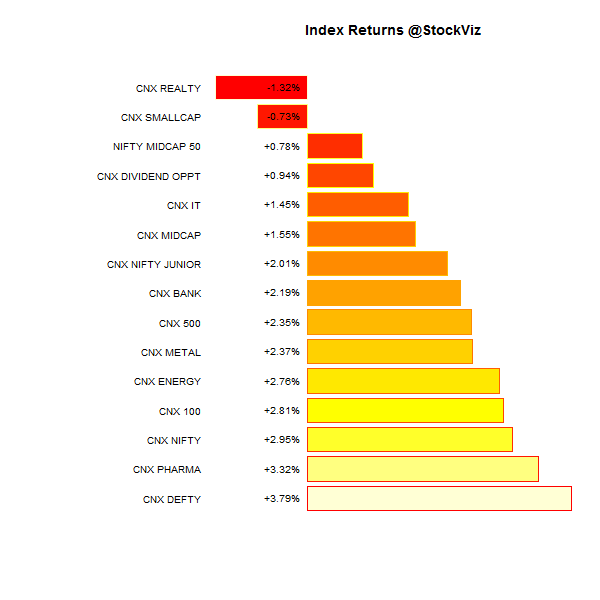

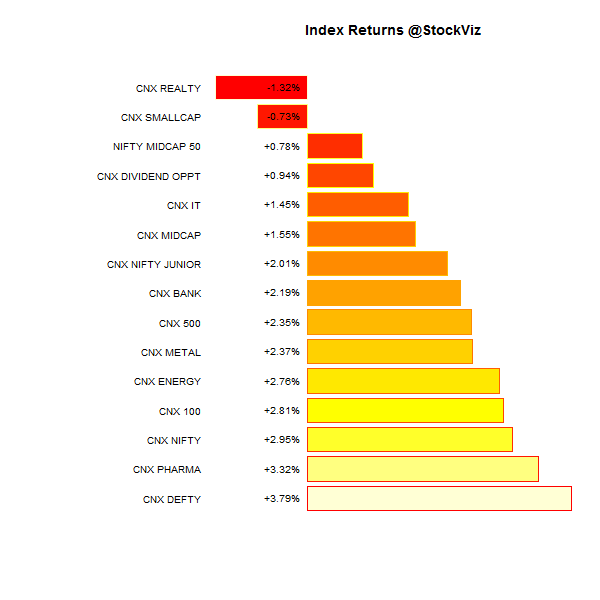

The Nifty ended the week +2.95% (+3.79% in USD terms.)

Equities

Commodities

| Energy |

| Brent Crude Oil |

-1.13% |

| Ethanol |

+6.41% |

| Heating Oil |

-0.97% |

| Natural Gas |

-4.59% |

| RBOB Gasoline |

-1.68% |

| WTI Crude Oil |

-0.31% |

| Metals |

| Copper |

-2.21% |

| Gold 100oz |

-0.35% |

| Palladium |

+3.60% |

| Platinum |

-1.31% |

| Silver 5000oz |

-2.01% |

| Agricultural |

| Cattle |

-1.08% |

| Cocoa |

+2.47% |

| Coffee (Arabica) |

+4.01% |

| Coffee (Robusta) |

+0.10% |

| Corn |

+3.91% |

| Cotton |

-0.81% |

| Feeder Cattle |

+1.05% |

| Lean Hogs |

-16.80% |

| Lumber |

+0.03% |

| Orange Juice |

+4.40% |

| Soybean Meal |

-2.39% |

| Soybeans |

-14.24% |

| Sugar #11 |

-1.30% |

| Wheat |

+0.82% |

| White Sugar |

-0.65% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.62% |

| Markit CDX NA HY |

+0.94% |

| Markit CDX NA IG |

-4.44% |

| Markit CDX NA IG HVOL |

-4.23% |

| Markit iTraxx Asia ex-Japan IG |

-5.10% |

| Markit iTraxx Australia |

-1.06% |

| Markit iTraxx Europe |

-3.07% |

| Markit iTraxx Europe Crossover |

-11.24% |

| Markit iTraxx Japan |

+1.25% |

| Markit iTraxx SovX Western Europe |

-1.44% |

| Markit LCDX (Loan CDS) |

-0.06% |

| Markit MCDX (Municipal CDS) |

-2.73% |

It was definitely a “risk on” week that saw credit spreads narrow and almost all equity markets end in the green. However, Friday saw the US markets give up most of their gains on the news that Ukraine destroyed Russian military vehicles crossing border (Russia denied the report.) Something that the markets will be fixated on when they open on Monday.

