Making use of technical analysis has always been a adrenaline rush for me, and I have been doing it for a long time now. But, from now on I will be sharing the trades and the ideas behind them with all of you. This portfolio will be of select few stocks that are picked up just for the technical reasons, and for the risk management reasons, I will be making both Buy and Sell calls for them.

Stocks that I bought today are CAIRN [stockquote]CAIRN[/stockquote], UCOBANK [stockquote]UCOBANK[/stockquote] and, VOLTAS [stockquote]VOLTAS[/stockquote]. Below are the price charts of all the above with reason of the transaction.

Its quite visible, that the CAIRN’s stock is going to experience the golden cross of 50×200 bullish cross-over, and the combination with declining histogram levels of MACD are suggesting a short-term up move for the scrip. The convergence of RSI with price action is also giving a positive support for the thesis. Also, the stock is trading close to the lower Bollinger-band, suggesting an upcoming Bullish move.

For UCOBANK, the stock was in a flag formation for a while and has been trading close to the lower Bollinger-band. An opportunity is visible around the current levels, with the increasing RSI levels combined with increase in volumes. Although, for the stock it is suggested to have Trailing stop losses in place.

The last stock is VOLTAS and it has broken out of a downward flag on Wednesday, confirmed by the large number of trades on Thursday and close above the upper line of Flag. The increase in RSI is also suggesting improved buys for the stock.

Here’s how I have allocated the trades:

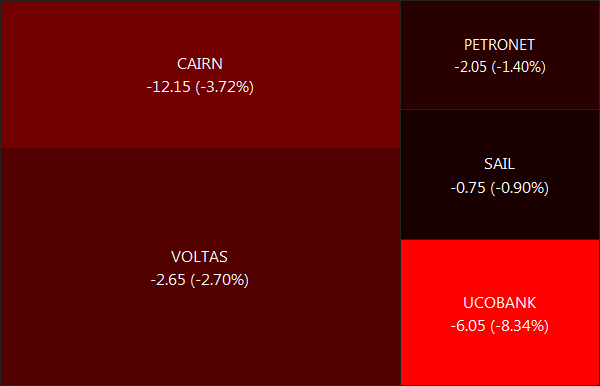

As you can see, its more or less an even split. And our demat account holders know the screen below very well:

Its tough trading when you have the spotlight focused on you. Fingers crossed!