Equities

The Nifty ended the week +0.52% (+0.46% in USD terms.)

Commodities

| Energy |

| Brent Crude Oil |

+0.94% |

| Ethanol |

+1.57% |

| Heating Oil |

+0.86% |

| Natural Gas |

+6.38% |

| RBOB Gasoline |

-4.09% |

| WTI Crude Oil |

+2.51% |

| Metals |

| Copper |

-1.88% |

| Gold 100oz |

+0.61% |

| Palladium |

+2.14% |

| Platinum |

+0.23% |

| Silver 5000oz |

+0.00% |

| Agricultural |

| Cattle |

+2.84% |

| Cocoa |

-0.10% |

| Coffee (Arabica) |

+7.11% |

| Coffee (Robusta) |

+2.72% |

| Corn |

-1.91% |

| Cotton |

+0.58% |

| Feeder Cattle |

+1.24% |

| Lean Hogs |

+5.69% |

| Lumber |

-0.54% |

| Orange Juice |

+2.30% |

| Soybean Meal |

+1.62% |

| Soybeans |

-6.68% |

| Sugar #11 |

-0.96% |

| Wheat |

-0.27% |

| White Sugar |

-0.73% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.13% |

| Markit CDX NA HY |

-0.02% |

| Markit CDX NA IG |

-0.34% |

| Markit CDX NA IG HVOL |

-1.60% |

| Markit iTraxx Asia ex-Japan IG |

-1.81% |

| Markit iTraxx Australia |

-0.53% |

| Markit iTraxx Europe |

-2.39% |

| Markit iTraxx Europe Crossover |

-15.19% |

| Markit iTraxx Japan |

-1.89% |

| Markit iTraxx SovX Western Europe |

-1.60% |

| Markit LCDX (Loan CDS) |

+0.06% |

| Markit MCDX (Municipal CDS) |

-4.63% |

SPX crossed 2000 for the first time after the dot-com crash. Credit indices, especially that of Europe, ended mostly in the green. Its not pretty in Europe and QE might just be around the corner…

