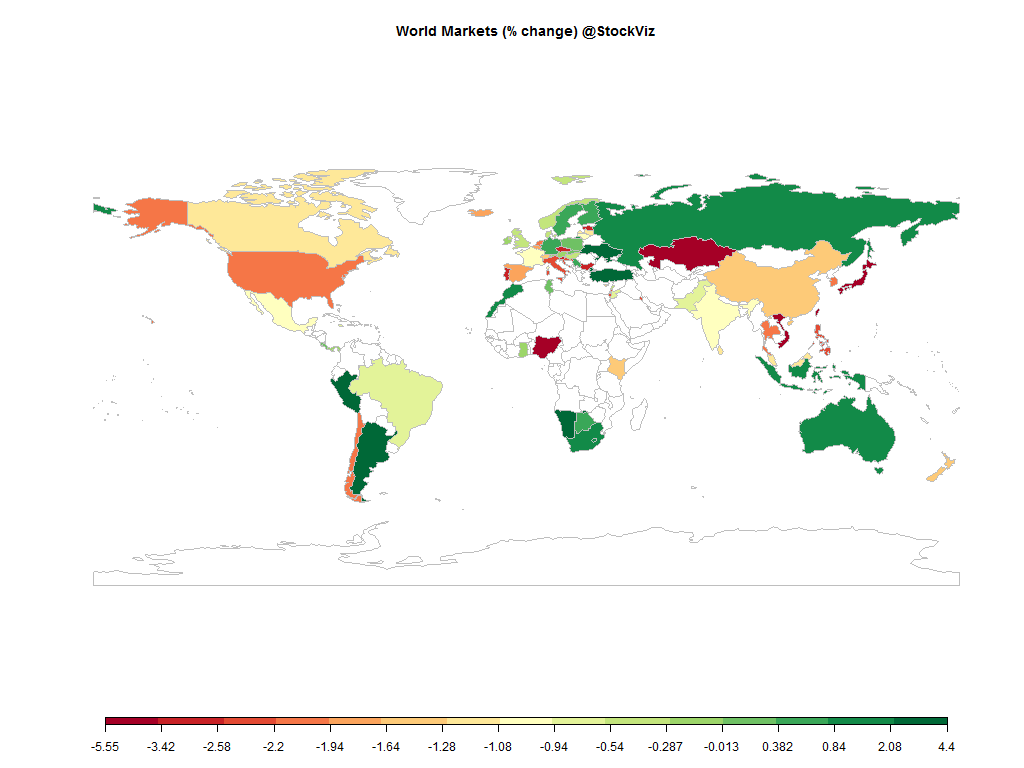

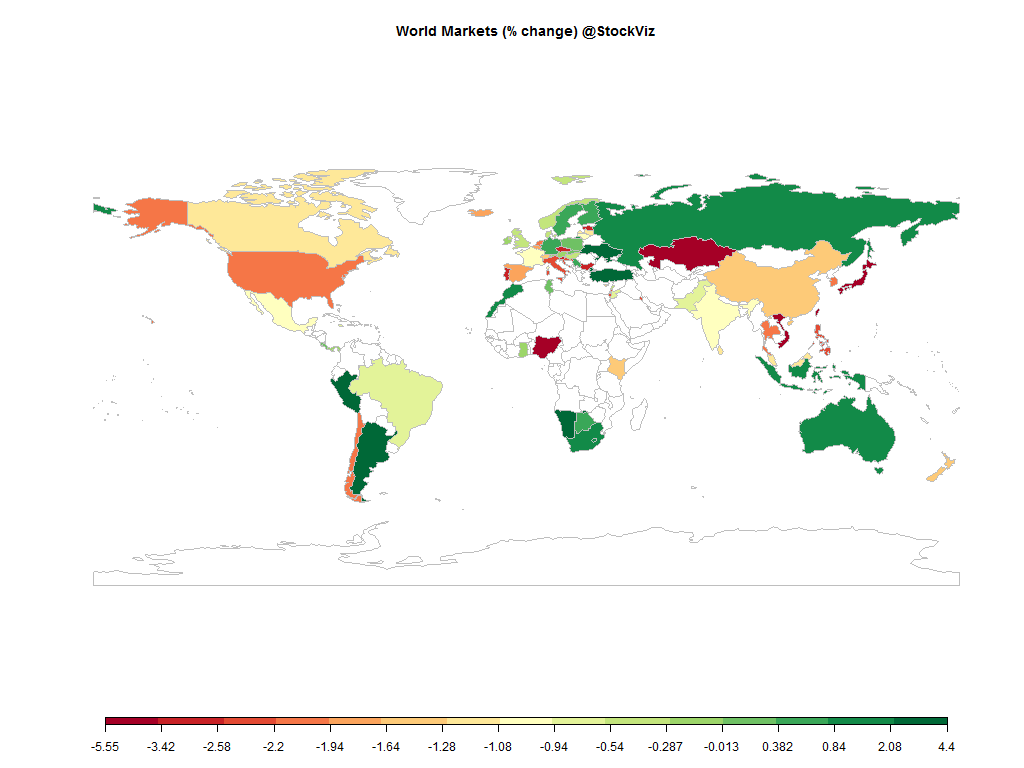

Equities

Commodities

| Energy |

| Brent Crude Oil |

-4.30% |

| Ethanol |

+9.65% |

| Heating Oil |

-2.29% |

| Natural Gas |

-2.44% |

| RBOB Gasoline |

-0.99% |

| WTI Crude Oil |

-3.31% |

| Metals |

| Copper |

-0.99% |

| Gold 100oz |

+1.32% |

| Palladium |

-3.78% |

| Platinum |

+0.05% |

| Silver 5000oz |

+0.58% |

| Agricultural |

| Cattle |

-0.10% |

| Cocoa |

-0.97% |

| Coffee (Arabica) |

-5.03% |

| Coffee (Robusta) |

-2.13% |

| Corn |

+3.96% |

| Cotton |

-1.90% |

| Feeder Cattle |

-0.85% |

| Lean Hogs |

-17.59% |

| Lumber |

-2.48% |

| Orange Juice |

-2.49% |

| Soybean Meal |

-2.28% |

| Soybeans |

+2.92% |

| Sugar #11 |

+0.24% |

| Wheat |

+3.36% |

| White Sugar |

+1.00% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-1.19% |

| Markit CDX NA HY |

-1.17% |

| Markit CDX NA IG |

+4.11% |

| Markit CDX NA IG HVOL |

+15.62% |

| Markit iTraxx Asia ex-Japan IG |

+7.44% |

| Markit iTraxx Australia |

+6.28% |

| Markit iTraxx Europe |

+8.22% |

| Markit iTraxx Europe Crossover |

+47.19% |

| Markit iTraxx Japan |

+6.47% |

| Markit iTraxx SovX Western Europe |

+1.20% |

| Markit LCDX (Loan CDS) |

-0.40% |

| Markit MCDX (Municipal CDS) |

+2.31% |

Markets were in full-blown panic mode this week. So much so that the president of the St. Louis Fed, James Bullard, a hawk, had to come out and

say that central-bank bond buying should continue beyond its scheduled end this month. And the chief economist at the Bank of England, Andrew Haldane,

said “interest rates could remain lower for longer.” Previously, UK interest rates had been expected to rise early next year.

