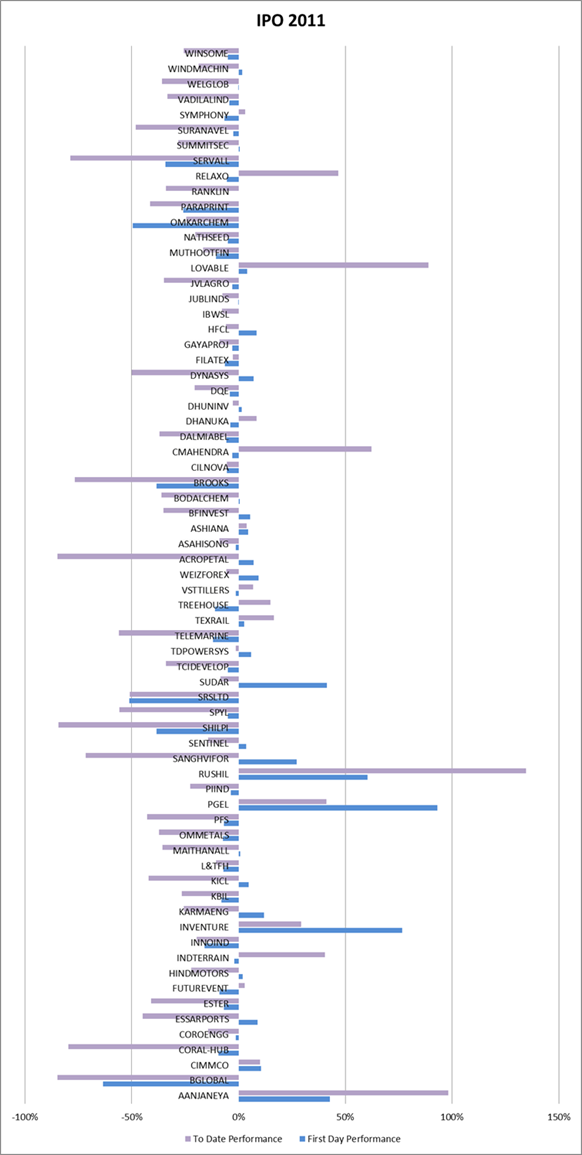

2011 is definitely not turning out to be a year for IPO investors. IPOs have lost an average of 17% so far. The speed at which some of these have become penny stocks is truly amazing:

| Ticker | To-date performance |

| BGLOBAL | -85% |

| ACROPETAL | -85% |

| SHILPI | -84% |

| CORAL-HUB | -80% |

| SERVALL | -79% |

| BROOKS | -77% |

| SANGHVIFOR | -72% |

| TELEMARINE | -56% |

| SPYL | -56% |

| SRSLTD | -51% |

| DYNASYS | -50% |

Out of the 69 stocks that were analyzed, an opening day fizzle forebodes a dismal future for the stock: 48% of the IPOs had a down day on their first day and continue to perform poorly till date. 25% of the IPOs performed poorly in spite of spiking the first day – so there really is no magic forecasting too that can guide investors through the process.

I would take the side of Warren Buffett who once said:

It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller (company insiders) to a less-knowledgeable buyer (investors).

An IPO’ed stock just doesn’t have all the pieces of information that an astute investor considers before buying the stock. You cannot do technical analysis on a stock that has never traded, nor can you dig into its previous years’ balance-sheets to discover (or at least verify) strengths and weaknesses. It would be smart to check out the lead book-runner as well. If its some garage operation based out of Kalasipalya, then it would serve you well to stay away from the issue. For example: BGLOBAL, ACROPETAL, SHILPI, SERVALL were run by Almondz Global Securities, Saffron Capital Advisors, D&A Financial Services, Keynote Corporate Services respectively. The next time you see issues brought out by these guys, tread carefully!

Here’s the chart you’ve been waiting for: