The almighty dollar

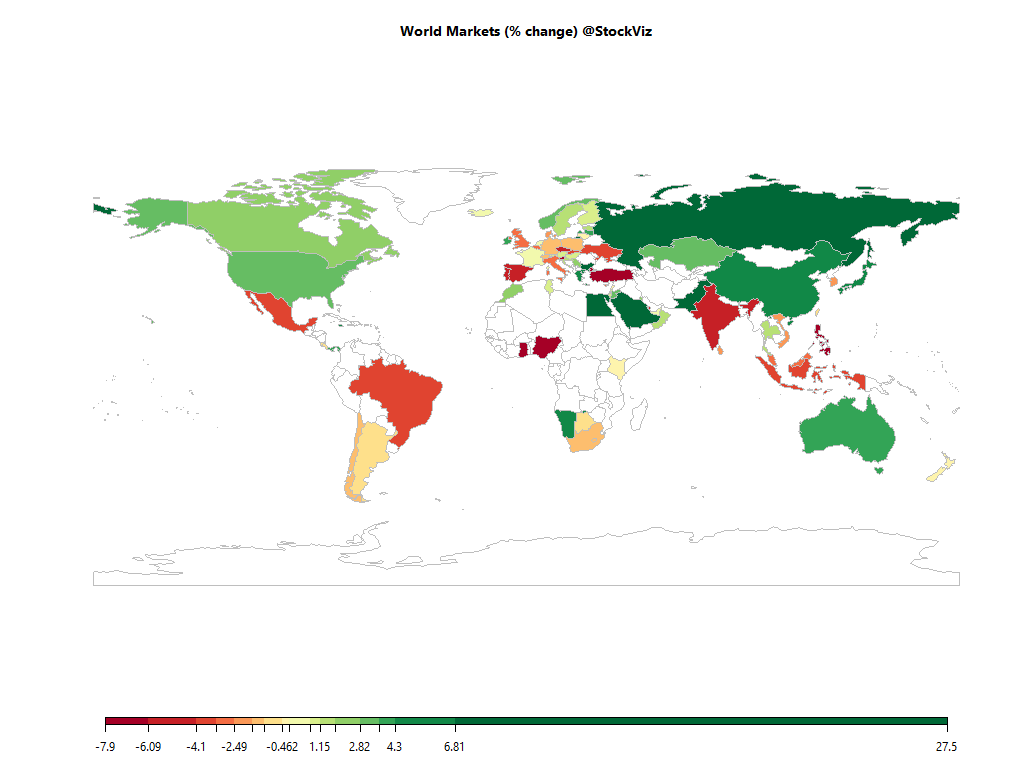

Although India and China account for a bulk of world gold consumption, the price of gold continues to be set in London and New York. When you buy gold in India, you are exposed to two things:

- The dollar price of gold.

- The USD/INR exchange rate.

Even at times when the price of gold goes down in dollar terms, if the rupee goes down more, then you still have a profit in your hands. This partly explains why Indians are crazy about gold – it is the easiest way to get short the rupee.

