This is our monthly update to our continuing coverage of the performance of portfolio management services. Read the first one for an intro.

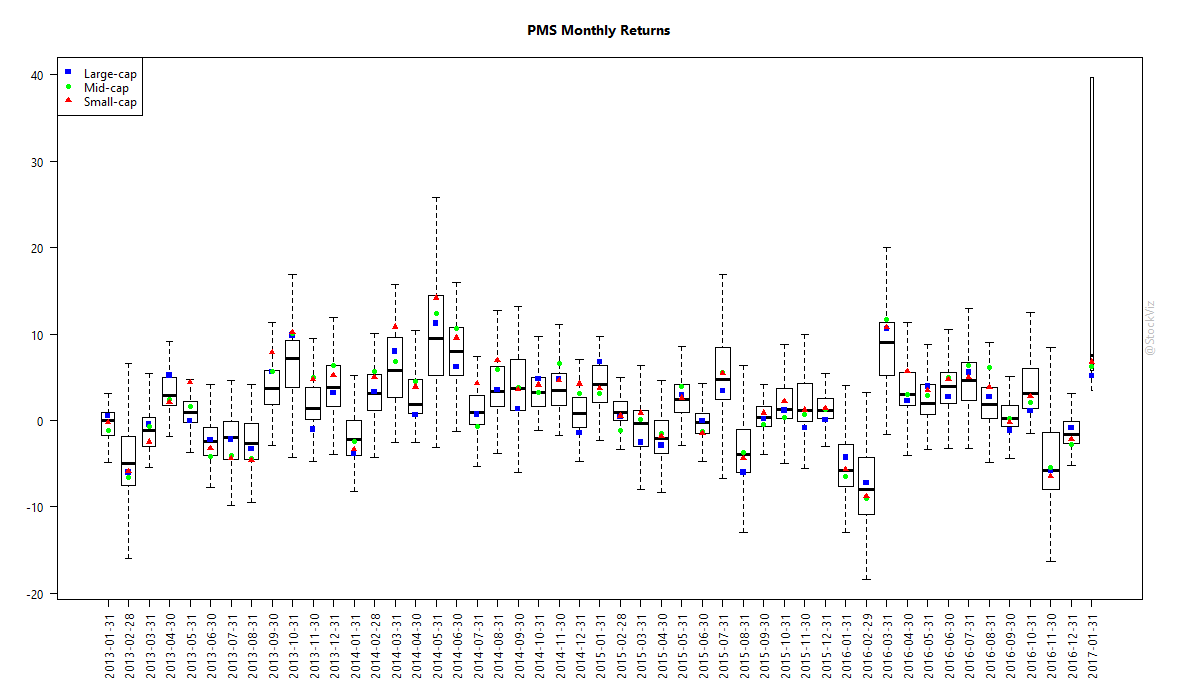

