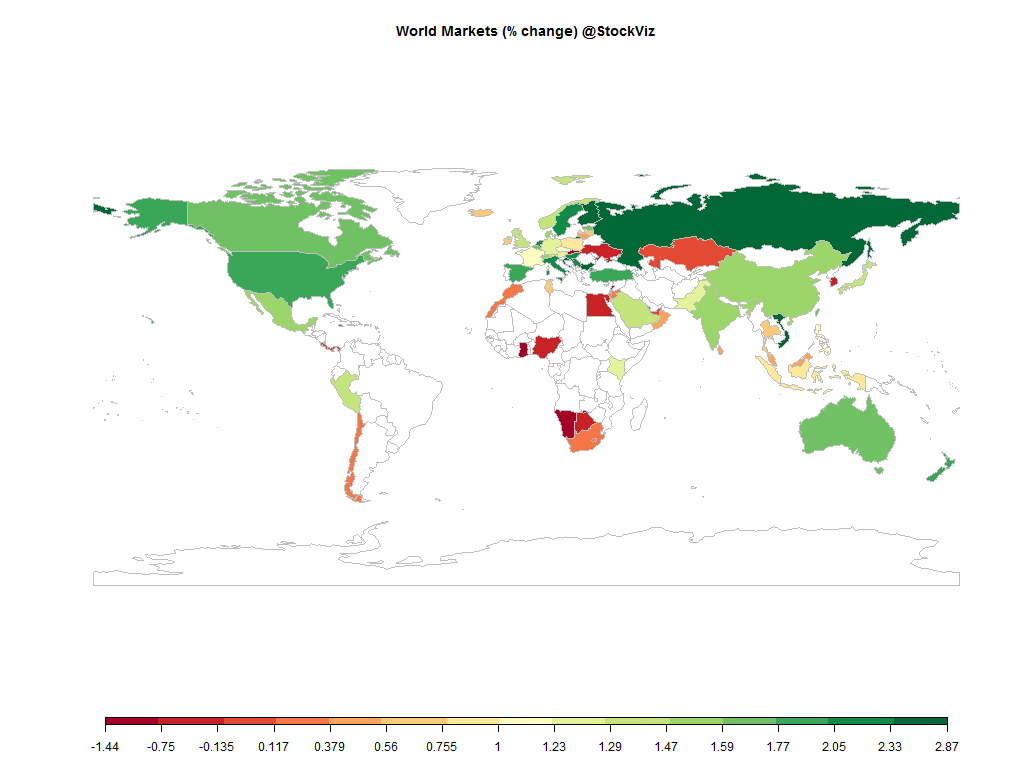

Equities

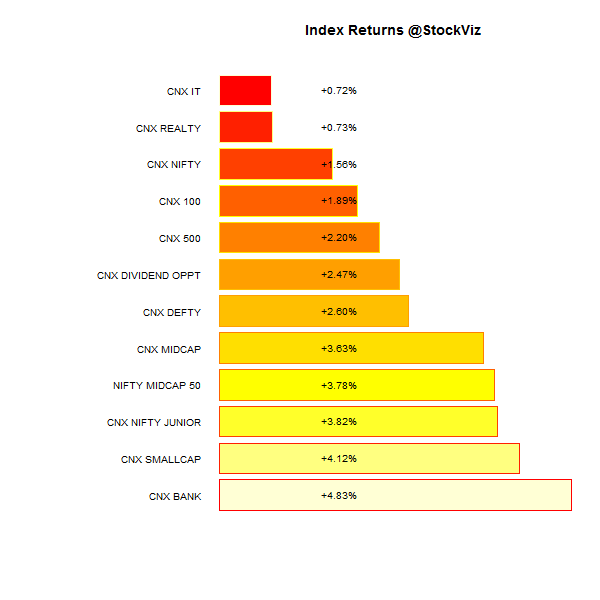

The Nifty ended the week +1.56% (+2.60% in USD terms.)

