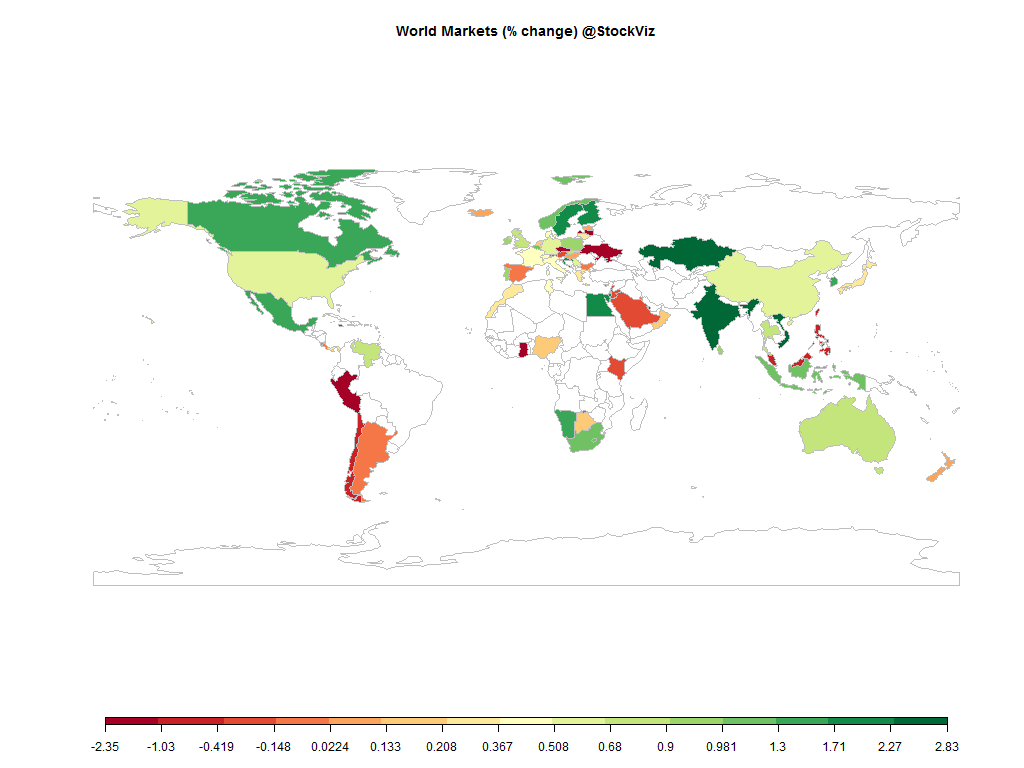

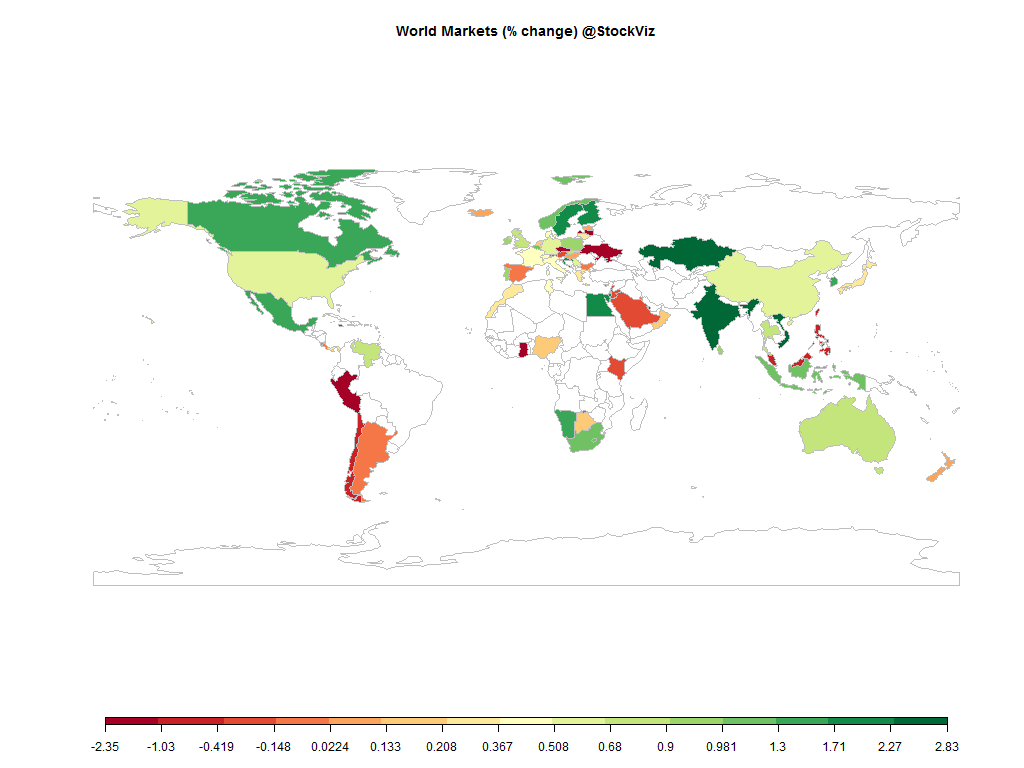

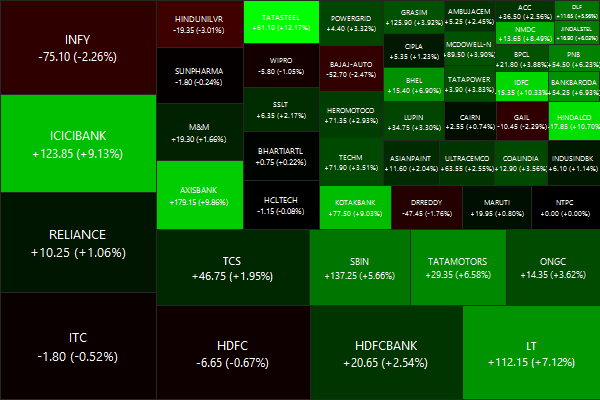

The Nifty clocked in a respectable +2.74% (+2.49% in USD) this week.

