Double and Triple

(Tops and Bottoms)

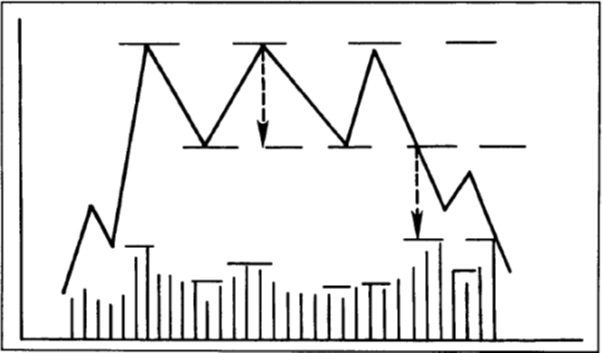

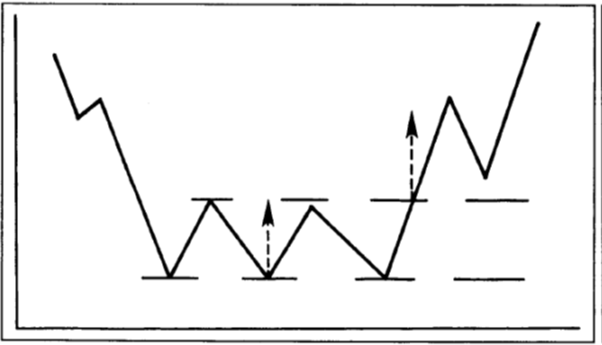

Now, let us look double tops and bottom first. These patterns are more common reversal patterns than others, most frequently seen and most easily recognizable.

I will not tell which of the above is a double top and which is the double bottom. Identify them yourself. By now you should be able to see for yourself and identify which one is what. Read ahead only after locating which one is top and which is the bottom pattern.

As you would be clear in the head by now, that for any reversal pattern we require having a previous trend. For a top reversal, the uptrend needs to be in the picture. You will have a high peek at A, and a retracement to the point B till the trend-line. The prices start rising from this trough, but are unable to cross the previous peek of A, and they reach the same level at point C. The uptrend comes to a stall, and now the prices start declining, way beyond the previous trend-line and also the last support point at B to reach a point D. Just like the head and shoulders there is a return move back to the last support point “B”, but now it should act as a resistance and would restrict any movement beyond it, thus completing the price pattern.

Just the same happen for the double bottoms, but in this case the volumes play a lot important role than the tops. (Please check the last session for the reason – why volumes are more important in bottoms than tops). You would see the resistance break, at point D in the tops to be happening at higher volumes for strong reversals. You also need to keep in mind that breaks with lower volumes should be taken with a pinch of salt.

Looking at the price targets, the minimum price targets would be the distance between the top A and B. Distance between any of the tops to the support line or the distance between any of the bottoms to the resistance line for tops and bottoms respectively.

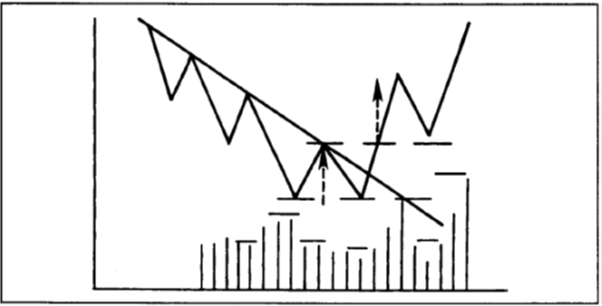

Going ahead let us look at the triple tops and bottoms. You will not see them very often, and also they are very close to head and shoulders tops and bottoms. Because of the above stated reason, the academicians (Technical Trainers and Prof.) have disconnects with using this nomenclature. As it is evident from the diagrams below, they do look different than their close relative – head and shoulder. Just look at the size of 2nd peak and trough in tops and bottoms – they are the only differentiator, and big ones. No doubt you will get confused with such patterns if not given enough concentration, but you need to remember of what they advice you for where the market or the stock is headed.

Triple bottoms – Same level of troughs.

Remember, for completion of the patterns the prices have to close below and above the troughs and peaks with higher volumes for tops and bottoms respectively. Also, just like the other top patterns, each consequent tops happen at lower volumes, and in case of bottoms, each top happens at higher volumes, and a rush of volumes at the 3rd and the final top. The return moves are common as well, and can happen with still some space between the last support and resistance levels.

That is all for the reversal patterns. I have intentionally not included any live examples for the indicators of the session. Go ahead and look at a few stock charts. Share with all your buddies as well, and show them the results that you have got from the pattern. Surprise yourself.

For any further details about the patterns feel free to browse through the john Murphy’s lesson on the same.

Hope to see you all with some new technical tool next week. We will move ahead of charting, a level further in the technical analysis sphere. Do share the live examples of the W’s and M’s and also the triple tops and bottoms if you find any. You can go and post it on the facebook page.

Always remember: “Trends are your Friends”.