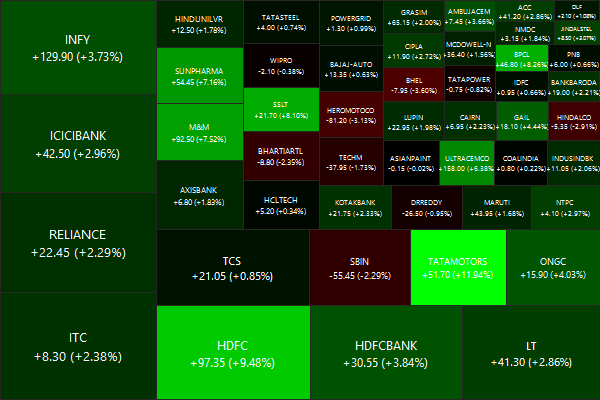

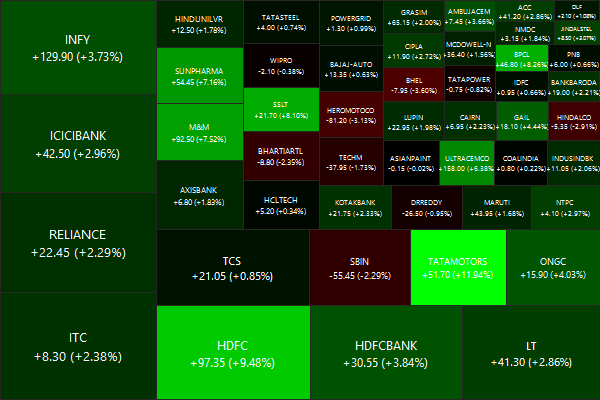

Nifty Heatmap

Index Returns

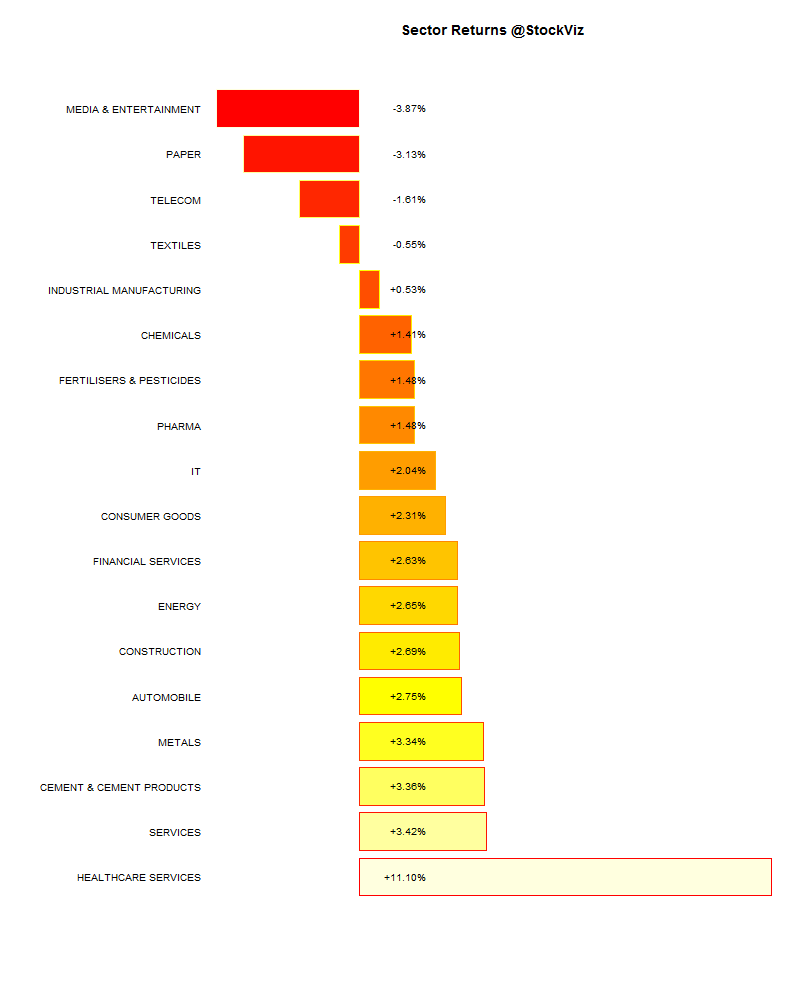

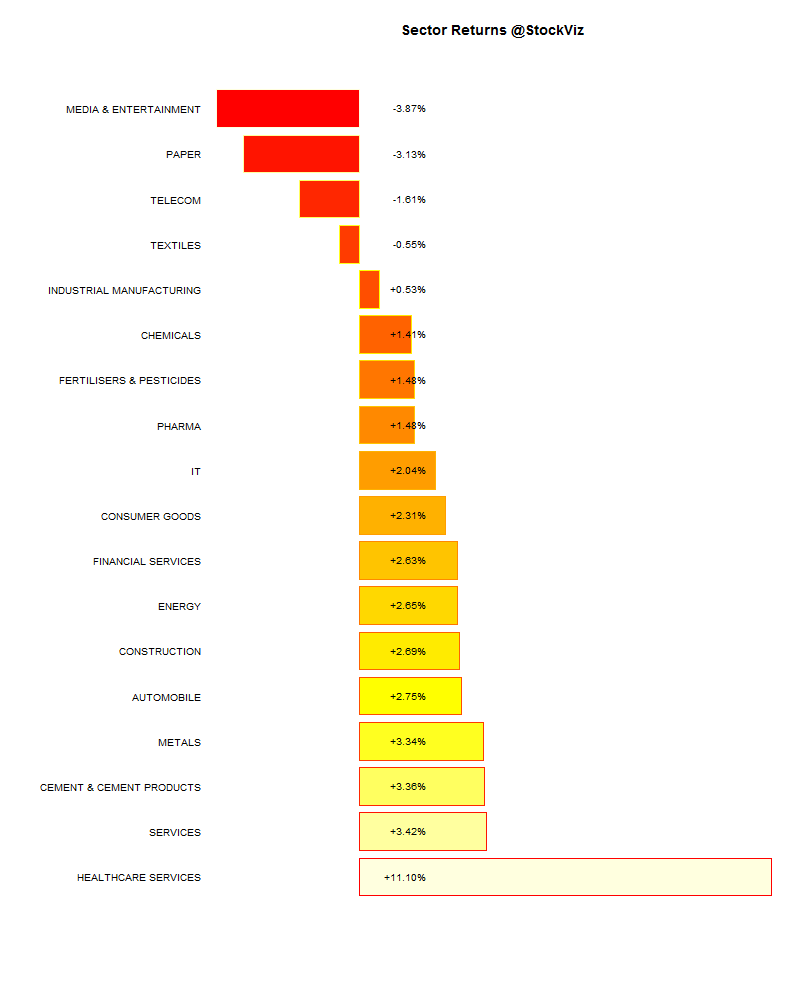

Sector Performance

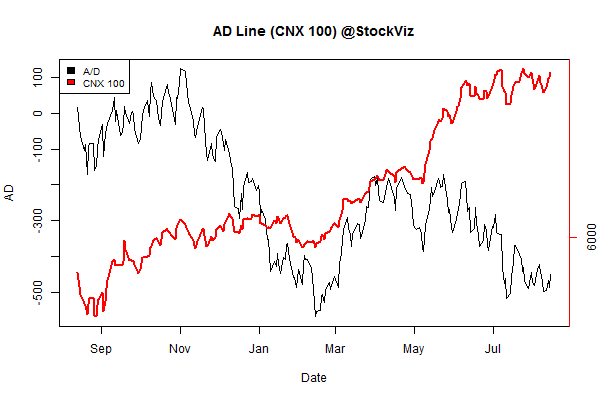

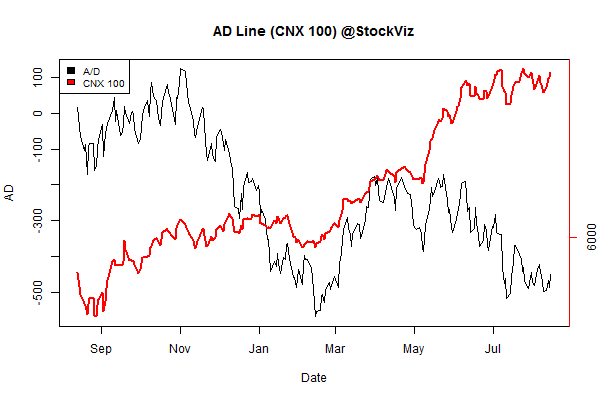

Advance Decline

Market cap decile performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (small) |

-4.44% |

73/61 |

| 2 |

-4.14% |

60/74 |

| 3 |

+0.07% |

64/69 |

| 4 |

-0.04% |

65/69 |

| 5 |

+0.03% |

64/68 |

| 6 |

-0.93% |

63/72 |

| 7 |

-0.34% |

68/65 |

| 8 |

+0.13% |

66/67 |

| 9 |

+0.67% |

65/69 |

| 10 (mega) |

+2.85% |

65/69 |

Large caps out-performance continued.

