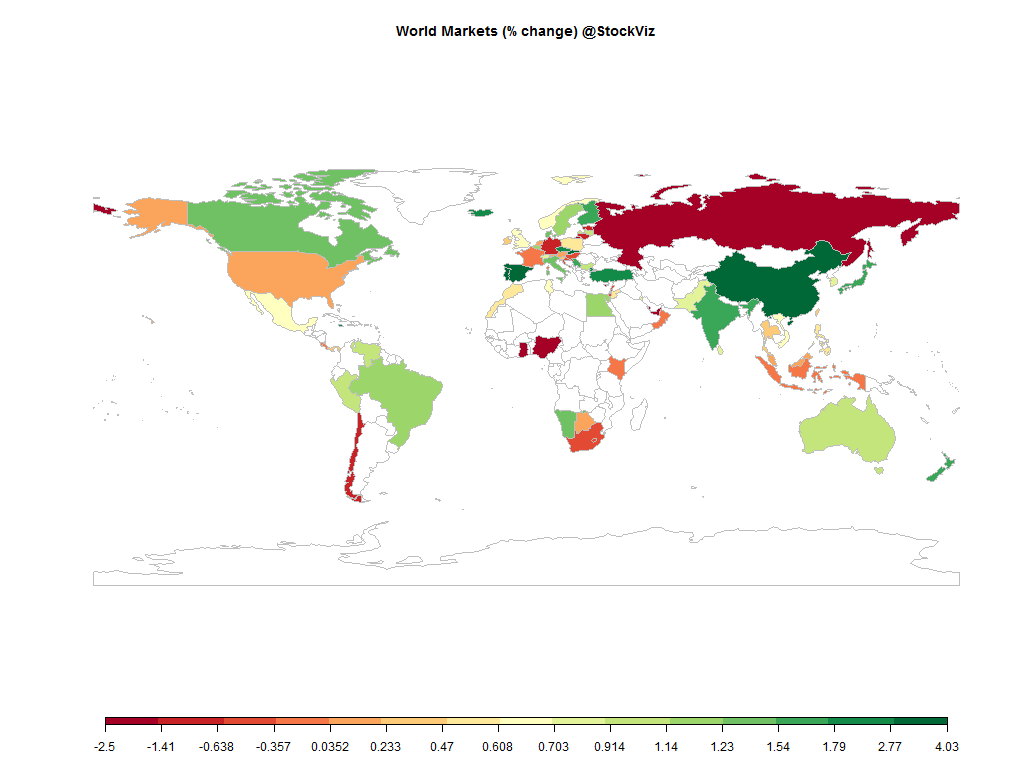

The Nifty posted a decent +1.65% this week (+1.96% in USD) in spite of Friday’s sell off.