Commodities

| Energy |

| Brent Crude Oil |

+0.25% |

| Ethanol |

-0.74% |

| Heating Oil |

+0.36% |

| Natural Gas |

-1.71% |

| RBOB Gasoline |

+2.71% |

| WTI Crude Oil |

-2.23% |

| Metals |

| Copper |

+3.90% |

| Gold 100oz |

-2.44% |

| Palladium |

+0.54% |

| Platinum |

-3.10% |

| Silver 5000oz |

-2.02% |

| Agricultural |

| Cattle |

+1.57% |

| Cocoa |

-0.77% |

| Coffee (Arabica) |

-1.41% |

| Coffee (Robusta) |

+2.16% |

| Corn |

+0.62% |

| Cotton |

+5.75% |

| Feeder Cattle |

+0.71% |

| Lean Hogs |

-18.68% |

| Lumber |

+2.62% |

| Orange Juice |

-2.15% |

| Soybean Meal |

-3.84% |

| Soybeans |

-8.63% |

| Sugar #11 |

-2.01% |

| Wheat |

+2.38% |

| White Sugar |

-1.00% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.16% |

| Markit CDX NA HY |

+0.31% |

| Markit CDX NA IG |

-2.67% |

| Markit CDX NA IG HVOL |

-5.81% |

| Markit iTraxx Asia ex-Japan IG |

-3.49% |

| Markit iTraxx Australia |

-2.86% |

| Markit iTraxx Europe |

-5.03% |

| Markit iTraxx Europe Crossover |

-19.04% |

| Markit iTraxx Japan |

-2.98% |

| Markit iTraxx SovX Western Europe |

-3.37% |

| Markit LCDX (Loan CDS) |

+0.06% |

| Markit MCDX (Municipal CDS) |

-2.40% |

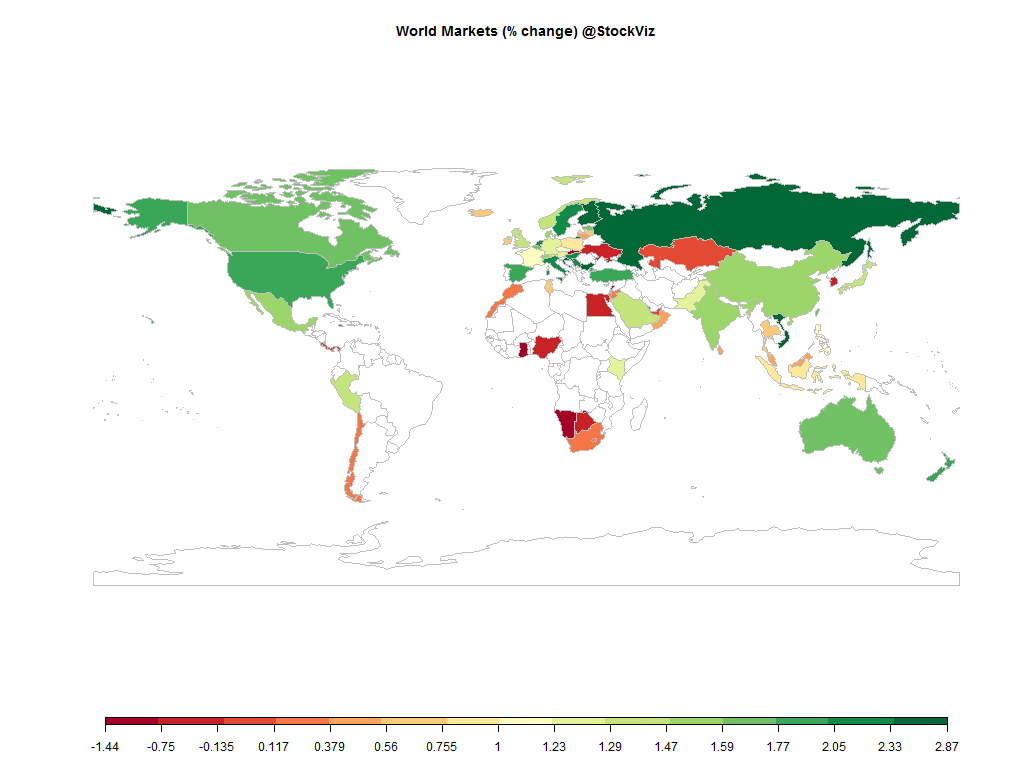

It was a good week for the markets. Both equities and credit did well. Longs ended strong!

