No.

Mutual fund conviction buys

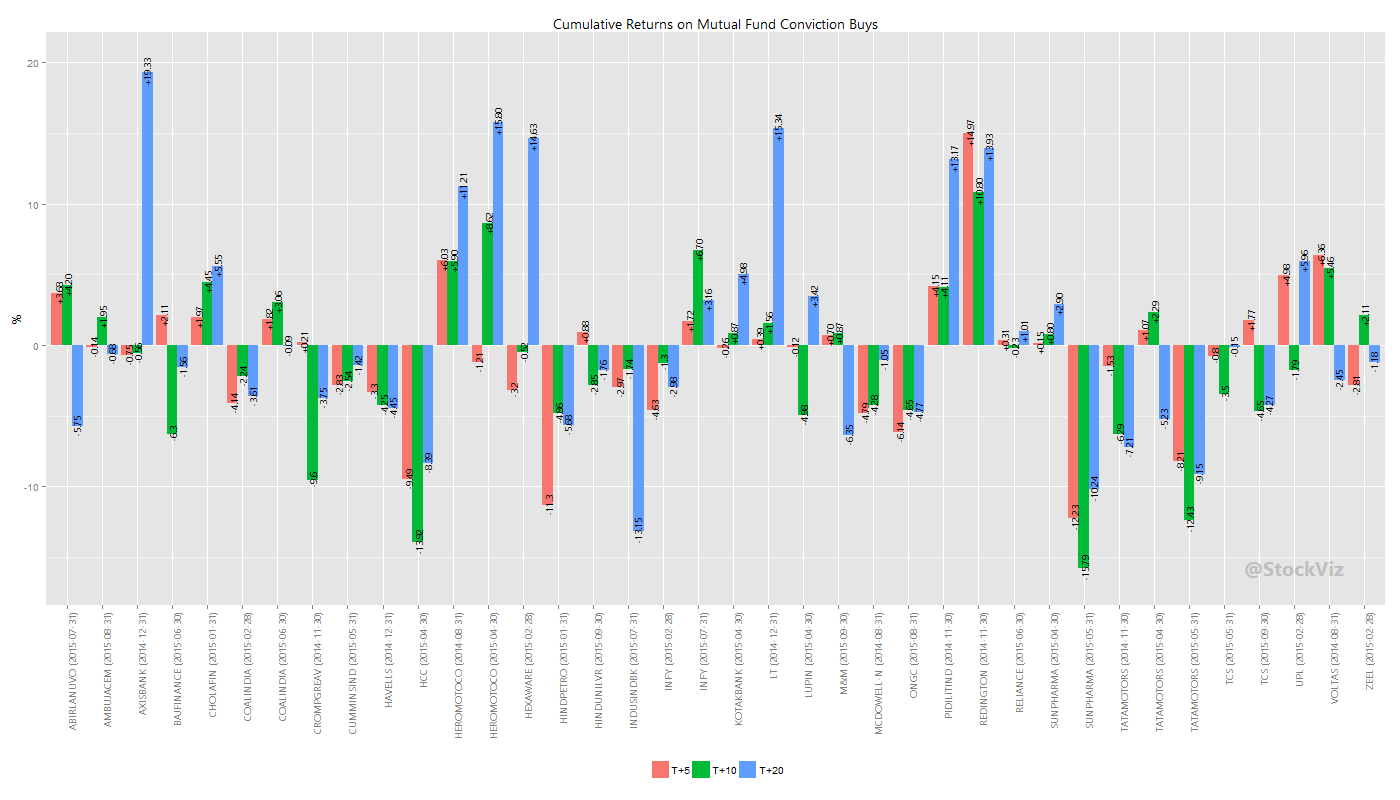

Every month, mutual funds disclose their portfolios and investors go to work on them to find investment ideas. But should they? Tracking their conviction buys – stocks that are new additions to their portfolios – tell a different story.

Median T+5, T+10 and T+20 returns were -0.13%, -0.93% and -1.3%

You were actually worse off following them if you were looking for a quick trade.

Does this mean fund managers miss the mark?

No. Their reason for buying a stock makes sense for the strategy and portfolio that they are running. Their time horizon extends beyond 20-days. Using their actions to guide your trading decisions is what misses the mark.

How is this data useful?

This is basically a negative result. The next time some fund manager is asked what he is buying on TV or you come across a media item that lists the most bought stocks, curb your instinct to go out and buy them.

If you really like what a fund manager is doing with his portfolio, it is cheaper to buy his fund rather than trying to do it yourself.

Related:

Mutual Fund Exposure of Stocks

Mutual Fund Portfolio Disclosures