Equities

Commodities

| Energy |

| Brent Crude Oil |

-3.51% |

| Ethanol |

-9.71% |

| Heating Oil |

-2.48% |

| Natural Gas |

+1.21% |

| RBOB Gasoline |

-2.27% |

| WTI Crude Oil |

-1.06% |

| Metals |

| Copper |

-1.90% |

| Gold 100oz |

-3.04% |

| Palladium |

-5.69% |

| Platinum |

-2.89% |

| Silver 5000oz |

-2.62% |

| Agricultural |

| Cattle |

-2.17% |

| Cocoa |

+2.55% |

| Coffee (Arabica) |

-9.16% |

| Coffee (Robusta) |

-4.17% |

| Corn |

-4.10% |

| Cotton |

+8.16% |

| Feeder Cattle |

+1.57% |

| Lean Hogs |

+0.14% |

| Lumber |

+1.34% |

| Orange Juice |

-2.86% |

| Soybean Meal |

-1.17% |

| Soybeans |

+0.55% |

| Sugar #11 |

-8.18% |

| Wheat |

-6.71% |

| White Sugar |

-5.41% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.87% |

| Markit CDX NA HY |

-0.45% |

| Markit CDX NA IG |

+1.45% |

| Markit CDX NA IG HVOL |

+5.31% |

| Markit iTraxx Asia ex-Japan IG |

-0.61% |

| Markit iTraxx Australia |

-0.03% |

| Markit iTraxx Europe |

+2.98% |

| Markit iTraxx Europe Crossover |

+18.20% |

| Markit iTraxx Japan |

-1.67% |

| Markit iTraxx SovX Western Europe |