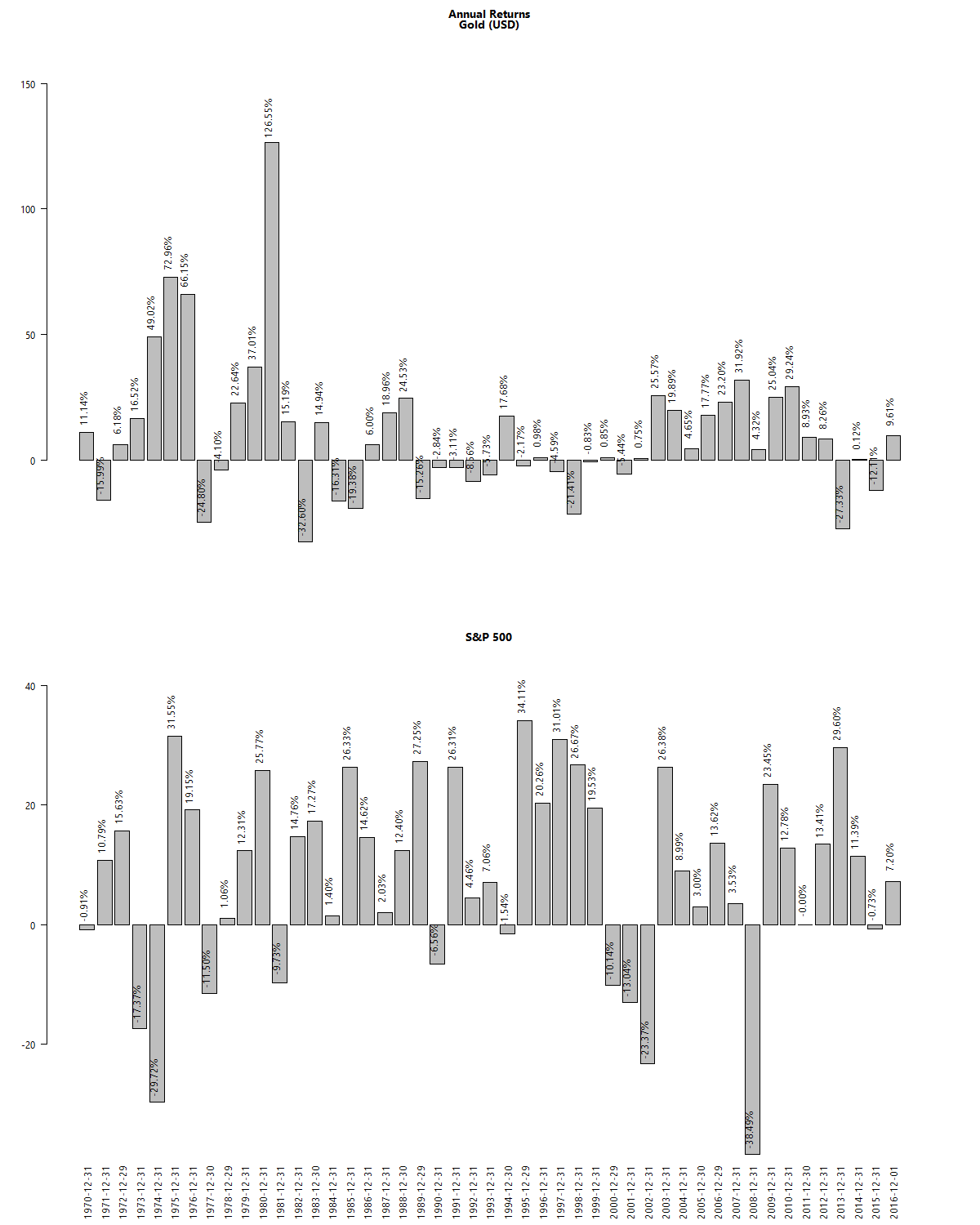

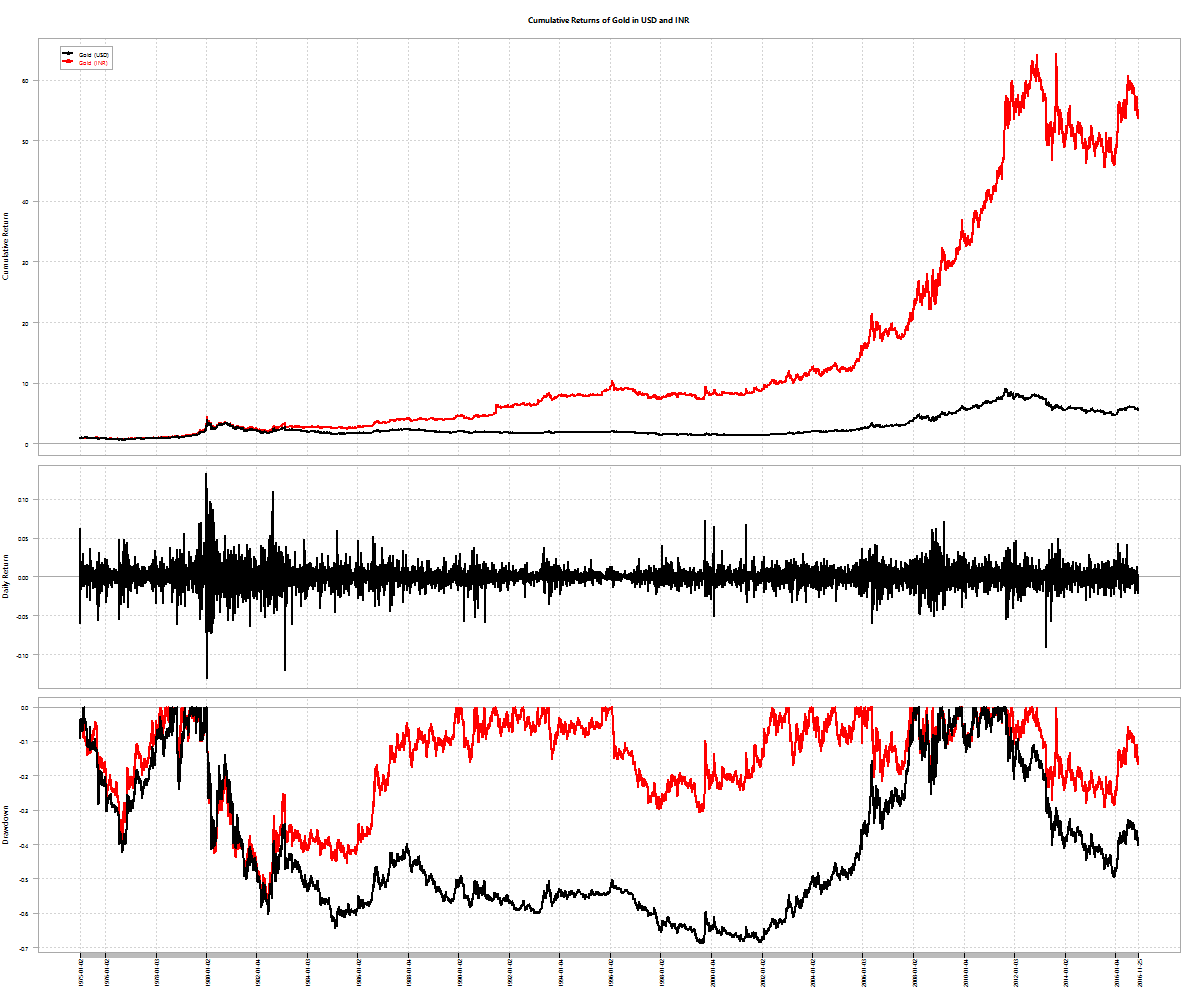

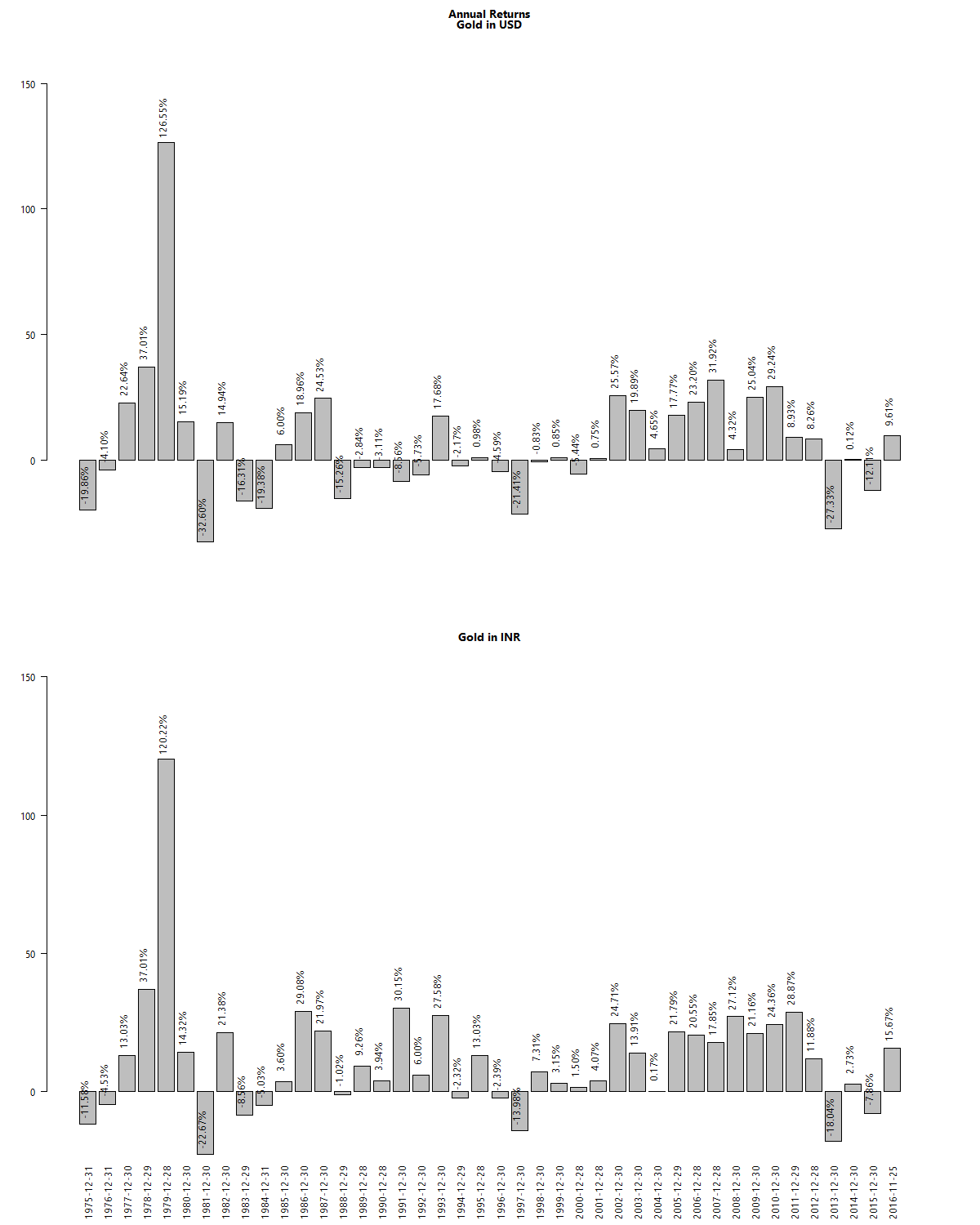

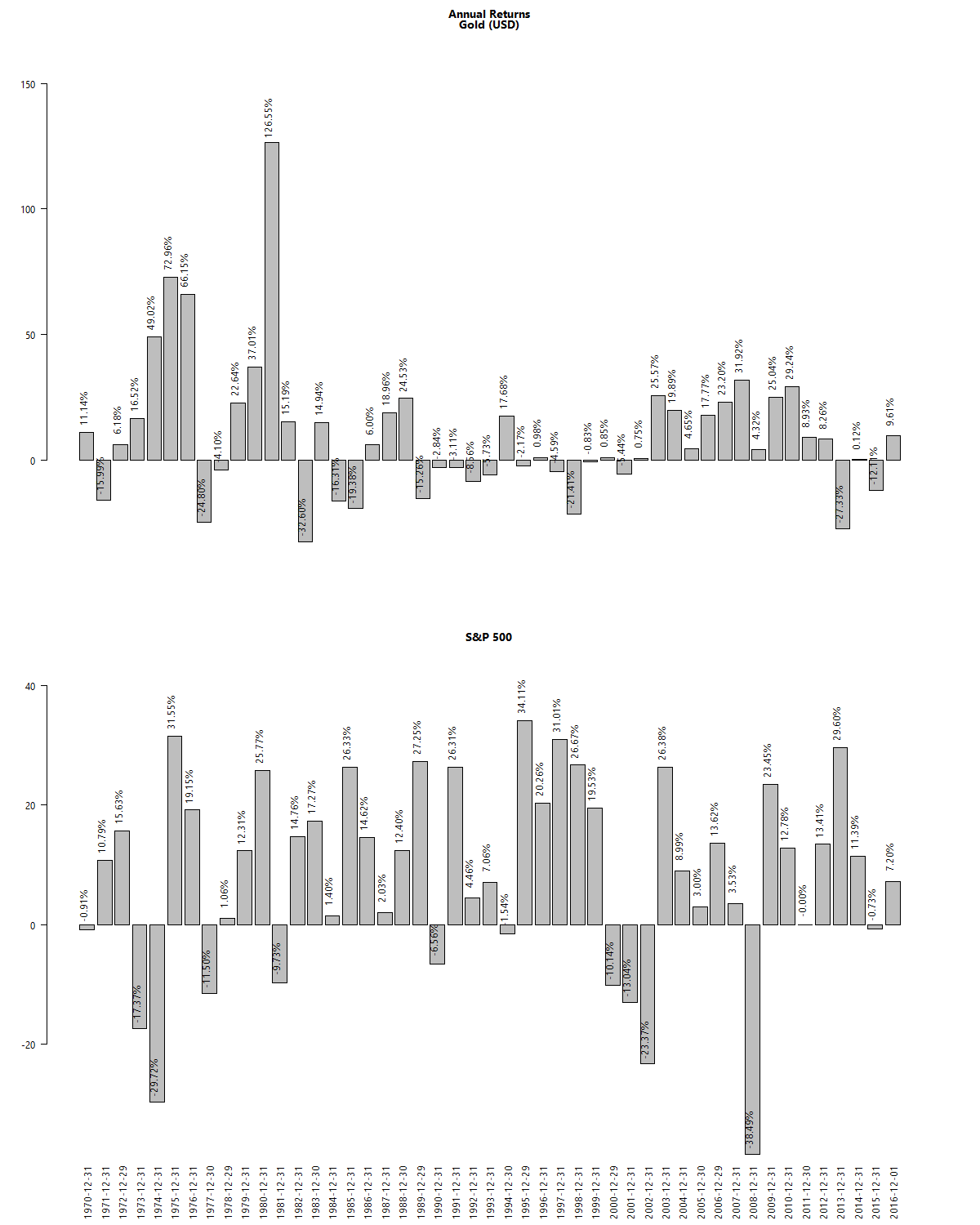