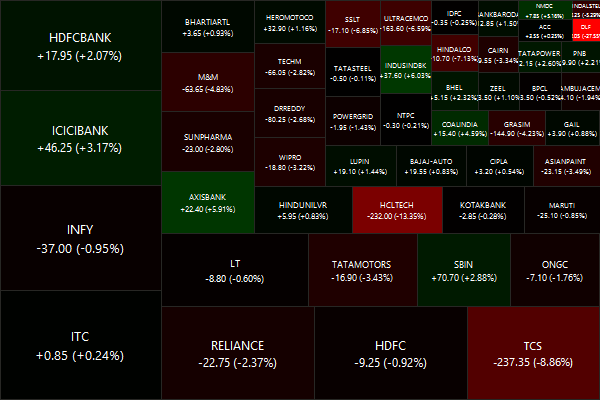

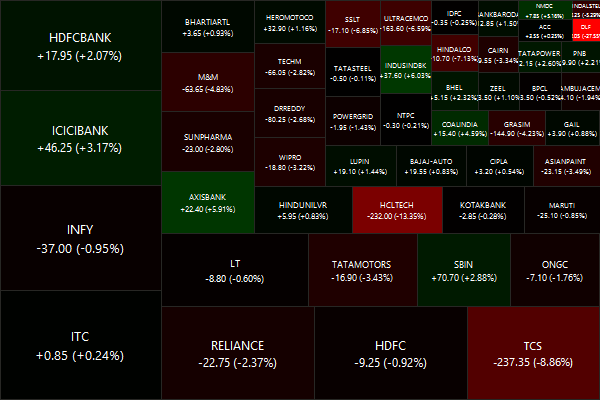

Nifty Heatmap

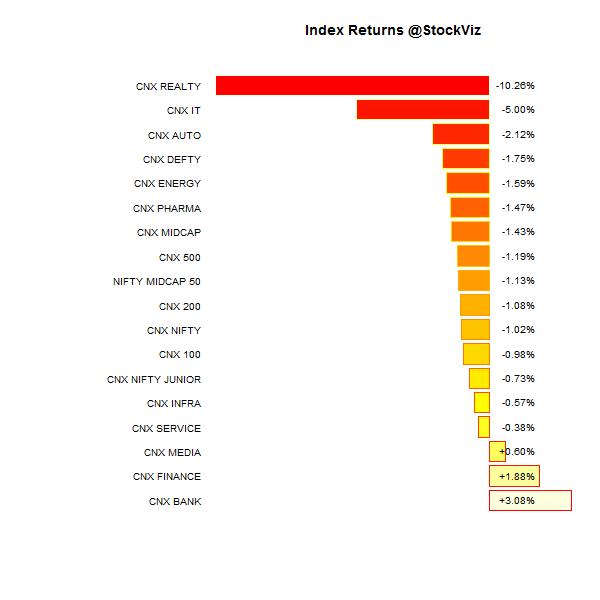

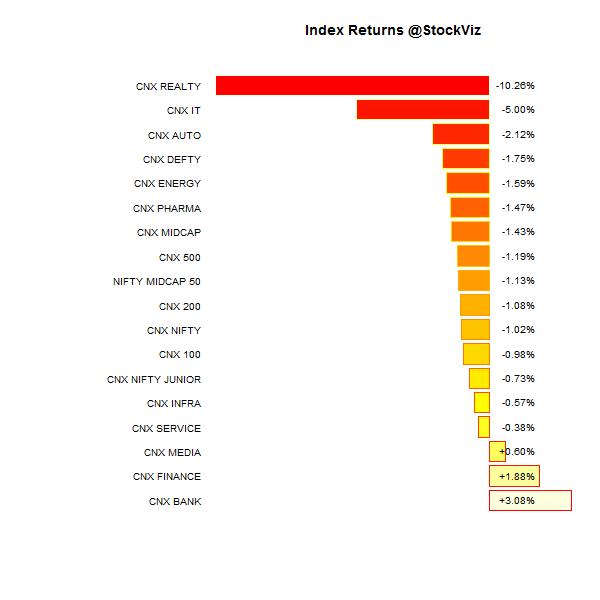

Index Returns

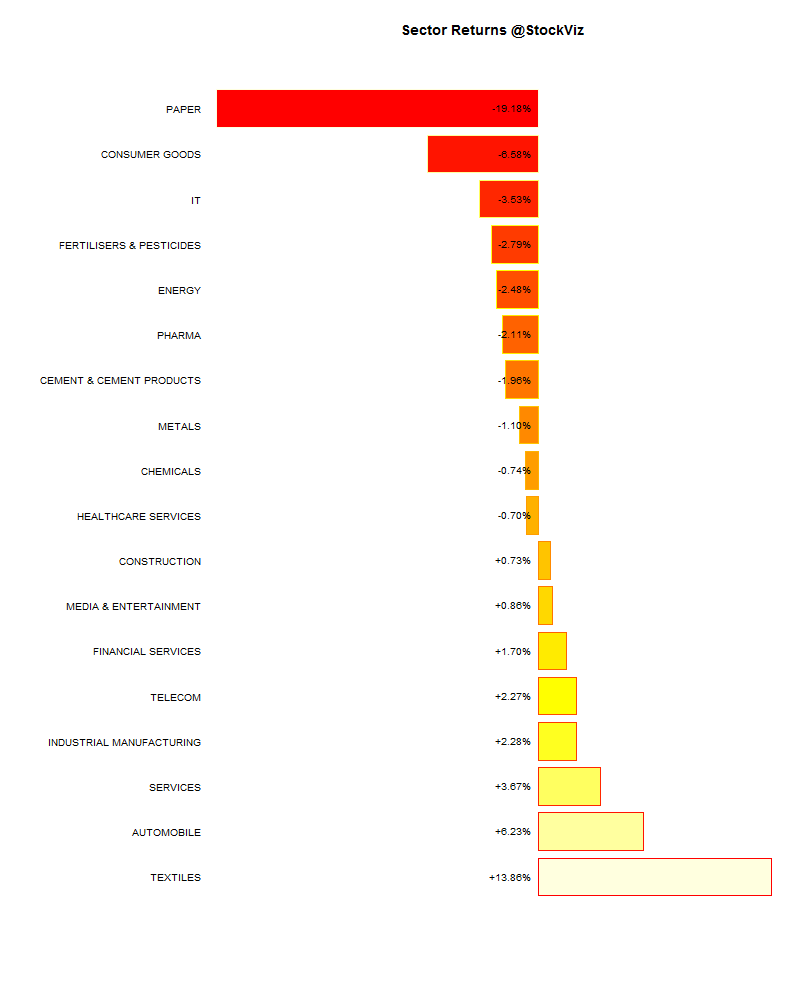

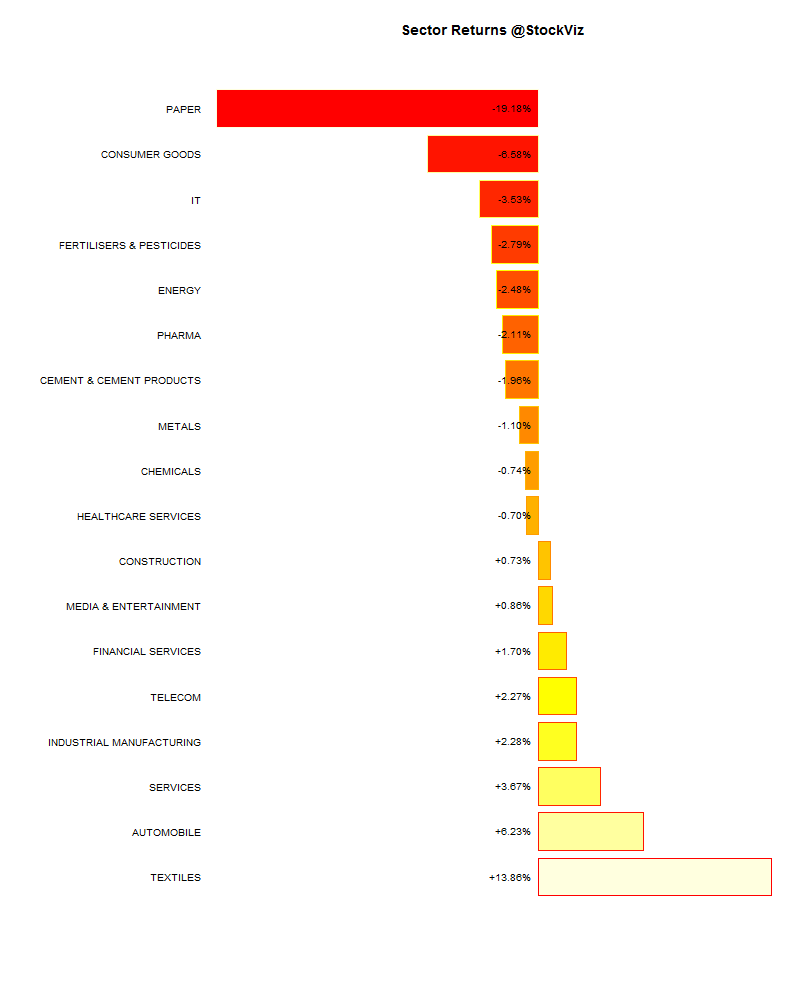

Sector Performance

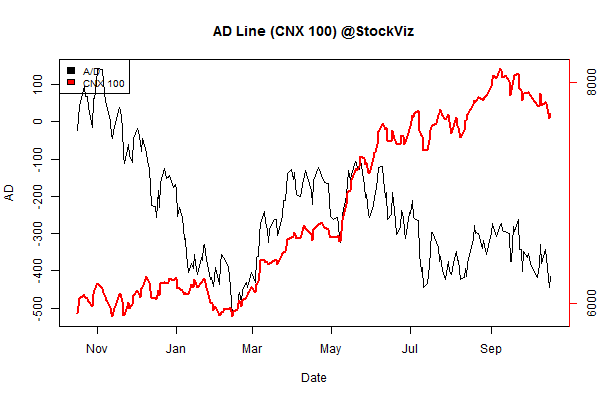

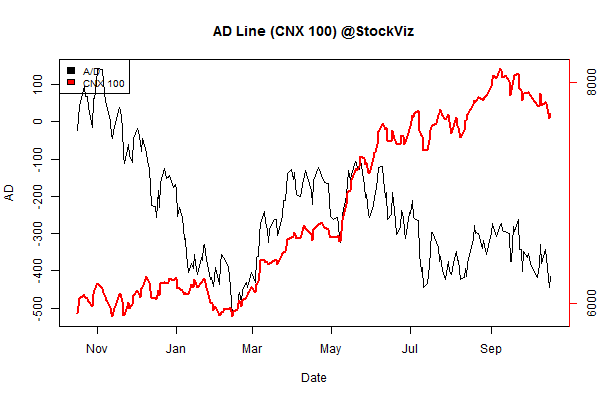

Advance Decline

Market cap decile performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-9.23% |

70/65 |

| 2 |

-3.31% |

56/79 |

| 3 |

-3.21% |

58/78 |

| 4 |

-2.90% |

59/75 |

| 5 |

-3.38% |

58/77 |

| 6 |

-2.42% |

60/75 |

| 7 |

-3.11% |

59/77 |

| 8 |

-1.58% |

61/73 |

| 9 |

-2.56% |

71/64 |

| 10 (mega) |

-0.98% |

67/69 |

A total bloodbath beyond the mega-caps.