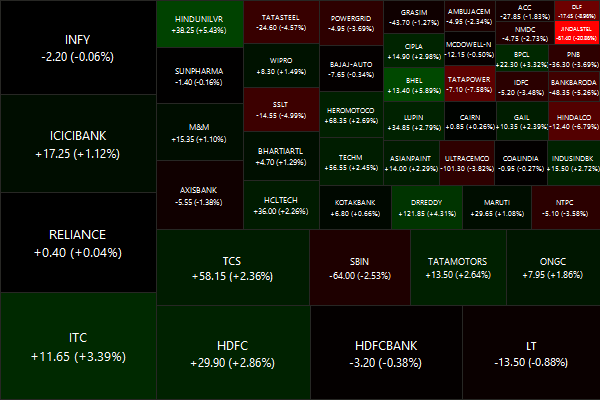

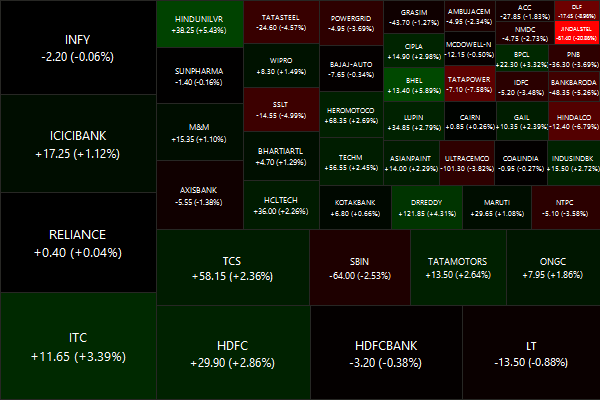

Nifty Heatmap

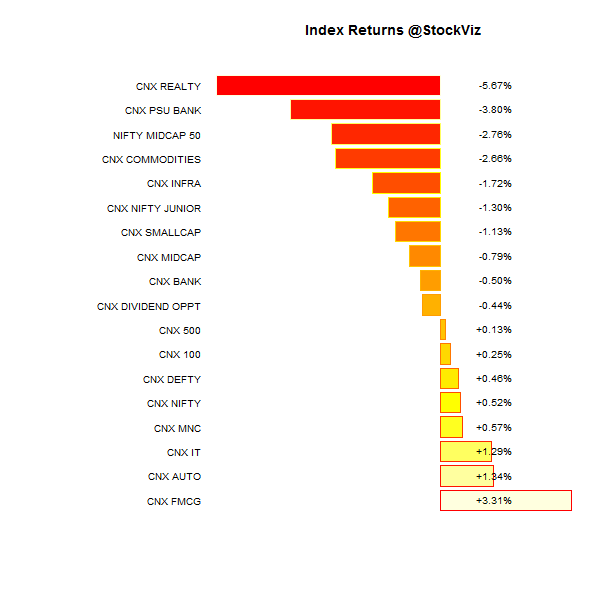

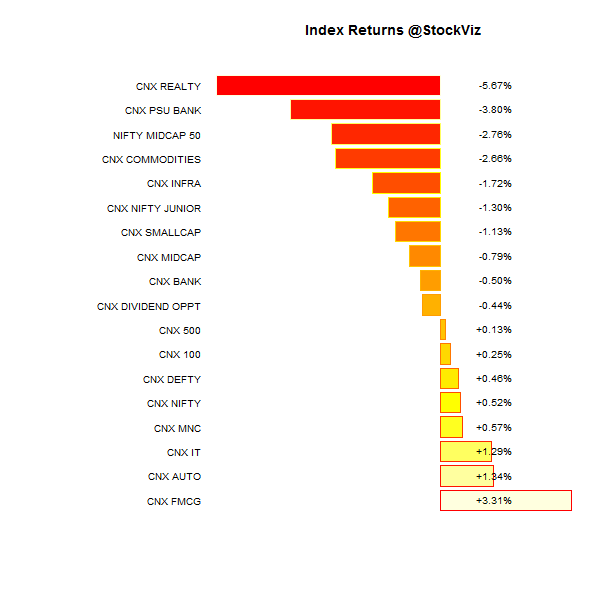

Index Returns

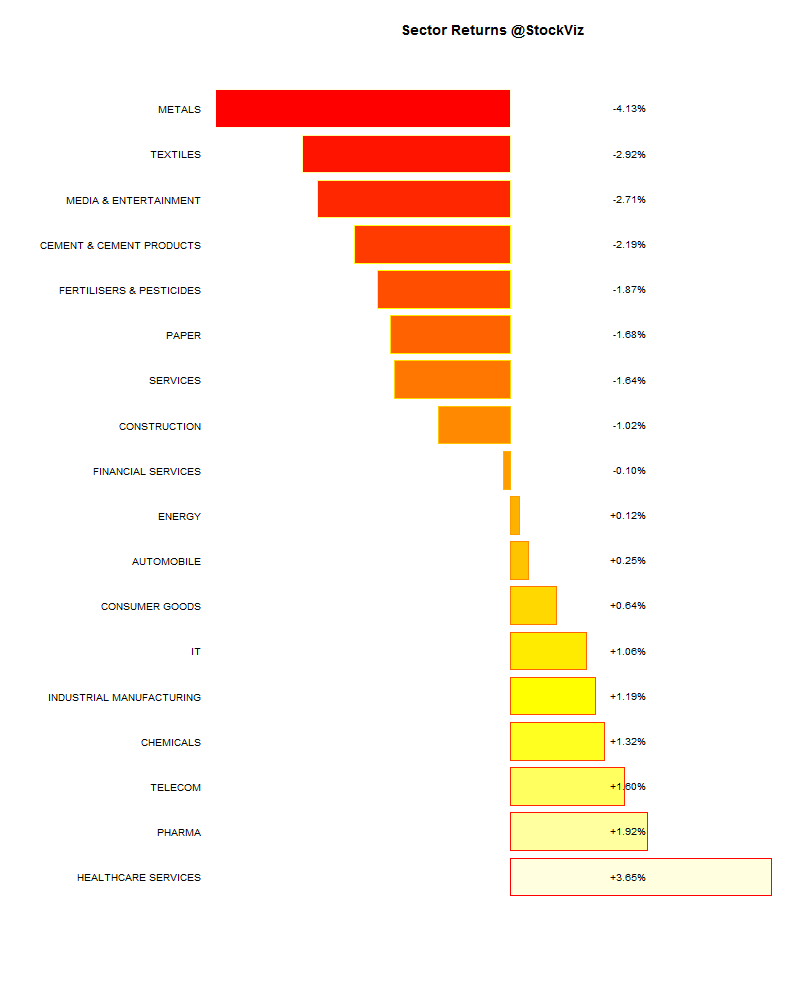

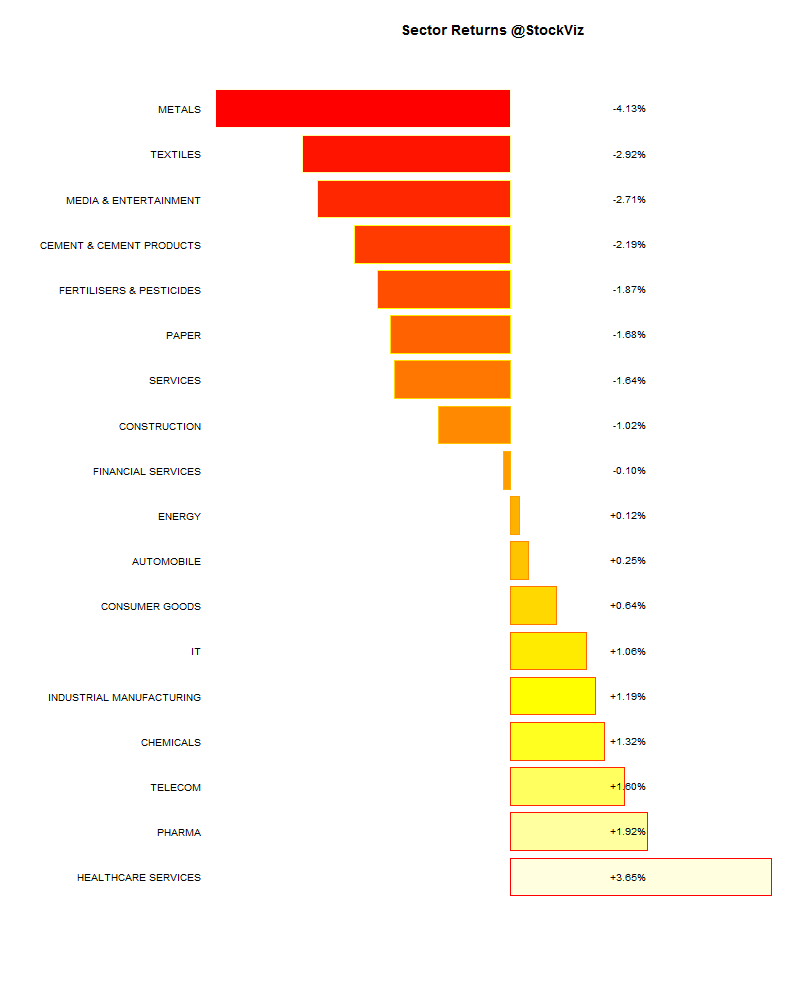

Sector Performance

Advance Decline

Market Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-7.31% |

69/70 |

| 2 |

-4.28% |

64/73 |

| 3 |

-0.70% |

65/73 |

| 4 |

-0.68% |

60/79 |

| 5 |

-0.67% |

75/63 |

| 6 |

-0.80% |

67/71 |

| 7 |

-0.85% |

69/70 |

| 8 |

-0.45% |

69/69 |

| 9 |

-1.05% |

68/70 |

| 10 (mega) |

+0.25% |

68/71 |

It was the large caps that held the market up. Small and mid-cap consolidation continued…

Top winners and losers

All eyes and ears on the Supreme Court’s decision on the coal scam on Monday. Will they de-allocate and order a fresh bidding? Will they take a more pragmatic approach?

ETFs

PSU banks – the biggest drain on Indian productivity?

Investment theme performance

High beta got pummeled due to its banks and real estate exposure. Momentum ended flat.