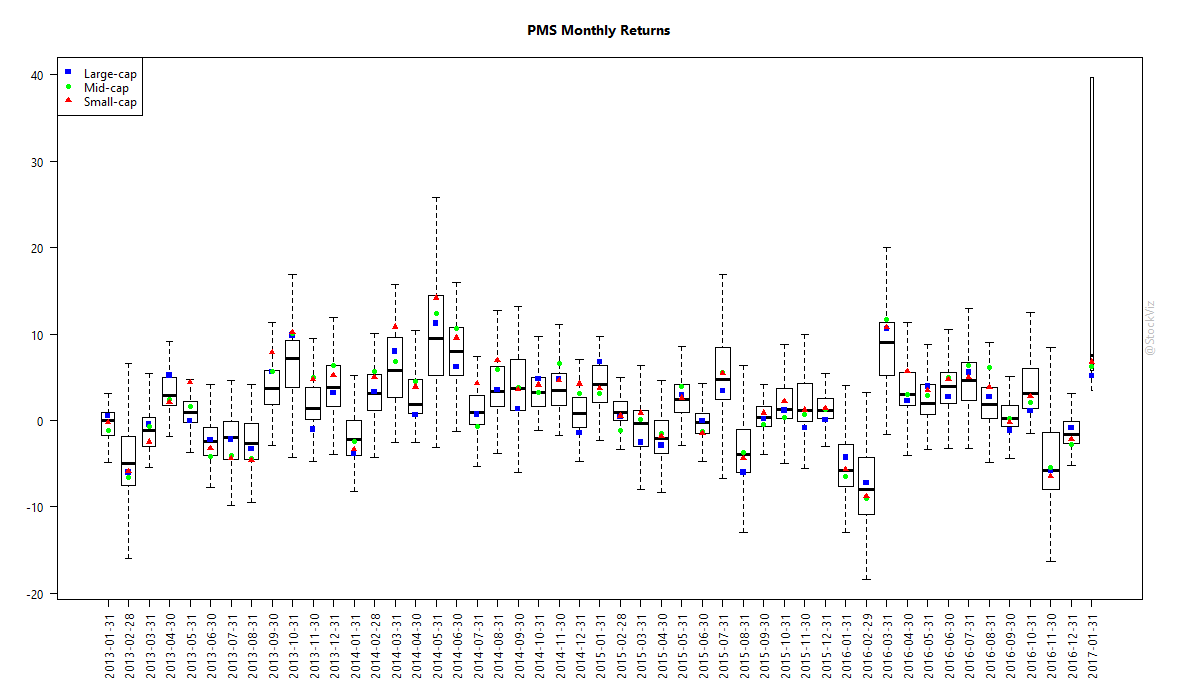

Monthly Performance Diffusion

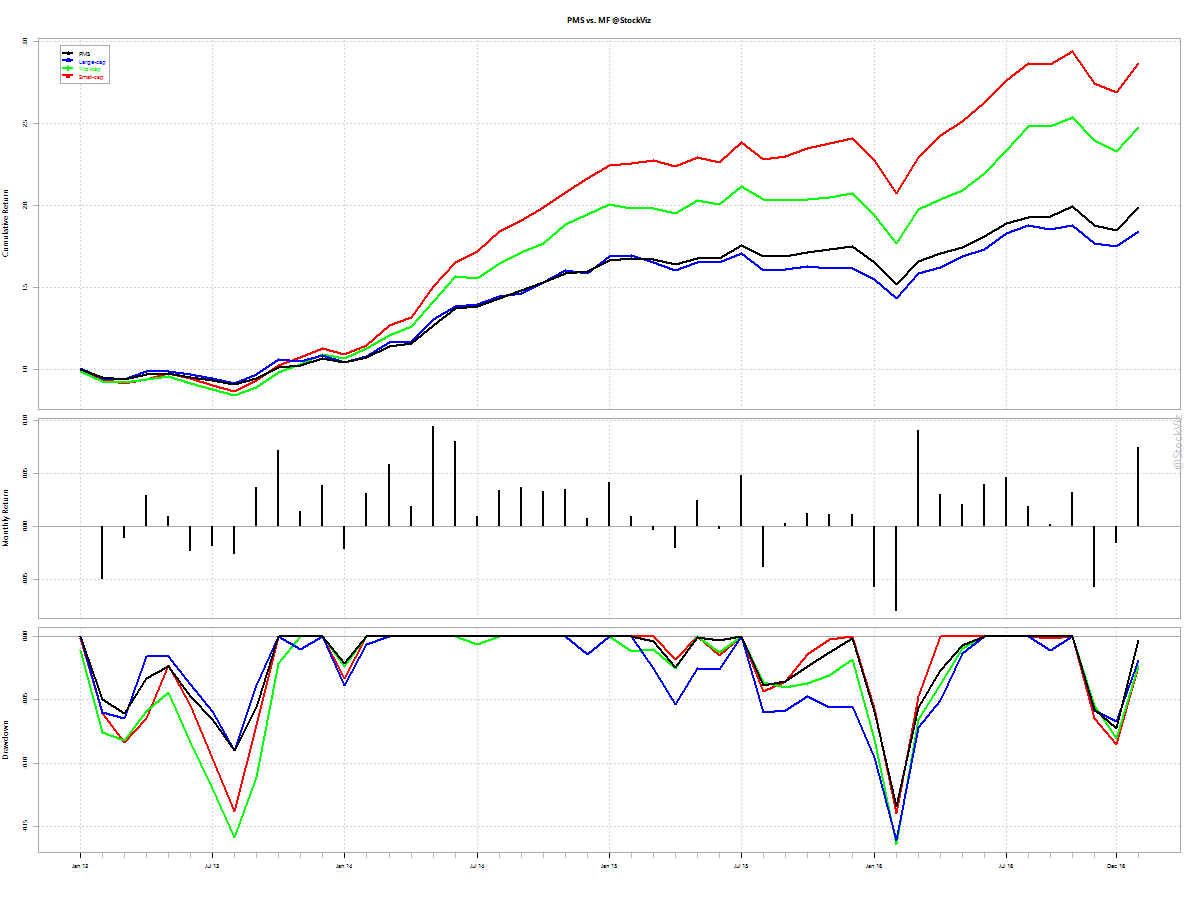

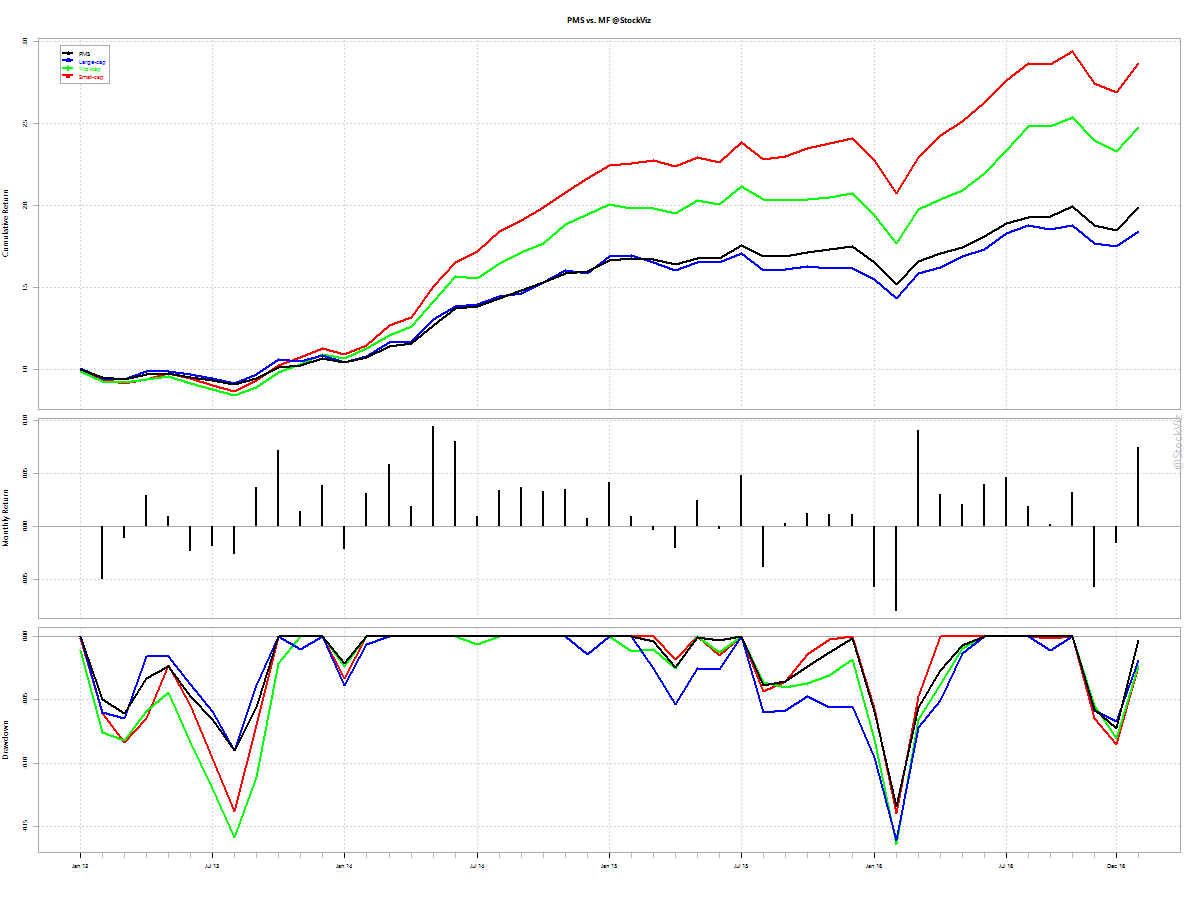

Cumulative Returns

Jan returns are a bit spotty right now. It should be fun…

Invest Without Emotions

This is our monthly update to our continuing coverage of the performance of portfolio management services. Read the first one for an intro.

