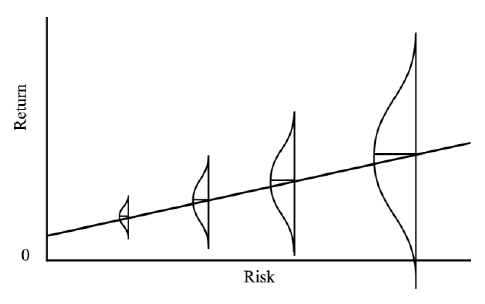

Many investors believe that more risk implies more returns. However, that is an over-simplification: more risk implies a higher probability of more returns (and a higher probability of loss, as well.) Higher risk also implies higher volatility. This graphic is probably the best illustration of the relationship between risk, volatility and returns.

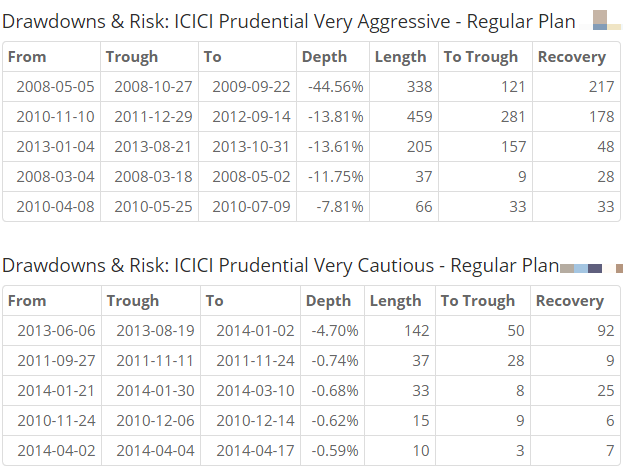

As mutual fund investors, you may have come across the ICICI Prudential “Very Aggressive” and the “Very Cautious” funds. Lets compare their relative performance across different time horizons to further understand the relationship between risk, volatility and returns.

Since March 2008

Since 2008-03-03, ICICI Prudential Very Aggressive fund has returned a cumulative 56.24% vs. ICICI Prudential Very Cautious fund’s cumulative return of 53.30%. The 3% out-performance came with significant stomach-ulcer causing volatility.

It would require someone to have some serious testicular fortitude to hang-on to their investments after a 45% drawdown. It took the “Very Aggressive” fund more than a year to claw itself out of the hole. And many investors would have abandoned the fund during that period.

Here’s wealth chart:

Since March 2009

Boom!

Since 2009-03-02, “Very Aggressive” returned a cumulative 169.40% vs. the “Very Cautious” cumulative return of 41.37%. Max Drawdown: -13.81% vs. -4.70%.

Peace of mind came with a very high performance penalty.

Since March 2010

Since 2010-03-02, “Very Aggressive”: 50.02%, “Very Cautious”: 35.48%.

And This Year

Since 2010-03-02, “Very Aggressive”: 17.58%, “Very Cautious”: 7.54%.

Conclusion

The real risk, if you are investing for retirement, is the inability to maintain a certain lifestyle post-retirement due to inadequate savings. Ideally, your investments should be risk-seeking when you are young and risk-avoiding as you near retirement. You can use a set of funds to reflect this attitude towards risk. And there is almost never a “one-size-fits-all-5-star-gold-plated” fund that you can remain invested forever.

You can run our very own comparison tool: FundCompare to see how different funds performed over different time frames, indices and other funds.

You can either WhatsApp him or call him at 080-2665-0232.

He is an AMFI registered IFA who can advice you on Mirae, HDFC, ICICI Pru, UTI and Birla Sun Life funds.