Top winners and losers

Are rate-cut expectations running ahead of themselves? Rally in banking and home-finance stocks feel a bit overdone. TCS and HCLTECH sold off on earnings. But read

this. DLF got royally fcuked by the SEBI.

ETFs

A surprising rally in banks while infrastructure remains sick…

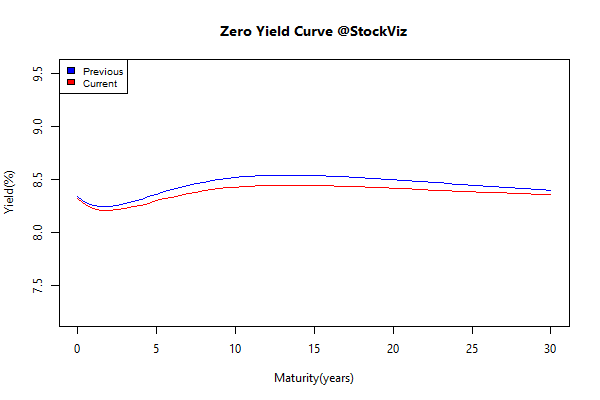

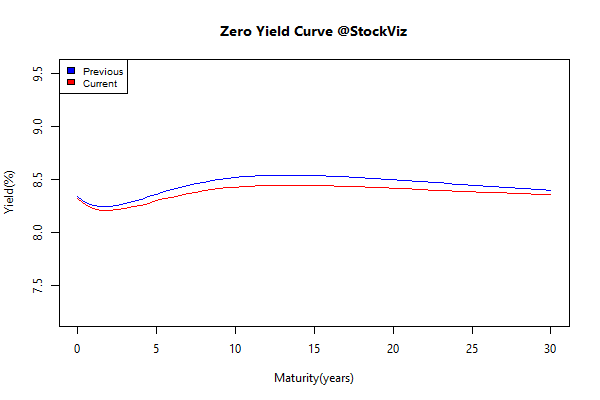

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.29 |

+0.24% |

| GSEC SUB 1-3 |

-0.65 |

-0.25% |

| GSEC SUB 3-8 |

+0.01 |

-0.59% |

| GSEC SUB 8 |

+0.03 |

+0.11% |

Curve can’t get any flatter…

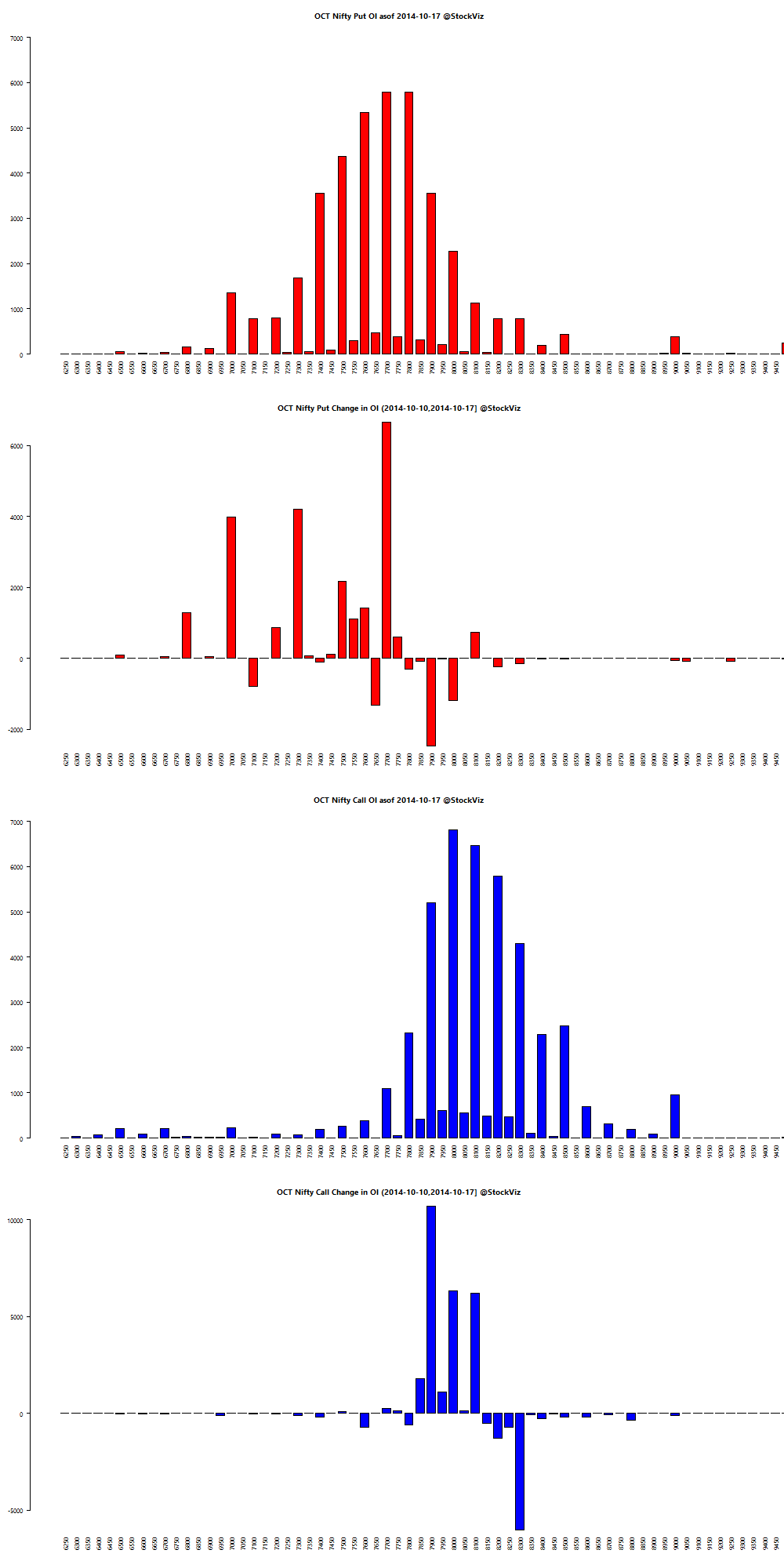

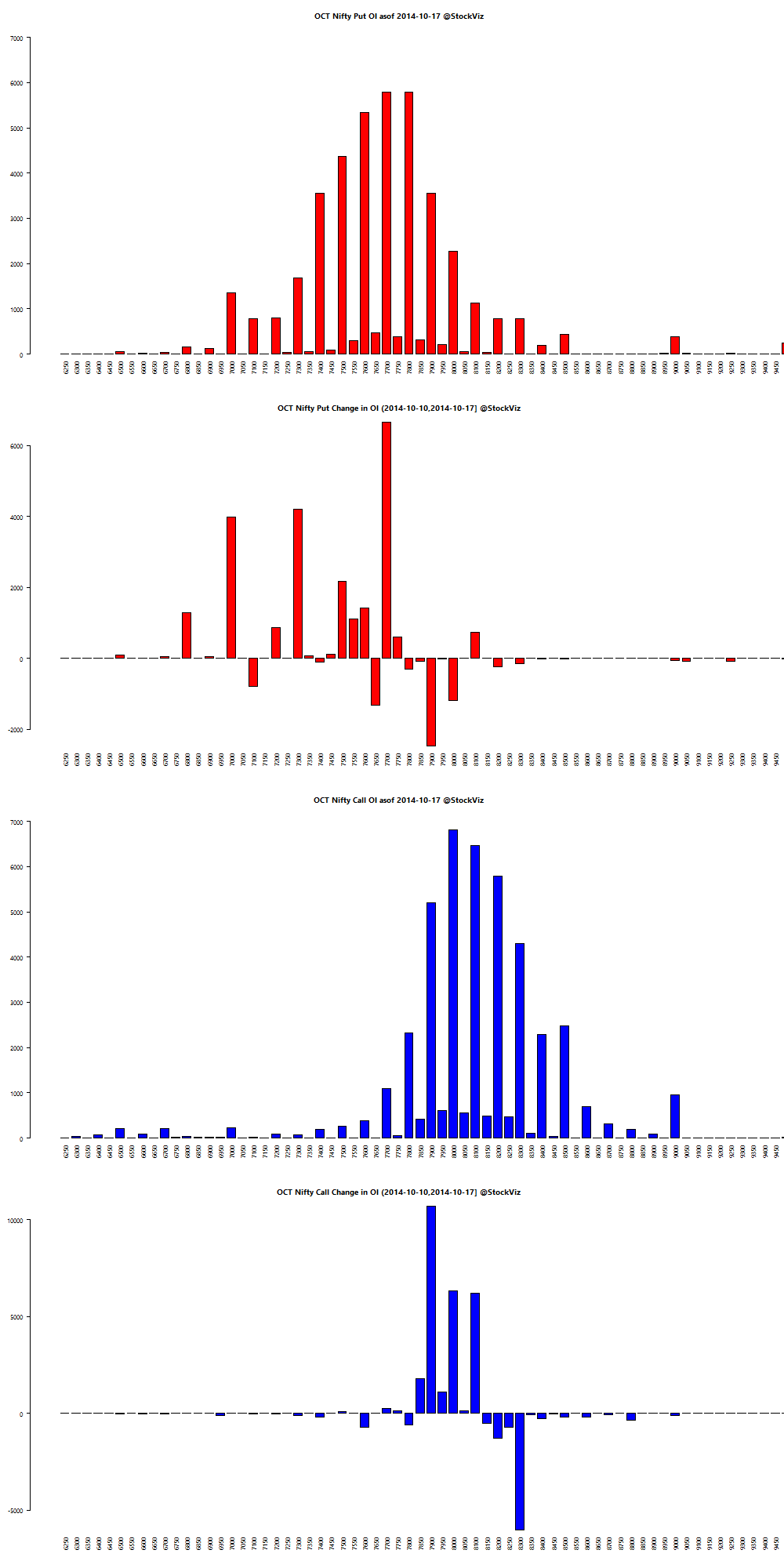

Nifty OI