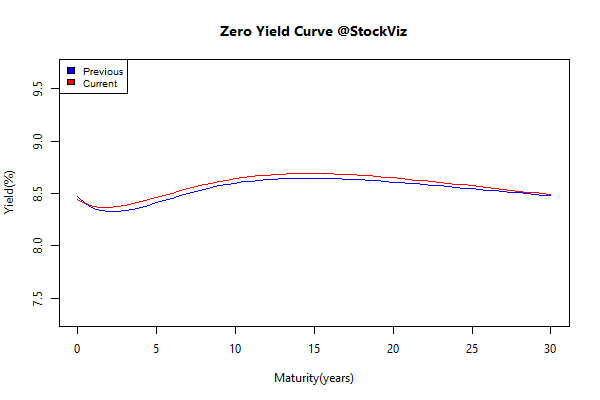

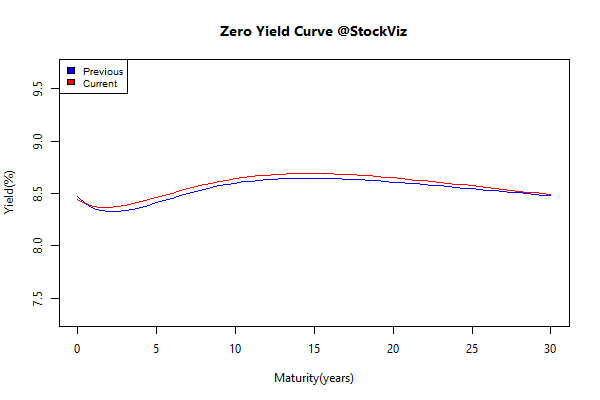

Yield Curve

Bond indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.07 |

+0.12% |

| GSEC SUB 1-3 |

+0.07 |

+0.15% |

| GSEC SUB 3-8 |

-0.15 |

+0.69% |

| GSEC SUB 8 |

-0.11 |

+0.95% |

Long bond yields continued to compress. If India’s credit rating doesn’t get revised higher, will we see a snap-back?