Jan returns are a bit spotty right now. It should be fun…

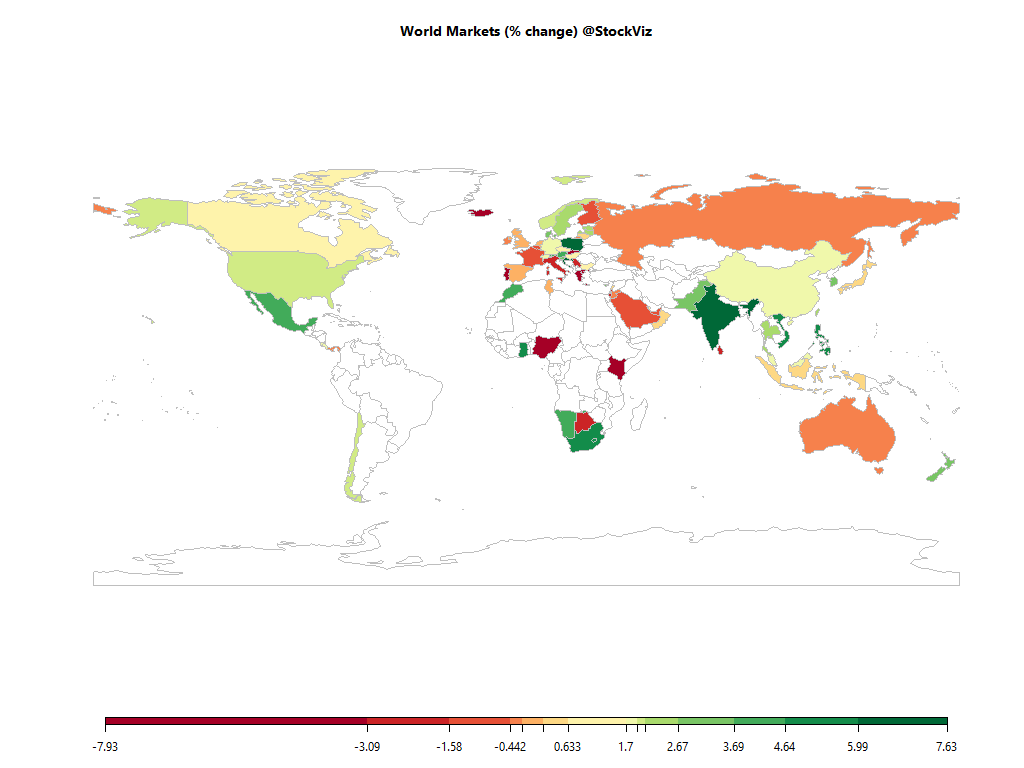

| MINTs | |

|---|---|

| JCI(IDN) | +0.57% |

| INMEX(MEX) | +4.07% |

| NGSEINDX(NGA) | -3.61% |

| XU030(TUR) | +11.21% |

| BRICS | |

|---|---|

| IBOV(BRA) | +8.73% |

| SHCOMP(CHN) | +1.79% |

| NIFTY(IND) | +6.48% |

| INDEXCF(RUS) | -0.23% |

| TOP40(ZAF) | +5.14% |

| Energy | |

|---|---|

| Heating Oil | -3.13% |

| Natural Gas | -14.44% |

| Ethanol | -8.41% |

| RBOB Gasoline | -5.01% |

| Brent Crude Oil | -0.81% |

| WTI Crude Oil | -0.50% |

| Metals | |

|---|---|

| Palladium | +10.95% |

| Platinum | +10.14% |

| Copper | +8.80% |

| Gold 100oz | +4.52% |

| Silver 5000oz | +10.06% |

| MINTs | |

|---|---|

| USDIDR(IDN) | -0.78% |

| USDMXN(MEX) | +0.69% |

| USDNGN(NGA) | +0.21% |

| USDTRY(TUR) | +7.13% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -3.12% |

