We defined the spread between a pair to be:

spread = A – βB

where A and B are prices and β is the first regression coefficient.

The β is also known as the hedge ratio.

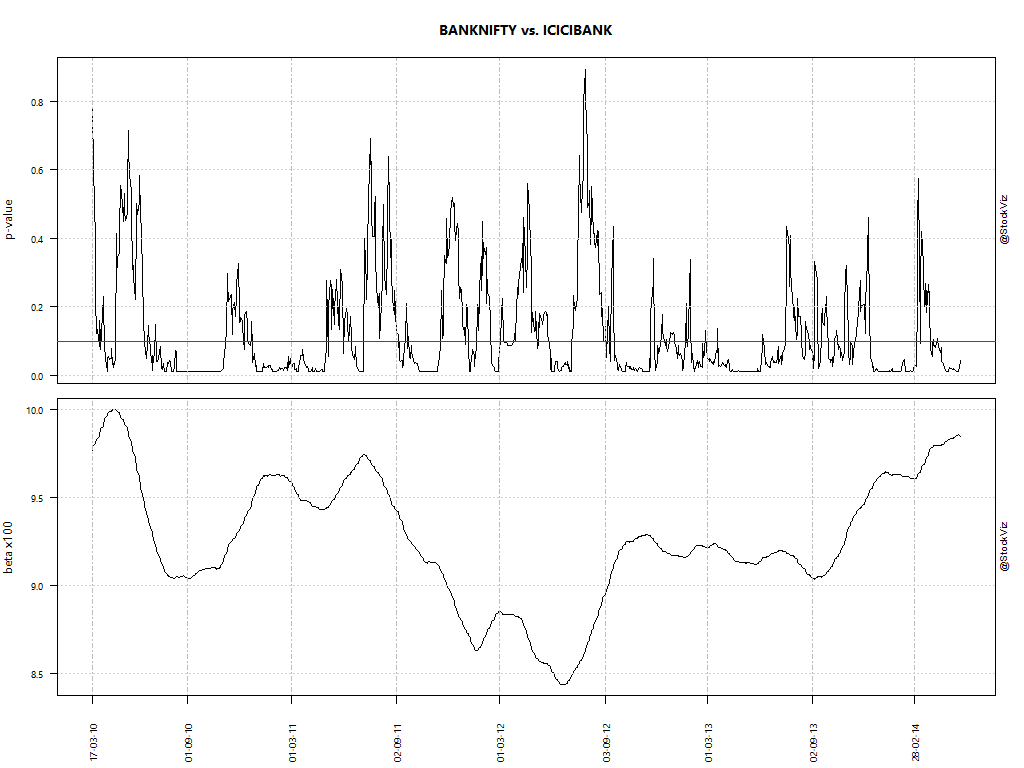

Neither β, nor the relationship is “guaranteed” to be stable. Here are the p-values and β of Bank Nifty vs. ICICI Bank nearest to expiry futures, with a 50-day look-back:

As you can see, the spread has periods of stability and adjustment. And sometimes, the stability is the anomaly.

To be continued…

Related articles

- Finding Pairs to Trade (stockviz.biz)

- Bank Nifty vs. HDFC Bank and ICICI Bank (stockviz.biz)