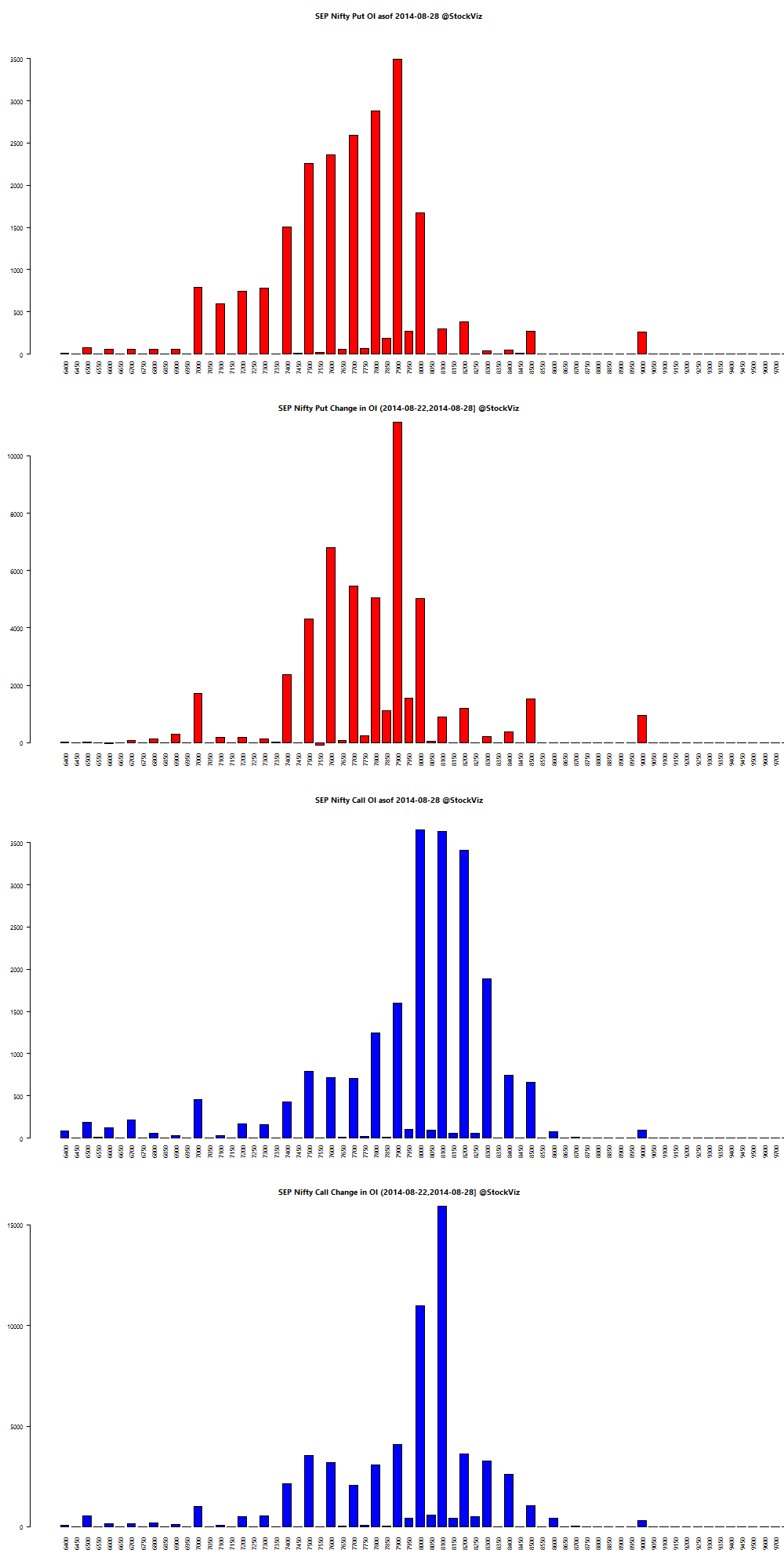

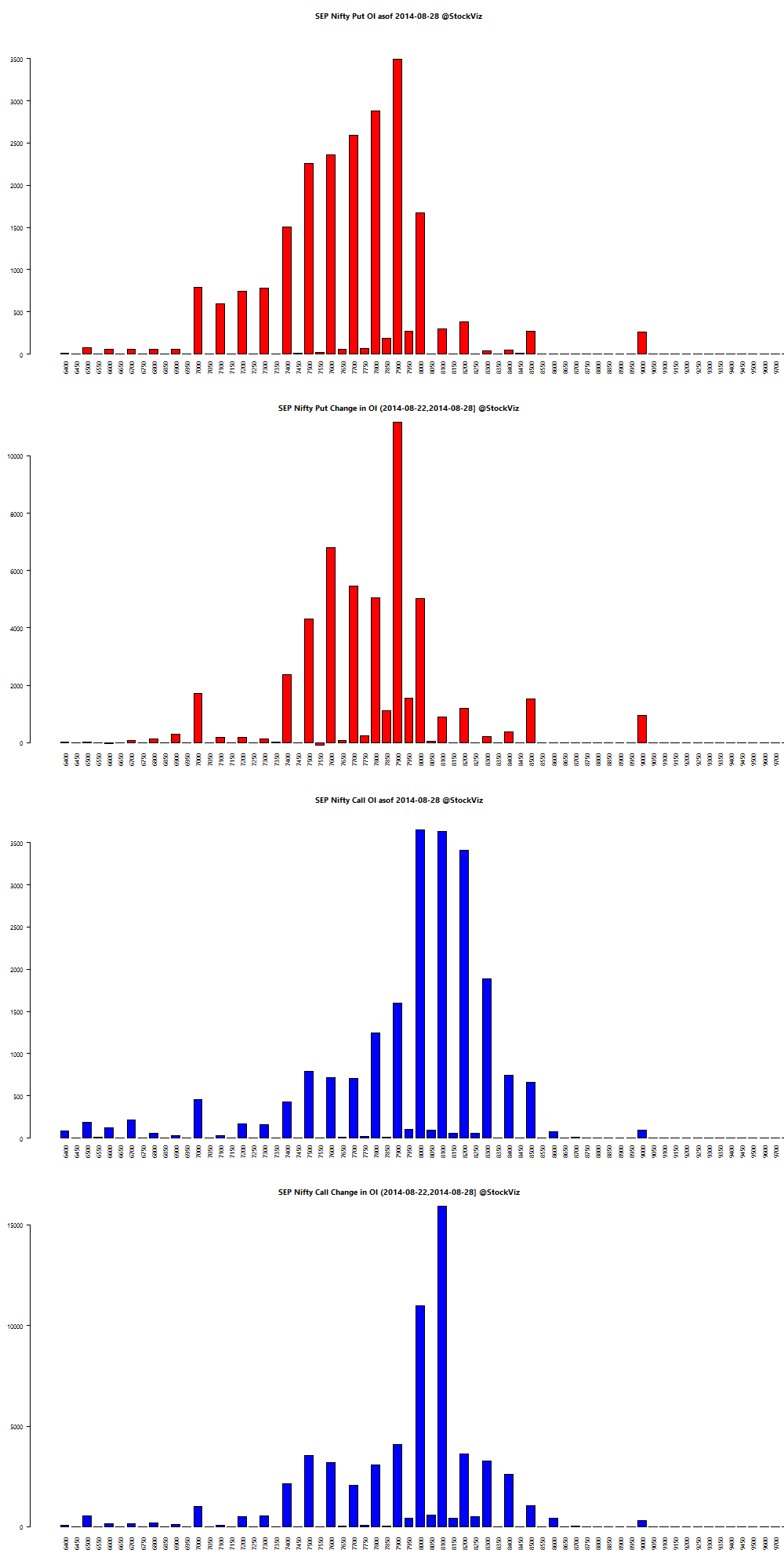

September Nifty OI

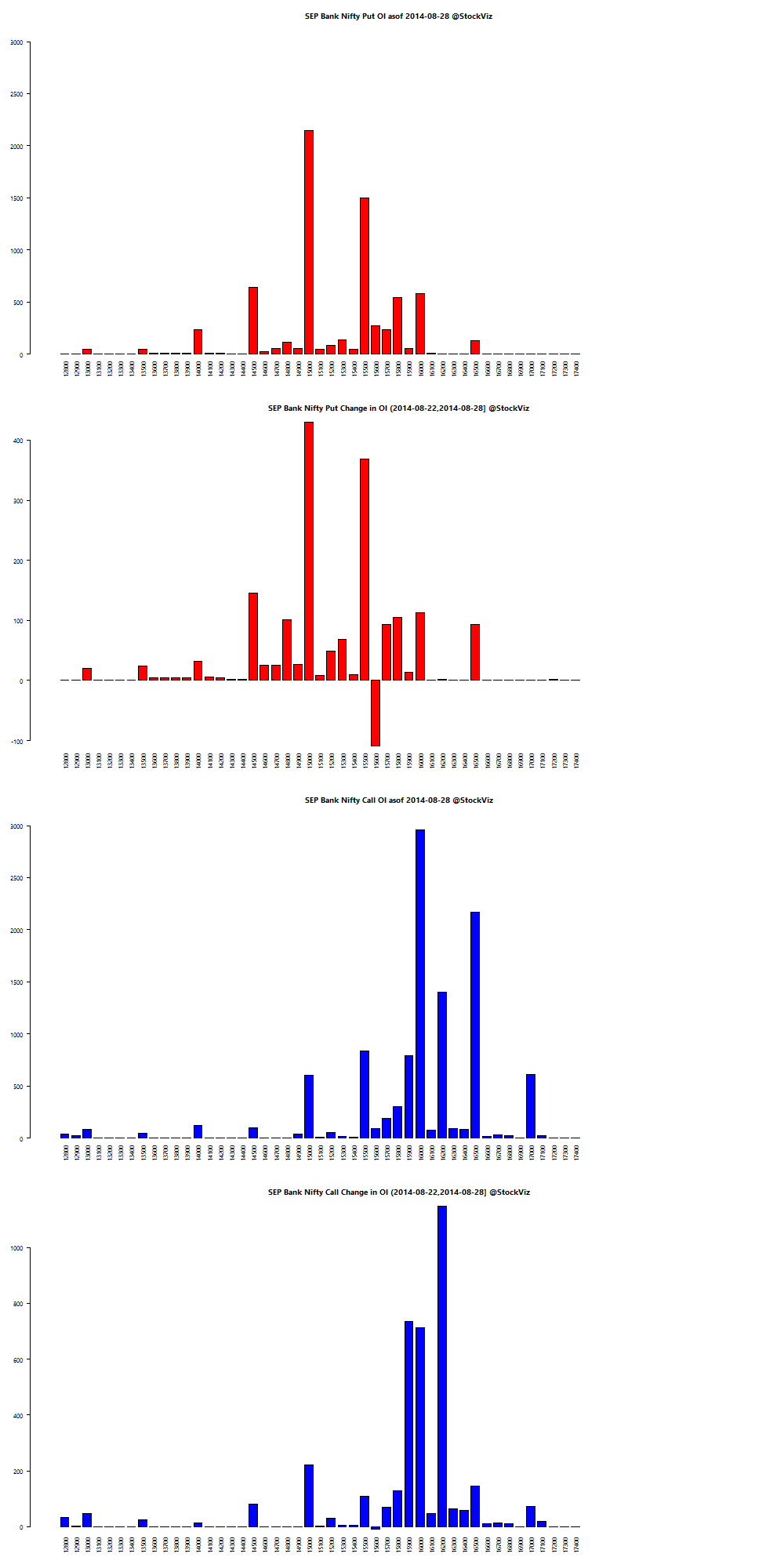

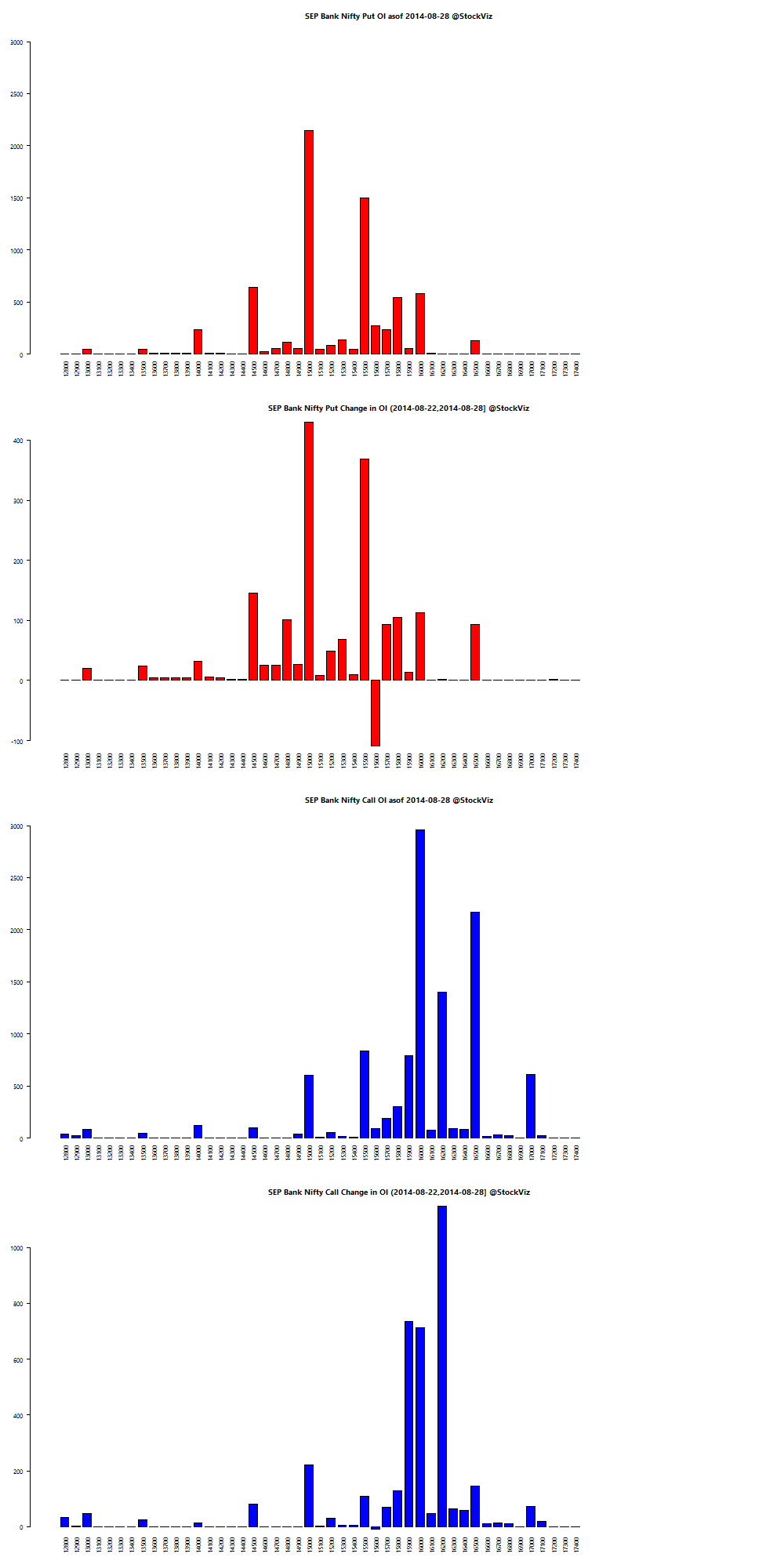

September BankNifty OI

Thought for the weekend

New research throws doubt on the classical idea that people are driven by relentless and consistent pursuit of self-interest to maximise their well-being. Nobel laureate Daniel McFadden: “We are in fact challenged by choice and we use all kinds of ways such as procrastination to avoid having to make choices. One of the reasons is that there are risks associated with making choices.”

The hedonic treadmill we are on can be characterised as not the pursuit happiness but the happiness of pursuit. That’s what that people really care about.

Source: Understanding better how people really make choices