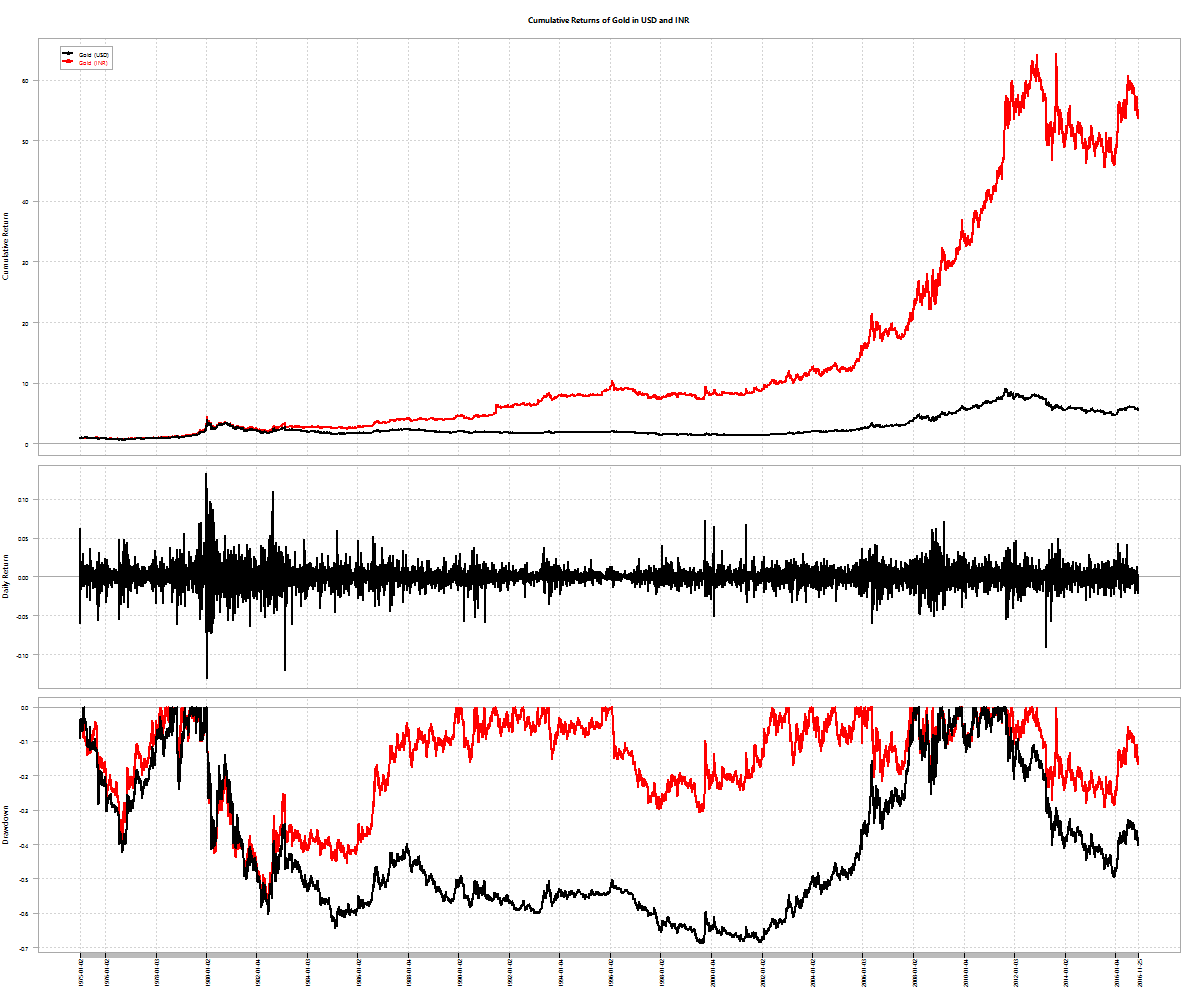

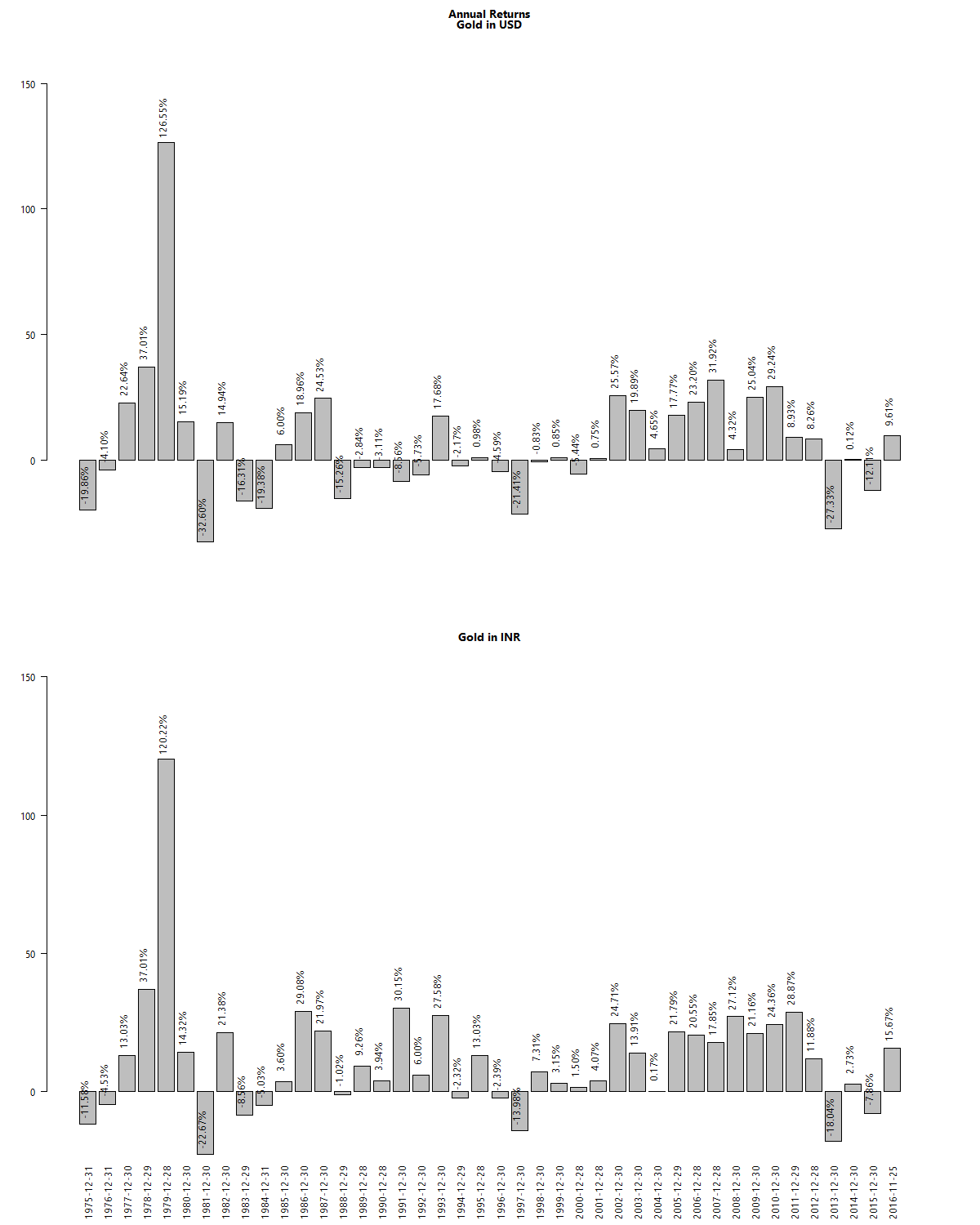

Dollar returns of gold