Equities

Commodities

| Energy |

| Brent Crude Oil |

+0.87% |

| Ethanol |

-0.71% |

| Heating Oil |

-0.30% |

| Natural Gas |

-4.92% |

| RBOB Gasoline |

-1.61% |

| WTI Crude Oil |

+2.33% |

| Metals |

| Copper |

-2.45% |

| Gold 100oz |

-1.96% |

| Palladium |

+1.08% |

| Platinum |

-1.42% |

| Silver 5000oz |

-2.80% |

| Agricultural |

| Cattle |

+1.49% |

| Cocoa |

-1.48% |

| Coffee (Arabica) |

+4.53% |

| Coffee (Robusta) |

-0.10% |

| Corn |

-7.04% |

| Cotton |

-0.51% |

| Feeder Cattle |

+0.28% |

| Lean Hogs |

-4.17% |

| Lumber |

-3.06% |

| Orange Juice |

+5.38% |

| Soybean Meal |

-9.79% |

| Soybeans |

-9.11% |

| Sugar #11 |

-0.41% |

| Wheat |

+2.75% |

| White Sugar |

+0.33% |

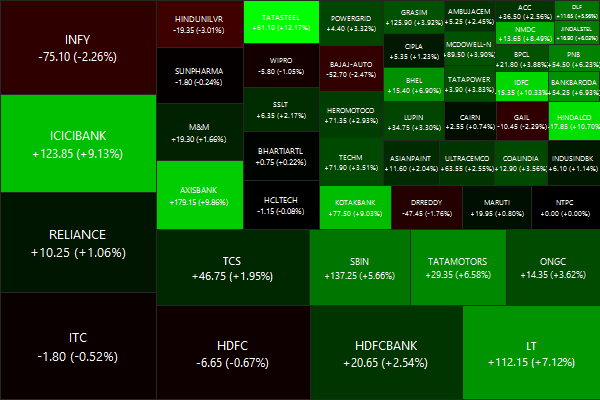

Nifty Heatmap

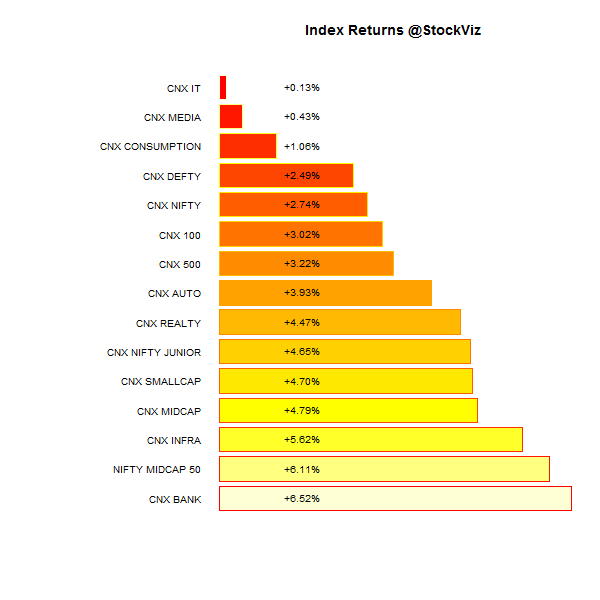

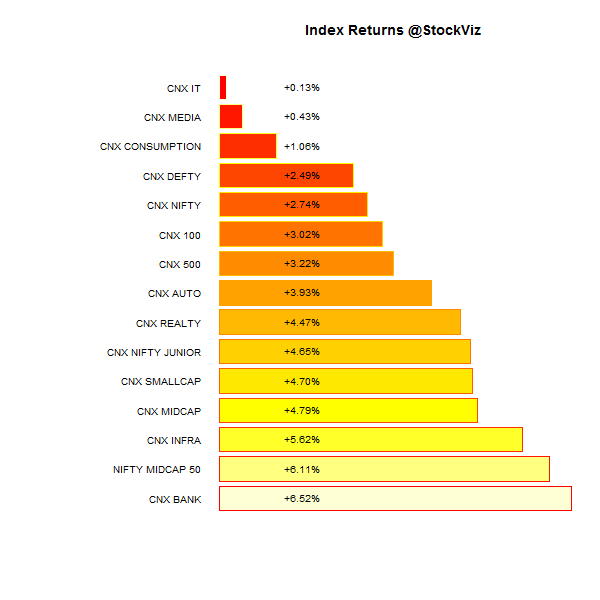

Index Returns

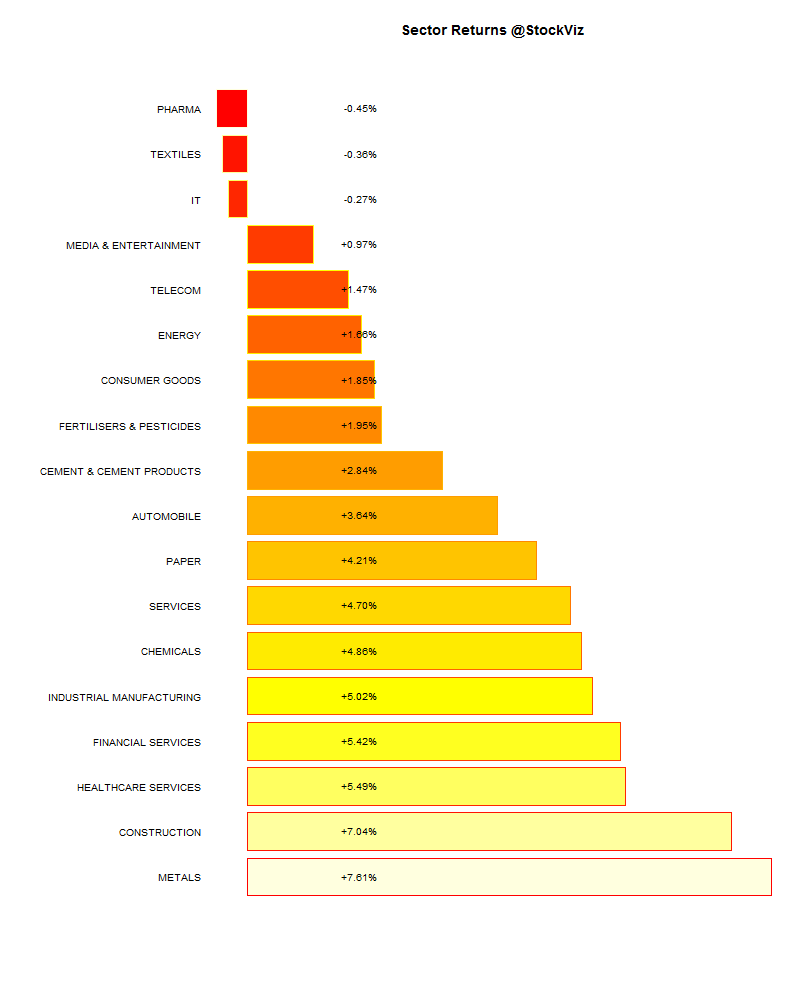

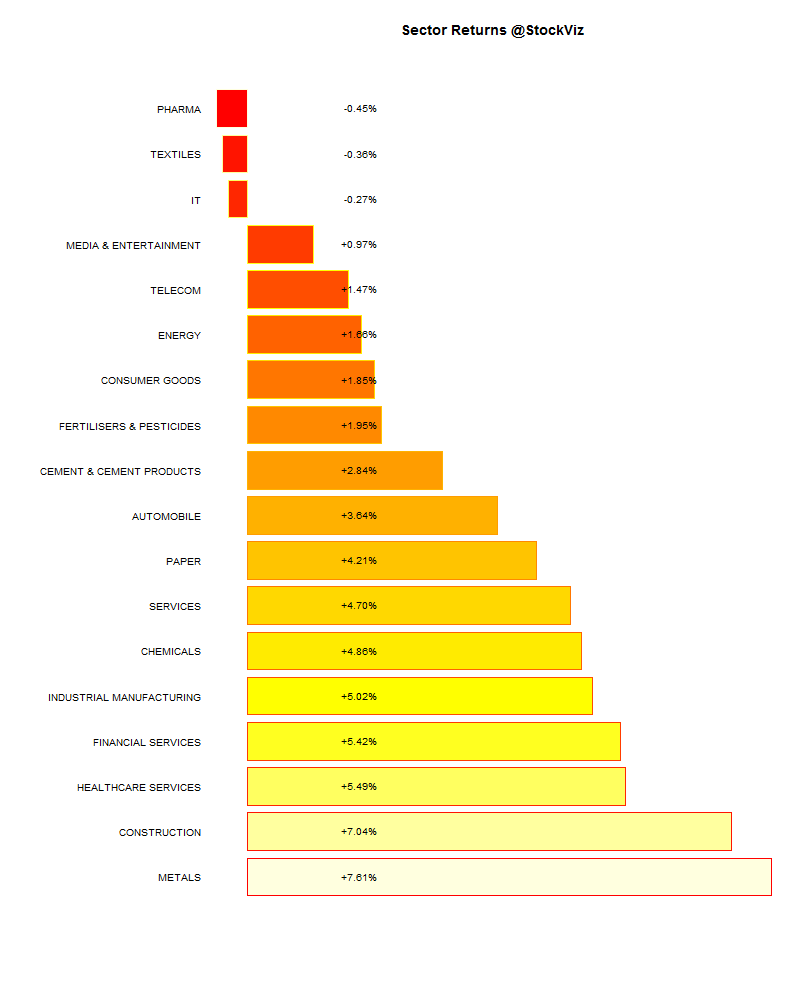

Sector Performance

MARKET CAP DECILE PERFORMANCE

| Decile |

Mkt. Cap. |

Advance/Decline |

| 1 (micro-cap) |

-4.54% |

65/72 |

| 2 |

+1.60% |

72/64 |

| 3 |

+4.22% |

76/60 |

| 4 |

+5.02% |

77/59 |

| 5 |

+4.53% |

84/52 |

| 6 |

+6.16% |

76/61 |

| 7 |

+5.84% |

81/55 |

| 8 |

+5.23% |

86/50 |

| 9 |

+4.39% |

74/62 |

| 10 (mega-cap) |

+3.21% |

68/69 |

Midcaps recovered somewhat from last week’s shellacking but micro-caps continued to bleed.

