Setting a stop loss can often times be an emotional decision. When you buy a stock, you expect it to go up; setting a stop loss at that point in time makes you play the devil’s advocate with yourself. Its not a nice feeling. However, setting a trailing stop loss, takes some of the pain away.

Quite simply, a trailing stop is not a fixed price at which you exit a loss making investment – it is a percentage below the most recent high set after you have made the buy.

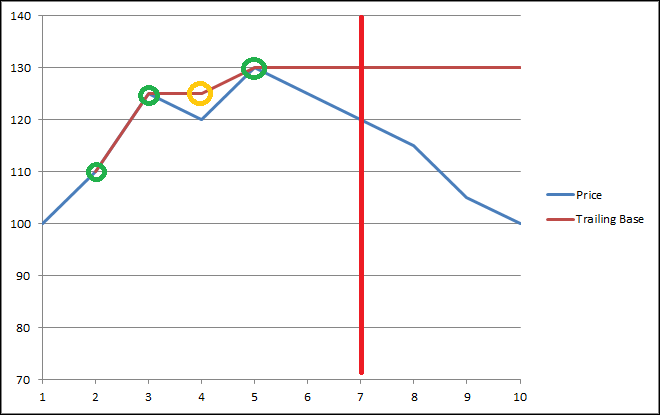

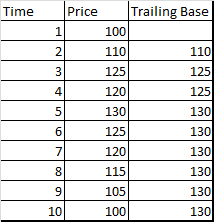

For example, lets assume that you bought a stock at Rs. 100. It then proceeds to move in this fashion:

Watch how the trailing base, hugs the highs made by the stock after you bought it.

The stop loss is then triggered when the price falls x % below the trailing base.

In this example, if you set the trailing stop loss % as 5, the stop loss is triggered at point (7) highlighted in the chart.

The positives are many:

- You will never let a profitable trade turn into a loss making one

- It acts like a regular stop loss if the stock turns negative right after you buy it

- You don’t have to reset your stop every time the stock makes a move

StockViz is proud to announce the availability of Trailing Stop Loss Alerts for our users. Start using them now!