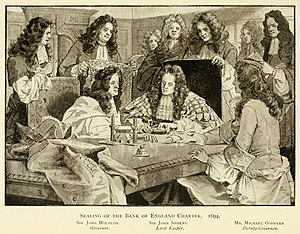

Image via Wikipedia

In June a deputy governor of the central bank predicted that the country’s economy would grow at a double-digit rate during the next 20-30 years. But in the past six months the private sector, which is supposed to do the heavy lifting that turns India from the world’s tenth-largest economy (measured at market exchange rates) into its third-largest by around 2030, has become fed up.

What happens in India is not because of the government but in spite of the government,” says the head of a pharmaceutical company. Corruption has “paralysed the government,” reckons the chief executive of one of India’s most prestigious firms.

The economy may still be slowing naturally, as the low interest rates and public spending that got India through the global crisis are belatedly withdrawn. To raise the economy’s growth potential, India could do with another dose of reform, aimed at markets for inputs, from electricity to labour and land, that are still choked. Foreign direct investment into India has been subdued for a year (though it did pick up in May). For India to grow at 8-10% a year, supply must at least double in a decade.

The central bank, which has raised interest rates ten times since the start of 2010, insists that the costs of getting richer-such as diets with more protein-are partly to blame. But India looks like an economy operating at full capacity.

A recent improvement in the current-account deficit, thanks to surging exports, suggests that India could be less reliant on foreign funds than in the past. Fundamentally the reason why bad debts haven’t built up is because the economy is doing so well,” says the boss of one lender.

Compared with a fragile world economy, an India on autopilot could chug along quite happily, growing faster than most other countries.