Top winners and losers

Tata Motors’ strategy of driving JLR mid/down market is working for now…

ETFs

PSU banks – when will the tide turn for them?

Investment Theme Performance

Flat, range-bound, large-cap market hasn’t been kind to investment strategies overweight midcaps…

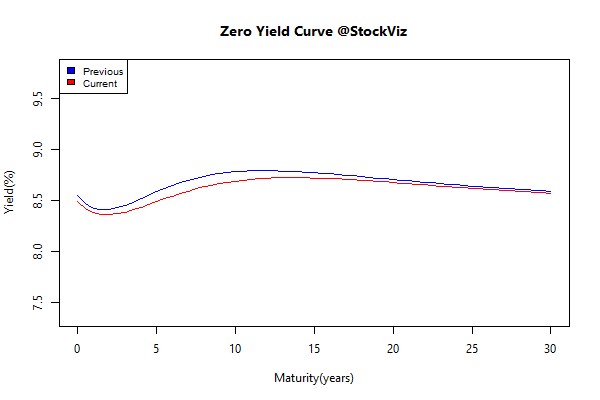

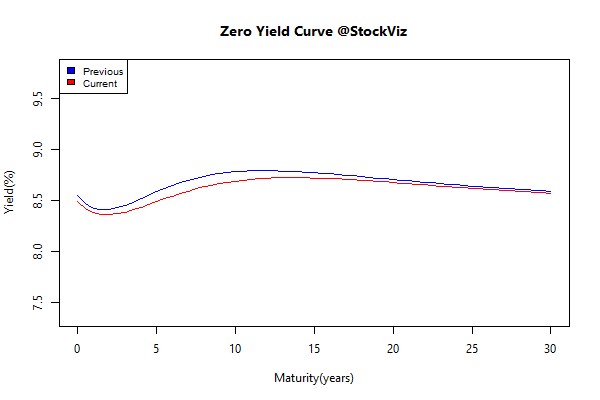

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.21 |

+0.08% |

| GSEC SUB 1-3 |

-0.02 |

+0.32% |

| GSEC SUB 3-8 |

-0.29 |

+1.44% |

| GSEC SUB 8 |

-0.27 |

+1.95% |

The curve’s inversion continued to steepen. Long bond yields continued to compress. With Rajan ruling out rate cuts anytime soon, is the bond market warning us of a slowdown in growth or is it projecting lower long-term inflation?

