This is the first of three posts by Abhishek Preetam on why he is bullish on the yellow metal. Please welcome him to StockViz and enjoy the post!

Gold has been in news for quite some time. With prices touching their highest values recently, the yellow metal is becoming red hot day by day. What is causing this sudden spur in the price?

Let’s look at the trend of gold prices (In USD and Euro) for the last 3 decades:

Prices were initially range bound nearly for two decades. Starting from 2001, prices have risen almost non-stop and have been on an absolute tear since 2003, rising over 325% and 150% since 2007. Following the trend, Gold just reached an all time high of $1813.5 an ounce on August this year. Let’s look for the reasons of this trend.

Supply side

Historically gold and silver were used as currencies and it was not until a few centuries ago that fiat currencies came into existence. The value of gold and silver did not lose their actual values, but instead were looked as commodities (a barter resource) and not actual money. Almost all currencies around the world are now fiat currencies.

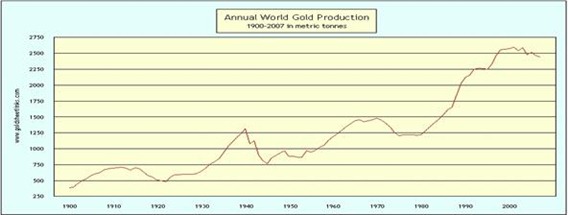

Gold and silver are non-renewable resources, and with their production decreasing, the supply side of market looks shallow. Looking at the long term production level of gold, we can see the dipping production levels from 2000 till 2007.

Mining on an average contributes 63% of gold production; the rest comes from recycling of gold. Recycling takes place majorly in South East Asian countries. In the Q2 2011, 429.3 tons of gold was recycled. This is 3% down Y-O-Y and slightly above for the trailing 10 months average of 407.3 tones.

Global demand report from WCG for Q2 2011 states “Over the ten years that preceded the 1997/98 Asian financial crisis, net new jewelry and investment demand amounted to more than double the tonnage accumulated during the ten years to the end of 2010. This suggests a considerably lower stock of gold to supply the market through recycling.”

As per the data from World gold council, supply of gold for the year 2010 increased by 1.81% whereas the demand shot up by 10% compared with 2009. For Q1 11, supply decreased by 4% whereas demand increased by 10% compared to year ago period.

Demand Side:

Gold is used for 3 main purposes – Jewelry, Technology (Electronics and Dentistry) and Investments. Pre 2008, Jewelry formed 69% and % investments formed 11.5% of the total demand, but after that they form 53% and 25% respectively.

For the last 2 year central banks have turned into the net buyers of gold. Even European countries have started buying up gold for their reserves. The central banks currently stand as the largest holder of gold at 16.5% of all the gold produced.

Finally, applying simple economics lesson of supply and demand on gold, the future looks promising. With almost stagnating supply (mining and recycling) and continuous rise in the investment related interest of central banks and also various end users, there will be a huge gap to fill. There might be some correction in the short run, but long term outlook of the asset seems bright.

So, whether paper or real, they should form some part of your portfolio.