GMMA: Guppy Multiple Moving Averages

Hope all of us remember the moving average principle. Refer to the first session of the series to understand them again. The technical tool that we are about to study is based exclusively on exponential moving averages. The crossing over of the average lines gives a great detail of the price movements and helps us establish the trend in the stock and market.

GMMA uses a total of 12 moving average lines (Yes you got it right!! 12 lines). The lines are divided into 2 kinds, namely Long term and the short term group.

- The short term group consists of 6 distinct exponential moving average lines made for past 3, 5, 8, 10, 12 and, 15 days. (The first point for creation of this group comes only on the 4th day of the time period selected.)

- The long term group consists of 6 EMA lines made for 30, 35, 40, 45, 50 and 60 days period. (The first point of this group can be placed only after one and a half month of the selected period)

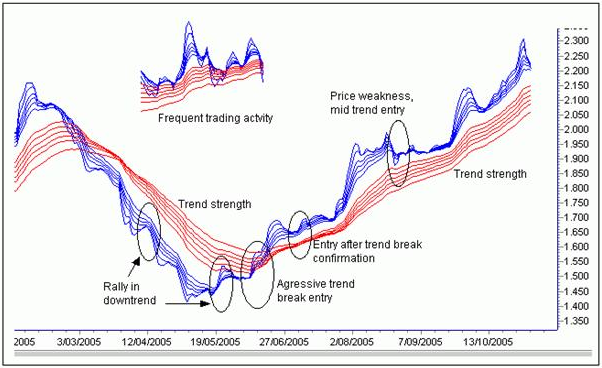

You must be wondering why we require these many lines to make trades. You will see it yourself in some time. The graph looks like this:

The blue lines form the short term group and the red ones are a part of the long term group.

The easiest way to work you way through the tool is to have your basics clear.

- Compression of the lines means that the averages are closing in and there is an agreement in the price.

- Degree of separation in the long term group defines the strength and weakness of the trend.

- Degree of separation for the short term group defines the nature of trading activity.

How to trade using the tool?

This tool is only applicable to the stocks which are trending. Penetration of the long term group lines by the short term group lines from above means a sell signal, whereas penetration from below means a buy signal.

Compression of both groups at the same time indicates a major re-evaluation of stock and potential for a trend change. It is suggestive from the tool to trade in the direction of the long term group of averages.

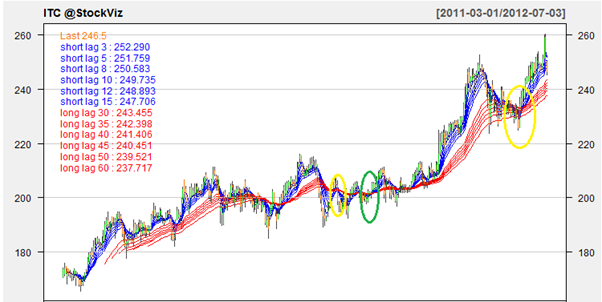

A slight penetration of the short term group into the long term group should be taken as a signal to be prepared for a next move, but it is advised to wait for 3 and 5 day EMA’s and even till 10 days EMA’s to penetrate the uppermost long term average line to make a buy trade. Otherwise, we might be making an early trade which might not prove to be profitable. Examples of the same can be seen in the chart below.

The yellow ovals signify a partial penetrations and reversals because of not enough strength in the movement, the green oval signify the successful penetration of the long term group and hence a start of a uptrend. The next compression of the short term and inability to cross the long term again is a reversal and hence is a continuation to the earlier uptrend.

Note that these lines should not be treated as normal moving averages (They are exponential). They are faster than the normal averages and hence are able to help us with the analysis effectively.

With the pro version, you can use this tool to help you in making a very informed decision when trading with trending stocks.

Happy technical trading!