Equities

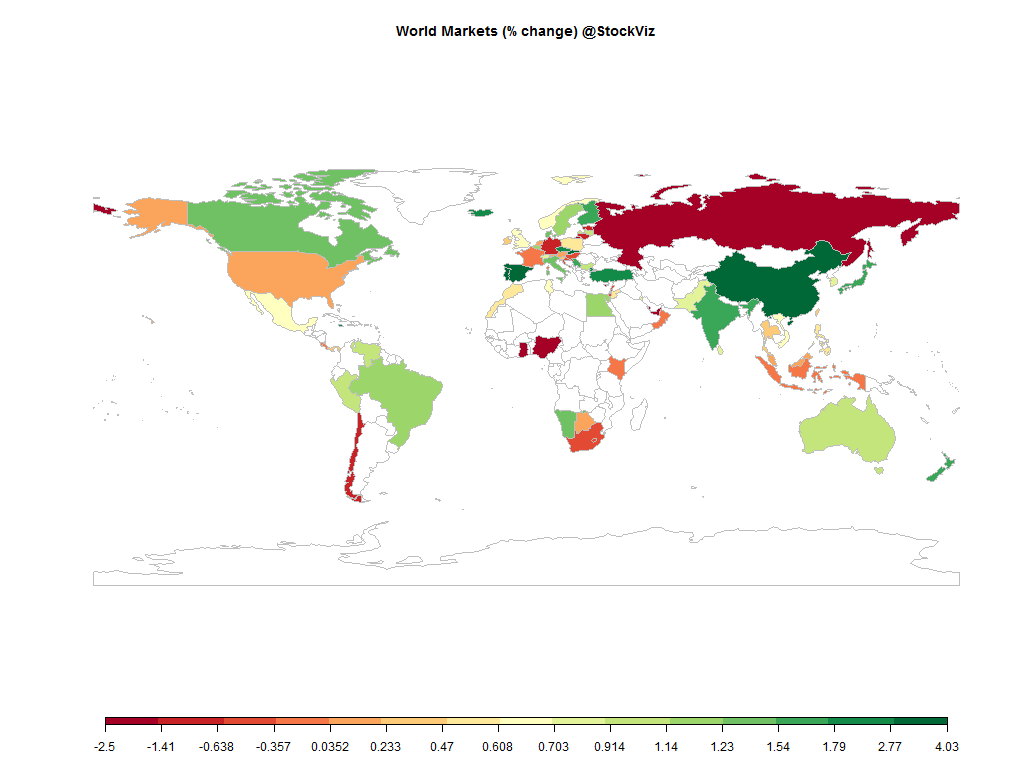

Commodities

| Energy |

| Brent Crude Oil |

+1.03% |

| Ethanol |

+1.91% |

| Heating Oil |

+2.17% |

| Natural Gas |

-4.23% |

| RBOB Gasoline |

+0.10% |

| WTI Crude Oil |

-1.26% |

| Metals |

| Copper |

+1.89% |

| Gold 100oz |

-1.08% |

| Palladium |

-0.19% |

| Platinum |

-0.50% |

| Silver 5000oz |

+0.00% |

| Agricultural |

| Cattle |

+4.70% |

| Cocoa |

+2.80% |

| Coffee (Arabica) |

+9.03% |

| Coffee (Robusta) |