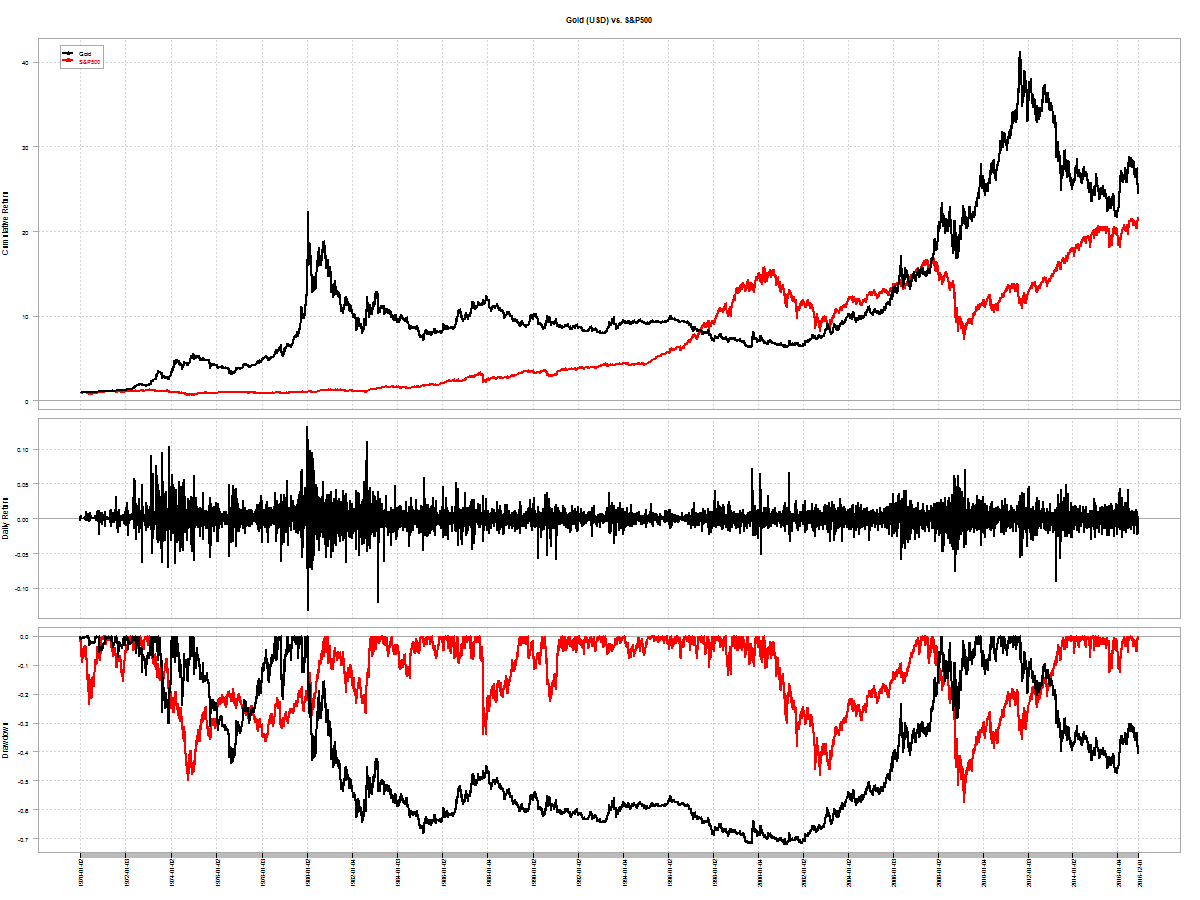

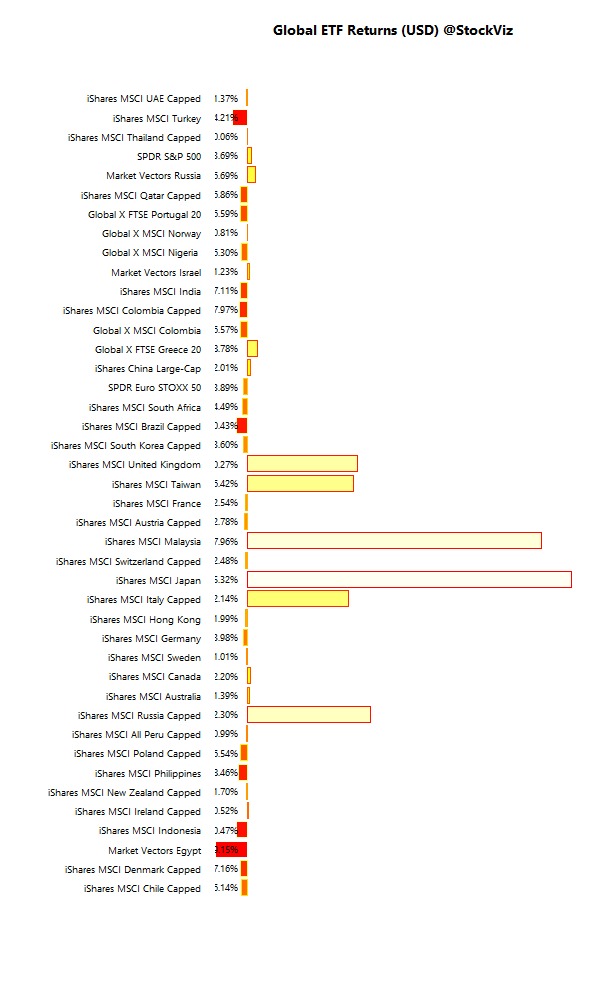

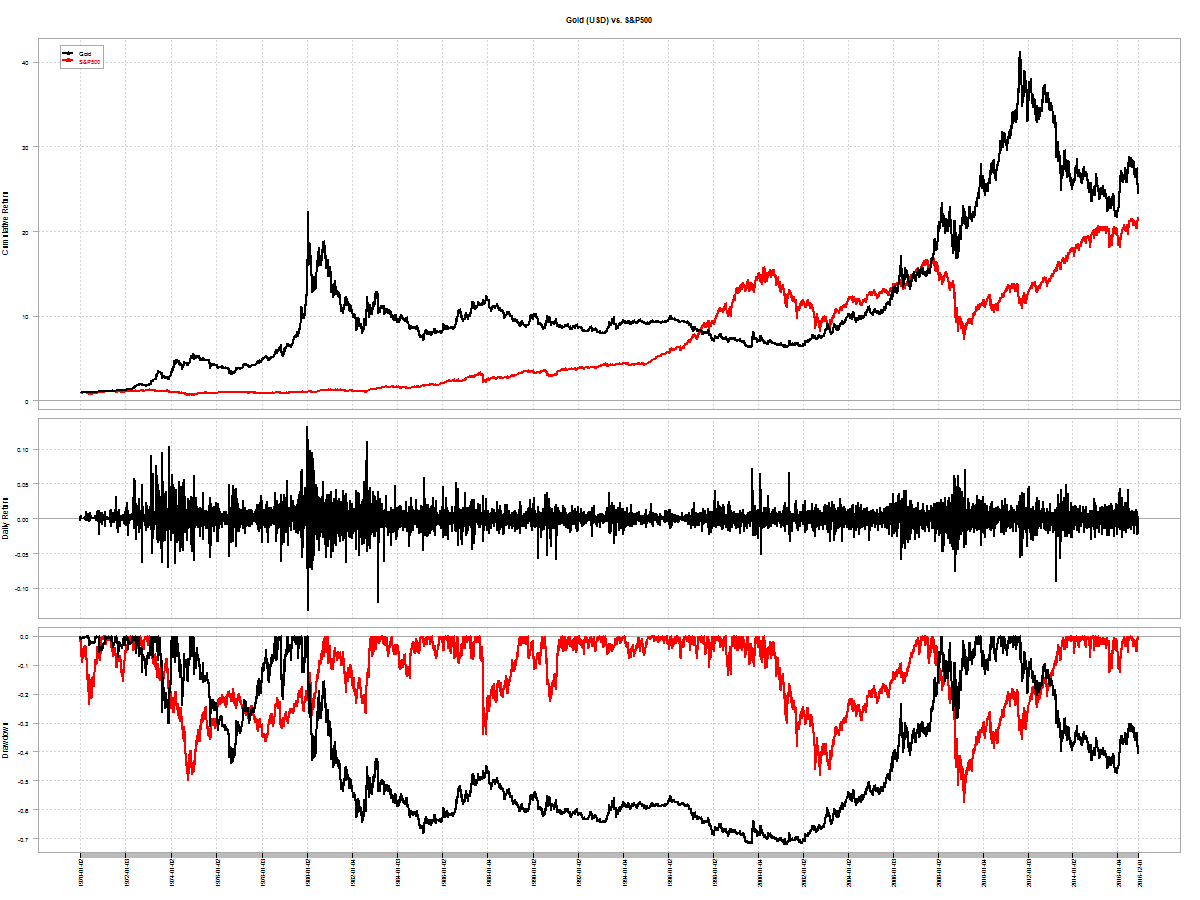

If you look at the returns of the S&P 500 vs. gold since 1970’s, gold comes out a winner.

Not to say that it was easy to own. Gold peaked in the 80’s and remained out of favor till 2008!

