In Apple in China – The Capture of the World’s Greatest Company (Amazon,) Patrick McGee lays out the how, what and why of Apple’s outsourcing efforts in China.

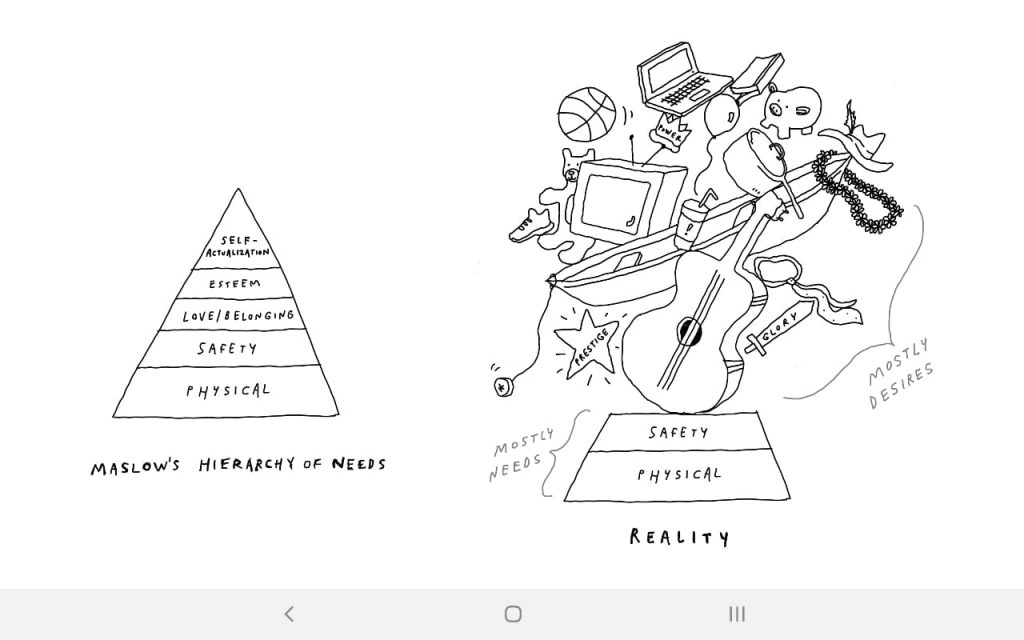

The growth of the manufacturing ecosystem in China resembles the growth of most social networks. First comes the hook: the “wow” factor. Then come the key nodes: the influencers. Before you know it, half your friends are there and you are compelled to join them or be left out. Then comes the theft of property by the owners of the social network (your photos, your activity, your thoughts, etc. are all theirs.) And then the monetization.

Steve Jobs initially wanted all of Apple’s products to be made in America. He was of the opinion that it was the only way in which he could maintain the strict standards that went into making Apple’s products. How did they end up making everything in China?

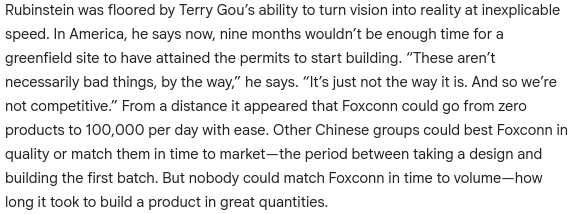

At first, the hook: Terry Gou of Foxconn.

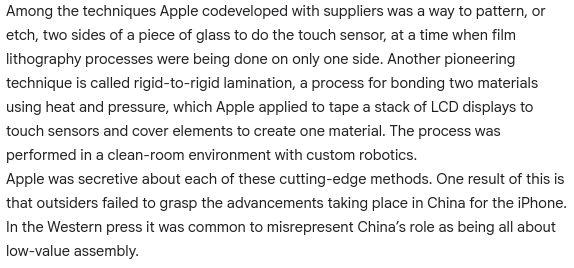

It reached a point where Apple (the influencer) was co-developing advanced manufacturing processes with vendors in China.

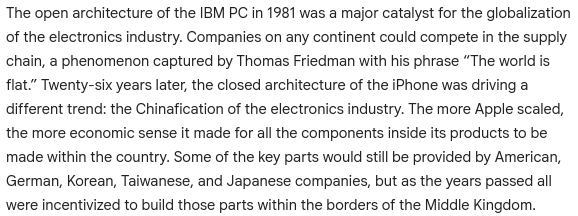

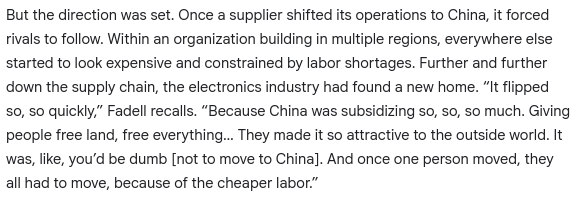

Slowly, and then suddenly, all of component manufacturing shifted to China.

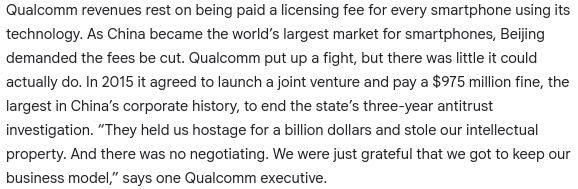

Then, the theft started.

Leading to the final step: monetization.

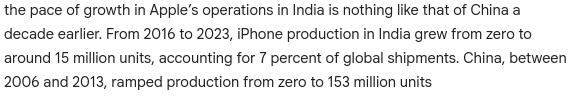

Apple finds itself enmeshed in China and scaling India in is proving difficult.

Primarily because of language politics, unionization and the perennial election cycle that prevents the Indian government from doing what China did: suppress worker rights.

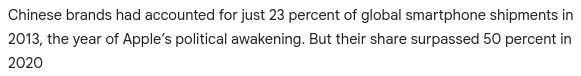

Facebook did not “die” in the traditional sense, like how MySpace did. It just became unpopular with the next set of cohorts. It is aging out, continuing to monetize its current user base, while Instagram attracts the next generation. A similar thing might happen to the Chinese manufacturing juggernaut because now, everybody know that:

In China, ‘win-win’ means China wins twice.