Top winners and losers

ETFs

Gold, once again, out of favor.

Investment Theme Performance

Back from the precipice. Quantitative value themes out performed…

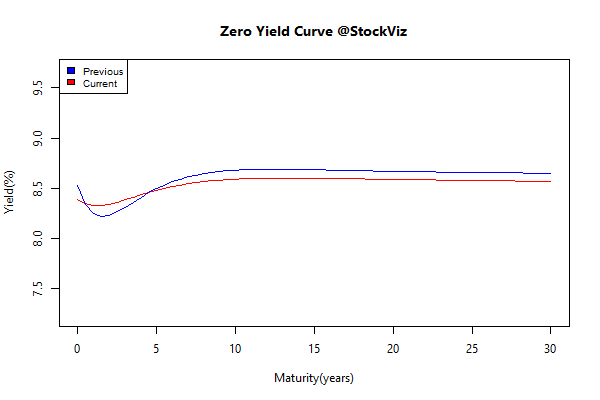

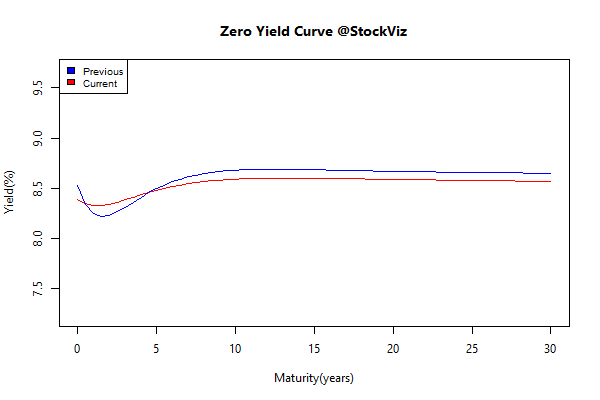

Yield Curve

A flat yield curve does not a bank profit make.