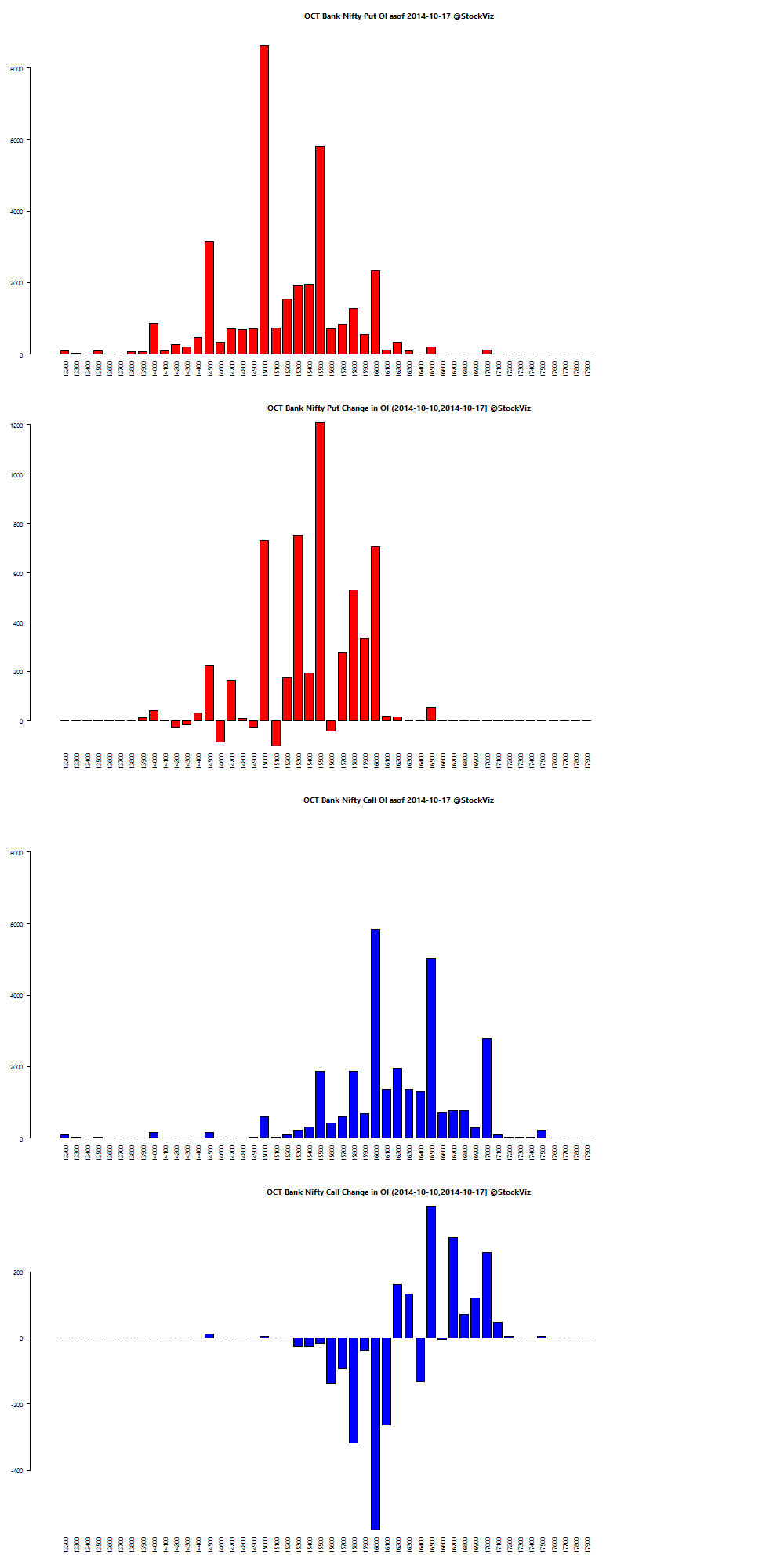

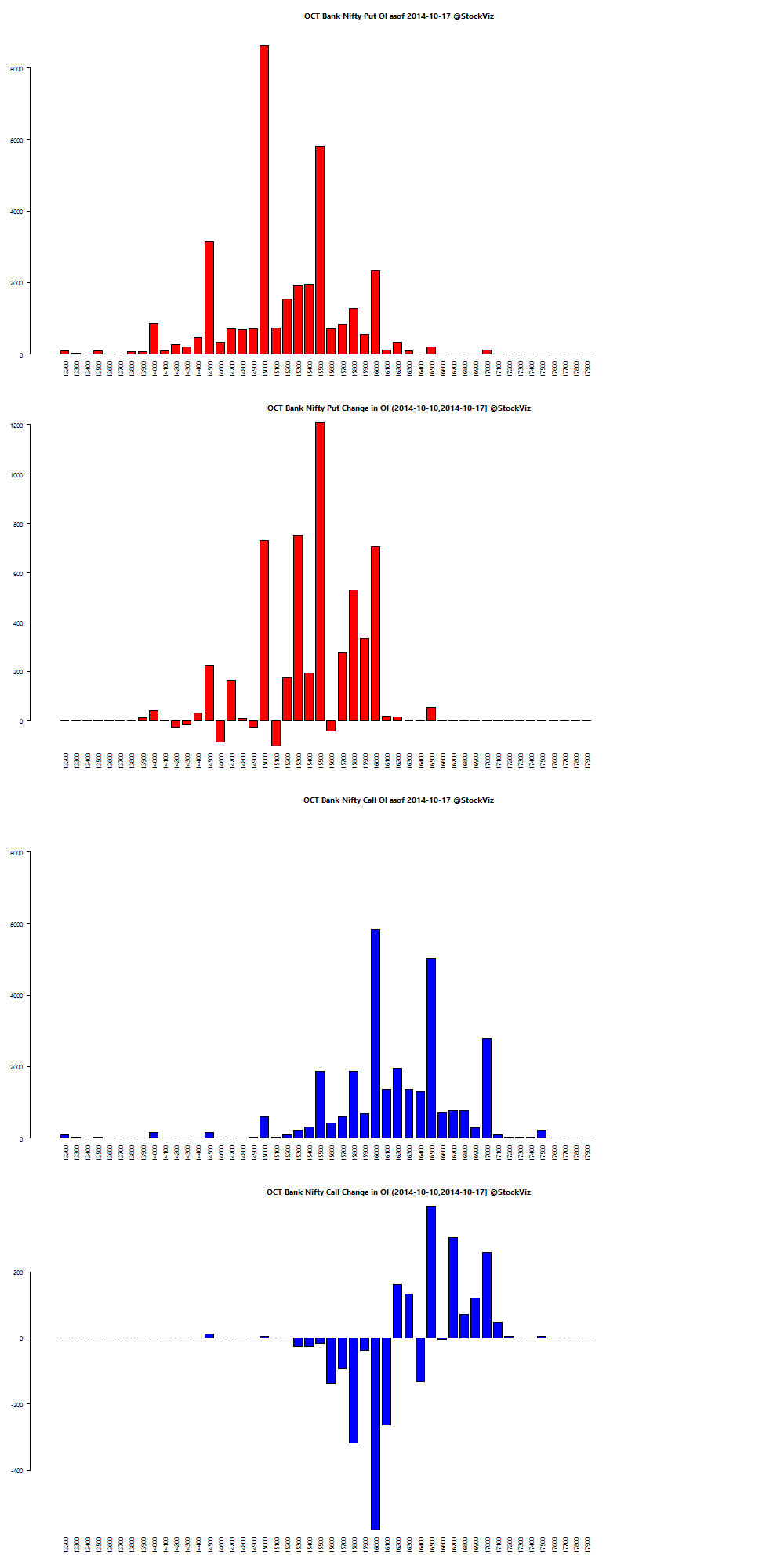

Bank Nifty OI

Theme Performance

The CNX 100 Tactical Theme spent the whole week in cash. Both value and momentum strategies got pummeled.

Thought for the weekend

Fearing the future is natural, as is the conviction that ultimately we each must depend on ourselves. But in truth, our safest asset is our collective prosperity. Technological progress and productivity gains continue to make us richer on the supply side.

It would be tragic if productivity gains end up making most of us poorer, just because we find it uncomfortable to face the euthanasia of the rentier.

Source: safe assets, secular stagnation, and financial repression