-1.04% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

+0.50% |

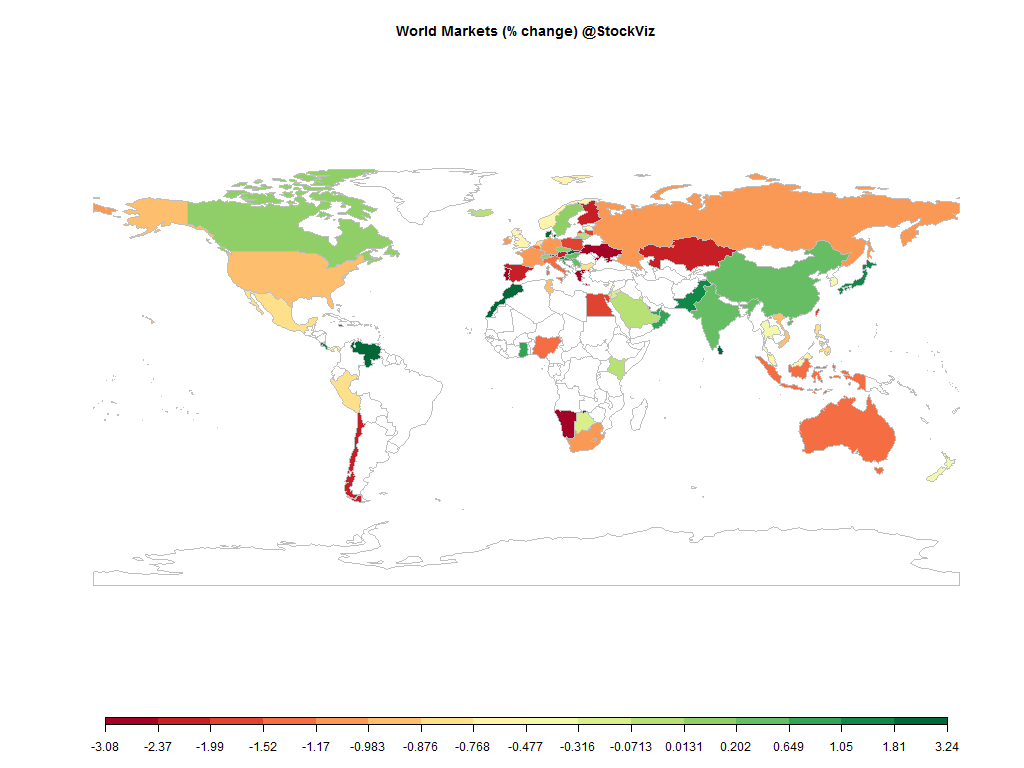

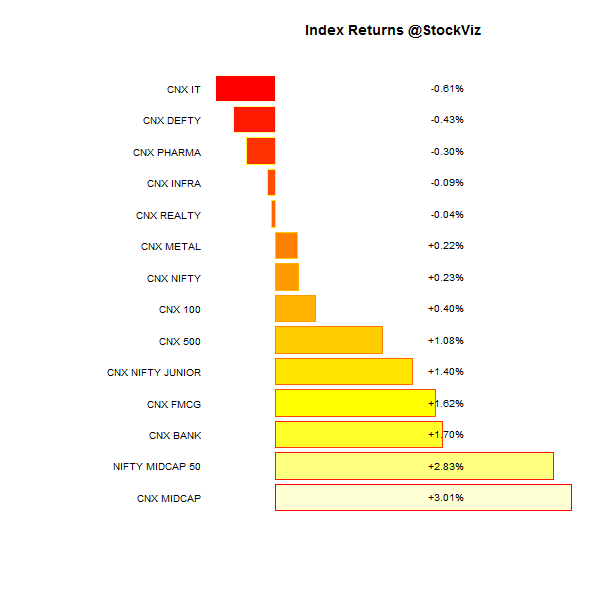

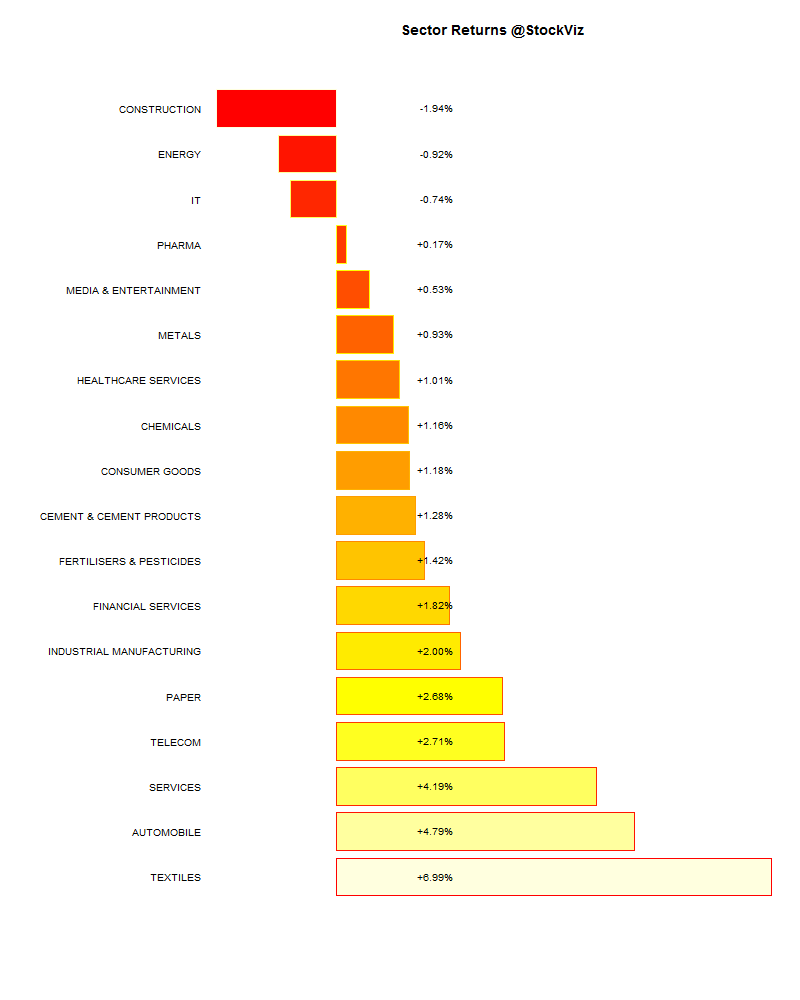

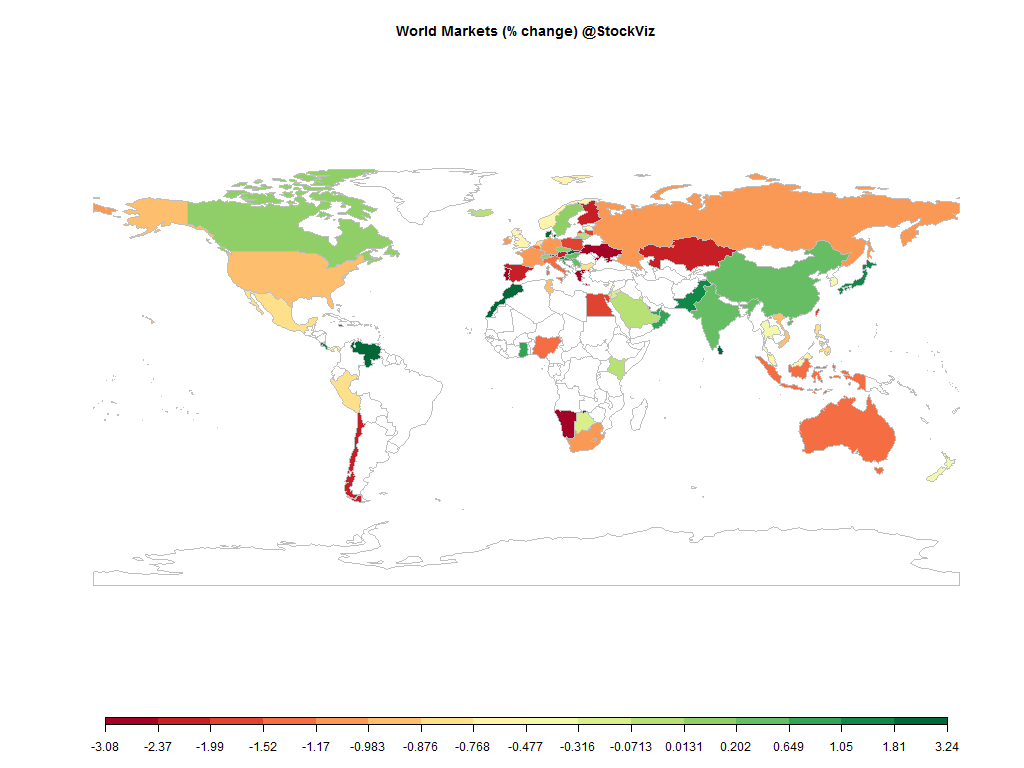

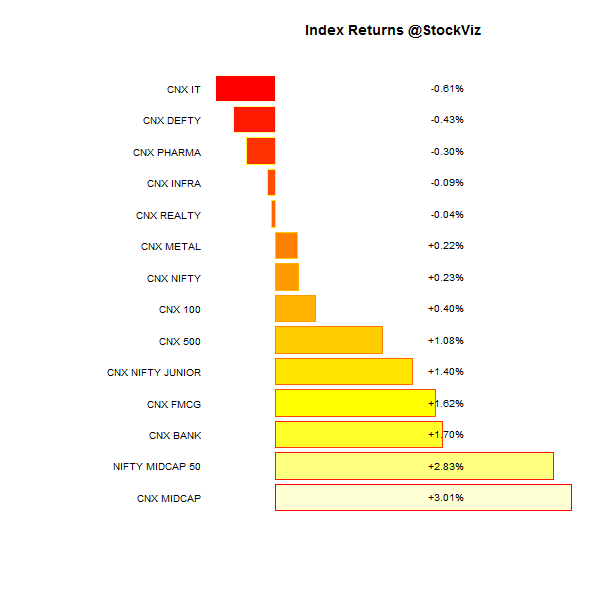

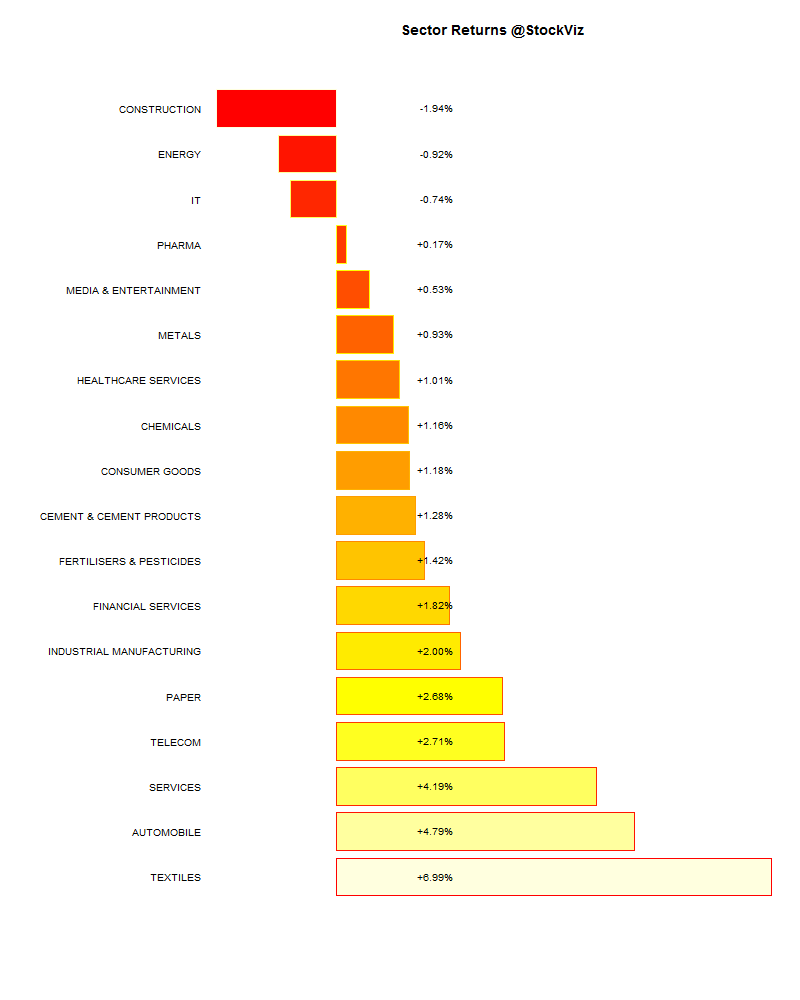

It was a week when most markets went down but Indian mid-caps rallied like a cat with its tail on fire. Commodities: down, MINT markets: down, USD: up, credit: wide. Indian mid-caps: +3% to +10%.

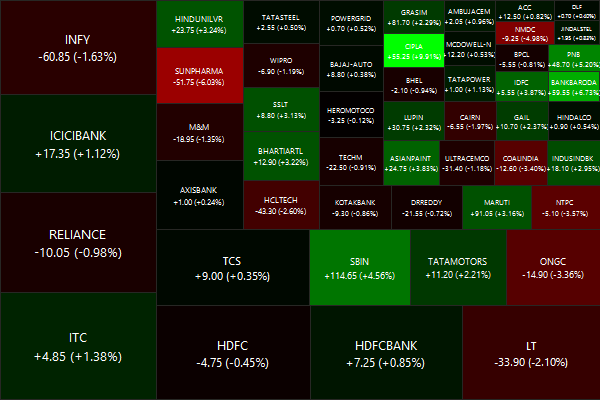