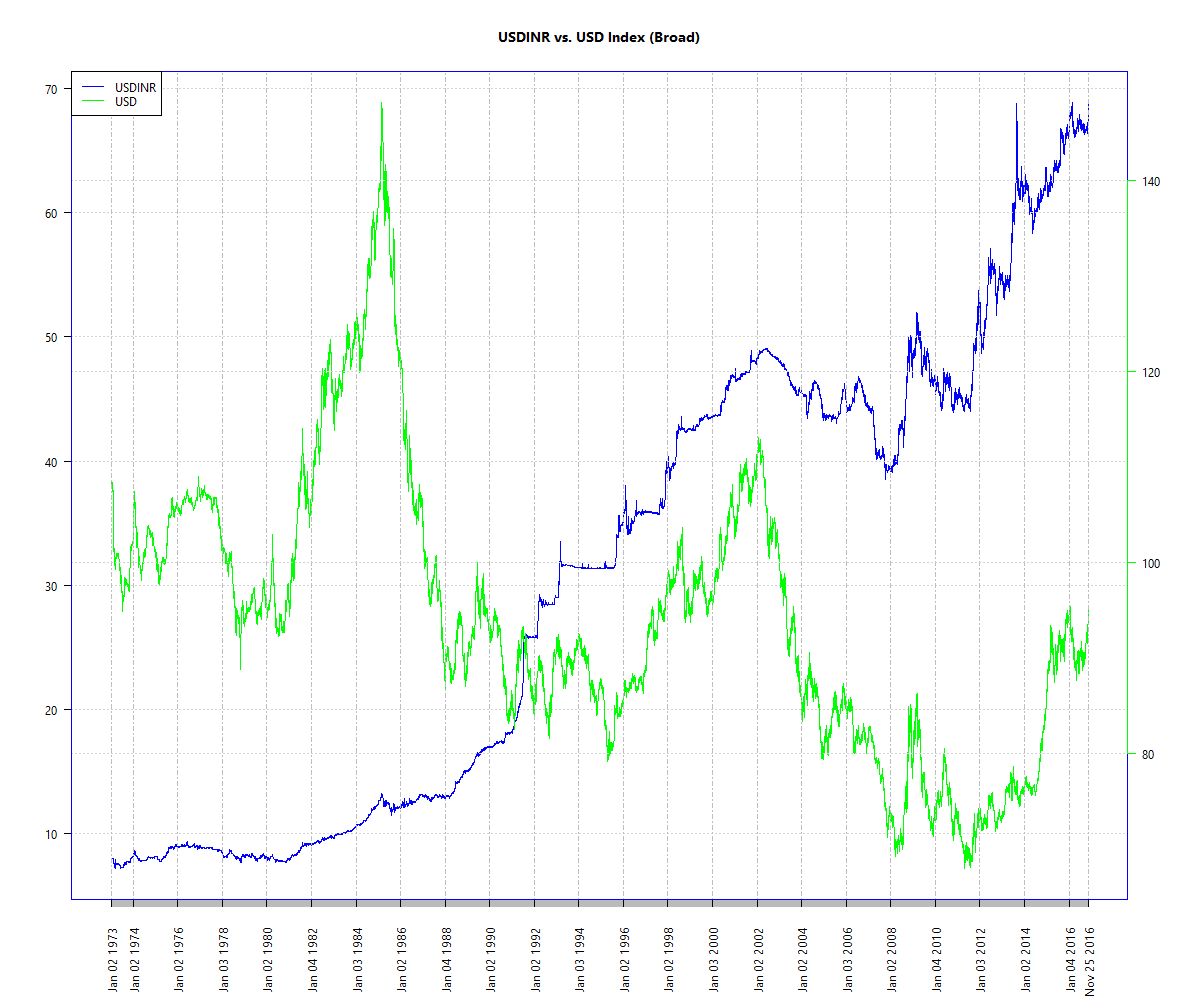

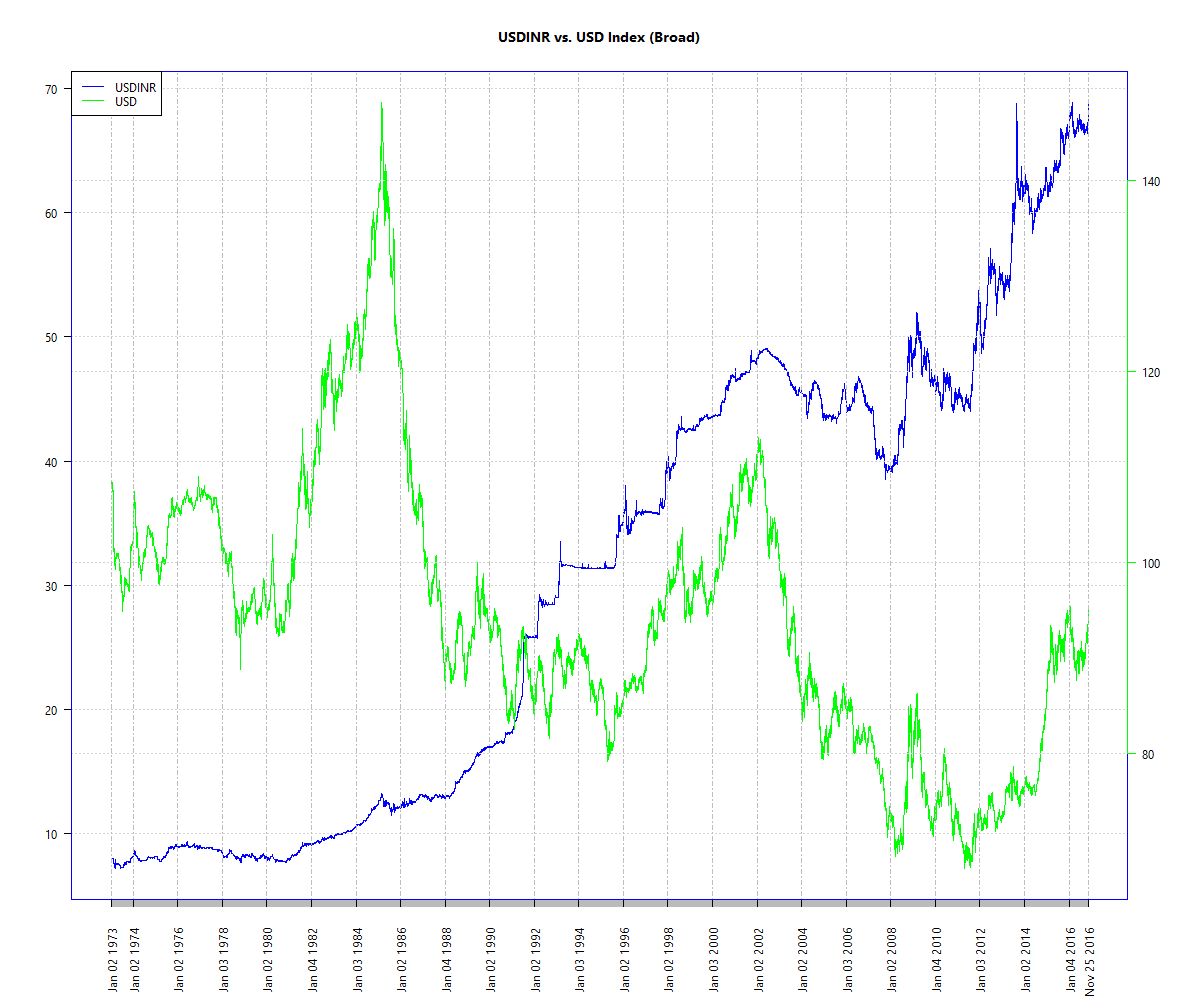

Rupee depreciation

The dollar returns of gold is only a small part of the story. The bigger picture here is that of rupee depreciation. Let us see how USDINR compares with USD vs. a board basket of currencies:

See the blue line? That is how much the US Dollar has appreciated against the rupee. The green line is the dollar vs. other currencies with which America does business with.

With this in mind, let’s compare the returns from gold in USD vs. gold in INR:

Notice the troughs of Gold/INR is shallower than those of Gold/USD?

When you have a depreciating currency in hand, you can’t get rid of it fast enough. And the easiest way to do that in India is to buy gold. Our government can’t print more of it, can’t set its price and is fairly liquid.

