Previously, we had looked at using the momentum of S&P 500 Sector SPDRs for potential rotation strategies. How would the Indian story unfold?

We take 16 sector indices, use a 6-month look-back window and go long the sector with the highest returns, holding it for a month.

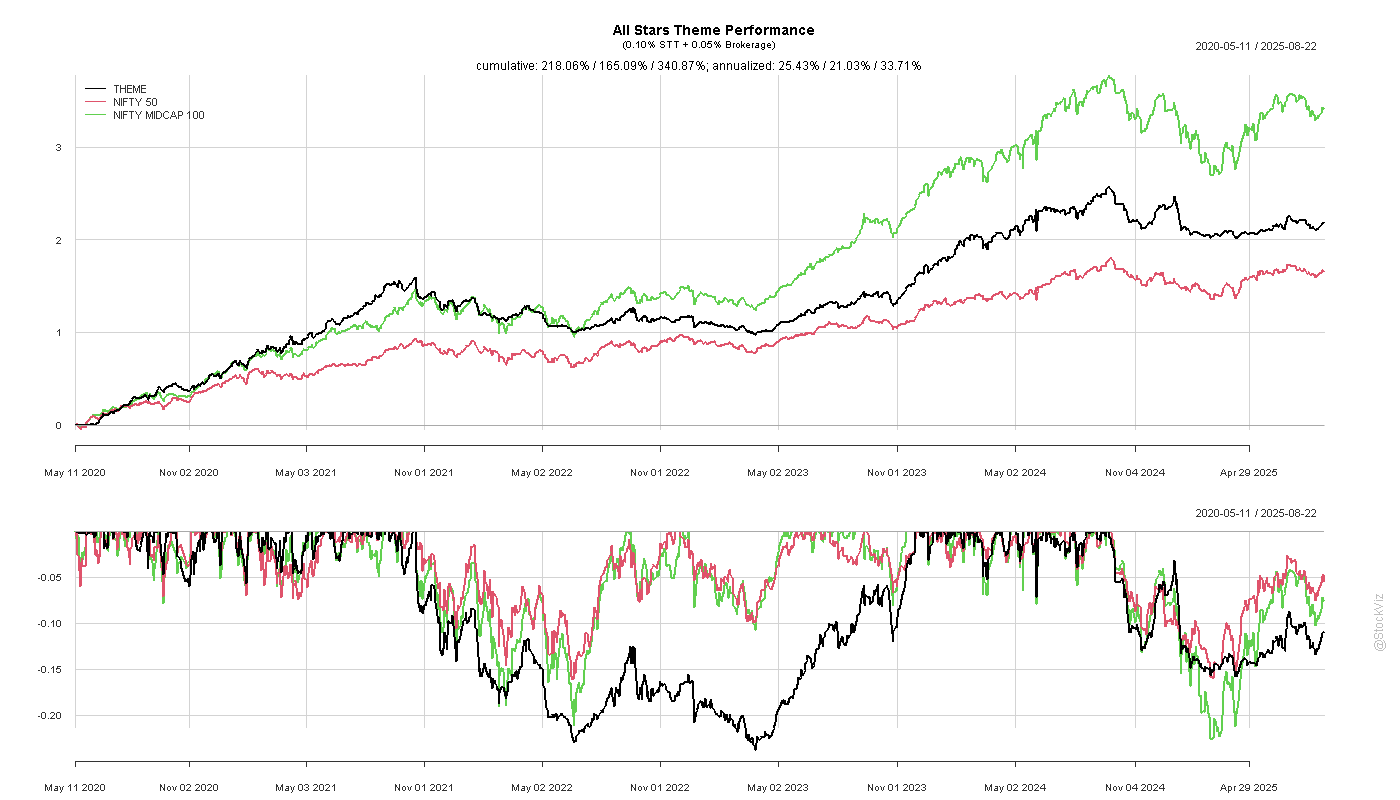

You end up with higher returns but lower Sharpe – makes sense given the super-concentrated nature of the portfolio.

The 4 points of out-performance (after costs, pre-tax) over the NIFTY 100 index is not much to write home about. Besides, this strategy trailed the benchmark pre-2020. If this were pitched back then, nobody would’ve deployed it and nobody would’ve been around for the post-2020 out-performance. On a positive note, the availability of index funds and ETFs should make this strategy fairly easy to implement.

The main caveat is that the index construction rules themselves are subject to change. Mid last year, SEBI capped the maximum concentration of a single stock for a sector index at 35% and required them to have at least 10 stocks.

Code and charts are on github.

Here are some other things we tried, so that you don’t have to:

Equal-weight all Sector Indices

Inverse-volatility weight all Sector Indices

Equal-weight Sectors in an Up Trend

Inverse-volatility weight Sectors in an Up Trend

The excess returns of these alternatives do not justify the costs.