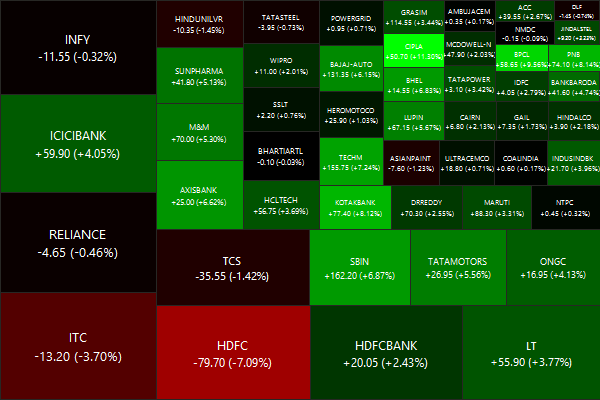

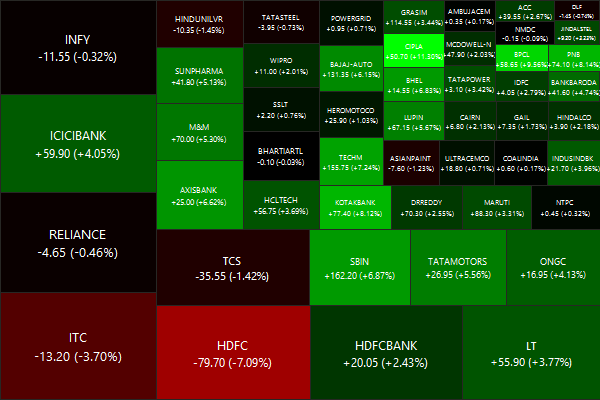

Nifty Heatmap

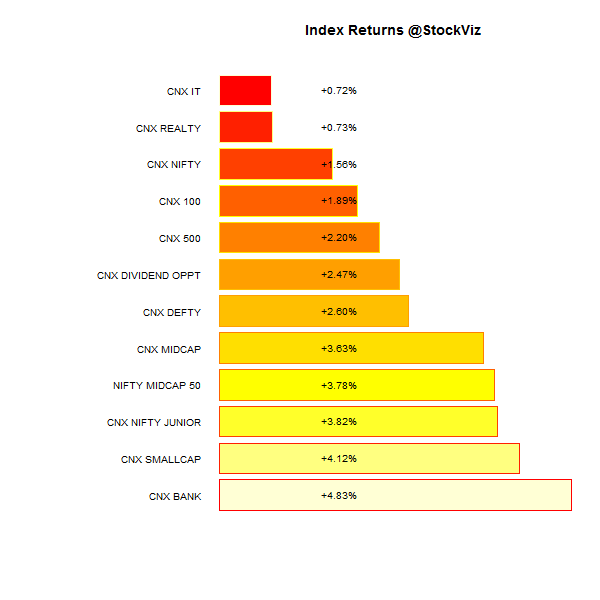

Index Returns

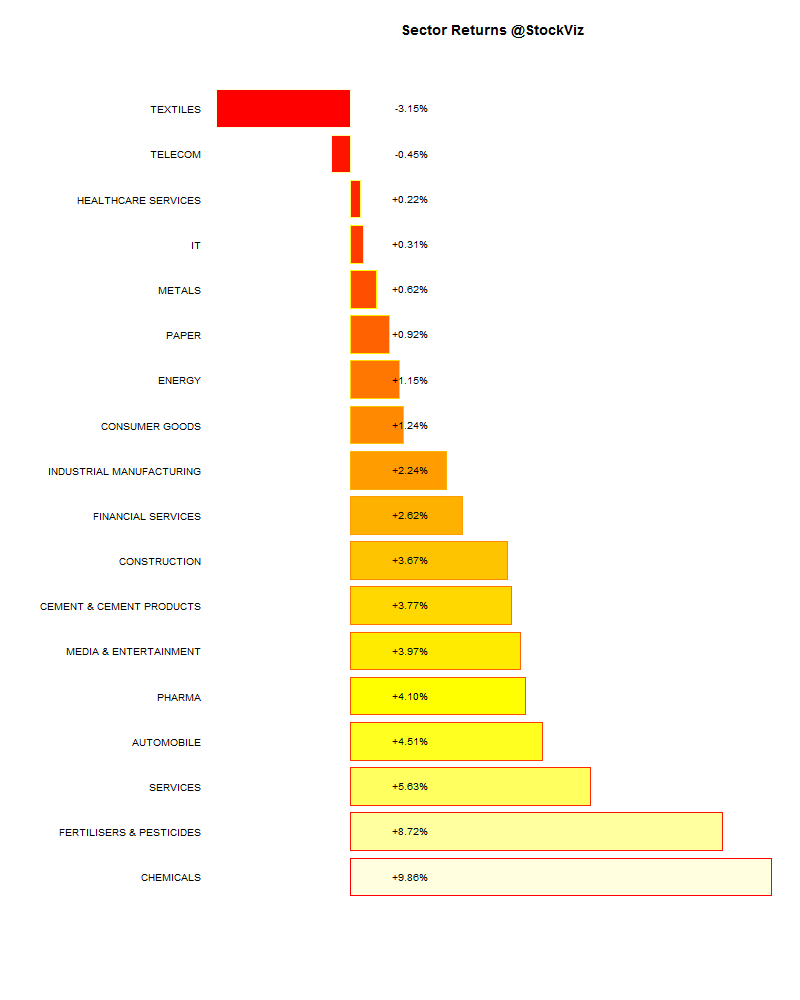

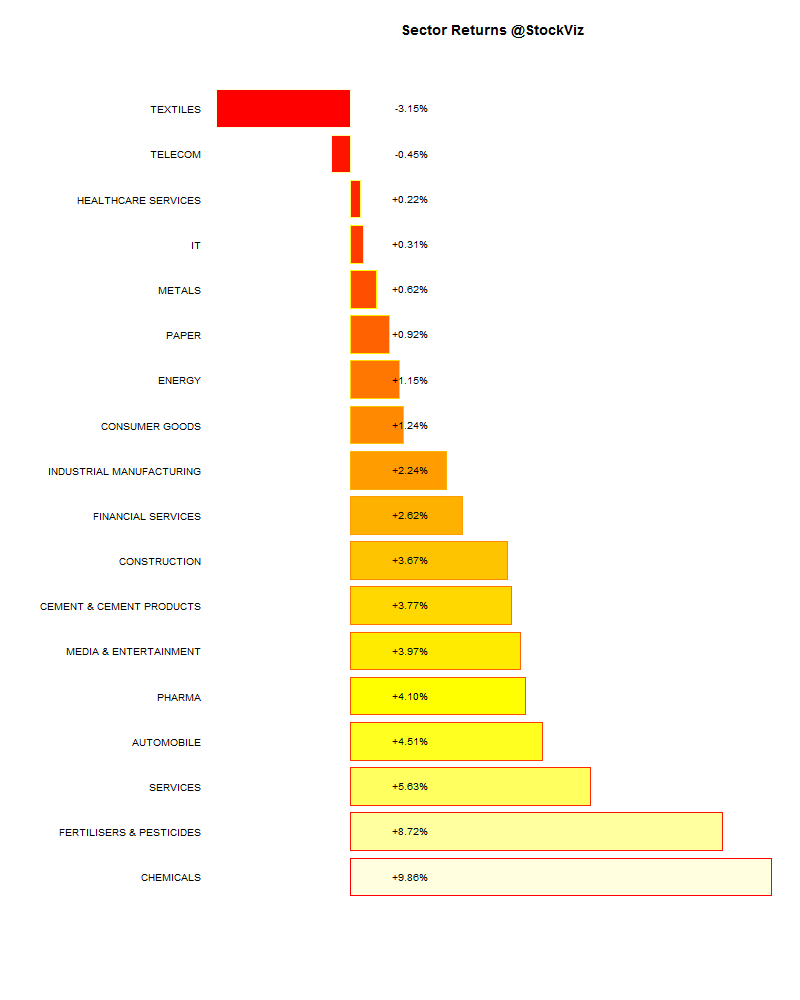

Sector Performance

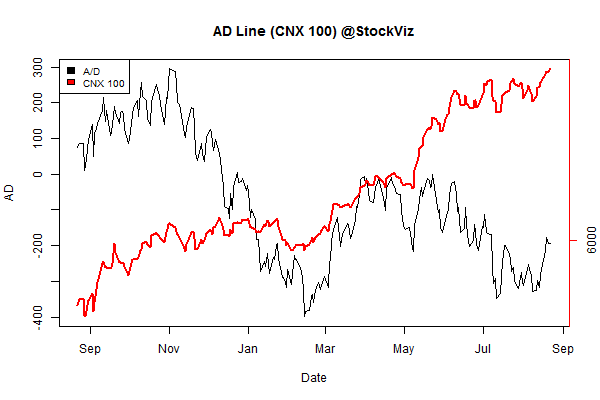

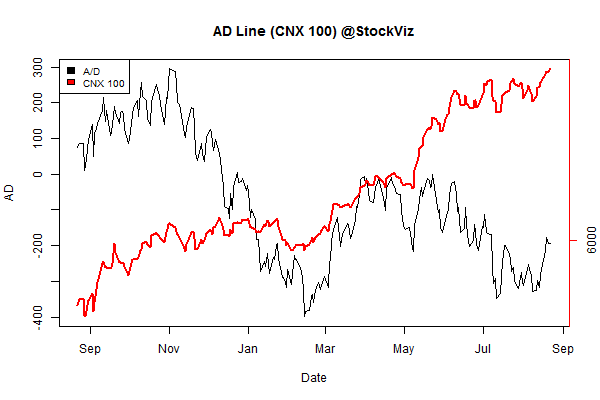

Advance Decline

Market cap decile performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 |