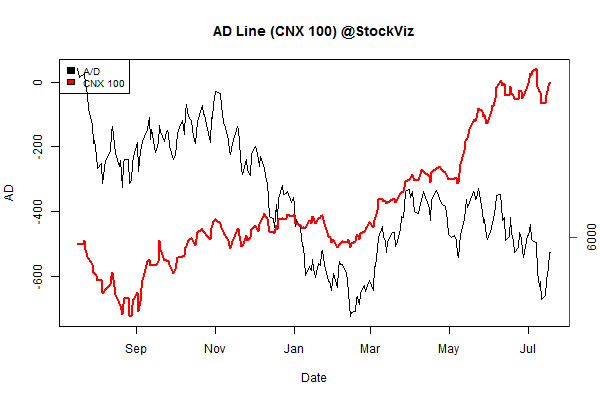

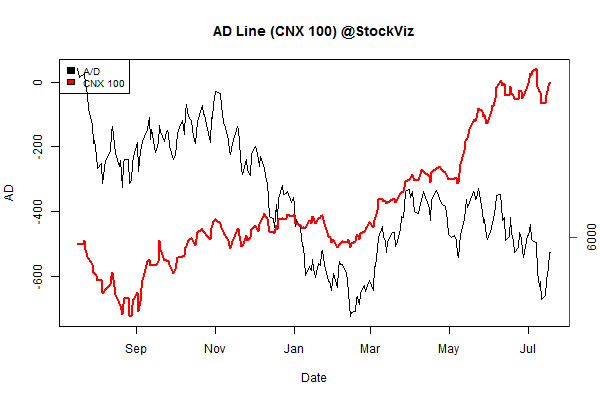

Advance Decline

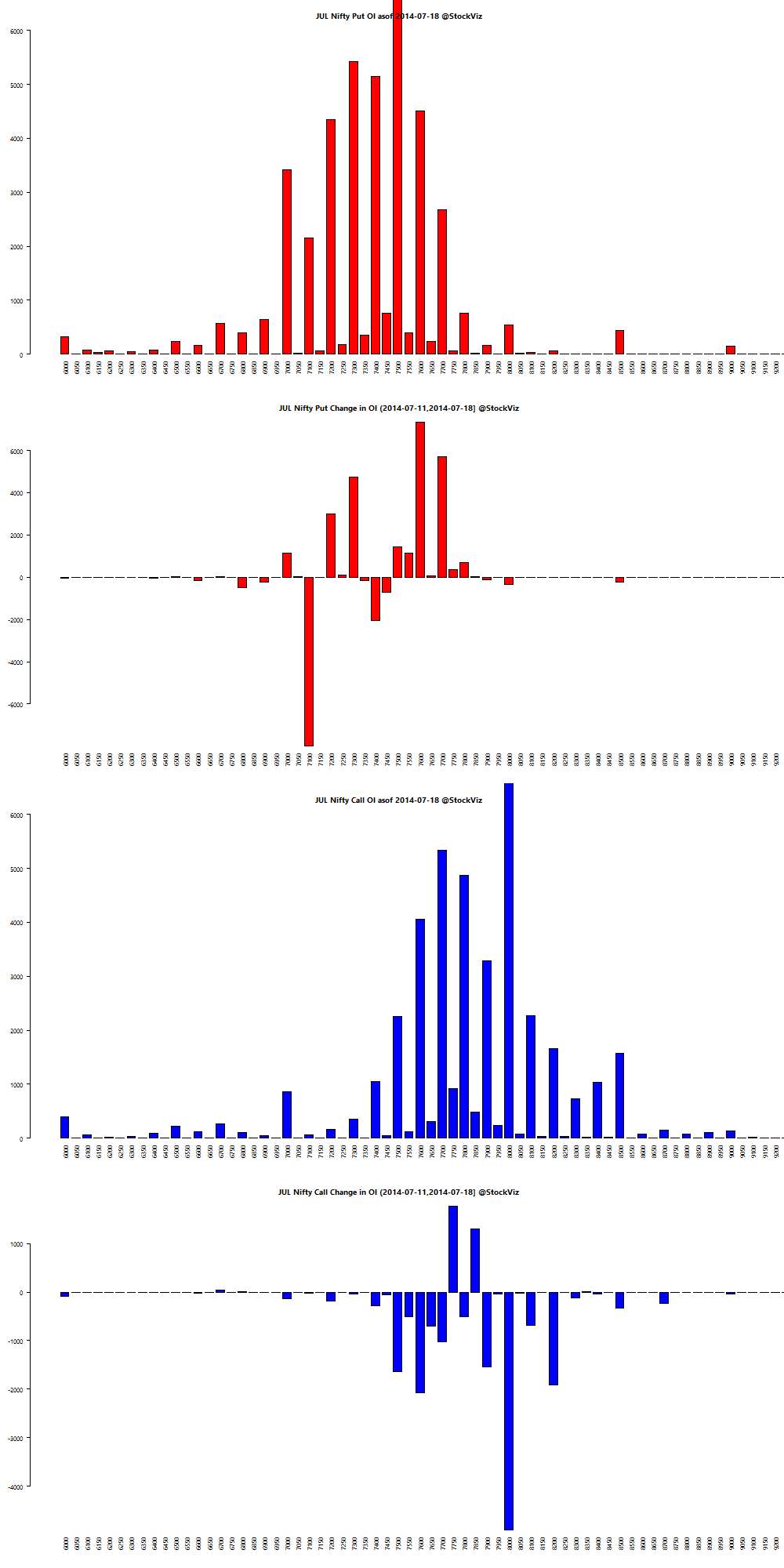

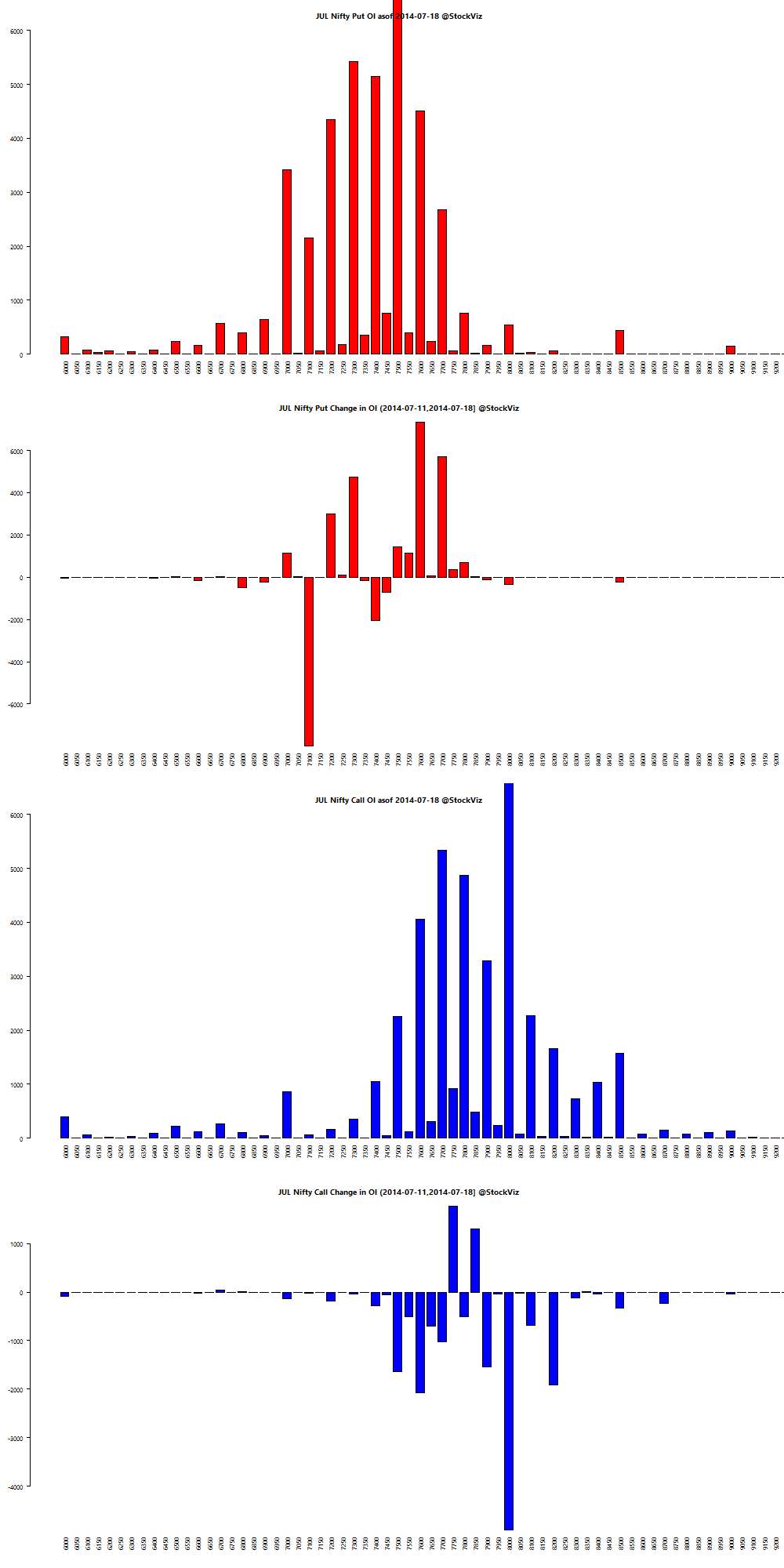

Nifty OI

Thought for the weekend

Experts have a poor understanding of uncertainty. Usually, this manifests itself in the form of overconfidence: experts underestimate the likelihood that their predictions might be wrong.

Source: Herman Cain and the Hubris of Experts

Related: Why Do Models Beat Experts?