National Spot Exchange Limited’s (NSEL) decision to suspend trading of all one-day forward contracts was enough to shake investors and have brokers hammering on NSEL doors. Shares in NSEL owner Financial Technologies (India) Ltd (FTIL) fell 73% and over ₹5,500 crore of investor money in NSEL is at stake. Fear of default has created widespread panic that NSEL and investigating authority, Forward Markets Commission (FMC), are trying but failing to allay.

Going by NSEL’s docile obeisance in face of FMC directives and disinclination to adopt legal recourse, it appears that NSEL has indeed been caught dipping its fingers in shady pies. NSEL is accused of allowing short sales by not verifying whether the seller of a commodity actually had stocks with them as well as offering 20-40 days settlement periods in forward contracts. If it turns out that there are no commodities to sell, how will NSEL meet its payment obligations? That’s the big question on everyone’s mind.

According to a report on the Press Trust of India, NSEL has formed an independent committee to advise and monitor the settlement of trade funds amounting to ₹5,500 crore. Chairman and managing director Jignesh Shah of FTIL says that NSEL will announce a pay-out settlement by August 14. Till then, investors will remain on tenterhooks.

What is NSEL about?

NSEL is the facilitator of on the spot trading of commodities in India. Promoted by FTIL, it was established in 2008 to lower costs of intermediation and increase market efficiency.

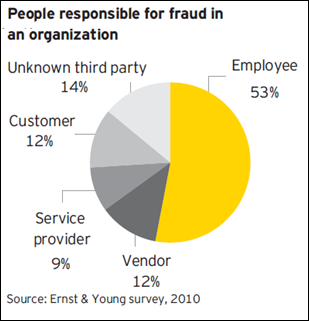

But like other agencies before and after NSEL such as the Multi Commodity Exchange (MCX), FTIL itself and even SEBI that’s participating in the investigation, the exchange has become just another channel for bureaucrats to swindle money from public.

Scam or rivalry, investors’ the scapegoat

Three years back at a regional commodity exchange meeting in Kolkata, some members brought FMC officials’ attention to trading issues at NSEL that did not conform to spot transaction practices. But nothing came out of that till July 9, 2013. This long gap is a question in itself. Was there an intentional lack of interest and vigilance on the part of the FMC, heading the meeting then?

There is another angle to the story too. NSE and FTIL are longtime rivals. FTIL is the promoter of NSEL and MCX-SX, direct competitor of NSE. In 2009, MCX-SX filed a case against NSE for which NSE was served a show cause notice for violation of provisions under the Competition Act, 2002. MCX charged NSE of lowering trading costs unfairly to kill competition. In June 2011, Competition Commission of India (CCI) fined NSE a penalty of ₹55.5 crore, payable within 30 days and ordered it to immediately stop subsidizing its services. Some say that the recent NSEL saga has a lot to do with the FTIL-NSE rivalry.

Last month, the Minister for Food and Consumer Affairs issued a statement that the Centre will take action against NSEL for violating spot trading rules. In three days, it sought an undertaking to stop the exchange from launching contracts with a greater than 10 day settlement period. On July 15, FMC directed NSEL to stop any such order till further notice.

That was the start of investor panic. When NSEL suddenly suspended all contracts, except the e-series that offer gold and base metals on July 31, there was total market chaos. NSEL then announced the deferment of payments amounting to ₹5,500 crore.

What now?

NSEL has announced that 13 of its members will pay 5% of their outstanding obligations, a total of ₹3,107 crore, on a weekly basis and 8 others will immediately settle contracts amounting to ₹2,180 crore. It is yet to reach an agreement with 3 members having outstanding obligations of ₹310 crore.

The FMC chairman Ramesh Abhishek has informed Reuters that the government has given it the power to take strong actions against any NSEL counterparties that default on their obligations.

Unanswered questions

How did NSEL get away with forward contracts in the first place? How come these goings-on went undetected by the State, FMC and Department of Consumer Affairs before now? Despite complaints 3 years back, why were NSEL’s operations not verified or monitored? And lastly, are the commodities really there? If they are, why the deferment?

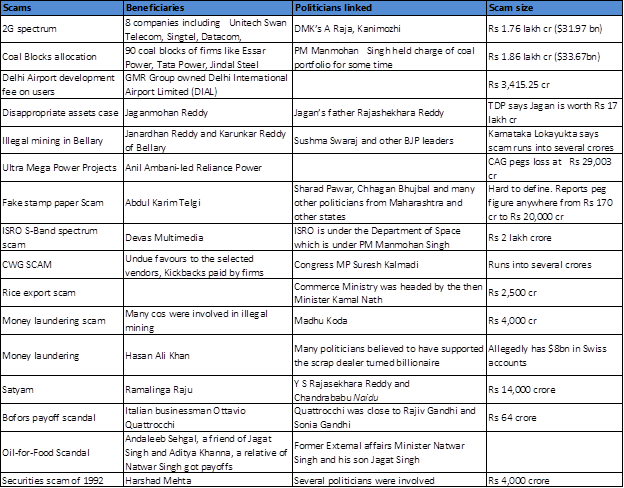

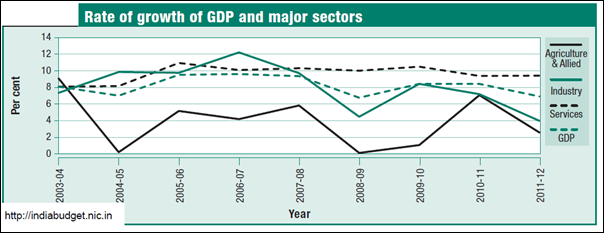

Inflation and global market volatility are hitting Indian investors from the outside and it seems Indian bureaucrats are hell-bent on eating the capital market from the inside. It’s a double whammy that’s crippling the economic growth of the country as scam after scam hurt its international reputation. Still, bureaucrats and politicians are too busy conniving schemes to hoodwink people and fill up their own pockets. What do they care?

Related articles