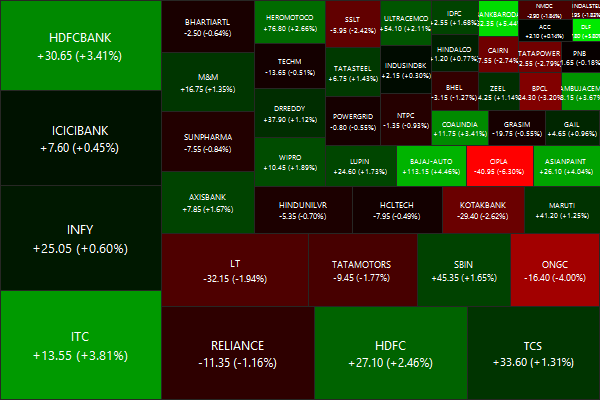

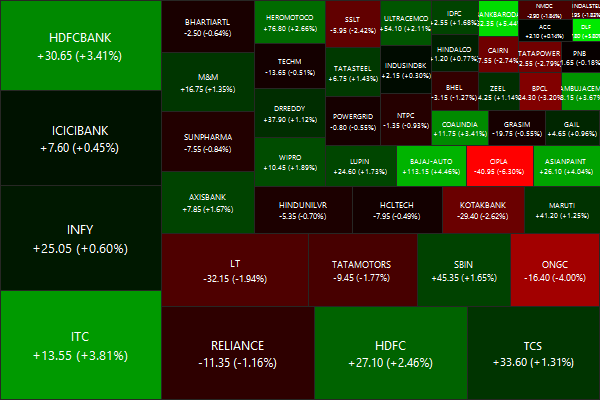

Nifty Heatmap

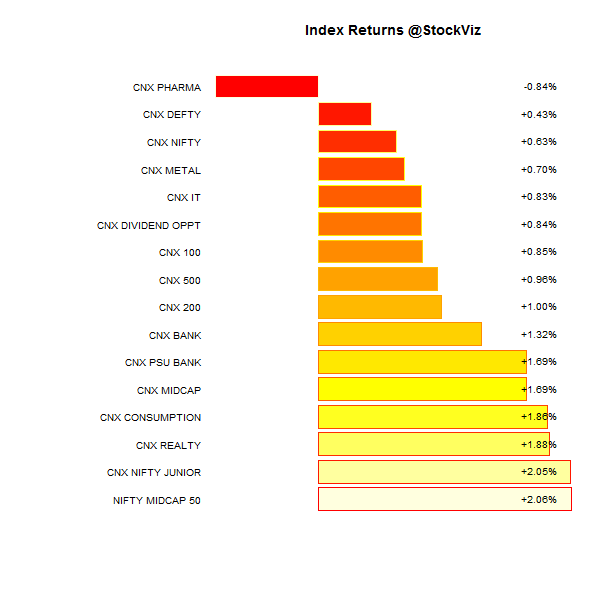

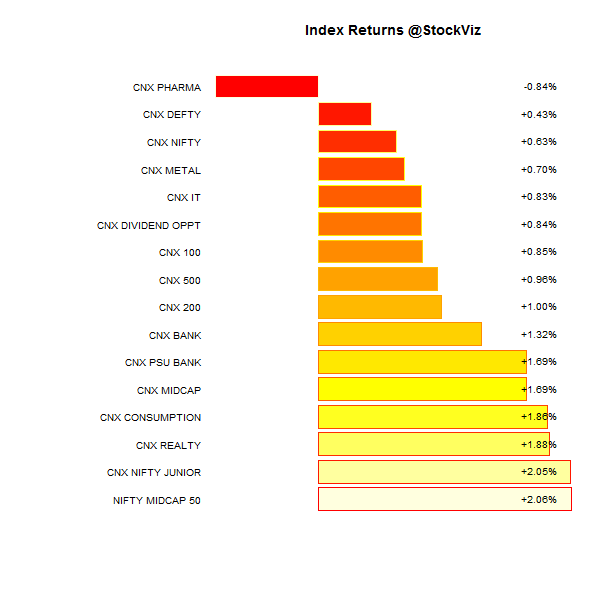

Index Returns

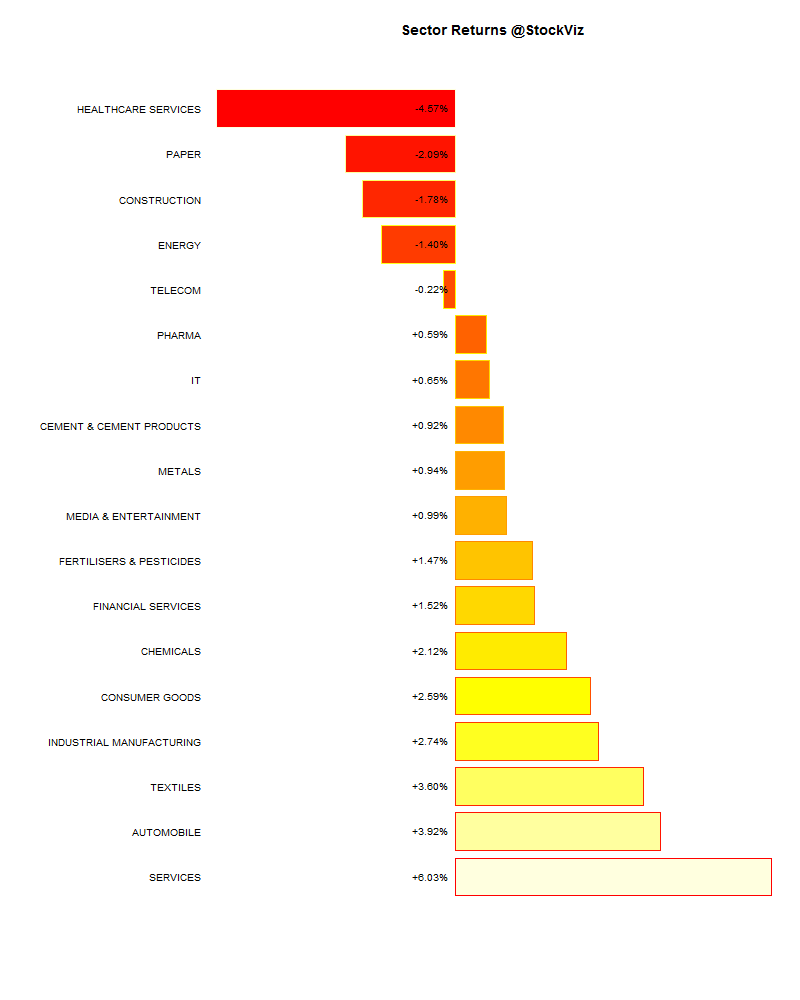

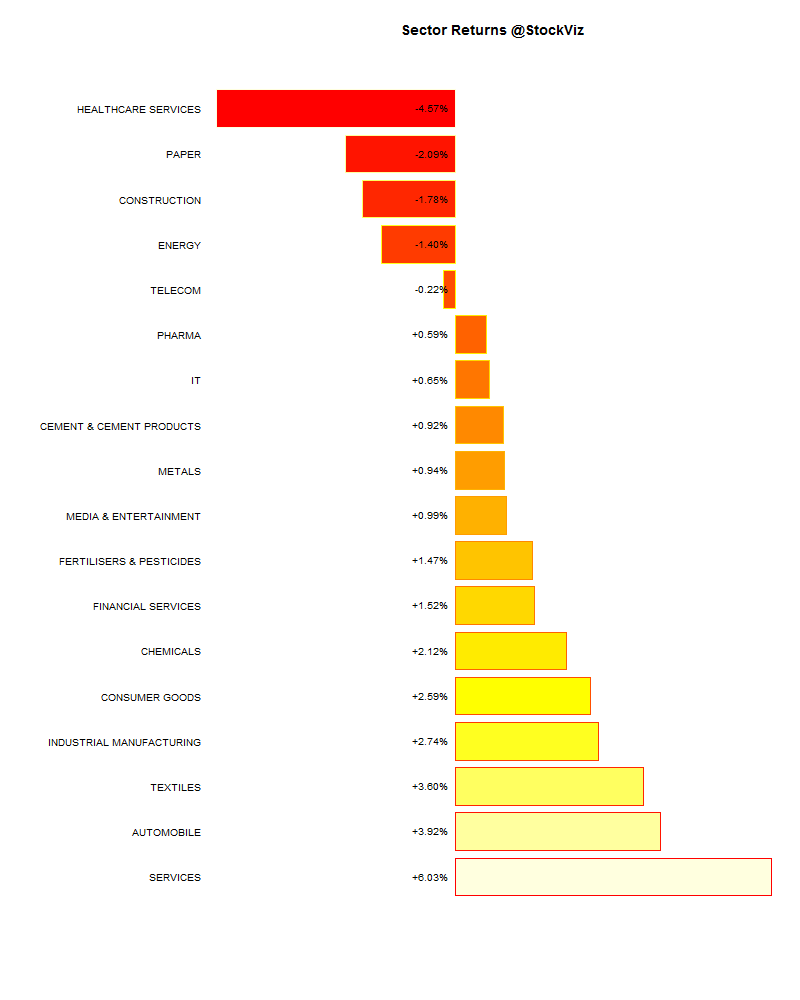

Sector Performance

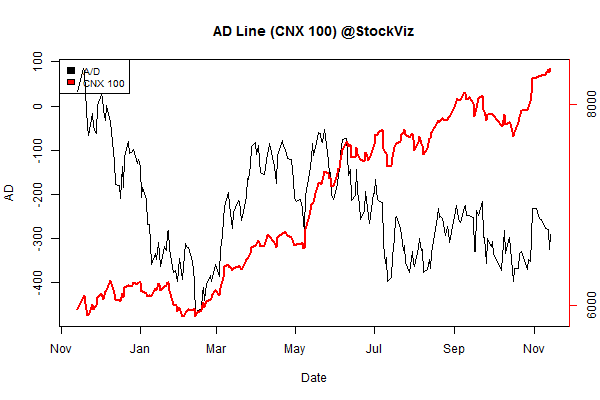