| USDCNY(CHN) | -0.88% |

| USDINR(IND) | -0.66% |

| USDRUB(RUS) | -1.67% |

| USDZAR(ZAF) | -2.44% |

| Agricultural | |

|---|---|

| Cattle | -3.26% |

| Sugar #11 | +5.09% |

| Wheat | +2.77% |

| White Sugar | +4.07% |

| Coffee (Arabica) | +7.34% |

| Coffee (Robusta) | +3.57% |

| Corn | +2.43% |

| Cotton | +5.27% |

| Orange Juice | -12.48% |

| Soybean Meal | +5.38% |

| Lean Hogs | +5.26% |

| Lumber | +4.30% |

| Cocoa | -2.81% |

| Feeder Cattle | -5.79% |

| Soybeans | +1.84% |

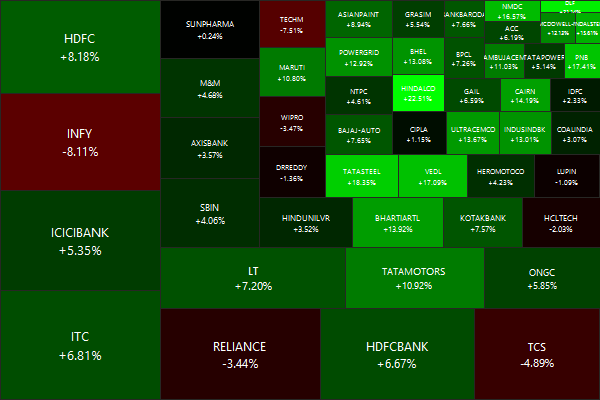

More: Sector Dashboard

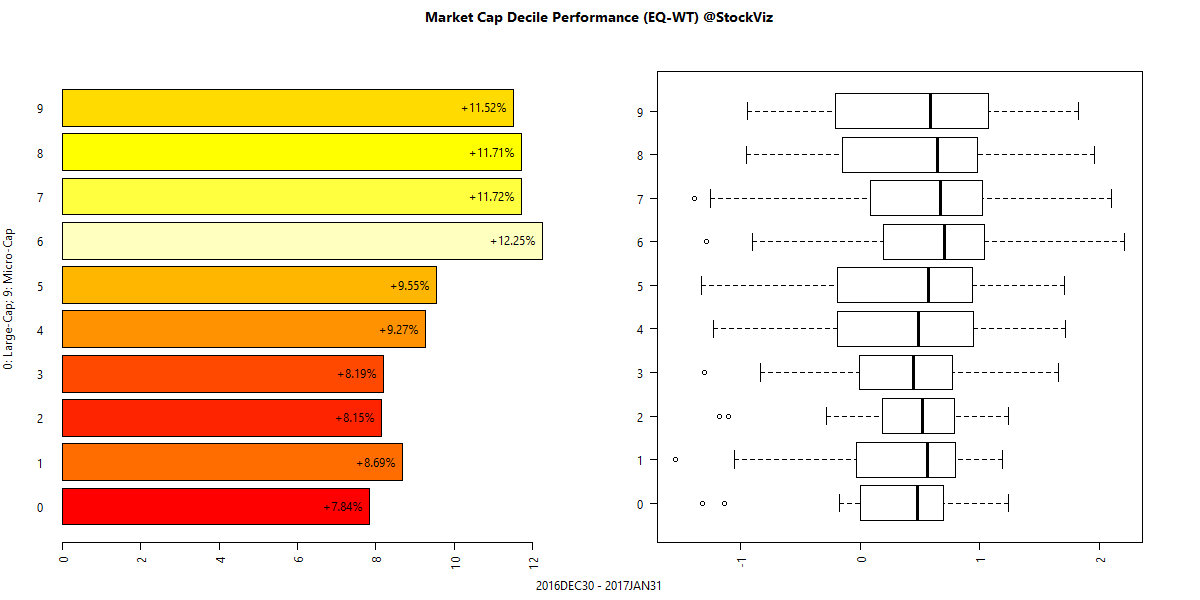