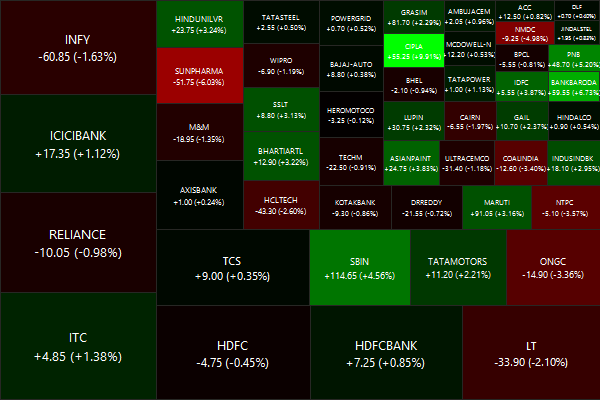

Nifty Heatmap

Index Returns

Sector Performance

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+11.06% |

81/60 |

| 2 |

+12.97% |

91/49 |

| 3 |

+11.06% |

90/50 |

| 4 |

+7.52% |

80/61 |

| 5 |

+10.47% |

87/53 |

| 6 |

+6.29% |

84/56 |

| 7 |

+5.64% |

83/58 |

| 8 |

+4.40% |

78/62 |

| 9 |

+3.14% |

74/66 |

| 10 (mega) |

+0.79% |

70/71 |

The action was in the lower end of the market-cap spectrum. The action in CNX 100/NIFTY was nothing compared to what happened in small/midcap stocks.