+1.09% |

| Corn |

-2.42% |

| Cotton |

-5.41% |

| Feeder Cattle |

+2.91% |

| Lean Hogs |

-2.67% |

| Lumber |

+0.06% |

| Orange Juice |

-3.14% |

| Soybean Meal |

+4.63% |

| Soybeans |

+2.82% |

| Sugar #11 |

+1.00% |

| Wheat |

+1.22% |

| White Sugar |

-0.47% |

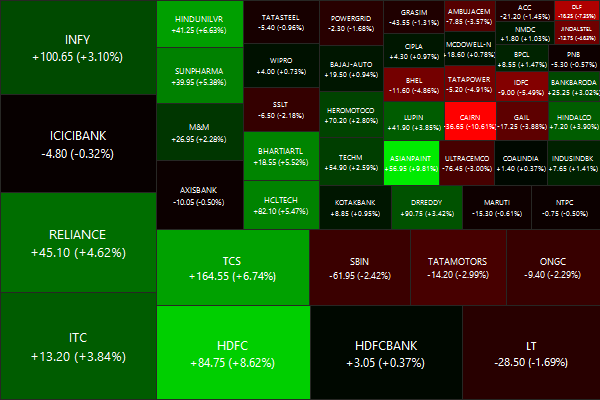

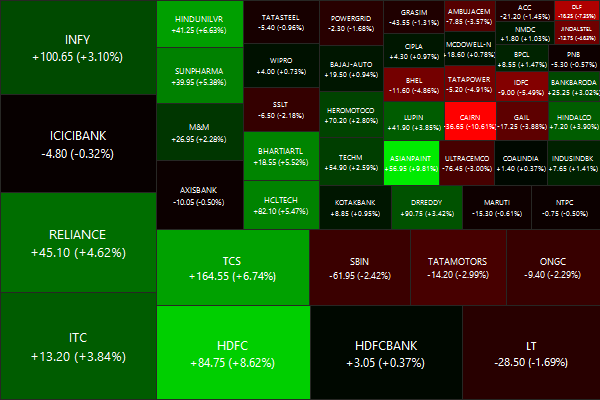

Nifty Heatmap

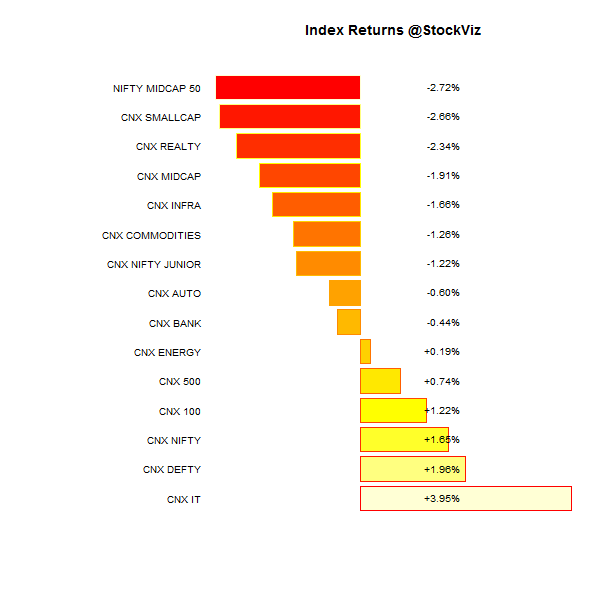

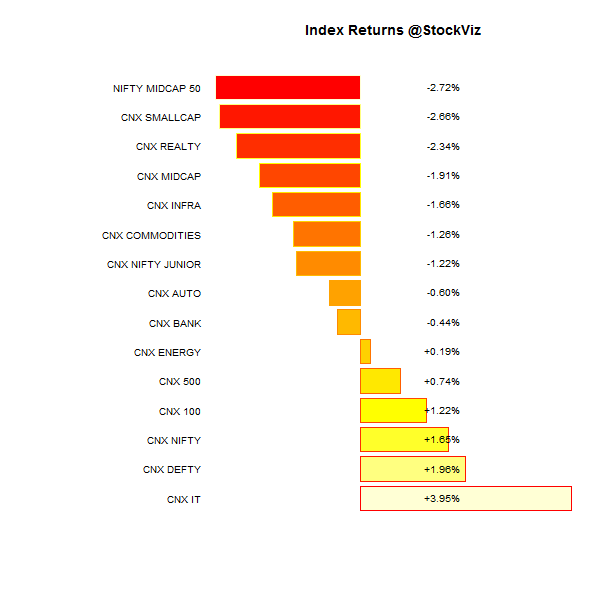

Index Returns

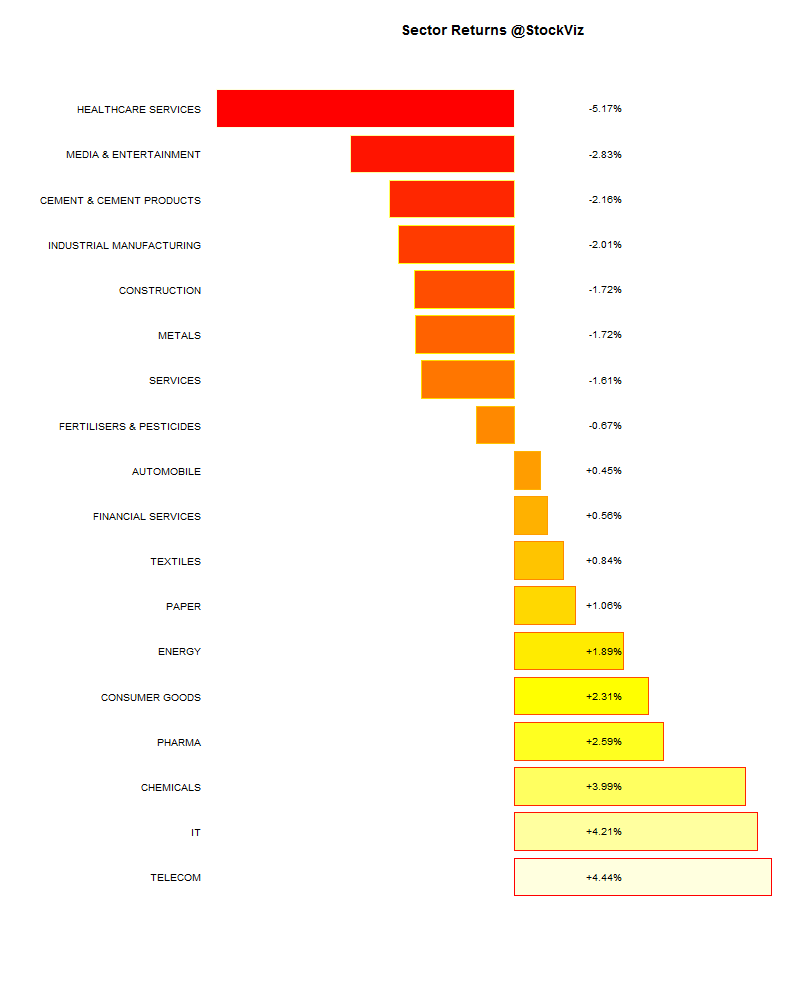