More: Equal-Weight Deciles, Cap-Weight Deciles

| JUNIORBEES | +9.07% |

| INFRABEES | +8.86% |

| BANKBEES | +7.44% |

| PSUBNKBEES | +7.05% |

| CPSEETF | +6.69% |

| NIFTYBEES | +4.48% |

| GOLDBEES | +2.58% |

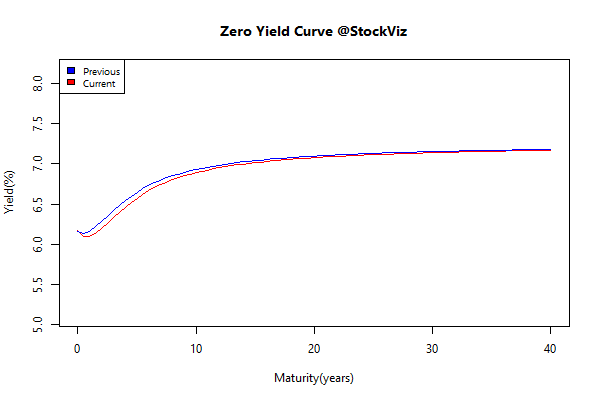

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.07 | +0.74% |

| 5 10 | -0.07 | +0.89% |

| 10 15 | -0.03 | +0.81% |

| 15 20 | +0.00 | +0.58% |

| 20 30 | -0.03 | +0.92% |

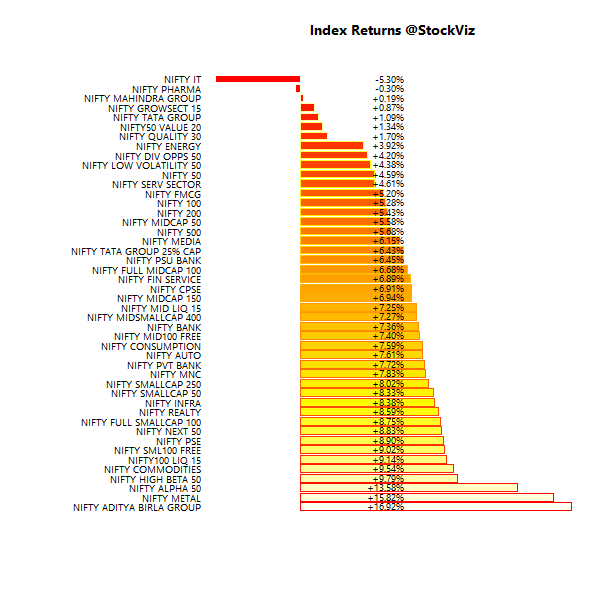

| Momo (Relative) v1.1 | +11.93% |

| Momo (Velocity) v1.0 | +11.40% |

| Velocity | +10.75% |

