In Narrative Economics: How Stories Go Viral and Drive Major Economic Events (Amazon,) Robert Shiller, Nobel laureate, pitches the importance of incorporating popular narratives in economic and financial models.

The biggest problem I have with the way most research is done in quantitative finance is that whatever data is available gets analyzed to death while data that is hard to get, unorganized or tedious to collate is ignored. And given the adaptive complex dynamic nature of the markets, signals derived from the former attenuate at a much faster rate as time goes on.

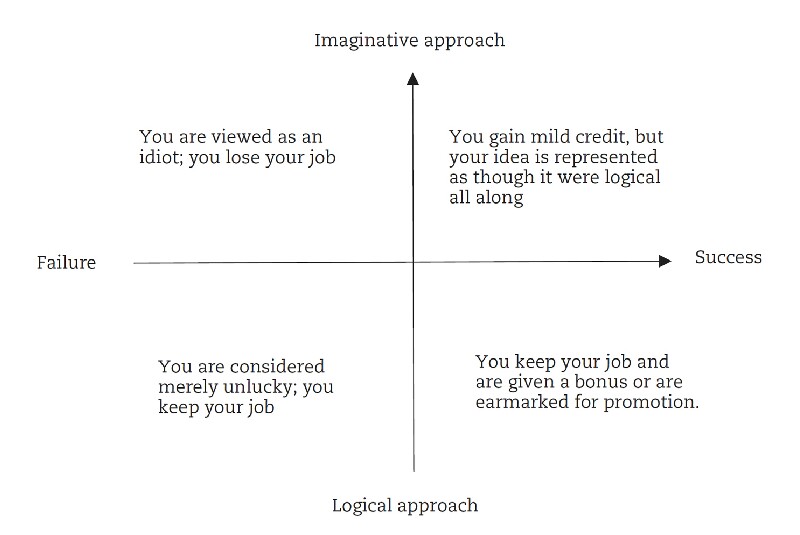

When markets break quant models, it is often because the underlying narrative has changed. The word “narrative” is just a fancy word to describe the stories we tell each other. And stories are virus. The spread of a narrative can be modeled like how epidemiologists model the spread of contagions. And the main thrust of the book is that it is high time economists and policy-makers began to incorporate narratives into their models and playbooks.

By 1932, the bottom of the stock market decline, the US stock market had lost over 80% of its 1929 value in less than three years. We have to ask: Why did people value the market at such a low level? A big part of the answer was a narrative that went viral: modern industry could now produce more goods than people would ever want to buy, leading to an inevitable and persistent surplus.

Narrative Economics, Shiller 2019

Investors would do well to take Shiller’s ideas and start to systematically track narratives that could impact their portfolios. Maybe, instead of Risk-Parity, try Narrative-Parity portfolios!

Recommendation: Must Read!