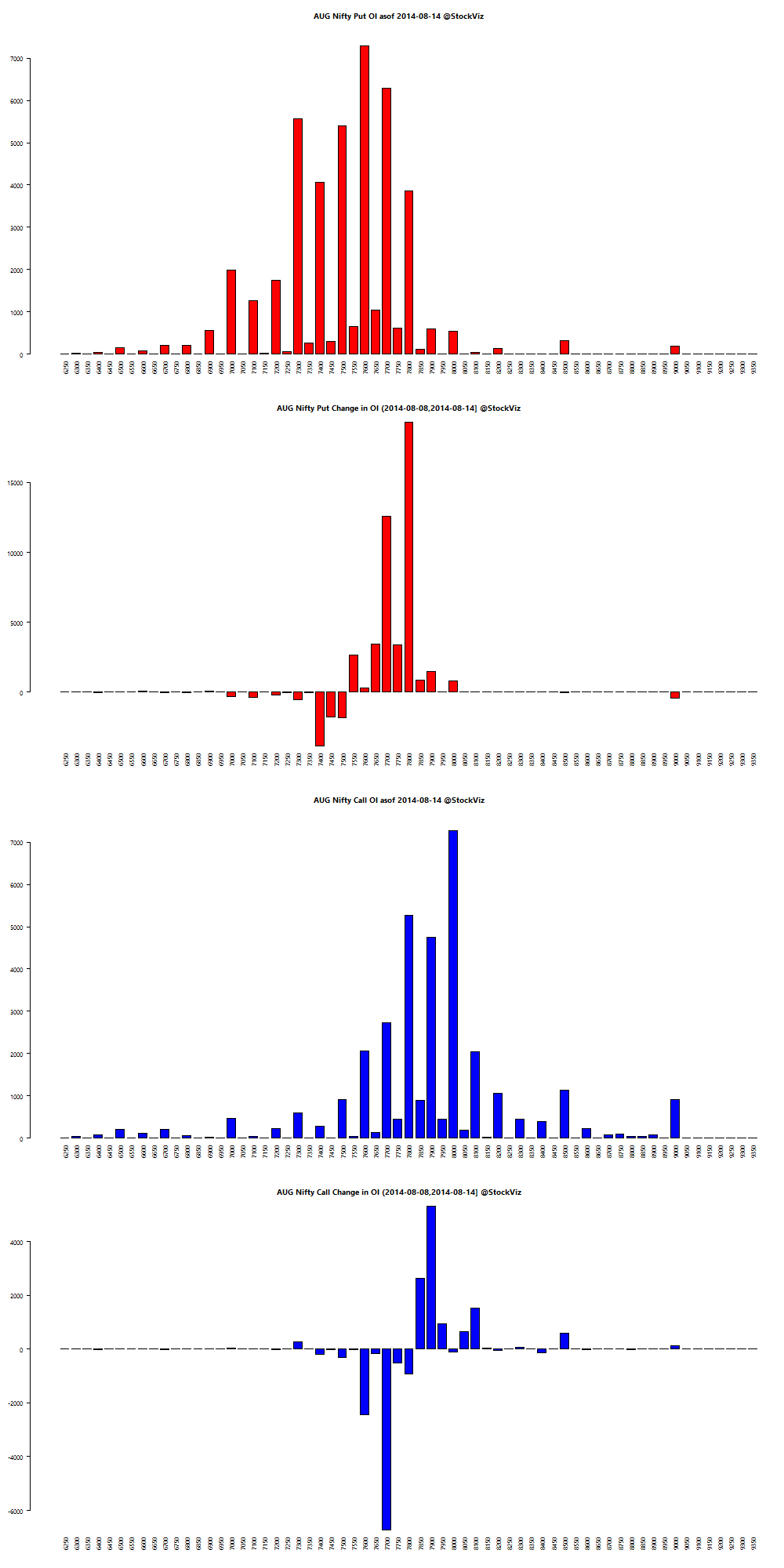

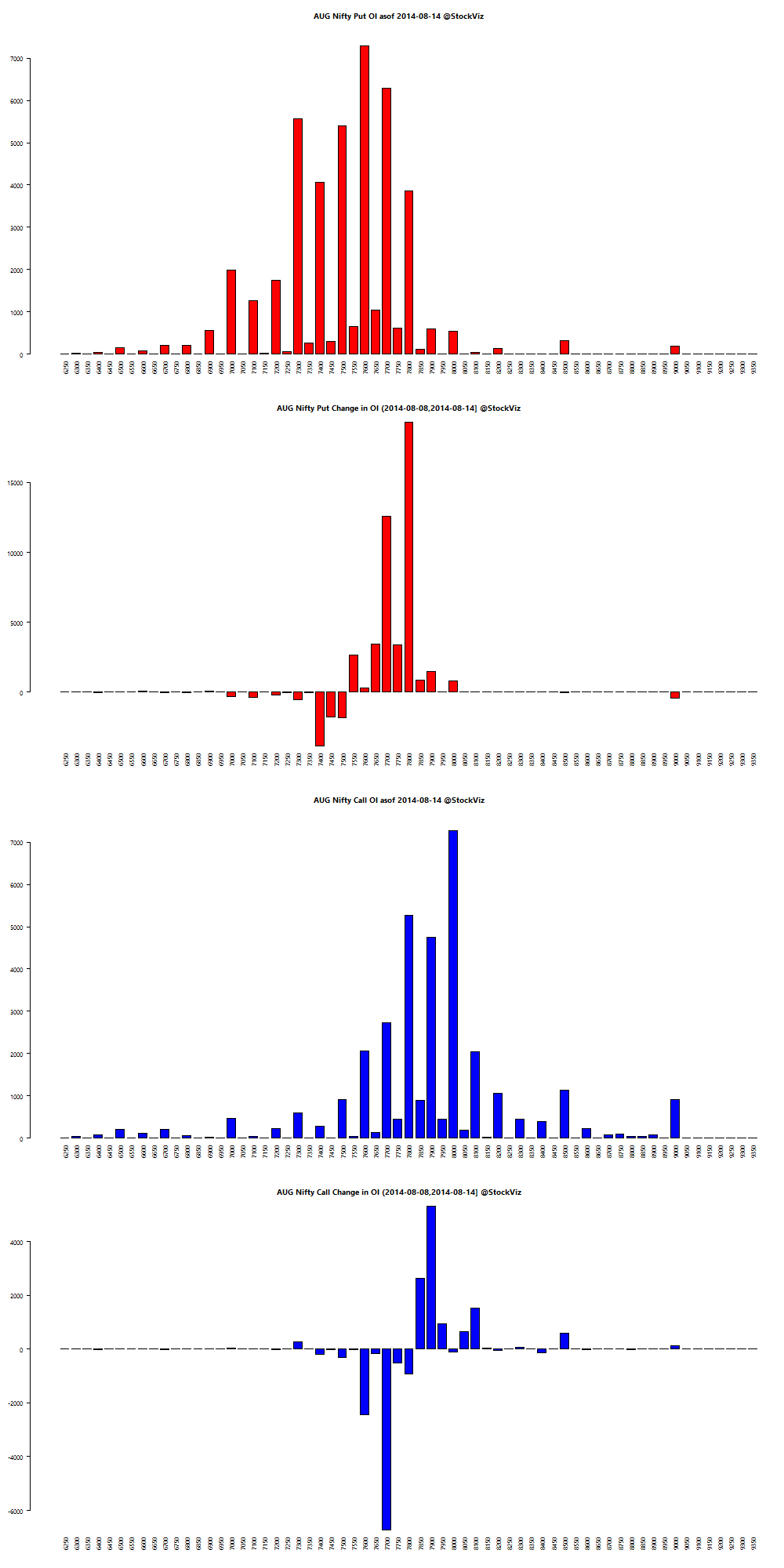

August Nifty OI

