A wise man once said, the decision to go passive is a very active one.

At first, going passive meant buying and holding a broad-based index fund. But that was over 40 years ago. Since then, in the US, the market has evolved and the number of indices, index funds and ETFs have exploded. Think of a theme, strategy, asset class, market or geography, there is an ETF for that.

As of today, there are 2,319 ETFs in the US. And given the intense competition over the last decade, fees have been driven to single-digit basis-points in most cases. Given this fee pressure, US based issuers looked east and landed on Europe a couple of years ago. And there too, competition quickly reduced fees and expanded access.

The next big virgin market is India.

Given this back drop and the small but increasing interest in passive indexing, if a DIY investor wishes to just buy and hold a market-cap based index, which one should she buy?

The most practical choices boil down to NIFTY 50, NIFTY NEXT 50 (collectively forming the NIFTY 100) and the NIFTY 500 indices.

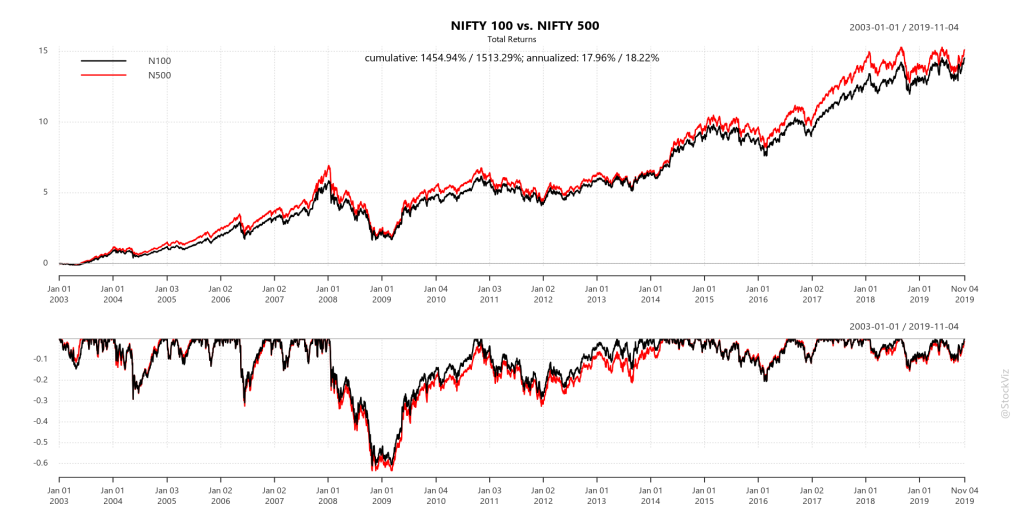

Given the fee differentials between the NIFTY 100 and NIFTY 500 based ETFs/funds, the big question to ask is: Is there any advantage of reaching below the 100 mark? Is 100 enough?

Market-caps follow a power-law. For NIFTY 100, 80% of the index is covered by the top 35 stocks and for NIFTY 500, the number is 82. So unless the rest of the stocks in the index deviate to an extreme degree in terms of total returns (change in price + dividends,) the top 35/80 stocks power most of the returns.

So, the answer is No. Unless NIFTY 500 based ETFs/funds achieve fee and liquidity parity with the NIFTY 100 based ones, investors are not missing out on anything by sticking with the mega-caps.