Inverse Head and shoulders & Price Targets

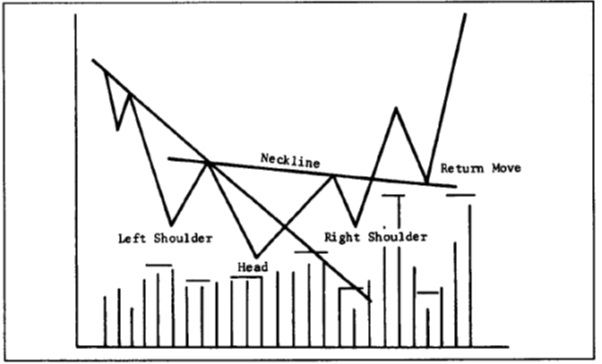

Just like the last pattern, the inverse head and shoulder also has 3 peaks, although these are inverted peaks. As you may think, it is actually a mirror image of the last pattern. The middle bottom (the Head) is slightly lower than the left and right shoulder. Again the neckline plays the vital role for the breakout. There is greater tendency for the return move back in the bottom patterns after the bullish breakout.

Volume plays a very vital for the reversal pattern, just like all other bottom patterns. A breakout with higher volumes is very critical for the completion of this pattern. It is such because, a stock price fall can happen just because of inertia. As Murphy states “Lack of demand or buying interest on the part of traders is often enough to push a market lower, but a market does not go up on inertia” and hence to push the prices up requires buying force, and hence occurs when buyers are more aggressive than sellers.

Let us look at how we can identify the pattern.

There needs to be a prior downtrend, a left shoulder, a slight upside, followed by a lower low forming the head. The upside after the shoulder acts as the beginning of neckline. After the head formation, the prices move up on higher volumes, they hit the neckline and drop to form the right shoulder. The breakout above the neckline happens with a spurt in the volumes and the return move finding support at the neckline confirms the completion of inverse head and shoulder pattern.

Let us look at the example of such pattern in action. We have here BHEL, from Feb 2009 to June 2009. See how discreetly the right shoulder came up. It was only for 2 days below the neckline, and because of the increasing volumes after the head, it got the buying pressure pushing the prices to new highs.

Hope this live example gives you an idea on how to identify such patterns. They might not look always like the book’s diagram, but you need to identify them by looking at the supplement indicators like rising volume in this case.

After we have identified the patterns, let’s talk about the price objectives related to them. We might not be able to go into details of it, but will look at how to measure it.

Price objectives basically are the amount of retracement of prices that can happen after the completion of pattern. When we are looking at the head and shoulder patterns, it is very easy to identify the objective. The easiest method to calculate them is to calculate the distance of the head from the neckline and to double it to find the objective. So let’s say, head is at 115, and the neckline appears at 100, so the difference is (115 – 100 = 15). Now we subtract the difference from the neckline (100 – 15 = 85) to come up with the objective of 85.

Such price objective is just a minimum target. The prices would usually move even further due to the inertia, but it is helpful to understand the minimum target for risk management or entering into new position for aggressive investors.

Try looking for the indicators in the daily charts, practice makes a man perfect, but giving exposure to the charts in the live prices will give exposure to your eyes and they will get trained on their own to help you identify the required patterns.

See you guys next week. Till then happy trading.