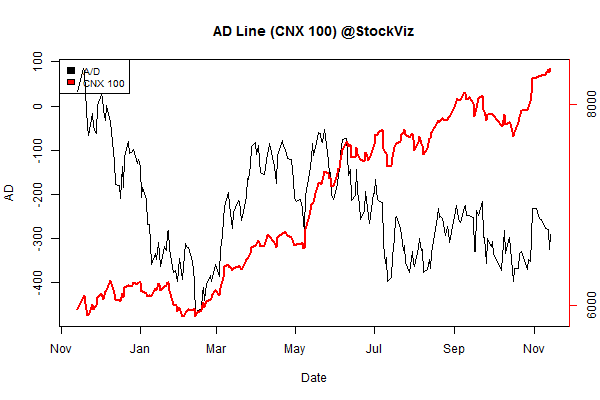

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+1.36% |

65/73 |

| 2 |

+2.57% |

72/65 |

| 3 |

+1.58% |

70/68 |

| 4 |

-0.78% |

72/65 |

| 5 |

+0.66% |

58/80 |

| 6 |

+0.64% |

76/61 |

| 7 |

+0.95% |

69/69 |

| 8 |

+0.37% |

64/73 |

| 9 |

+1.24% |

69/69 |

| 10 (mega) |

+0.98% |

72/66 |

Midcaps chalked up a decent score. It was an even keeled performance across the market cap spectrum…

Top winners and losers

The results season was not kind to Cipla (overblown expectations) and RCOM (typical ADAG nautanki.)

ETFs

The Juniors reflected mid-cap performance. Banks continue to catch a bid and are expected to outperform…