Top winners and losers

Sunpharma got dinged with an US-FDA inspection. No idea what happened to OFSS…

ETFs

Gold continued its tumble. Banks seem to have caught a bid…

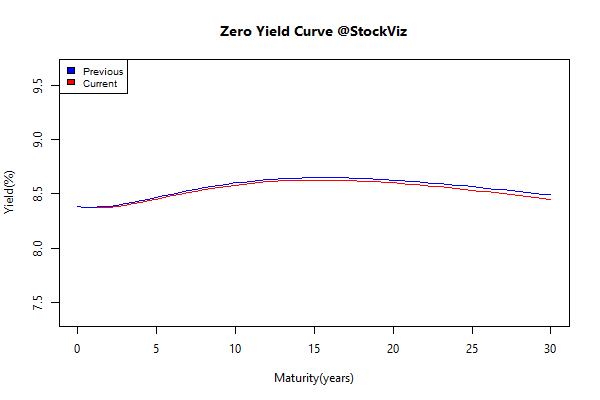

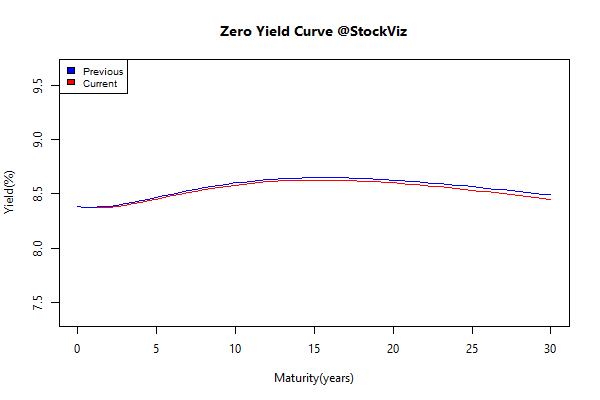

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.40 |

+0.27% |

| GSEC SUB 1-3 |

-0.24 |

+0.81% |

| GSEC SUB 3-8 |

-0.17 |

+1.08% |

| GSEC SUB 8 |

-0.10 |

+0.88% |

3-8 year part of the curve saw some action. But the last couple of weeks in the bond markets was as exciting as watching paint dry…