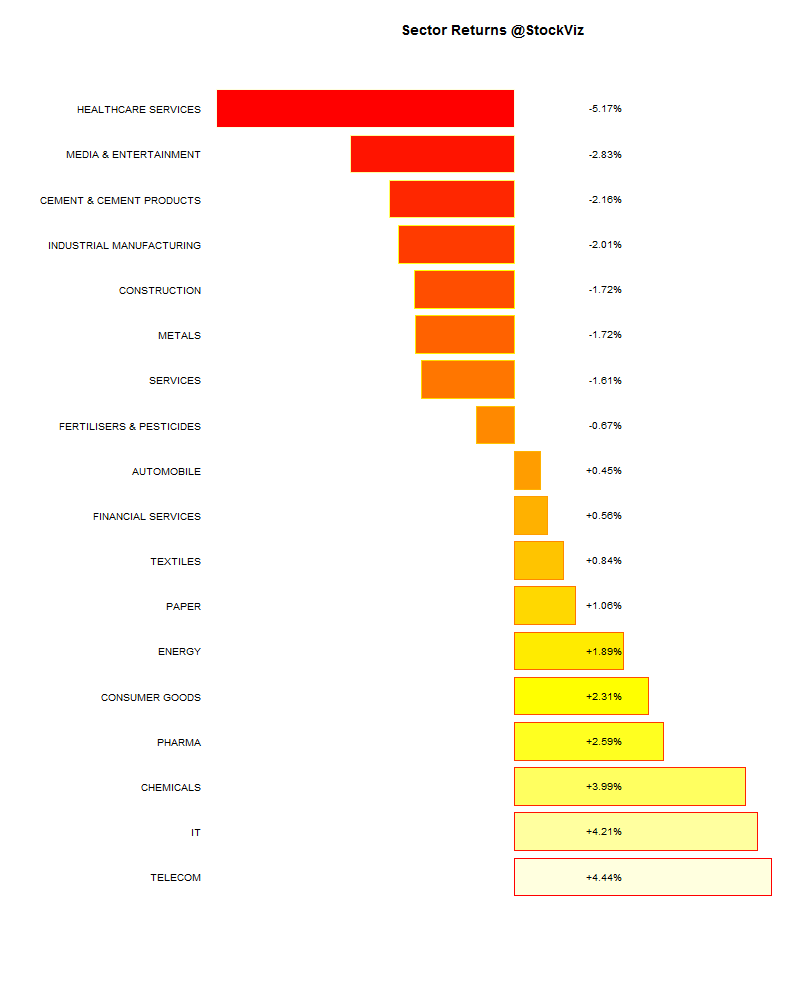

Sector Performance

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Advance/Decline |

| 1 (micro-cap) |

-6.16% |

68/66 |

| 2 |

-0.32% |

62/72 |

| 3 |

-3.25% |

60/74 |

| 4 |

-0.68% |

62/72 |

| 5 |

+0.39% |

70/64 |

| 6 |

-2.19% |

60/74 |

| 7 |

+0.03% |

65/69 |

| 8 |

-1.79% |

60/74 |

| 9 |

-0.05% |

66/68 |

| 10 (mega-cap) |

+1.07% |

70/64 |

Most of the market performance was centered around large-caps.

