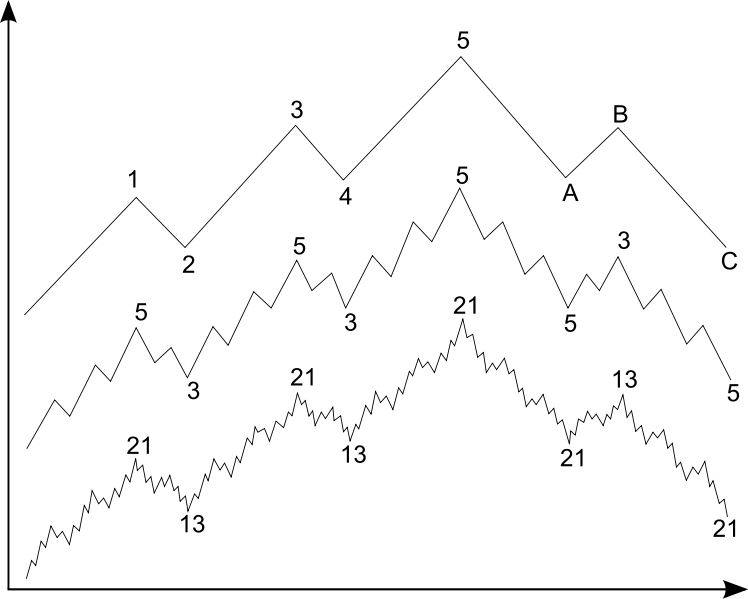

The Elliot Wave Principal: Stock market averages rise in 5 ‘waves’ and fall in 3 ‘waves’

The Elliot Wave Principal: Stock market averages rise in 5 ‘waves’ and fall in 3 ‘waves’

The Elliot Wave Principal (EWP) has a strong following amongst technical traders. However, nobody, including Elliot himself, has been able to explain why it works and remains an extraordinarily complex system to apply.

EWP applies to all degrees of price movements. In a 5-3 bull/bear cycle, the first 5 waves themselves are composed of smaller 5-3 bull/bear cycles, etc. So each 5-3 cycle is actually part of a larger, higher-degree cycle.

Indications

The emergence of a 5-wave impulse pattern, either upwards or downwards, indicates the direction of the long-term trend. A rising 5-wave pattern after a sharp fall would indicate further rises, while a falling 5-wave pattern after a sharp rise would indicate further loses.

Within each 5-wave movement:

- Wave 4 will not penetrate below the peak of wave 2.

- Wave 3 is often the longest, but never the shortest of the 5 waves the constitute the whole movement

- Two of the three waves will be of equal length.

Within each 3-wave movement:

- No ABC formation will ever fully retrace the preceding 5-wave formation of the same degree.

- Each correction will be at least as large and as long as all lower degree corrections that preceded it.

- Each correction tends to return to the price range spanned by a corrective wave of one degree lower (i.e., either to wave 2 or 4)

There are some variations that exist

- Failures and extensions of the 5th wave

- Diagonal triangles of the 5th wave

- The three-phase A wave during corrections

Combined with the variations, the EWP covers the complete catalogue of price movements.

This is one of a series of posts reviewing The Psychology of Technical Analysis by Tony Plummer.