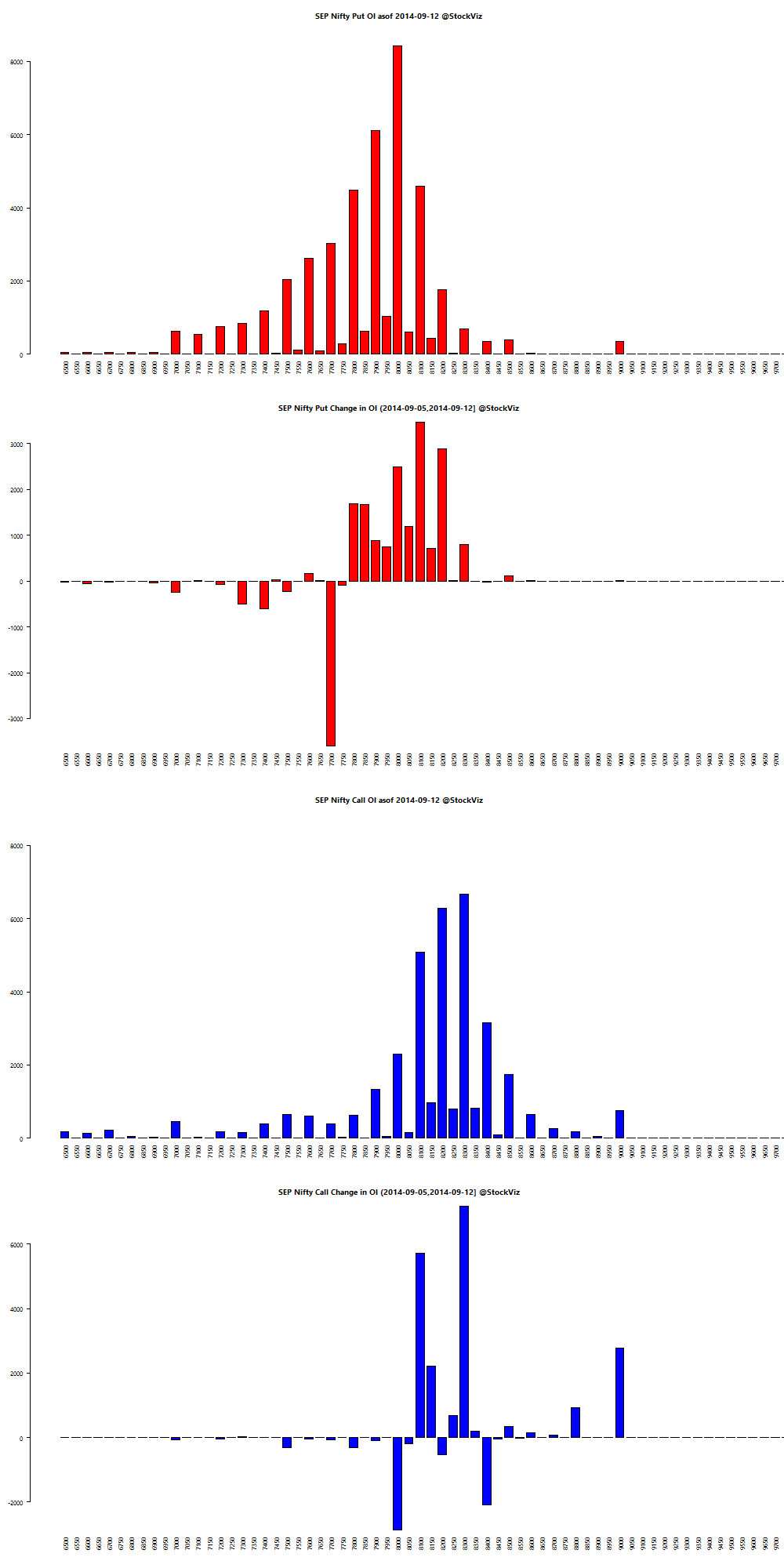

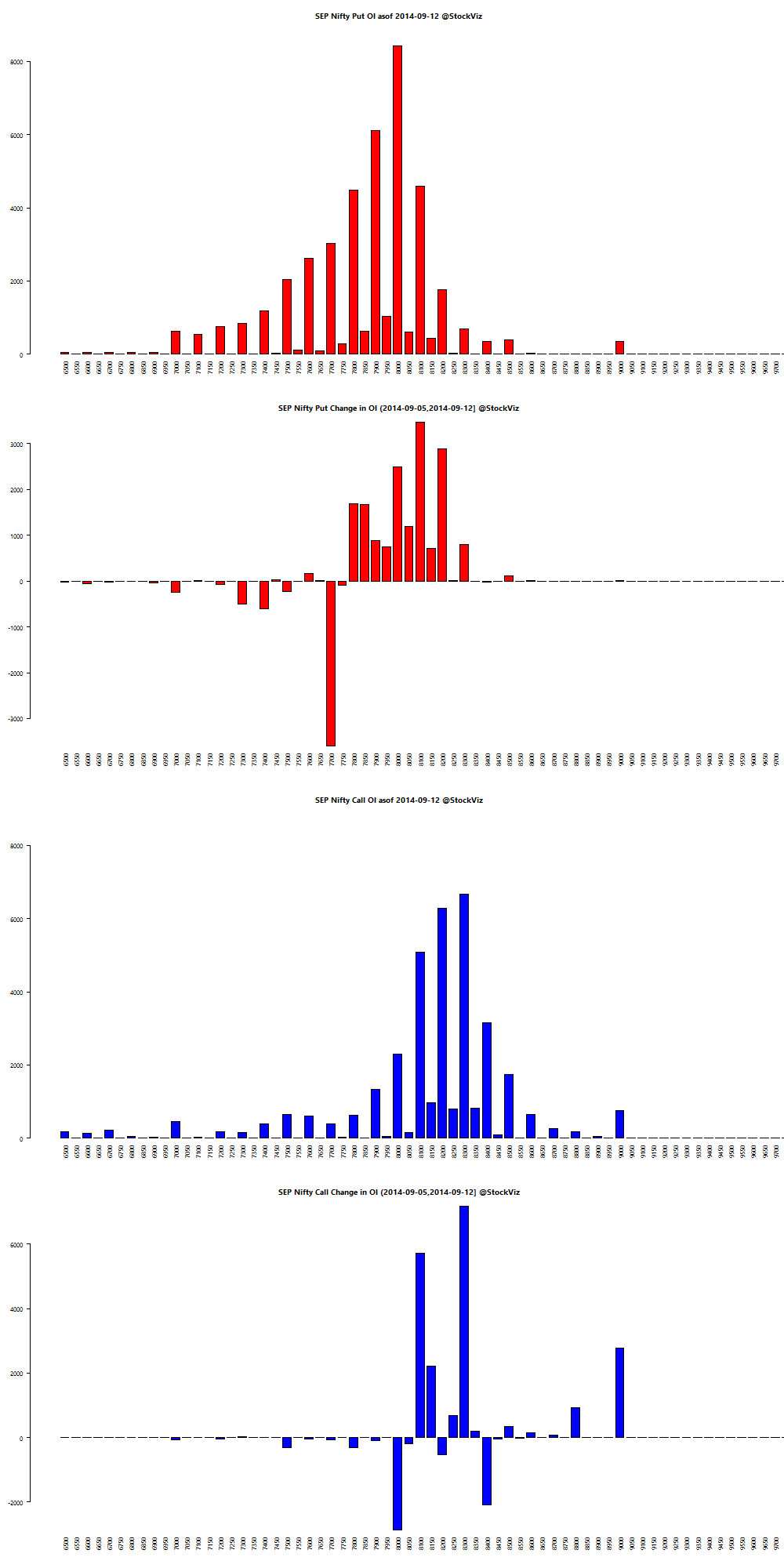

Nifty OI

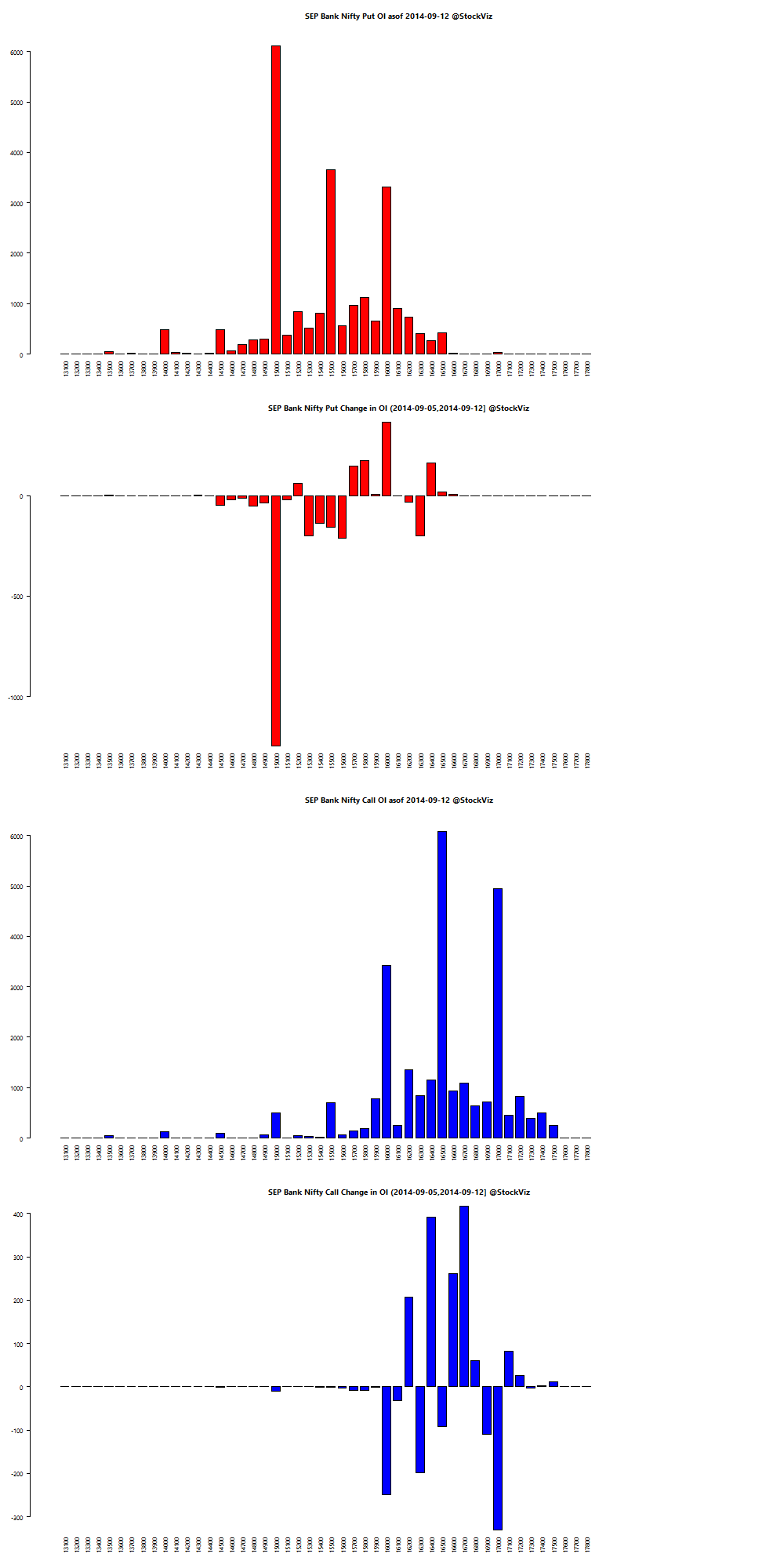

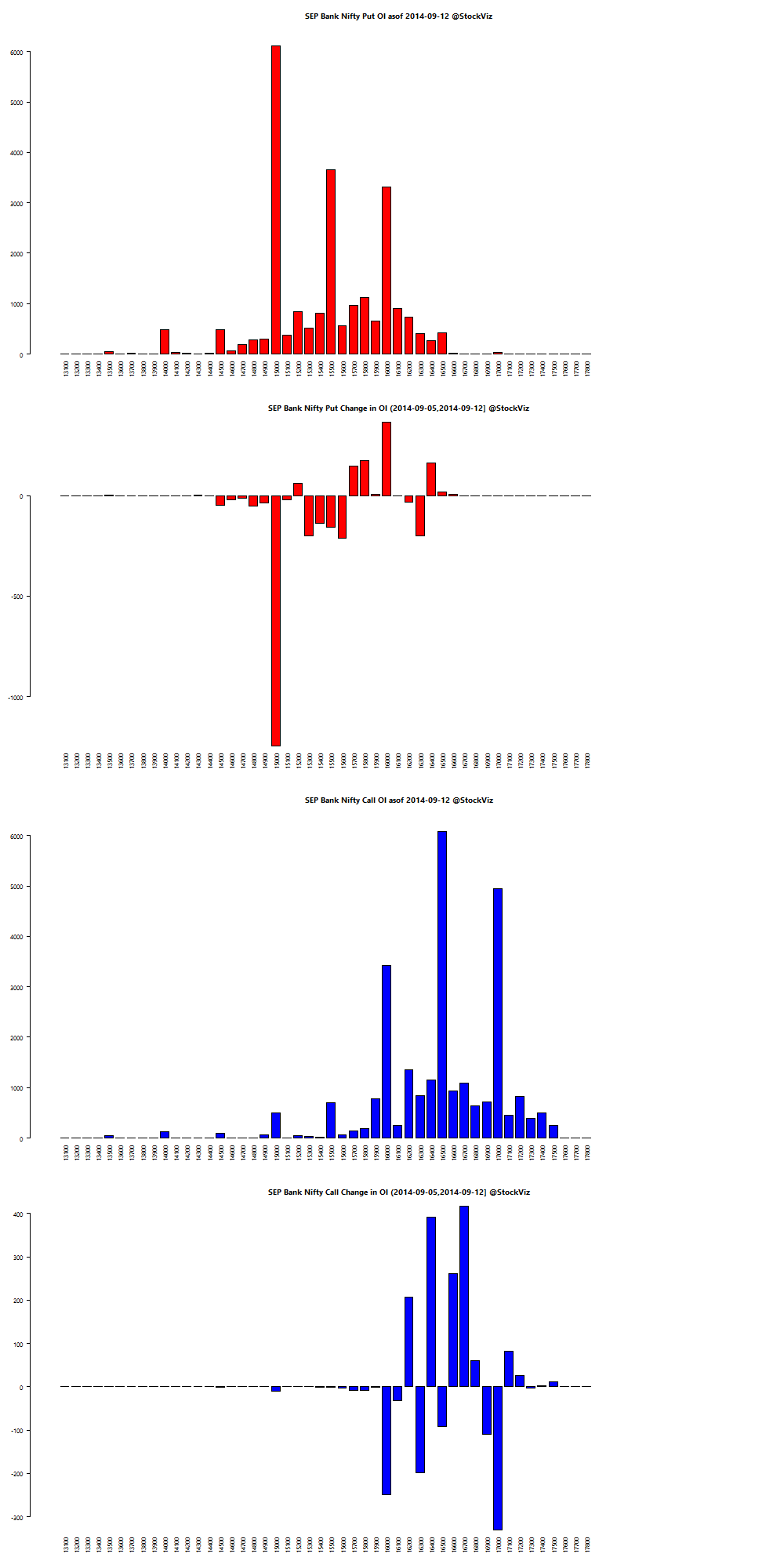

Bank Nifty OI

Theme Performance

Midcap value stocks shot ahead of the rest of the markets. We have three user contributed themes that are listed under ‘User Contributed Themes’

here.

Thought for the weekend

Sentiment data is inconclusive and sometimes contradictory. There is no signal within the noisy data. Besides, no one has the ability to consistently forecast any of the inevitable market corrections. Its probably best to ignore the short-term action and concentrate on being on the right side of the long-term trend.

Source: Buying Stocks Based on How Other People Feel