+2.25% |

69/66 |

| 2 |

+6.22% |

78/57 |

| 3 |

+4.32% |

77/56 |

| 4 |

+5.44% |

79/57 |

| 5 |

+6.02% |

77/57 |

| 6 |

+5.75% |

77/58 |

| 7 |

+4.54% |

74/61 |

| 8 |

+4.98% |

73/61 |

| 9 |

+3.68% |

77/58 |

| 10 |

+1.97% |

69/66 |

An across the board rally is quite a sight!

Top Winners and Losers

Banks and pharma did well this week…

ETFs

PSU Banks finally put in an up week…

Investment Theme Performance

All strategies in the green. Confirms what the market decile performance scan showed…

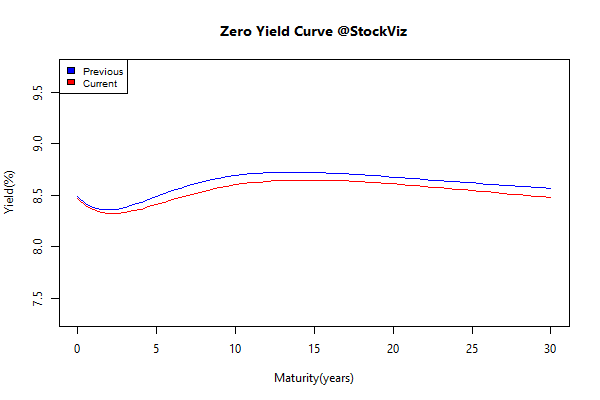

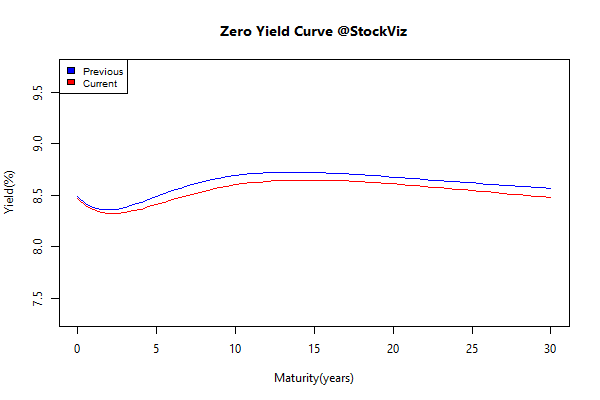

Yield curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.05 |

+0.20% |

| GSEC SUB 1-3 |

-0.14 |

-0.01% |

| GSEC SUB 3-8 |

-0.05 |

+0.20% |

| GSEC SUB 8 |

-0.03 |

-0.27% |

This is interesting: Franklin Templeton bought a record Rs 16,000-crore government securities in a day. (