Both 7800 puts and 7900 calls were added.

August Bank Nifty OI

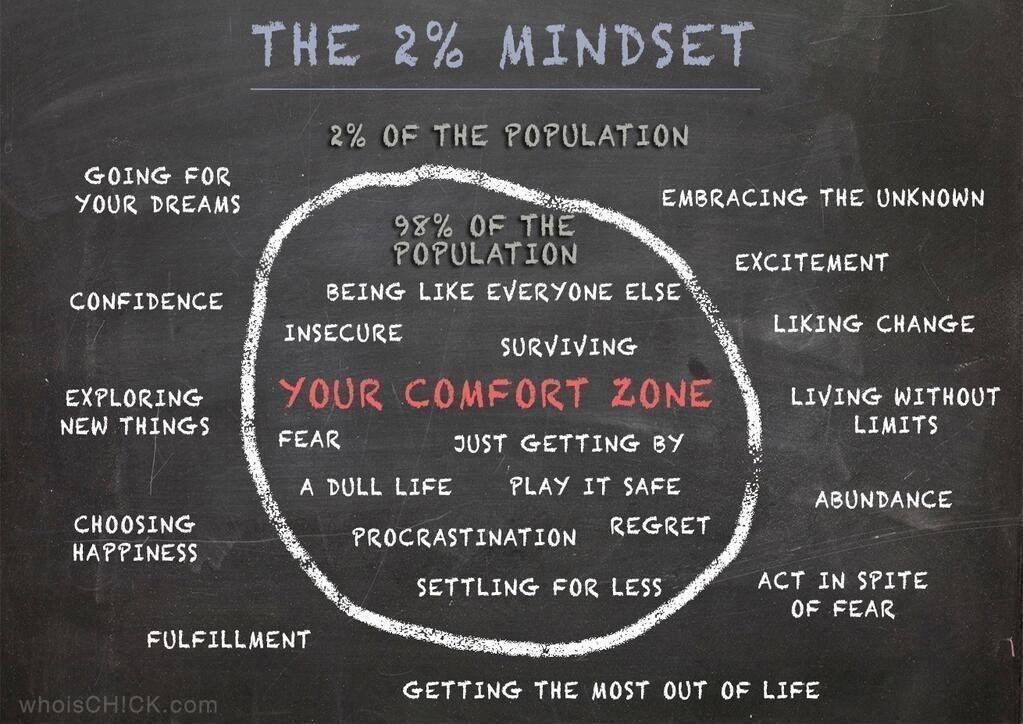

Thought for the weekend