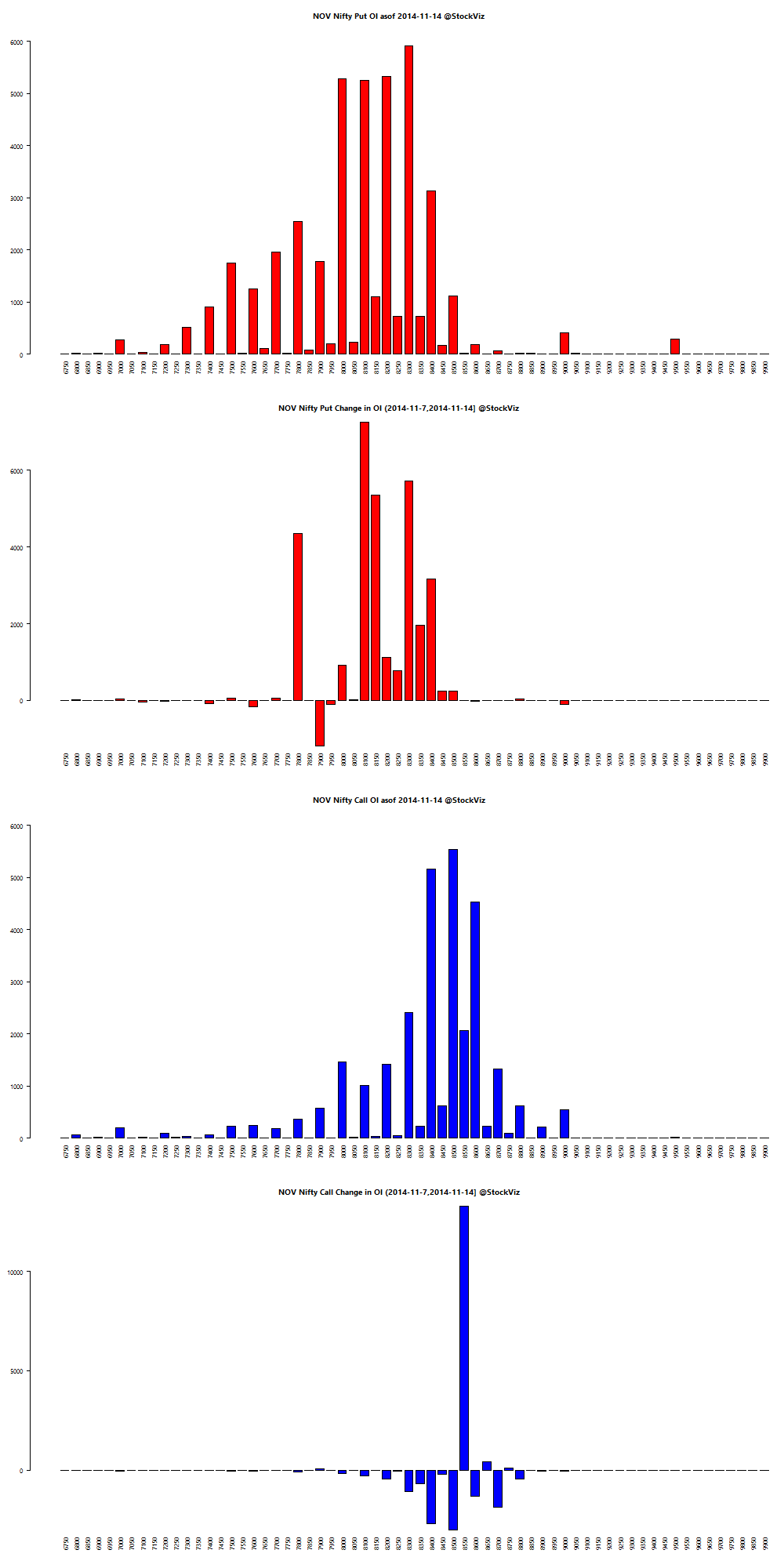

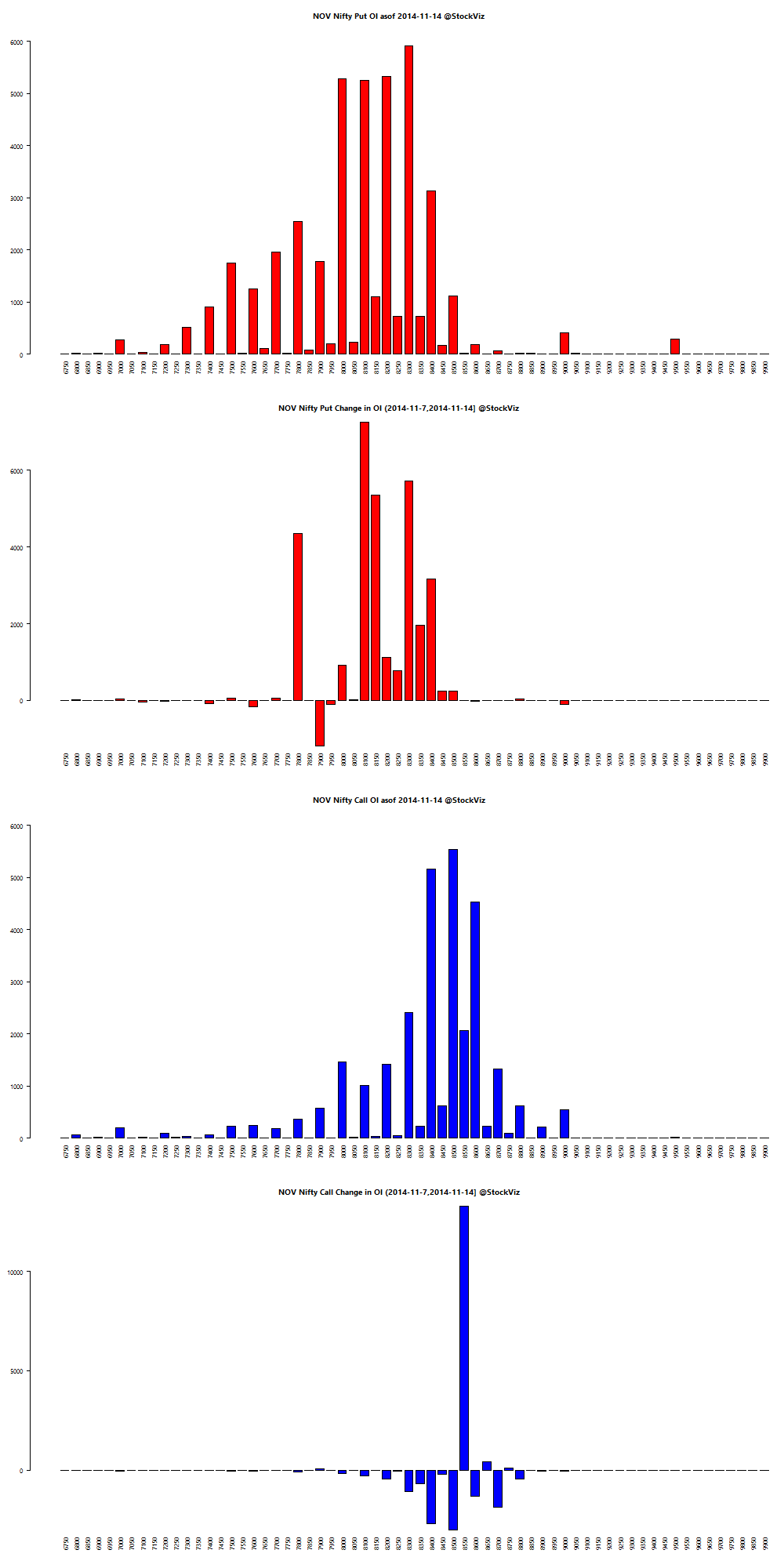

Nifty OI

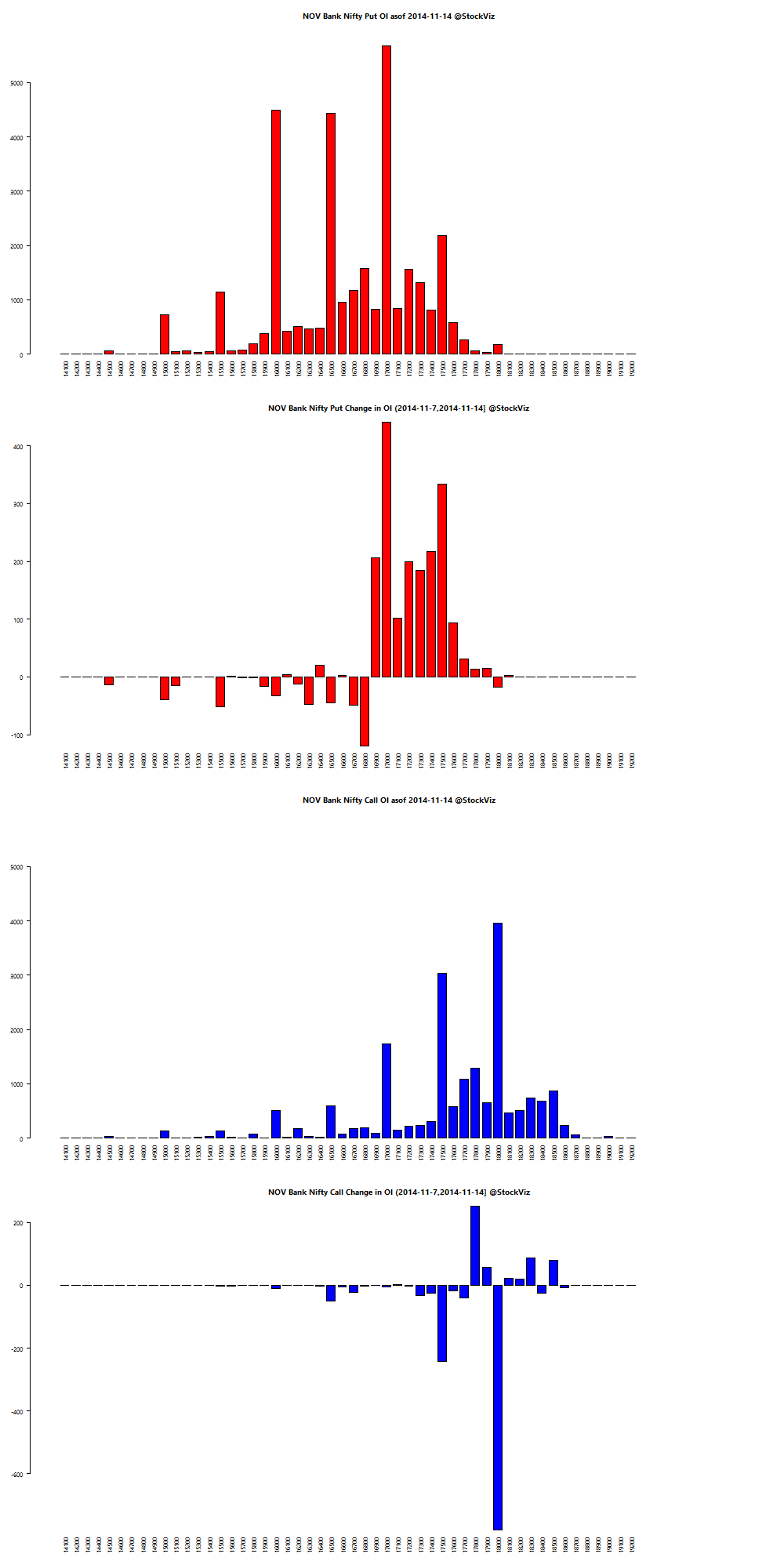

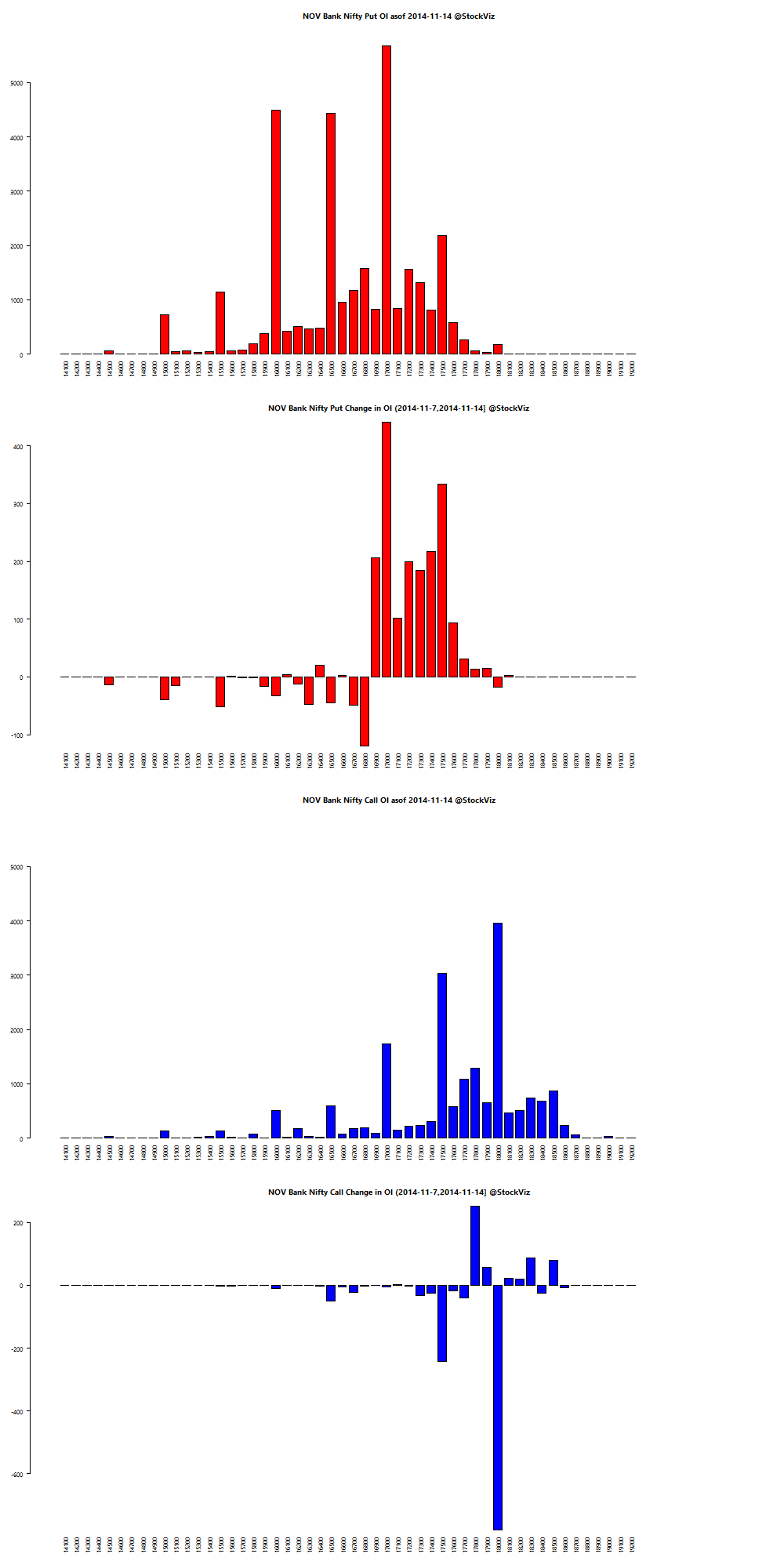

Bank Nifty OI

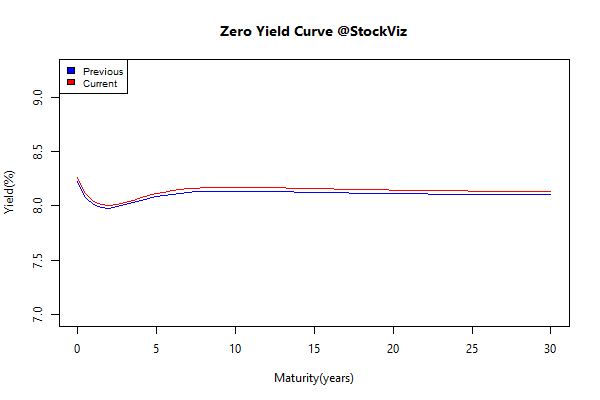

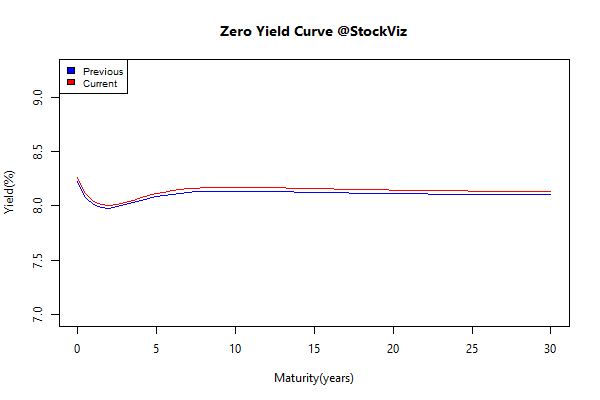

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.17 |

+0.11% |

| GSEC SUB 1-3 |

+0.17 |

+0.01% |

| GSEC SUB 3-8 |

-0.10 |

-0.01% |

| GSEC SUB 8 |

-0.05 |

+0.37% |

The flat yield curve drifted down with lower inflation numbers and rate cut expectations.

Theme Performance

Momentum continued to rock. Midcap value, not so much.

Thought for the weekend

Lessons and observations from the recent FX scandal:

- Everyone was much more interested in managing the dealing costs that they could see, not the execution quality which they couldn’t.

- Information is currency. But regulators tend to like to work on the assumption of markets in which everyone has exactly the same information set. Paying in information is sometimes cheaper for the client than paying in money.

- The client keeps on bidding the visible cost of trades downward, but isn’t prepared to put in any effort at all on his own part to see what consequences this has.

Source: Oranges, lemons and forex