Top Winners and Losers

A dick move by Cairn sent its stock reeling. After insisting that it need the cash for expansion (and not paying it out in dividends and being less than honest about its buyback), it loans $1.25 billion to Vedanta.

Independent directors sleeping at the wheel as usual.

ETFs

Banks vs. PSU banks – its a walk off!

Investment Theme Performance

We have this thing called “

Refract” going on where we plan to take the NSE equity only portion of a mutual fund’s portfolio and setup an equally weighted theme. Its a live experiment, so follow along…

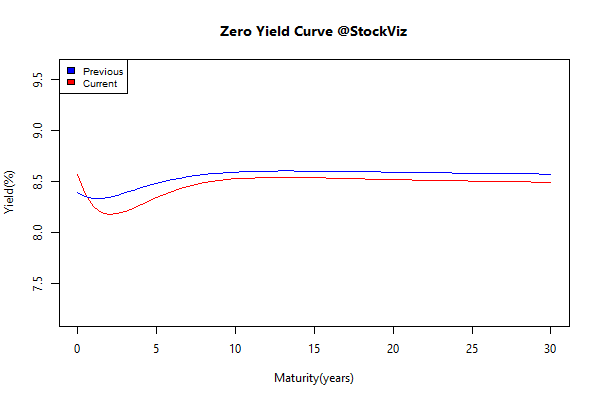

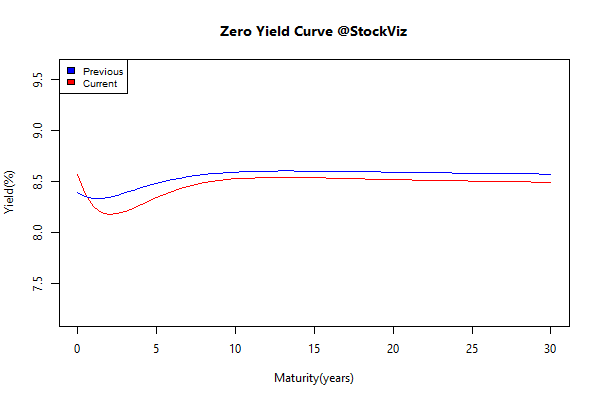

Yield Curve

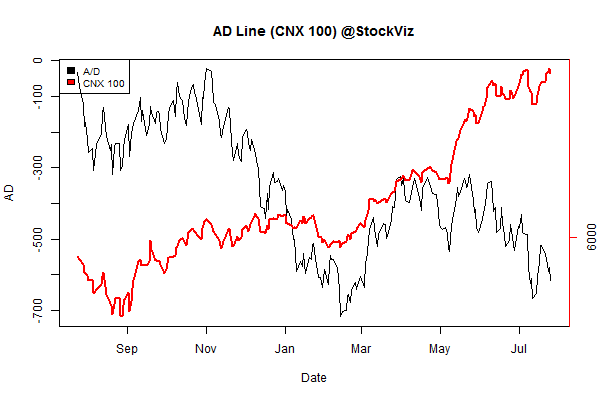

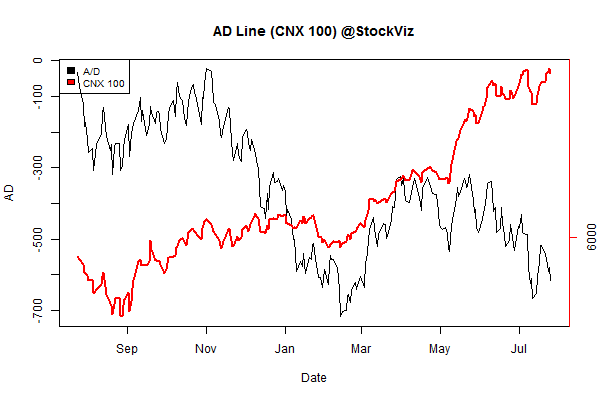

Advance Decline

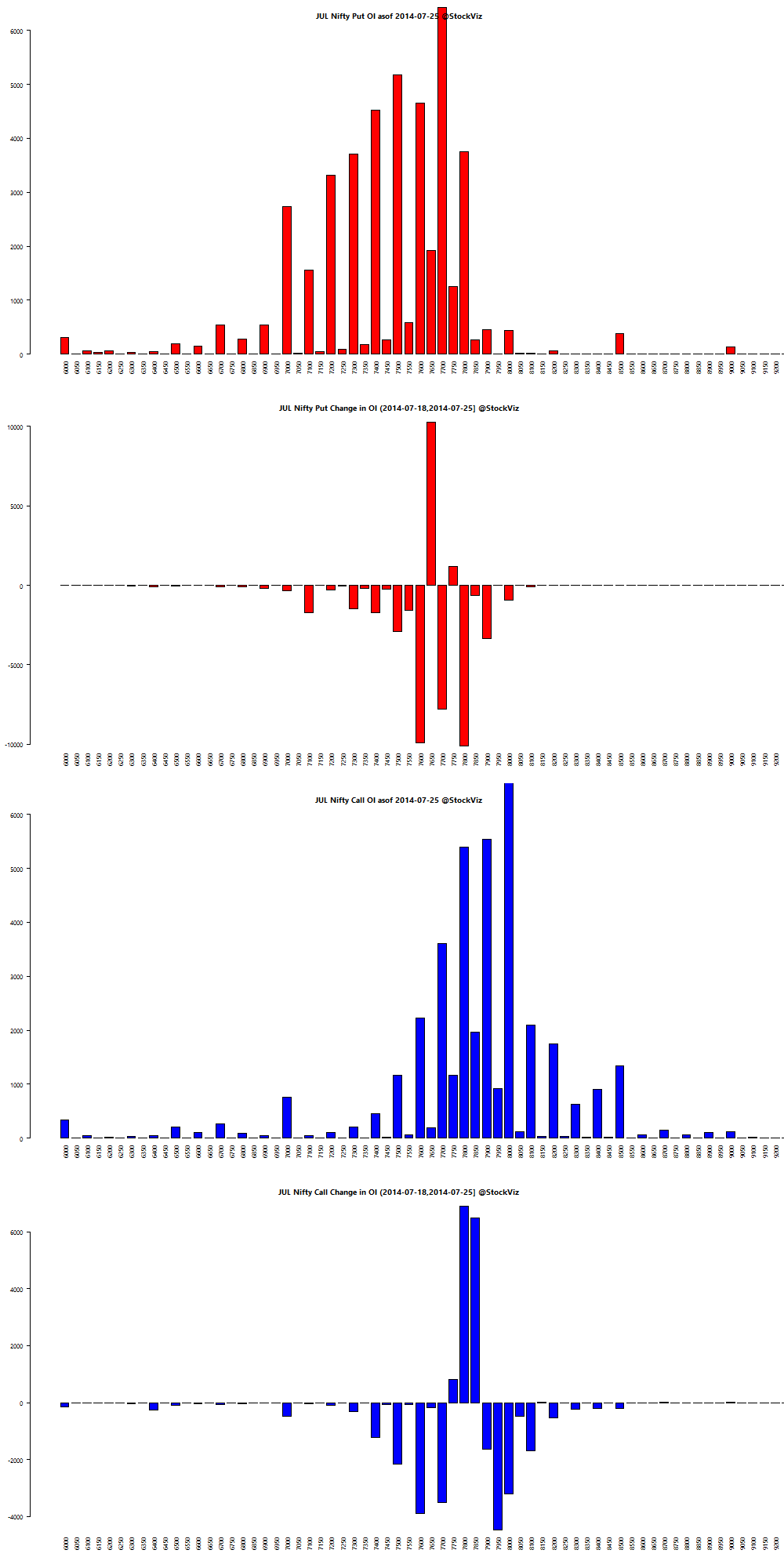

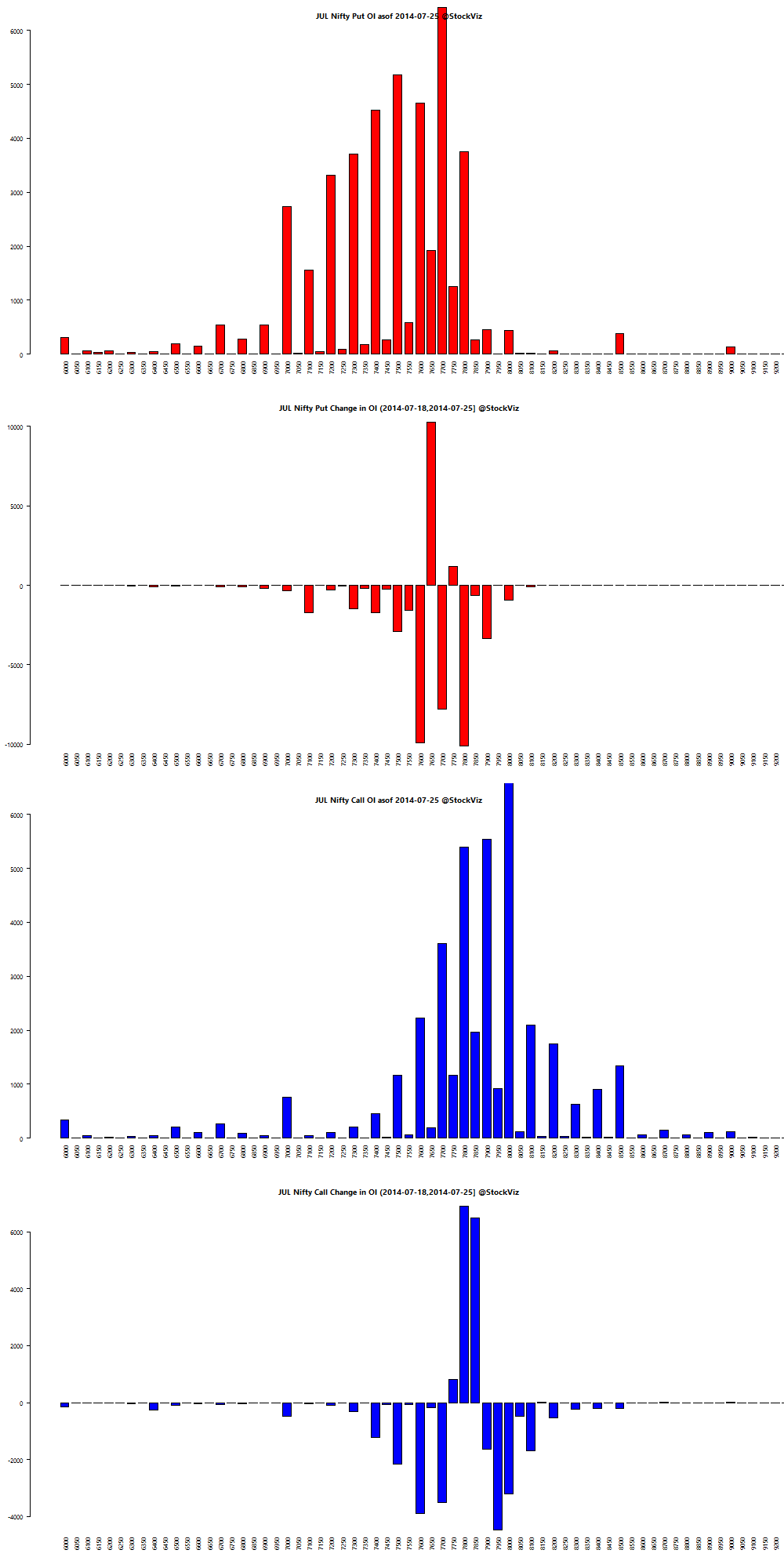

July Nifty OI

August Nifty OI

Thought for the weekend

8 things that you understand intellectually, but don’t accept in reality.

- Anyone can outperform at any time, no one can outperform all the time.

- Persistence of performance is nearly non-existent.

- Taxes and commissions matter.

- Smart doesn’t equal good.

- Incentives matter.

- The crowd is always at its most wrong at the worst possible time.

- Fear is significantly more powerful than greed.

- There is no pleasure without the potential for pain.

Source: Truths Investors Simply Cannot Accept