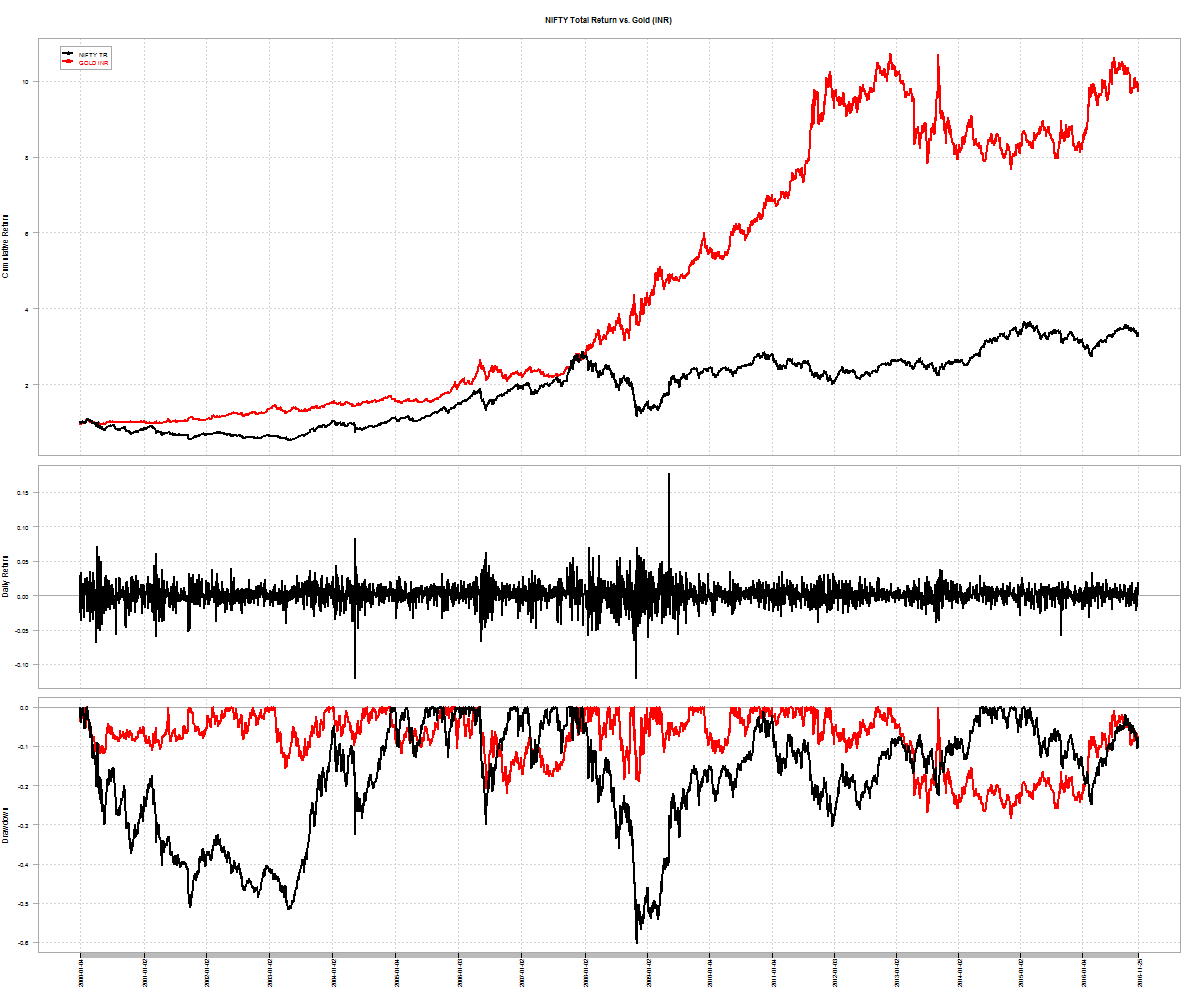

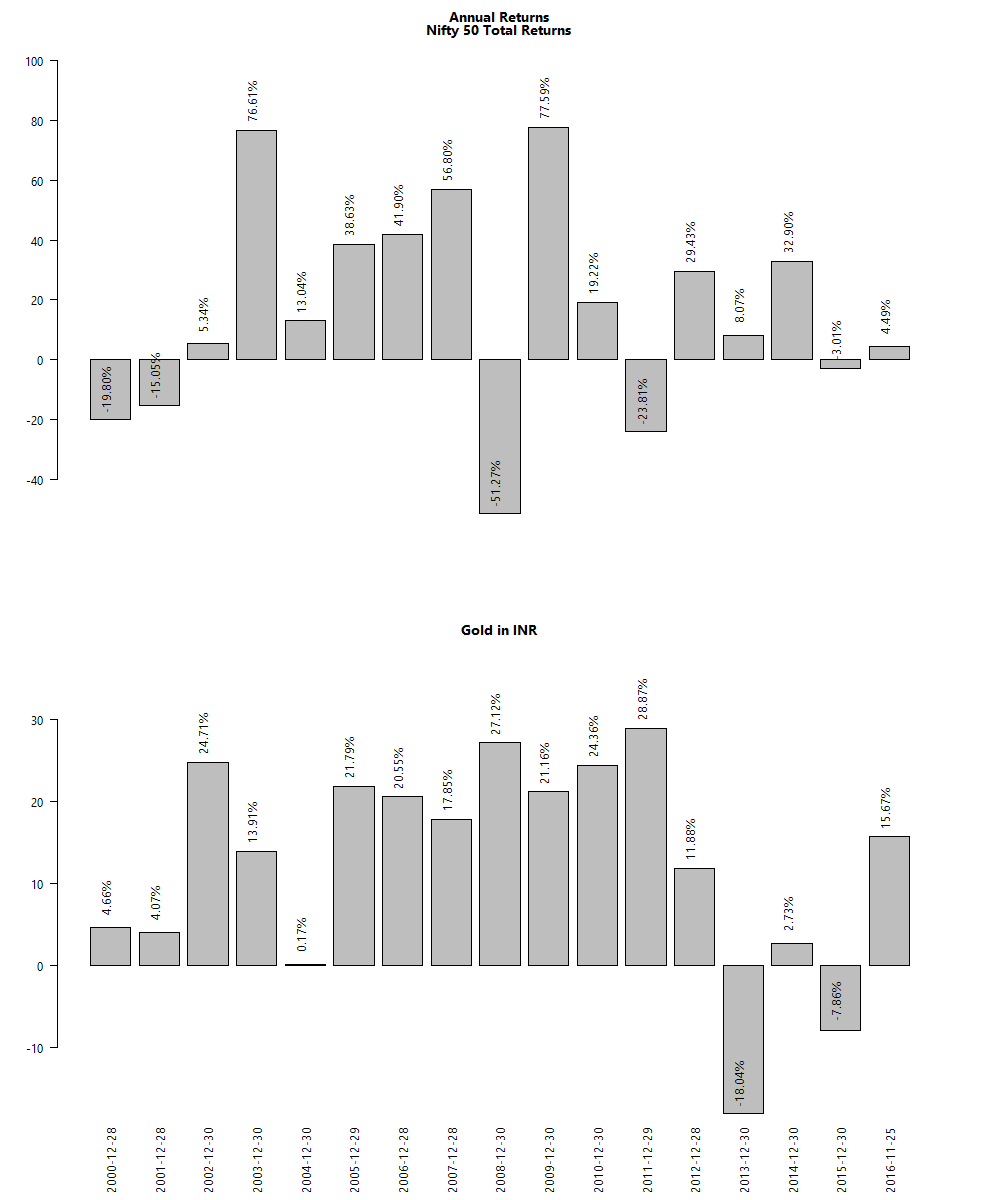

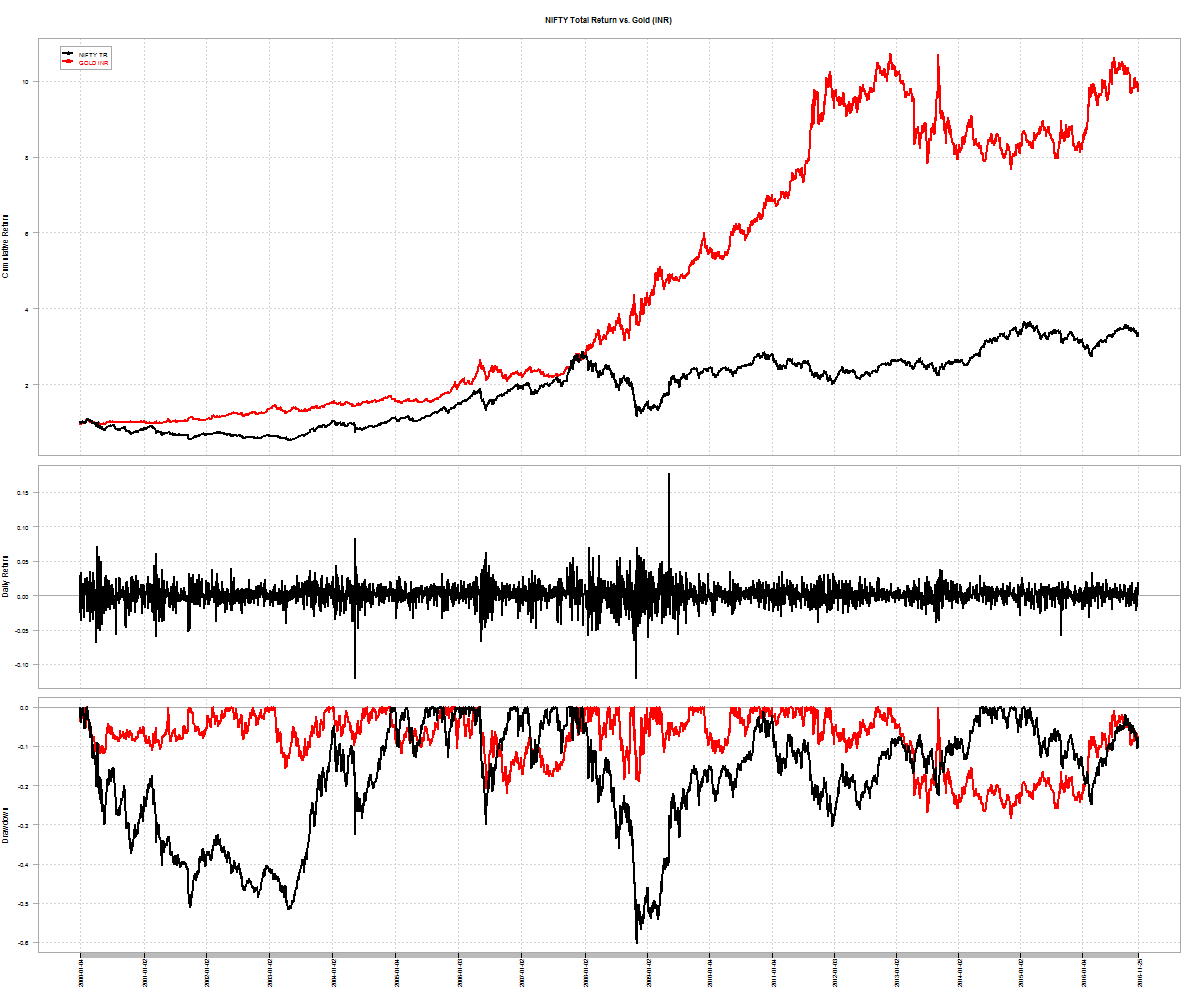

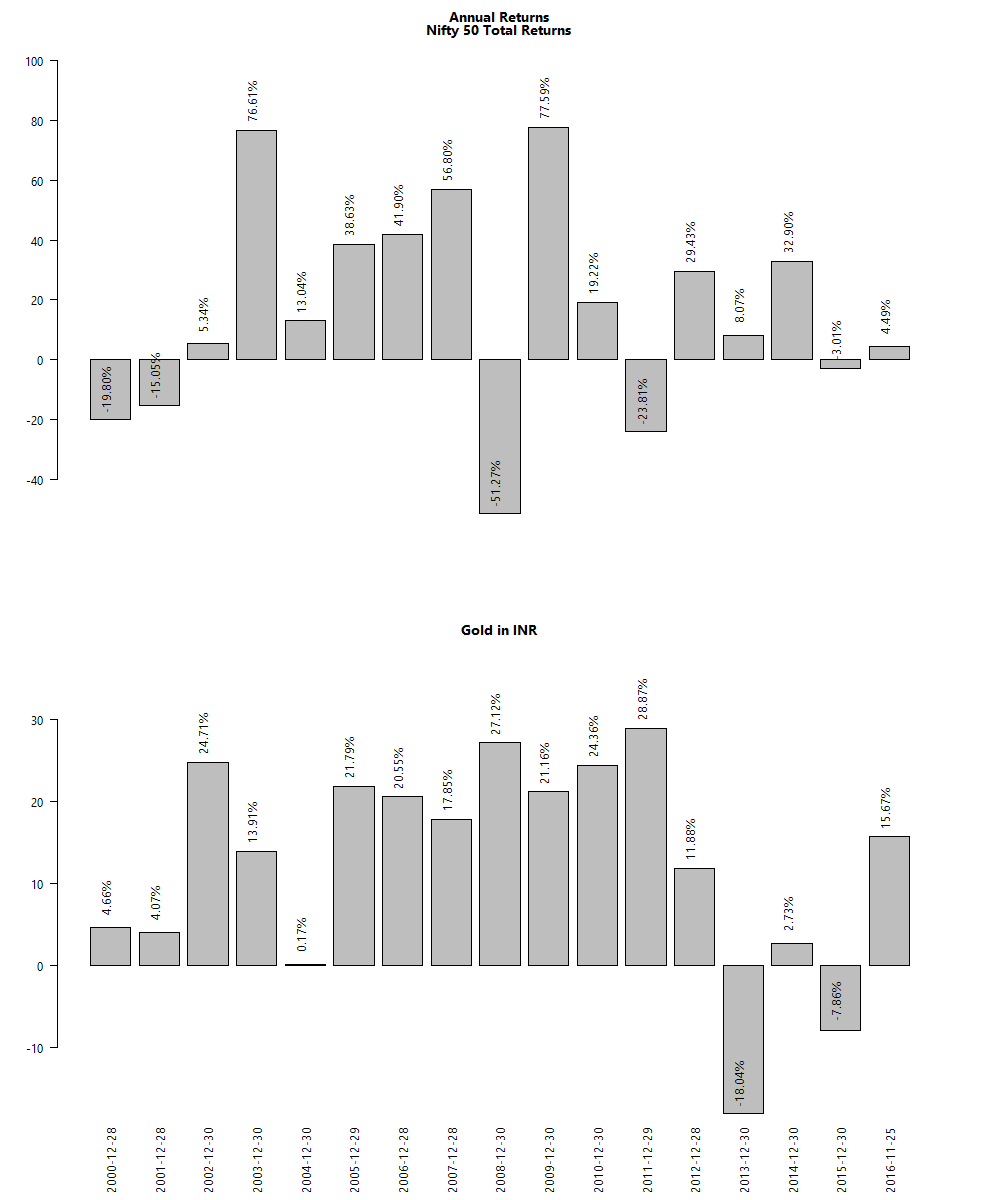

Gold vs. NIFTY50

Since 2000, Rupee-for-rupee, gold had given better returns than the NIFTY 50.

It is only the recent under-performance that has the anti-gold lobby all fired up.

The long arch of the depreciating rupee is a more powerful force than what equity-only investors will have you believe.

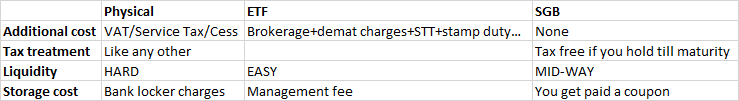

Ways to invest in gold

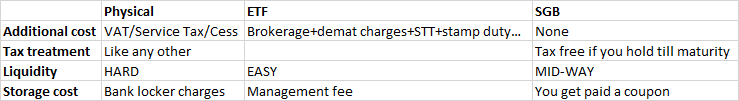

Until recently, the only way to buy gold was to buy physical gold. However that is a very expensive proposition. Then came the gold ETF – GOLDBEES – that allowed investors to hold paper gold in demat form and provided instant liquidity. This year, the government came out with Sovereign Gold Bonds that is pretty good alternative. Here’s a handy table that looks at different aspects:

SGBs not only pay the price of gold at maturity but actually pay the investors an annual coupon. Currently, investors get 2.5% on their investment in SGBs. Contrast this to gold ETFs where investors have to pay asset management fees to the the fund house. From an asset allocation perspective, SGBs are a better deal than Gold ETFs. Go with gold bonds!