ET)

August Nifty OI

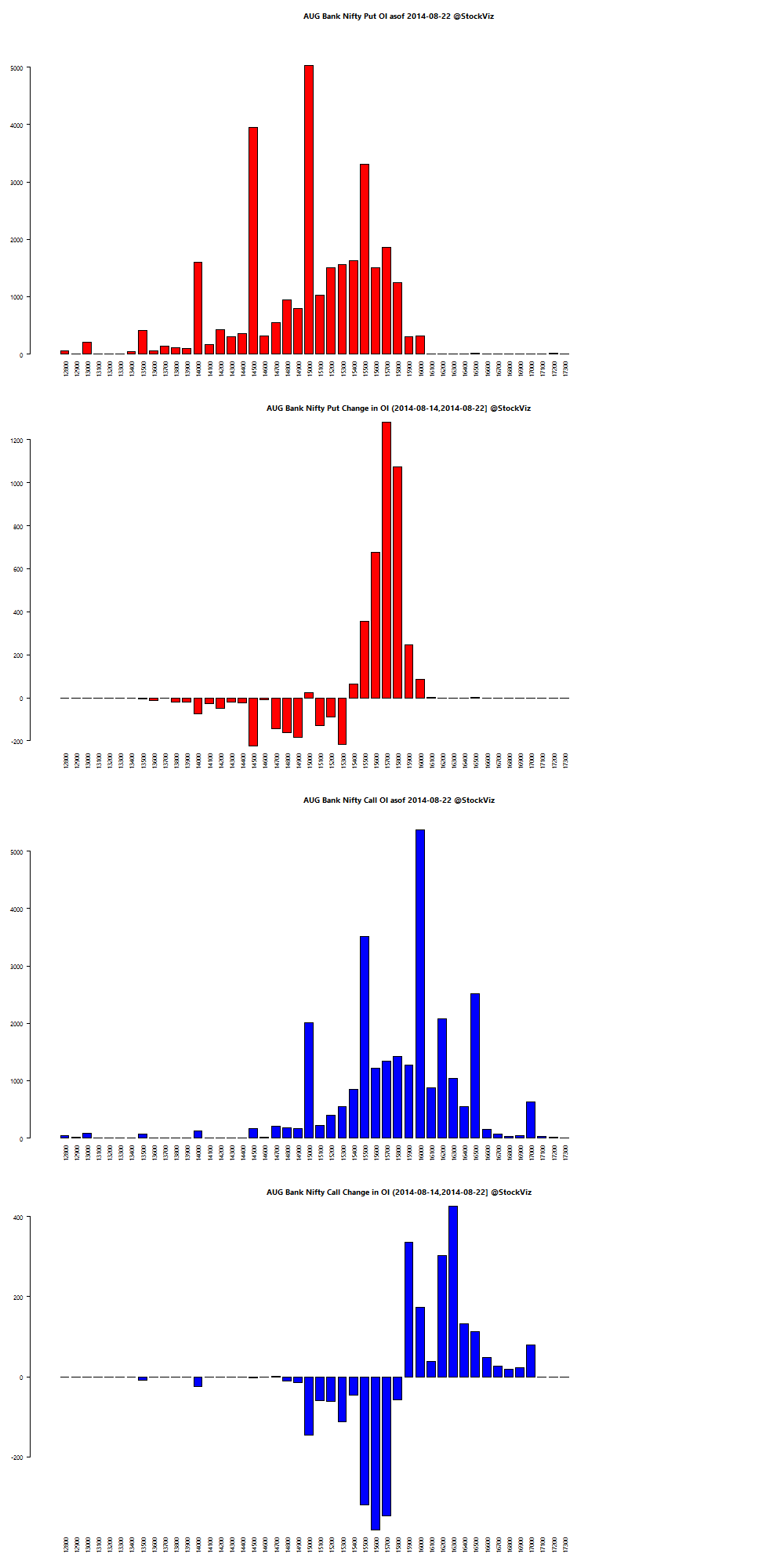

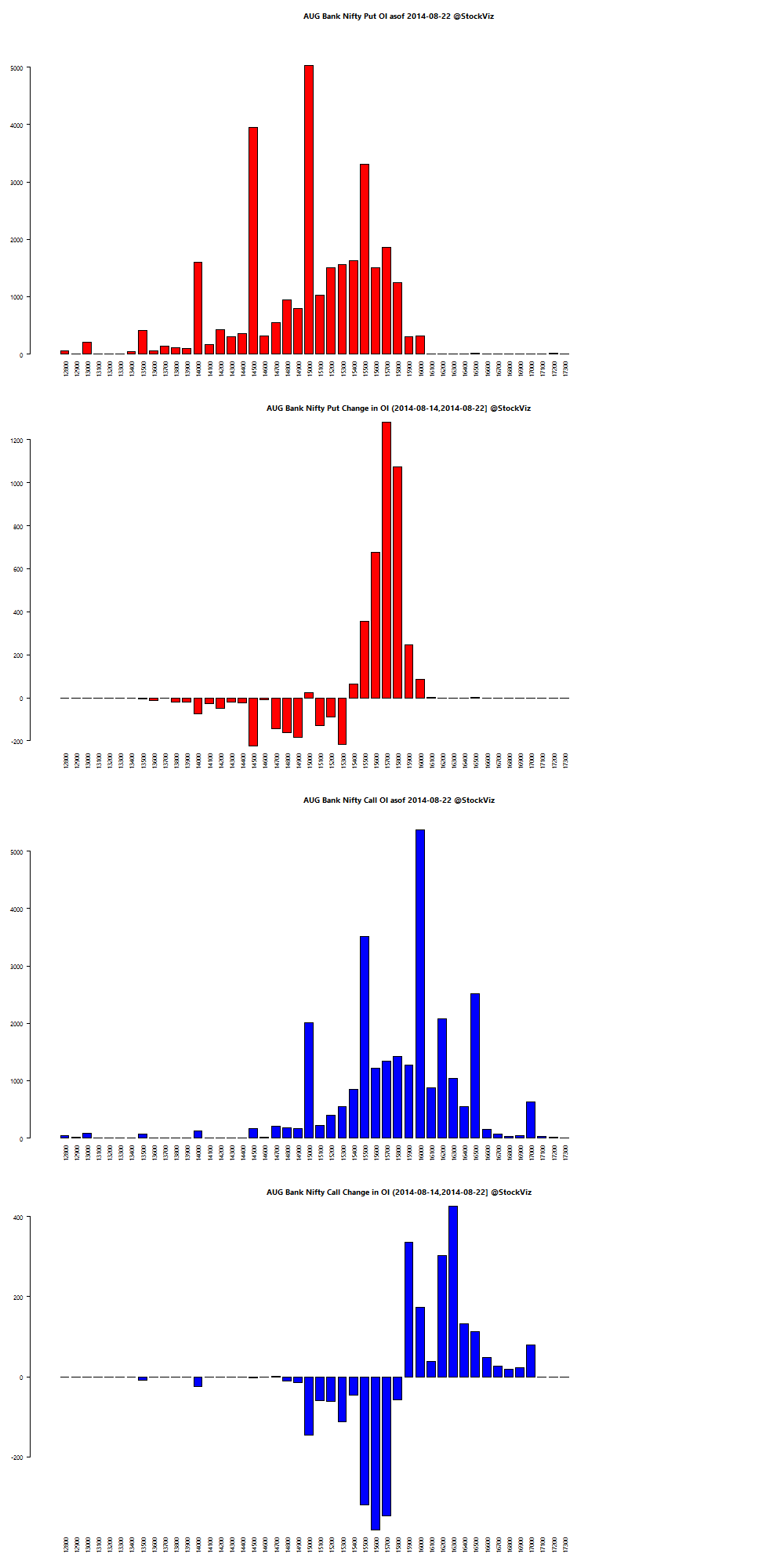

August BankNifty OI

Thought for the weekend

E-commerce operations aren’t as cheap to run as most people think. Their economics greatly resemble those of mail order catalogs and they aren’t all favorable. E-commerce companies ship to customers from large, expensive, highly productive fulfillment centers. A state-of-the-art center can cost $250 million or more to build, or about 10 times as much as a big box store. And competition is growing while growth is slowing.

Source: Online Shopping Isn’t as Profitable as You Think (HBR)