| Momo (Acceleration) v1.0 | +10.09% |

| HighIR Momentum | +10.01% |

| Enterprise Yield | +9.92% |

| Momentum | +9.76% |

| Value in Flight | +8.53% |

| Acceleration | +7.16% |

| Quality to Price | +7.08% |

| Balance Sheet Strength | +6.58% |

| Magic Formula | +5.31% |

| Financial Strength Value | +4.70% |

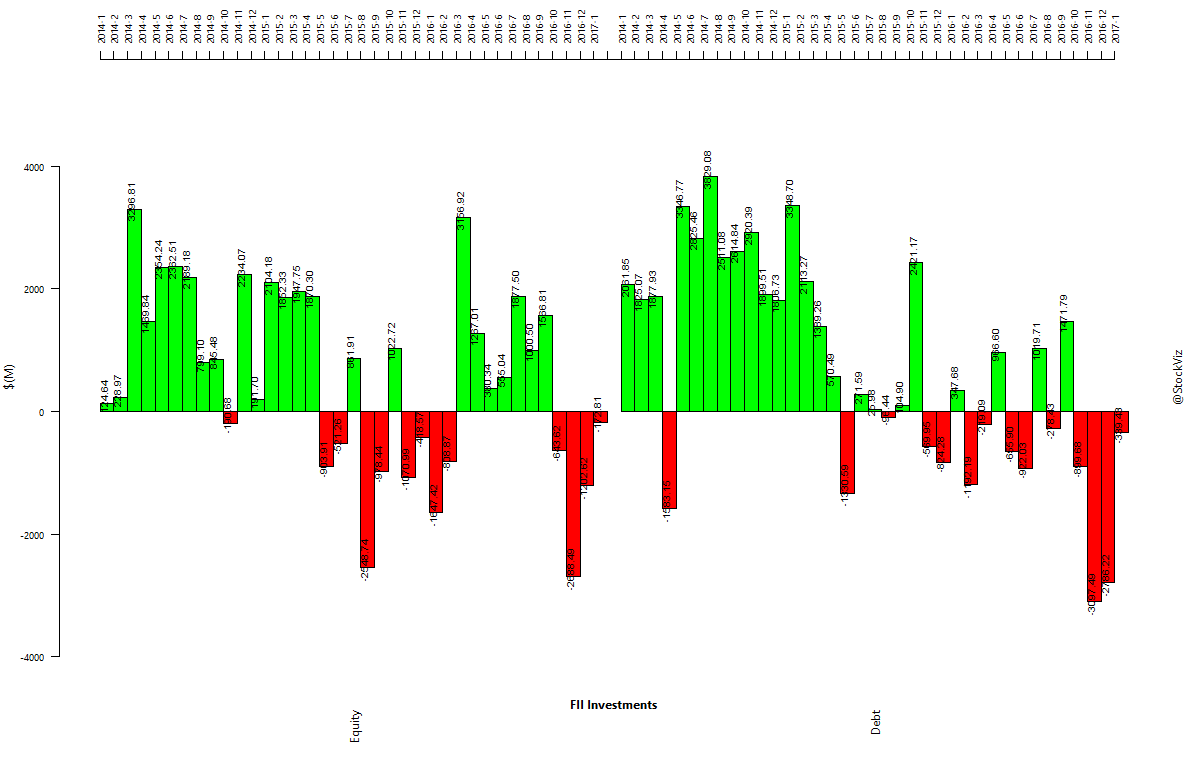

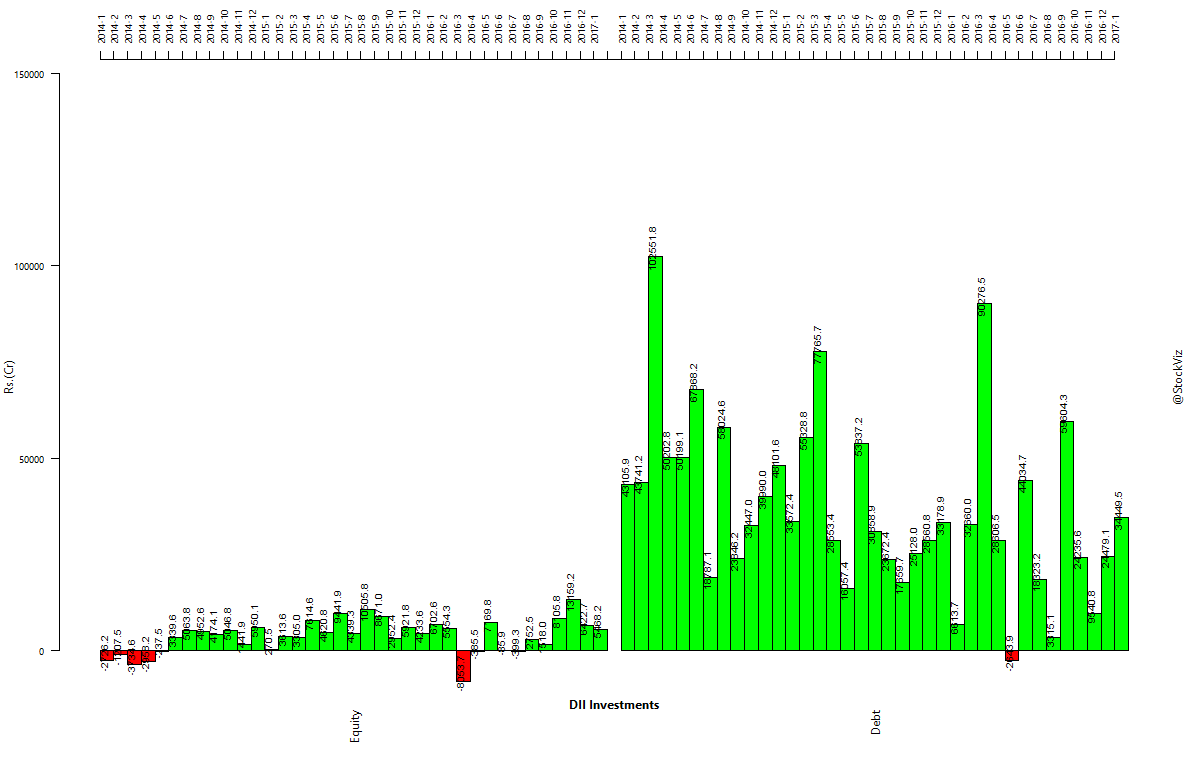

Foreigners sold and domestic investors SIPped…

Boomerang – Travels in the New Third World (Amazon,) is about how the 2008 banking crisis morphed into a sovereign crisis. (Excerpts)

The 2008 Global Financial Crisis established a few things:

This book adds a 5th one to the list: a country’s banking system reflects the society within which it operates. It embodies and amplifies all the cynicism, envy and hypocrisy of its owners, regulators and customers.

After reading this book, I wonder if all banks should be forced to become utilities where the state guarantees a certain return on equity to its shareholders and the banks are allowed to take a narrow set of very specific risks. For example, the regulated power and gas utilities in the US have a guaranteed monopoly status within a region, allowed a fixed maximum return on capital and a highly regulated set of activities.

As usual, Michael Lewis does a good job of presenting his research is easy to digest chunks of wit. Highly recommend that you read the book.

Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry (Amazon,) tells the story of RIM (Research In Motion,) the maker of the once popular Blackberry. (Excerpts.)

The very thing that made you successful has the potential to drag you down if you hold onto it too long. That is the tragic tale of RIM. It slayed established phone makers like Nokia, Siemens and Samsung in the corporate market with its email focused device. And just when it started to focus on the consumer market, it was dealt a body blow by Apple’s iPhone. Then Android came along and finished it off.

The following excerpt succinctly captures the challenge:

The company’s business had been disrupted on several levels, with no obvious path forward. Was RIM supposed to defend the QWERTY keyboard, or jump all-in and become a touch-screen smartphone maker? Was it supposed to challenge Apple at the high end of the smartphone market or focus on the lower end with devices like its Curve and Gemini models, which were driving heady sales gains in foreign markets where Apple wasn’t yet a factor? Should the company stick to its closed, proprietary software technology or open its platform? One of the biggest puzzles was what to do about apps. was RIM taking the right approach or should it stick to its “constructive alignment” narrative and leave the sale of apps to carriers?

It wasn’t that RIM was oblivious of Apple’s and Android’s threat to their handset business. It was that they badly bungled the response. The management was distracted and couldn’t agree on a strategy. However, with the old CEOs out and Prem Watsa’s help, $BBRY plots its next act.

How The Mighty Fall: And Why Some Companies Never Give In (Amazon,) contrasts companies that survive challenges to their business models with companies that failed to respond. (Excerpts.)

Reading Christensen, one can be lead to believe that a company that doesn’t earmark a large R&D budget is doomed to failure. “Disrupt thyself or have it done onto you.” However, Collins presents a long list of well known companies with huge R&D budgets that did not survive. The key take-away for me was:

“Innovation can fuel growth, but frenetic innovation — growth that erodes consistent tactical excellence — can just as easily send a company cascading through the stages of decline… Catastrophic decline can be brought about by driven, intense, hard-working, and creative people.”

It fits into the ROC world-view of the previous book (Outsiders) where CEOs donned the role of hard-headed investors, leading to an ever-growing cash pile. Cash on hand gives you options while dealing with disruptive innovations. The response to disruption need not always be a panicked acquisition or “ignore it and hope that it goes away.” There are other ways in which an incumbent can strike back, existing regulatory frameworks can be used to put up a long and expensive fight and can be a significant source of their competitive advantage. As long as you have cash, you can survive.

At the same time, where Outsiders’ CEOs were brutal in cutting out businesses that they thought were ‘dogs’, Collins takes a mellower approach: “A core business that meets a fundamental human need — and one at which you’ve become best in the world — rarely becomes obsolete.” But it does: the newspaper business in the US is a recent example (buggy whips, chimney cleaning…) Knowing when to cut your losses is a big part of running a successful business.

The book provides a useful template to identify companies in decline and it is worthwhile reading it for that alone. However, I disagree with its principal worldview that the primary/core business is always worth saving. Sometimes it is not.